Is Aqua Metals A Good Investment

In a world increasingly focused on sustainability and resource recovery, the spotlight shines brightly on companies pioneering innovative recycling solutions. Among these, Aqua Metals, a Nevada-based company aiming to revolutionize lead-acid battery recycling, has garnered significant attention – and scrutiny – from investors. Is this company, with its promise of cleaner, more efficient battery recycling, a worthwhile investment, or does it harbor risks that outweigh its potential rewards?

This article dives deep into the financial performance, technological advancements, market position, and future prospects of Aqua Metals (AQMS) to provide a comprehensive analysis for potential investors. We'll explore the company's patented AquaRefining technology, its partnerships, and the challenges it faces in a competitive and evolving industry. This balanced perspective will help readers determine if Aqua Metals aligns with their investment strategies and risk tolerance.

AquaRefining: A Disruptive Technology?

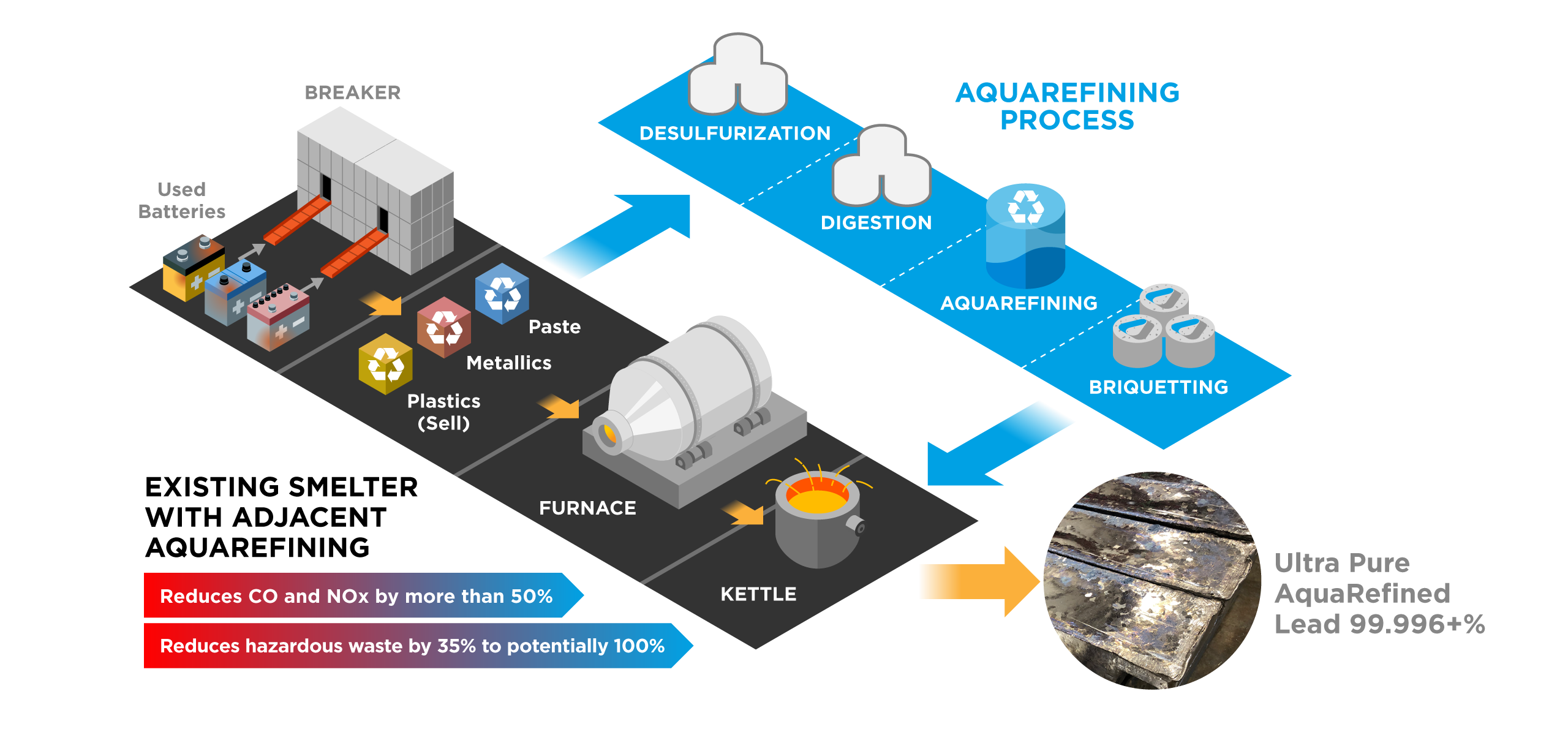

Aqua Metals' core innovation lies in its AquaRefining technology, a process that aims to replace traditional smelting with an electrochemical method. Smelting, the conventional method for recycling lead-acid batteries, is known for its significant environmental footprint, including air pollution and hazardous waste generation. AquaRefining, on the other hand, uses an electrolyte solution to selectively dissolve lead compounds, purportedly resulting in a cleaner and more sustainable process.

The company claims several advantages for its AquaRefining process, including lower emissions, reduced energy consumption, and higher lead purity. Additionally, they claim to be able to recover valuable materials beyond lead, such as plastics and other metals, further enhancing the economic viability of their recycling operations.

Financial Performance and Challenges

Despite the promising technology, Aqua Metals has faced significant financial challenges. The company has a history of net losses and has relied heavily on equity financing to fund its operations. Achieving consistent profitability and scaling up production to meet market demand remain key hurdles.

According to recent financial reports, the company's revenue stream has been inconsistent. Capital expenditures required to build and maintain AquaRefining facilities are substantial, placing a strain on the company’s resources.

"We believe our AquaRefining technology offers a compelling value proposition for battery recyclers and the environment," stated Steve Cotton, Aqua Metals' President and CEO, in a recent investor call. "However, scaling our operations and achieving consistent profitability remains our top priority."

Market Landscape and Competition

The battery recycling market is competitive, with established players employing traditional smelting techniques. These companies benefit from economies of scale and established relationships with battery manufacturers and collectors. Aqua Metals must demonstrate its ability to compete effectively against these incumbents.

Increasing environmental regulations and growing demand for recycled materials are driving growth in the battery recycling market. This presents both opportunities and challenges for Aqua Metals, as stricter regulations could favor cleaner technologies like AquaRefining, while increased competition could put pressure on margins.

Another challenge comes in the form of new battery technologies, such as lithium-ion batteries, which are becoming increasingly prevalent in electric vehicles and energy storage systems. Aqua Metals will need to adapt its technology or diversify its operations to address the growing market for lithium-ion battery recycling.

Strategic Partnerships and Future Growth

Aqua Metals has pursued strategic partnerships to accelerate its growth and market penetration. Collaborations with battery manufacturers and recycling companies are crucial for securing feedstock and deploying its AquaRefining technology. These partnerships can provide access to capital, expertise, and established distribution networks.

The company has been exploring opportunities to license its technology to other recycling facilities. This licensing model could provide a more capital-efficient way to expand its reach and generate revenue.

Key Considerations for Investors

Technological Risk: While AquaRefining holds promise, it is still a relatively new technology. Its long-term reliability and scalability need to be further demonstrated.

Financial Risk: Aqua Metals has a history of losses and requires significant capital investment. Investors should carefully assess the company’s financial stability and ability to raise capital.

Market Risk: The battery recycling market is competitive and subject to regulatory changes. Aqua Metals must effectively compete against established players and adapt to evolving market dynamics.

Regulatory Environment: Changes in environmental regulations can significantly impact the demand for cleaner recycling technologies. Investors should monitor regulatory developments closely.

Conclusion: A High-Risk, High-Reward Opportunity?

Aqua Metals presents a compelling, yet complex, investment opportunity. The company's AquaRefining technology has the potential to disrupt the lead-acid battery recycling industry and contribute to a more sustainable future. However, significant challenges remain in terms of financial performance, technological scalability, and market competition.

For risk-averse investors, Aqua Metals may be too speculative. However, for investors with a higher risk tolerance and a belief in the company's long-term potential, Aqua Metals could offer significant rewards. Thorough due diligence, careful monitoring of the company's progress, and an understanding of the associated risks are essential before making an investment decision.

Ultimately, the success of Aqua Metals hinges on its ability to execute its strategic plan, secure funding, and demonstrate the economic viability and environmental benefits of its AquaRefining technology. Only time will tell if this innovative company can truly revolutionize the battery recycling industry and deliver value to its investors.