How Much Does H&r Block Charge Per W2

Tax season looms, and for millions, that means grappling with W-2s and the often-complex process of filing returns. Navigating this process can be daunting, leading many to seek professional help. A common question on the minds of taxpayers is: How much will it cost? Specifically, what does H&R Block, a leading tax preparation service, charge per W-2?

The cost of tax preparation services at H&R Block isn't a straightforward per-W-2 fee. Instead, the pricing structure is based on the complexity of the return and the services required. This means the number of W-2s you have is just one factor influencing the overall cost. Understanding this pricing model is crucial for taxpayers aiming to budget effectively for tax season.

Understanding H&R Block's Pricing Structure

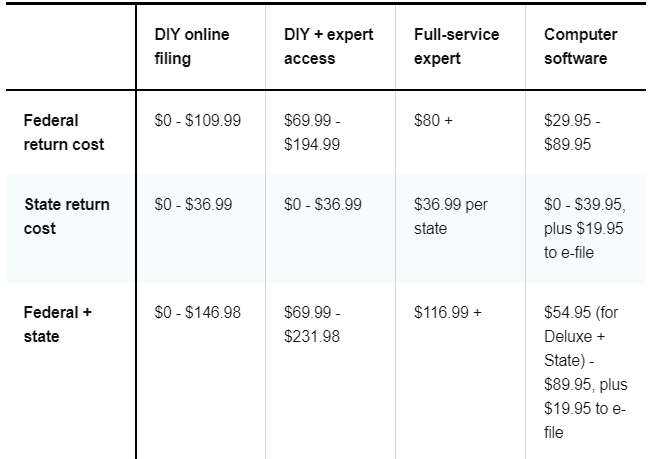

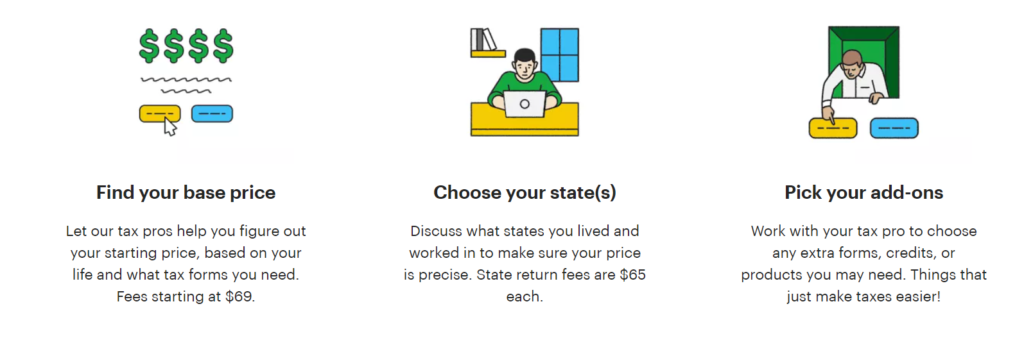

H&R Block offers various tax preparation methods, each with its own pricing. These options include online filing, in-person assistance at a retail location, and virtual tax preparation services. The final cost depends on the method chosen and the specific forms needed for your tax situation.

Online filing is generally the most affordable option, with prices varying based on the complexity of the return. H&R Block offers different online tiers, ranging from simple returns that can be filed for free to more comprehensive packages that cater to self-employed individuals or those with investment income. The number of W-2s indirectly contributes to the complexity and, therefore, the price of these online packages.

For in-person tax preparation, H&R Block charges a fee based on the time and expertise required to complete the return. This fee incorporates the complexity of the tax situation, including the number of W-2s, deductions, and credits claimed. It is difficult to pinpoint a precise “per-W-2” charge because the preparer considers the entire financial picture.

Factors Affecting the Cost

Several factors, beyond just the number of W-2s, influence the total cost of tax preparation services. These include the complexity of your tax situation, the need for itemized deductions, and whether you own a business or have investment income. State tax returns also add to the overall expense.

If you have multiple income streams represented by numerous W-2s, but your deductions are straightforward, the cost might be lower than someone with a single W-2 but intricate itemized deductions or business income. The key is the time the tax professional spends on your return.

The location of the H&R Block office can also play a role. Prices can vary slightly between different franchise locations, although generally the pricing is fairly standardized across the company.

Alternative Perspectives and Comparisons

Other tax preparation services, like TurboTax or local CPAs, have similar pricing models that consider the complexity of the tax return rather than charging directly per W-2. TurboTax also offers various tiers of online filing, with more complex returns incurring higher fees.

Local Certified Public Accountants (CPAs) often charge higher fees than H&R Block, particularly for complex returns. However, they can offer more personalized advice and potentially identify more tax savings opportunities. Choosing between these options depends on individual needs and the complexity of their financial situation.

Getting a Quote and Planning Ahead

The best way to determine the cost of H&R Block’s services is to get a personalized quote. You can do this by using the online cost estimator on their website or by scheduling a consultation at a local office. Gathering all relevant documents, including your W-2s, 1099s, and any records of deductions, will help provide an accurate estimate.

Consider organizing your tax information well in advance of the filing deadline. This not only makes the tax preparation process smoother but can also potentially reduce the time required by a tax professional, leading to lower fees.

Tax software is another option to explore. It may be cost effective if the tax payers have the time and the skills required to properly file the taxes, and the tax situation is not complex.

Looking Ahead

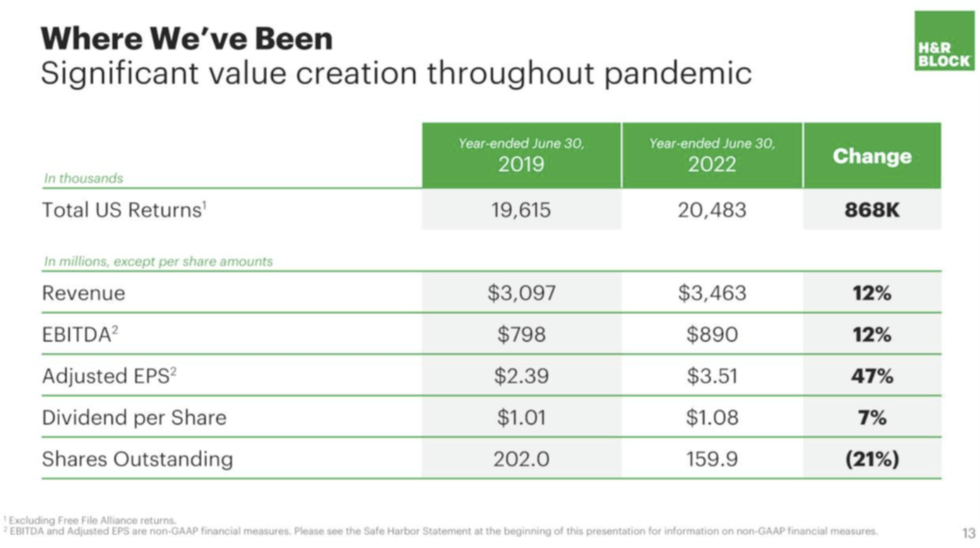

As tax laws evolve, the complexity of tax preparation will likely increase. This could affect the overall cost of professional tax services. Staying informed about changes in tax legislation and maintaining organized financial records will become even more crucial in managing tax preparation expenses in the future.

While it's impossible to provide a precise "per-W-2" cost for H&R Block's services, understanding their pricing structure and the factors that influence it can help taxpayers make informed decisions and budget effectively for tax season.

.jpg)