The Budget And Economic Outlook 2024 To 2034

The Congressional Budget Office (CBO) has released its latest budget and economic outlook, projecting a concerning surge in the national debt and persistent inflationary pressures over the next decade. This forecast demands immediate attention from policymakers as it outlines potential risks to long-term economic stability.

This analysis, covering 2024 to 2034, reveals a widening gap between federal spending and revenues, coupled with potentially sluggish economic growth. The report paints a stark picture, demanding swift and decisive action to address the unsustainable fiscal trajectory facing the nation.

Key Findings: The National Debt

The CBO projects that the federal debt held by the public will climb to 122% of GDP by 2034. This represents a significant increase from the 97% recorded in 2024. The surge is primarily driven by rising mandatory spending on programs like Social Security and Medicare, coupled with increasing interest costs on the existing debt.

Net interest costs are projected to nearly double as a percentage of GDP over the next decade. This increase will further exacerbate the debt burden, diverting resources from other essential government programs and investments.

Specifically, net interest spending will rise from 3.1% of GDP in 2024 to 5.0% in 2034, consuming an increasingly larger portion of the federal budget.

Economic Growth Projections

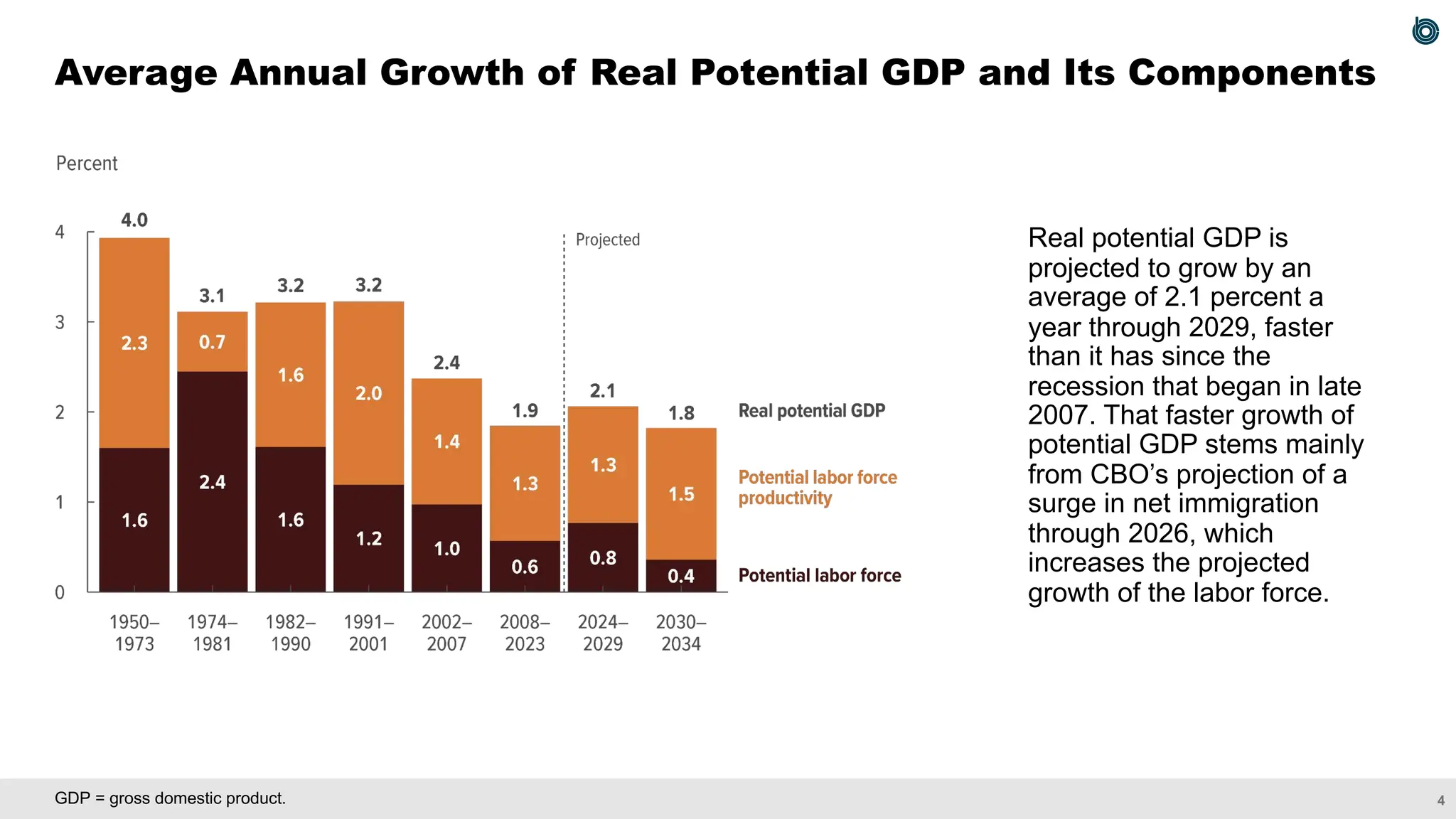

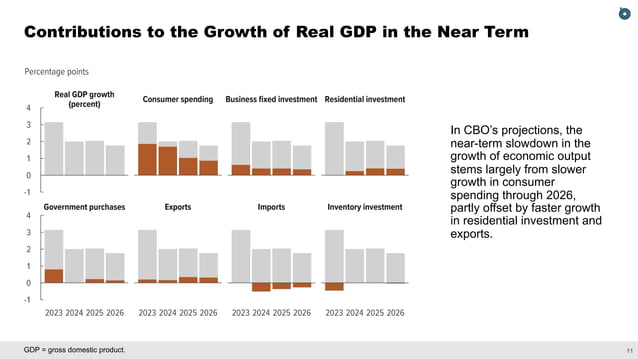

The CBO anticipates a moderate pace of economic growth over the next decade. Real GDP growth is projected to average 2.0% annually between 2024 and 2034, reflecting a slowdown from the post-pandemic recovery period.

Several factors contribute to this projected slowdown, including demographic shifts, such as an aging population and slower labor force growth. Increased interest rates and tighter financial conditions are also expected to dampen economic activity.

The labor force participation rate is projected to remain relatively stable, but the overall growth of the labor force will be constrained by demographic trends.

Inflation Outlook

While inflation has moderated from its peak in 2022, the CBO expects it to remain above the Federal Reserve's target of 2% for the near term. Persistent supply chain disruptions and strong consumer demand contribute to this elevated inflation outlook.

The CBO projects that the Personal Consumption Expenditures (PCE) price index, a key measure of inflation, will average 2.3% in 2024 before gradually declining to 2.2% in 2025 and beyond.

High inflation will continue to erode the purchasing power of consumers and businesses, impacting economic activity and financial stability.

Federal Spending and Revenue

Federal spending is projected to increase from 23.1% of GDP in 2024 to 24.1% of GDP in 2034. This increase is primarily driven by mandatory spending on programs like Social Security, Medicare, and Medicaid.

Federal revenues are projected to remain relatively stable at around 17% of GDP over the next decade. Tax revenues are expected to be influenced by changes in tax laws and economic activity.

The gap between federal spending and revenues will continue to widen, leading to larger budget deficits and increased borrowing. This necessitates a critical review of spending priorities and revenue policies.

Impact on Social Security and Medicare

The CBO's projections highlight the long-term fiscal challenges facing Social Security and Medicare. Both programs are projected to face significant funding shortfalls in the coming years as the population ages and healthcare costs rise.

Lawmakers will need to address these shortfalls through a combination of benefit reforms and revenue increases to ensure the long-term solvency of these vital programs.

Failure to address these issues will have significant consequences for retirees and future generations.

Policy Implications and Next Steps

The CBO's budget and economic outlook serves as a crucial wake-up call for policymakers. It underscores the urgent need for fiscal responsibility and comprehensive reforms to address the nation's growing debt burden.

Congress and the President must work together to develop a credible plan to reduce the deficit, control spending, and promote sustainable economic growth. This requires difficult choices and a willingness to compromise.

The immediate focus should be on identifying areas where spending can be reduced and revenues can be increased without harming the economy. Debates on spending cuts, tax reforms, and entitlement reform are likely to intensify in the coming months, with the looming threat of fiscal instability driving the urgency.