How To Generate Multiple Streams Of Income

Imagine waking up to the gentle hum of your laptop, not with a sense of dread about the looming workday, but with the quiet satisfaction of knowing that money is working for you, even while you sleep. Picture yourself sipping coffee, deciding which projects to pursue, not because you have to, but because you want to. This idyllic scenario isn't just a dream; it's the reality many are crafting by building multiple streams of income.

The core idea is simple: instead of relying solely on one source of income, you create several different avenues for money to flow your way. This provides financial security, independence, and the freedom to pursue your passions.

Why Multiple Streams Matter

For generations, the conventional wisdom was to find a good job, work hard, and retire comfortably. This model, however, is increasingly fragile in today's rapidly changing economy.

Job security is no longer guaranteed, and relying solely on a single paycheck leaves you vulnerable to layoffs, economic downturns, or unexpected company closures. The Bureau of Labor Statistics shows the average person holds 12 different jobs in their lifetime.

Having multiple income streams offers a safety net. If one source dries up, you have others to fall back on. This reduces stress and provides peace of mind, empowering you to take calculated risks and pursue opportunities you might otherwise avoid.

Crafting Your Income Portfolio

Building multiple income streams isn't about getting rich quick; it's about diversification and strategic planning. It's about leveraging your skills, passions, and resources to create a sustainable financial ecosystem.

Identifying Your Assets

Start by taking inventory of your skills, interests, and resources. Are you a talented writer, a skilled photographer, or a knowledgeable gardener?

These can be turned into income-generating activities. Do you have a spare room, investment properties, or a collection of valuable items? These can become sources of rental income or capital gains. Consider assets such as time, money, and network.

Active vs. Passive Income

Understanding the difference between active and passive income is crucial. Active income requires your direct involvement and effort, like freelancing or consulting.

Passive income, on the other hand, generates revenue with minimal ongoing effort, such as royalties from a book, returns from investments, or income from a rental property. Aim for a mix of both. Active income can provide immediate cash flow, while passive income builds long-term wealth.

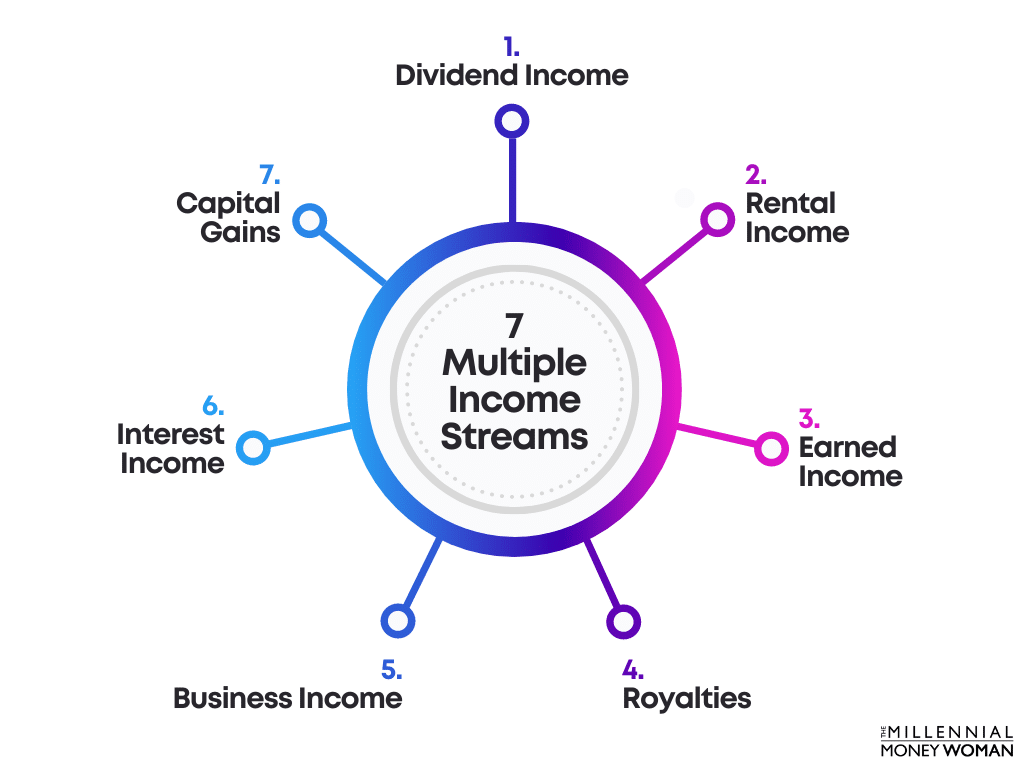

Exploring Income Streams

Here are some popular and accessible income stream options:

- Freelancing: Offer your skills on platforms like Upwork, Fiverr, or LinkedIn.

- Online Courses: Share your expertise by creating and selling online courses on platforms like Udemy or Teachable.

- Affiliate Marketing: Promote other companies' products on your website or social media and earn a commission on sales.

- Rental Income: Rent out a spare room, vacation home, or investment property.

- Investing: Invest in stocks, bonds, or real estate to generate dividends, interest, or capital gains.

- E-commerce: Sell products online through platforms like Etsy, Shopify, or Amazon.

- Content Creation: Create content on YouTube, a blog, or a podcast and monetize it through advertising, sponsorships, or merchandise.

Start Small, Scale Gradually

Don't try to do everything at once. Choose one or two income streams that align with your interests and skills, and start small. Focus on building a solid foundation before expanding.

As Warren Buffett famously said, "Do not save what is left after spending, but spend what is left after saving". It's important to reinvest some of the income you generate to fuel further growth.

The Future of Financial Freedom

Building multiple income streams isn't just about financial security; it's about creating a life of freedom and purpose. It's about having the resources to pursue your passions, support your loved ones, and make a positive impact on the world.

The digital age has democratized access to opportunities, making it easier than ever to create multiple income streams. By embracing this mindset, you can take control of your financial destiny and build a life that is both fulfilling and financially secure. The path to financial freedom is paved with creativity, perseverance, and a willingness to learn.

![How To Generate Multiple Streams Of Income How to Create Multiple Streams of Income [7 Proven Methods]](https://themillennialmoneywoman.com/wp-content/uploads/2022/02/How-to-Create-Multiple-Streams-of-Income.webp)