How Much Does It Cost To Start A Buisness

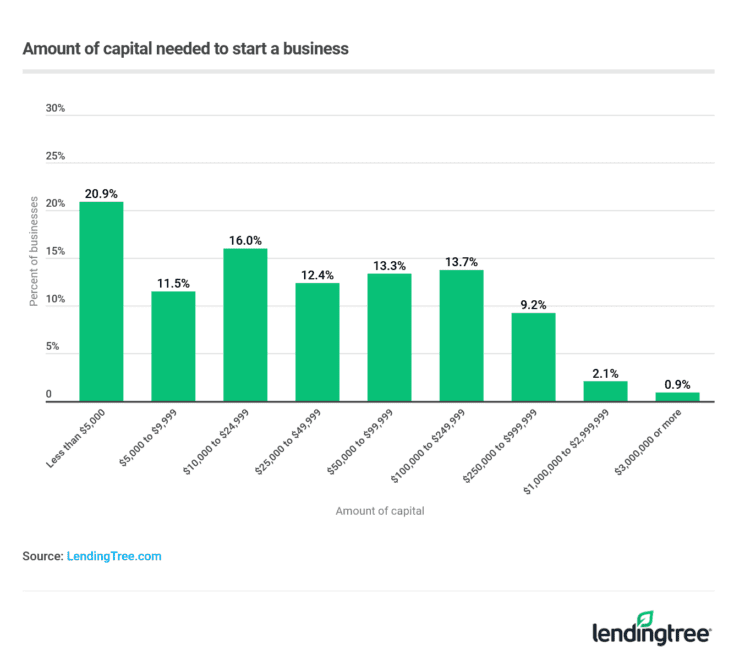

Starting a business: Costs can range wildly, from a few hundred dollars to millions. The ultimate price tag depends heavily on industry, business model, and scale.

Understanding the financial commitment is crucial. Aspiring entrepreneurs must consider more than just initial investments; operational costs and unforeseen expenses also need budgeting.

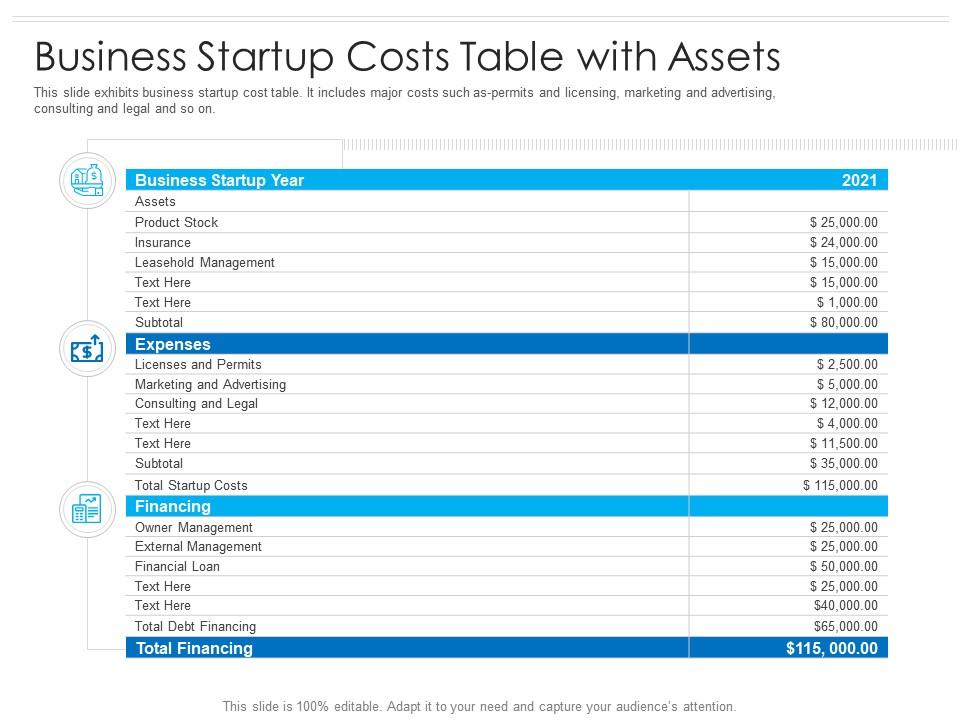

Startup Costs: A Breakdown

Legal Fees: Expect to pay between $500 to $2,000 to establish a legal entity (LLC, S-Corp, etc.). Costs depend on legal complexity and state regulations.

Permits and Licenses: Varies significantly, from $50 to thousands depending on location and industry. Research local, state, and federal requirements.

Office Space/Rent: Ranges from a few hundred for a coworking space to thousands for a commercial lease. A virtual office may be a cost-effective initial alternative.

Equipment and Supplies: This is highly variable. A home-based consultant may need just a laptop, while a manufacturing facility requires specialized machinery costing tens of thousands.

Marketing and Advertising: Budget at least $500-$5,000 for initial marketing efforts. This includes website development, social media campaigns, and print materials.

Inventory: If selling physical products, allocate funds for inventory purchase. Costs depend entirely on the product type and quantity ordered.

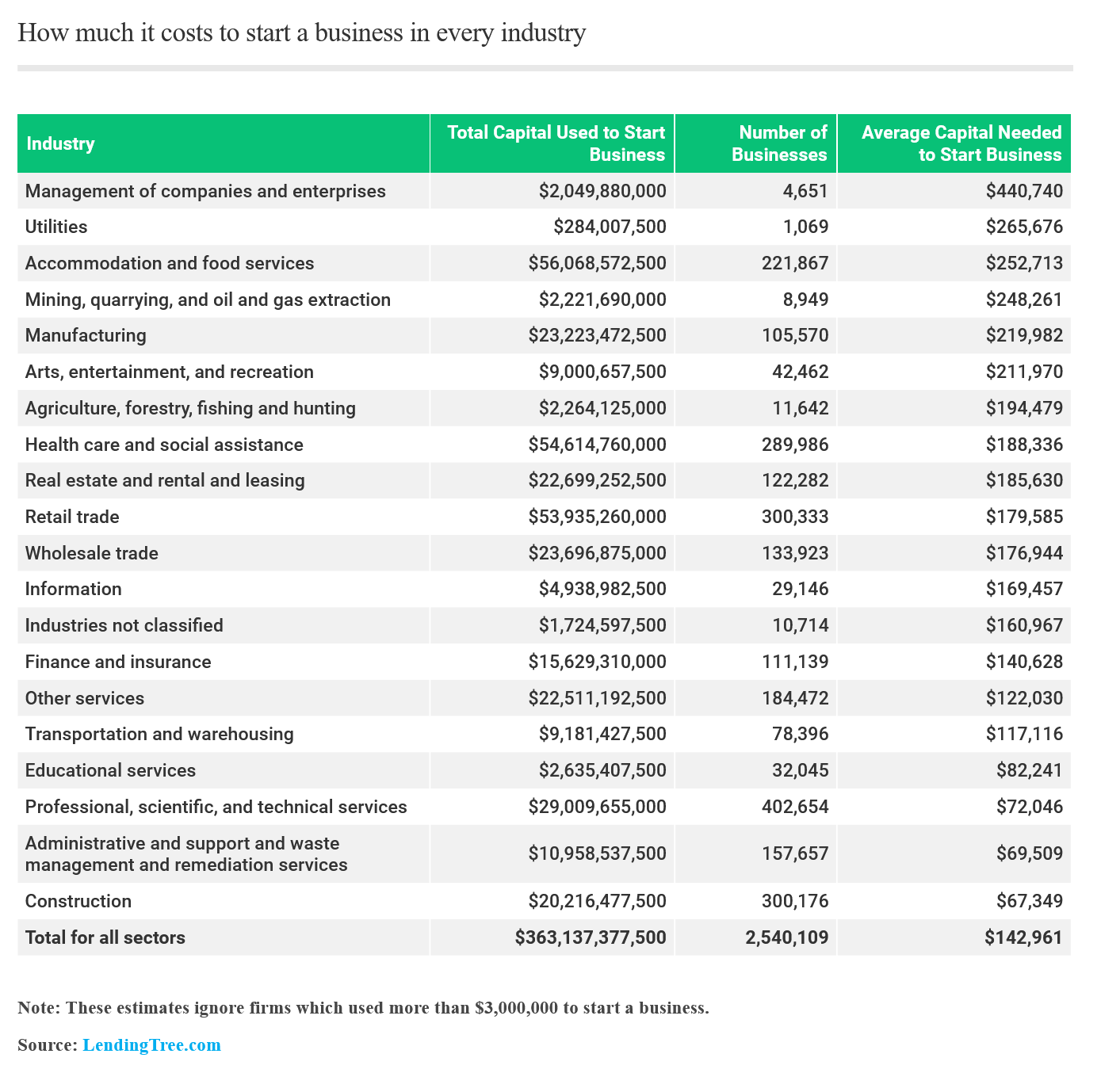

Industry Specific Costs

E-commerce: While seemingly low-cost, setting up an e-commerce store involves platform fees (Shopify, etc.), payment processing costs, and digital marketing expenses. Expect to spend a minimum of $1,000 to $5,000 to get started.

Restaurant: Starting a restaurant is capital-intensive. Leasing space, renovating, purchasing equipment, and obtaining licenses can easily exceed $100,000, even for a small establishment.

Consulting: The lowest barrier to entry. Costs are primarily related to marketing and professional development. Starting costs can be as low as a few hundred dollars.

Hidden Costs to Watch Out For

Working Capital: Crucial to cover operational expenses during initial months. Many businesses fail due to underestimating this need.

Insurance: Liability, property, and worker's compensation insurance are essential. Costs vary based on industry and risk level.

Contingency Fund: Always set aside a reserve for unexpected expenses. Experts recommend having 10-20% of the total budget for contingencies.

Funding Sources

Self-Funding: Using personal savings or assets. Requires a realistic assessment of personal financial risk tolerance.

Loans: Small business loans from banks or credit unions. Requires a strong business plan and good credit score.

Investors: Seeking capital from angel investors or venture capitalists. Requires giving up equity in the company.

Grants: Government or private grants for small businesses. Often highly competitive and require specific qualifications.

Next Steps

Develop a detailed business plan and budget. Seek advice from experienced entrepreneurs and financial advisors.

Thorough research and planning are crucial for success. Overestimating costs is always safer than underestimating them.

![How Much Does It Cost To Start A Buisness [Infographic] Small Business Startup Costs – Canada Small Business](https://www.canadastartups.org/wp-content/uploads/2017/07/startupbuddy.com_.png)