Which Of The Following Items Are Plant Assets

Figuring out what qualifies as a plant asset can be tricky for businesses, especially when making important financial decisions. Understanding this distinction is crucial for accurate accounting, tax compliance, and long-term financial planning.

This article clarifies which items commonly encountered in business operations are classified as plant assets, also known as property, plant, and equipment (PP&E). We will define plant assets and explore examples of tangible items.

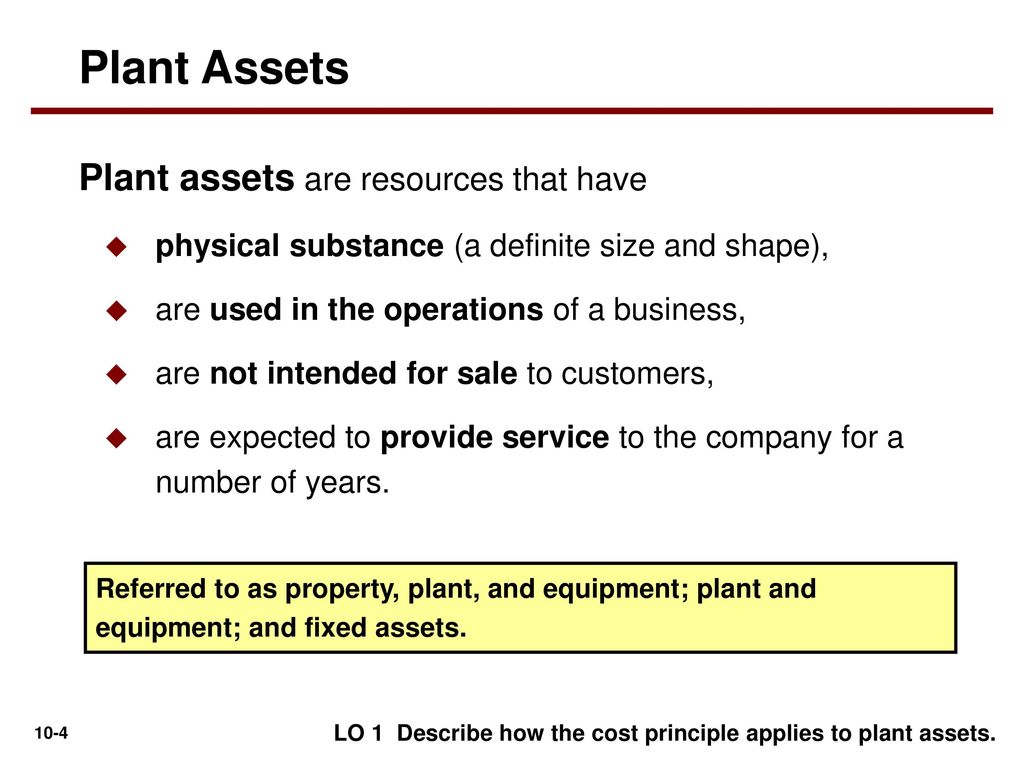

Defining Plant Assets

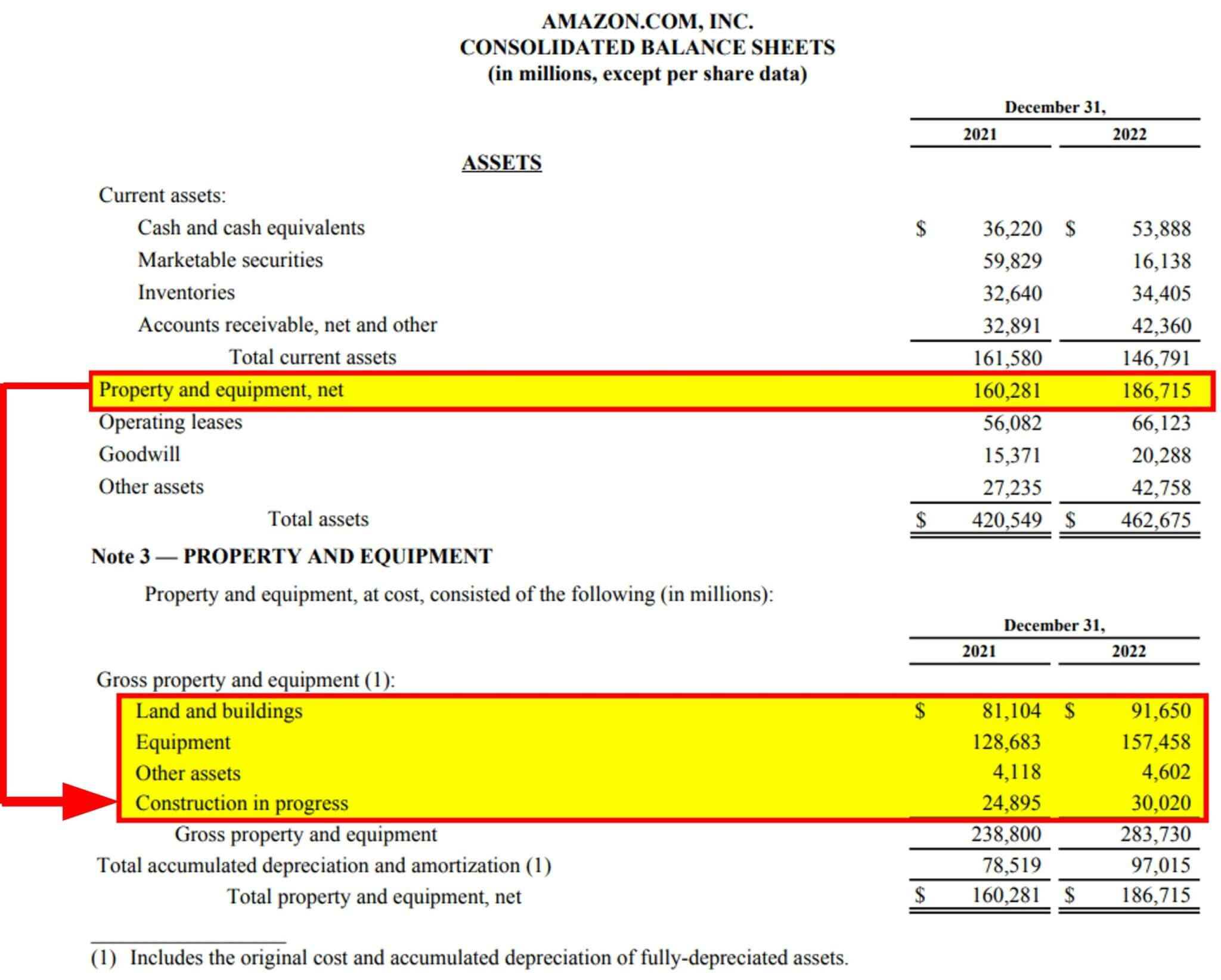

Plant assets are tangible items a company owns and uses for more than one accounting period to generate revenue. They are not intended for resale to customers in the ordinary course of business. These assets are recorded on the balance sheet and are subject to depreciation (except for land, which has an unlimited useful life).

Key Characteristics of Plant Assets:

Tangible: Plant assets have a physical substance that can be seen and touched. Used in Operations: They are used to produce goods or services, for rental to others, or for administrative purposes. Long-Term Use: Plant assets are expected to be used for more than one accounting period, typically exceeding one year.

Examples of Plant Assets

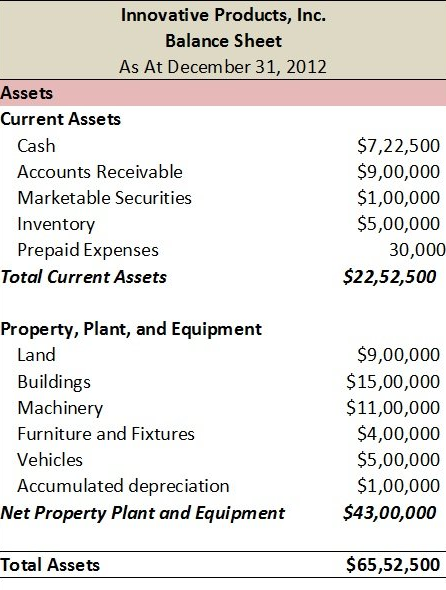

Numerous items qualify as plant assets, depending on the nature of the business. Common examples across various industries include land, buildings, equipment, machinery, and furniture.

Land: Land used in business operations, such as land used for a factory or office building, is a plant asset. It’s crucial to note that land held for investment purposes, like future development, might not be classified as a plant asset. Land is not depreciated because it has an indefinite life.

Buildings: Factories, warehouses, office buildings, and retail stores owned by the company fall under plant assets. The cost of acquiring or constructing a building includes expenses such as purchase price, construction costs, legal fees, and any necessary improvements. Depreciation expense is recorded over the building's useful life.

Equipment and Machinery: This category encompasses a wide array of items depending on the company's industry. This includes production machinery in a manufacturing plant, specialized medical equipment in a hospital, and computer systems in an office. These assets are typically depreciated over their useful lives.

Furniture and Fixtures: Office furniture, display cases, and store fixtures are also considered plant assets. While individual items may be less expensive than larger pieces of equipment, their collective value can be substantial. Like other plant assets, they are depreciated over their estimated useful lives.

Items That Are Not Plant Assets

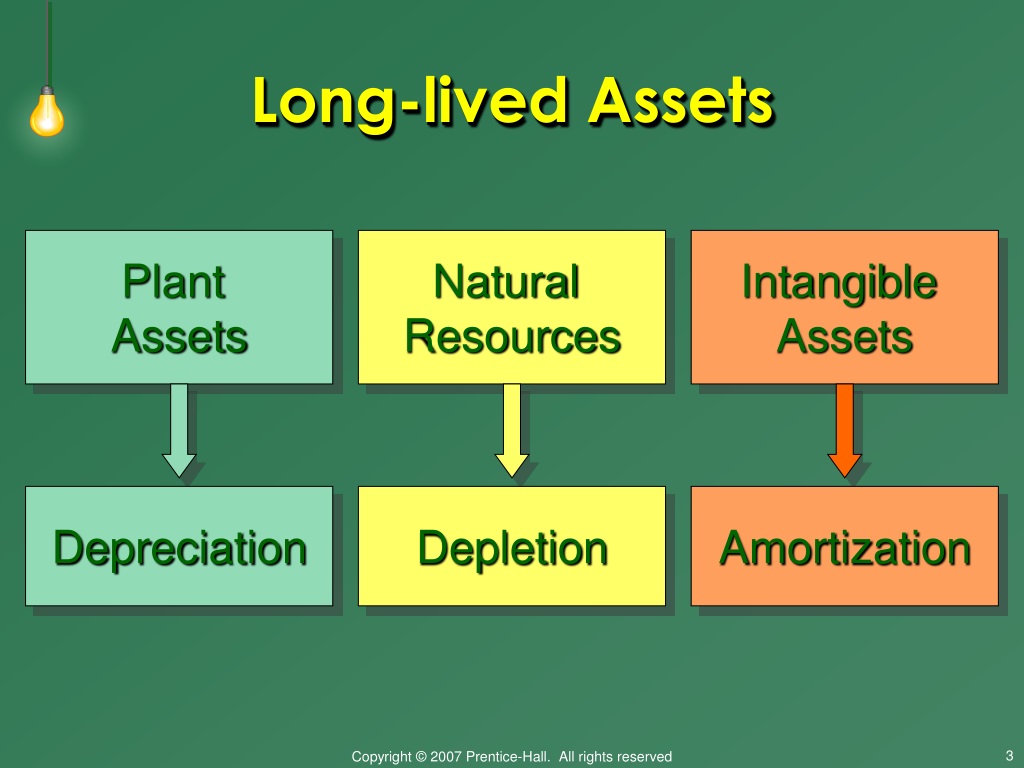

It’s equally important to identify items that do not qualify as plant assets. These include inventory, short-term investments, and intangible assets.

Inventory: Inventory refers to goods held for sale to customers in the ordinary course of business. While tangible, inventory is classified as a current asset and is not considered a plant asset.

Short-Term Investments: Investments expected to be converted to cash within one year are classified as current assets and are not plant assets. These are typically recorded at fair market value on the balance sheet.

Intangible Assets: These are assets that lack physical substance, such as patents, trademarks, and copyrights. Intangible assets can provide long-term benefits to the company, but they are accounted for separately from plant assets.

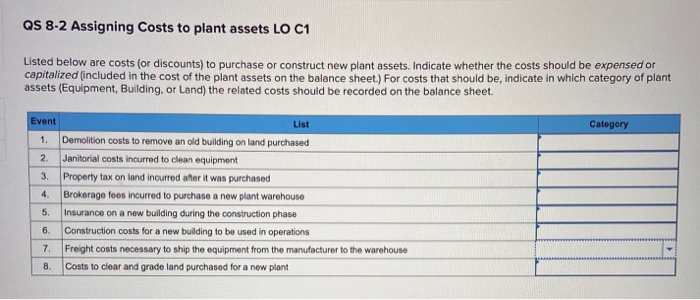

Distinguishing Between Capital Expenditures and Revenue Expenditures

A crucial aspect of managing plant assets is correctly classifying expenditures related to them. Expenditures that increase the asset's useful life or improve its functionality are considered capital expenditures and are added to the asset's cost.

Expenditures that maintain the asset's existing condition are considered revenue expenditures and are expensed in the current period. Incorrect classification can distort a company's financial statements.

Example: Replacing an old machine with a newer, more efficient model would be a capital expenditure. Routine maintenance, such as oil changes on a vehicle, would be a revenue expenditure.

Accounting for Depreciation

Depreciation is the systematic allocation of the cost of a plant asset over its useful life. There are several methods to calculate depreciation, including the straight-line method, the declining balance method, and the units of production method.

The choice of depreciation method can significantly impact a company's reported earnings. Businesses must choose a method that accurately reflects the asset's consumption pattern.

Importance of Accurate Plant Asset Classification

Properly identifying and accounting for plant assets is crucial for several reasons. It ensures accurate financial reporting, facilitates informed decision-making, and aids in tax compliance.

Accurate depreciation expense impacts the net income reported. Businesses can make informed choices on reinvestment and expansion when they have a clear picture of the company's long-term assets.

The Internal Revenue Service (IRS) has specific guidelines on depreciating assets for tax purposes. Adhering to these regulations is essential for minimizing tax liabilities and avoiding penalties.

Conclusion

Understanding which items qualify as plant assets is fundamental to sound financial management. By correctly classifying these assets and accounting for them properly, businesses can achieve accurate financial reporting, make informed decisions, and ensure tax compliance. Consulting with accounting professionals can further refine these understandings and ensure best practices in asset management.

![Which Of The Following Items Are Plant Assets [Solved] Common categories of a classified balance | SolutionInn](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/04/660a5f0c399e9_724660a5f0c361ff.jpg)