How To Set Up Deductions In Quickbooks Payroll

Time is money! Employers using QuickBooks Payroll need to act fast to correctly set up deductions. Failure to do so can lead to costly errors and compliance issues.

This article provides a crucial guide to setting up deductions in QuickBooks Payroll, ensuring accurate payroll processing and avoiding potential penalties. Ignoring this process isn't an option.

Setting Up Deductions: A Step-by-Step Guide

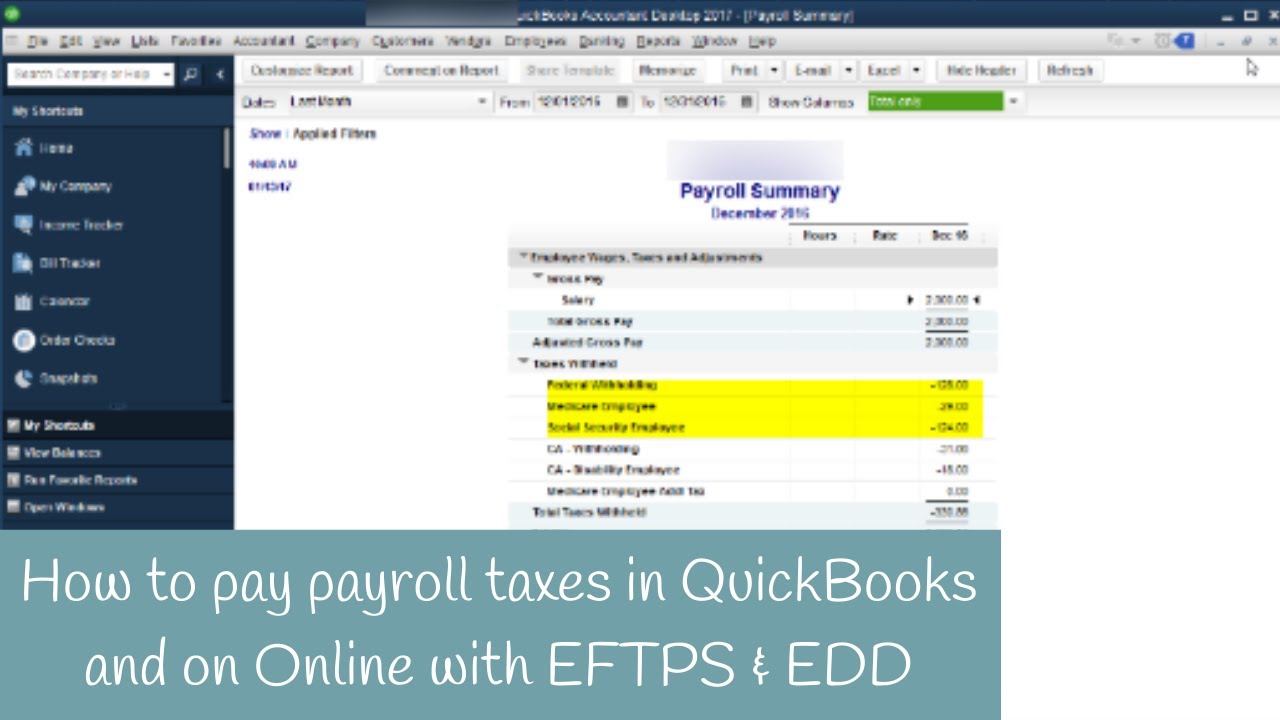

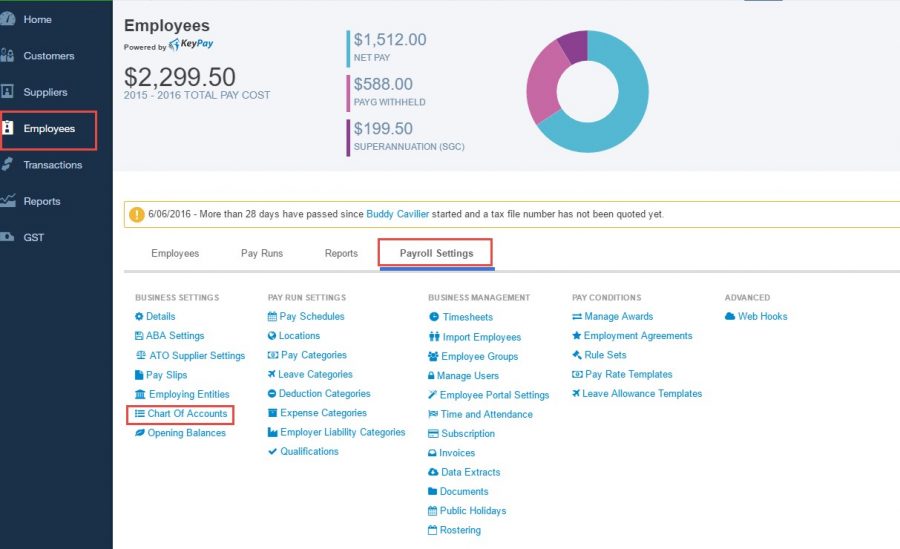

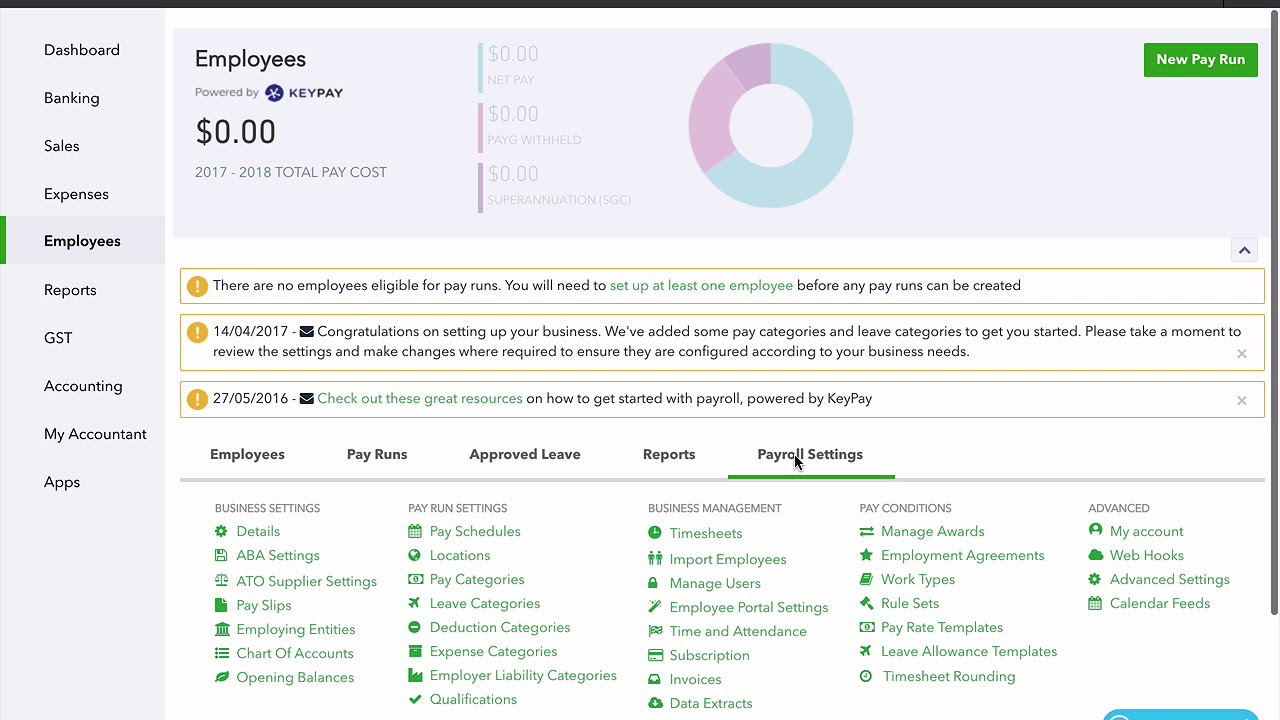

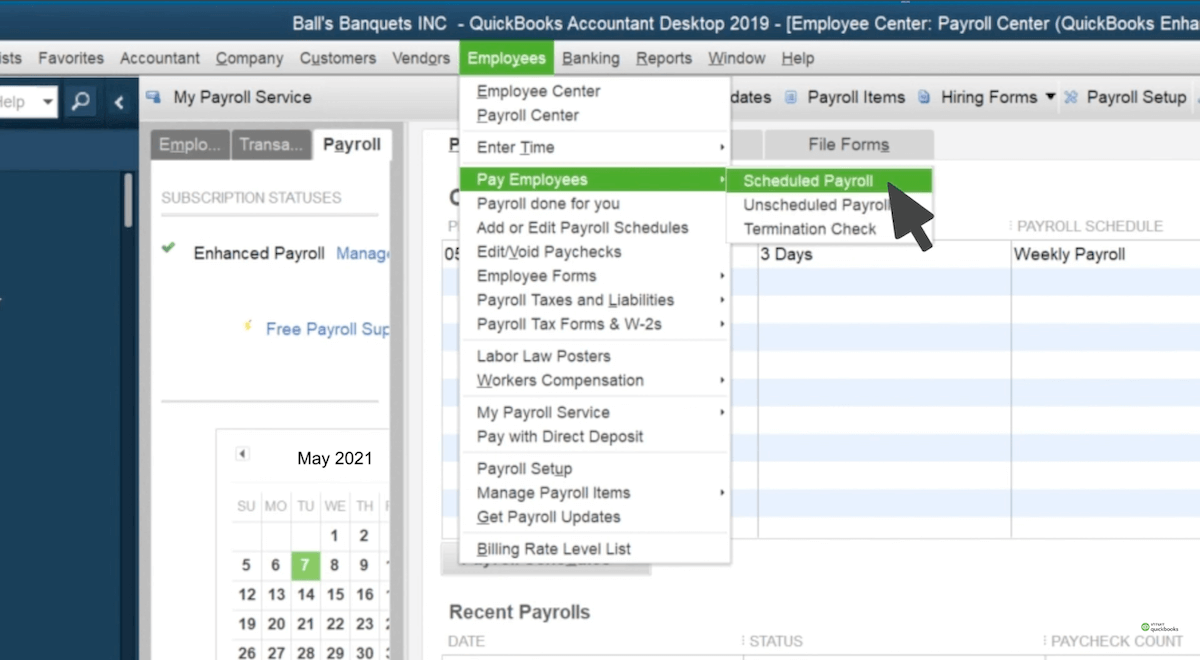

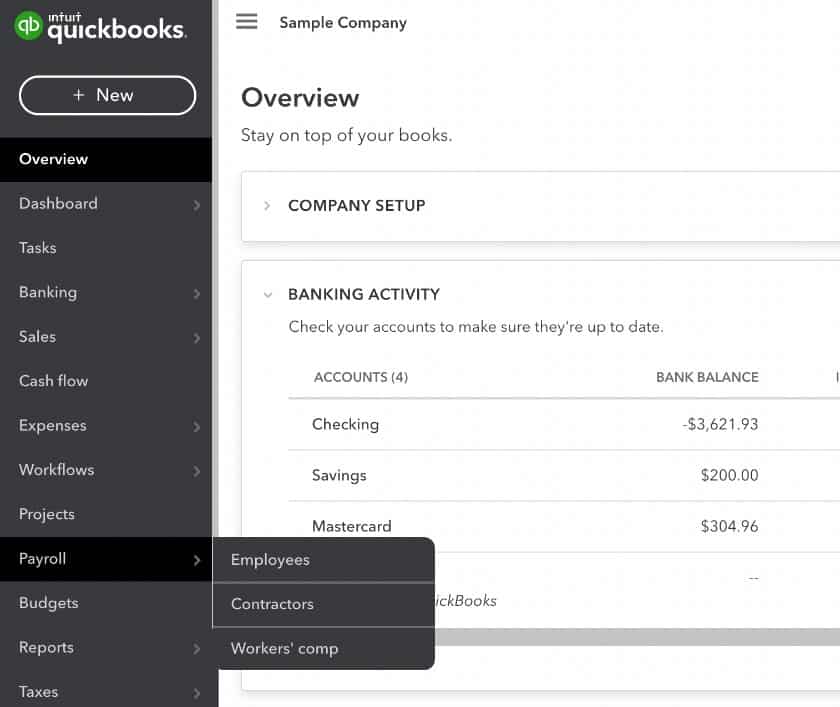

First, navigate to the Payroll Settings within QuickBooks Payroll. Access this through the Gear icon, then choose "Payroll Settings."

Next, locate the "Deductions" section. Click on "Deductions" to begin the setup process.

Creating a New Deduction

Click the "Add new" to initiate setting up a new deduction. Provide a descriptive name for the deduction.

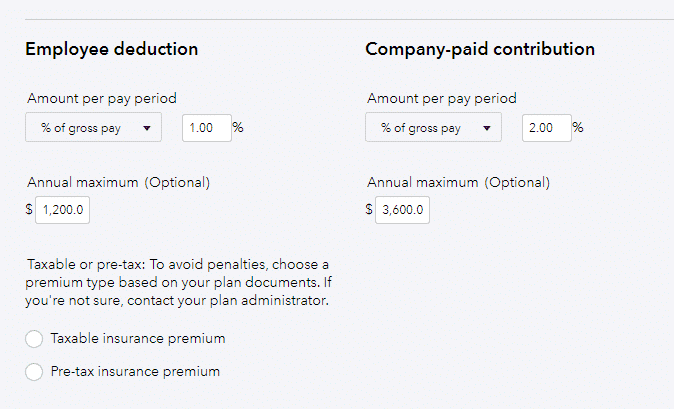

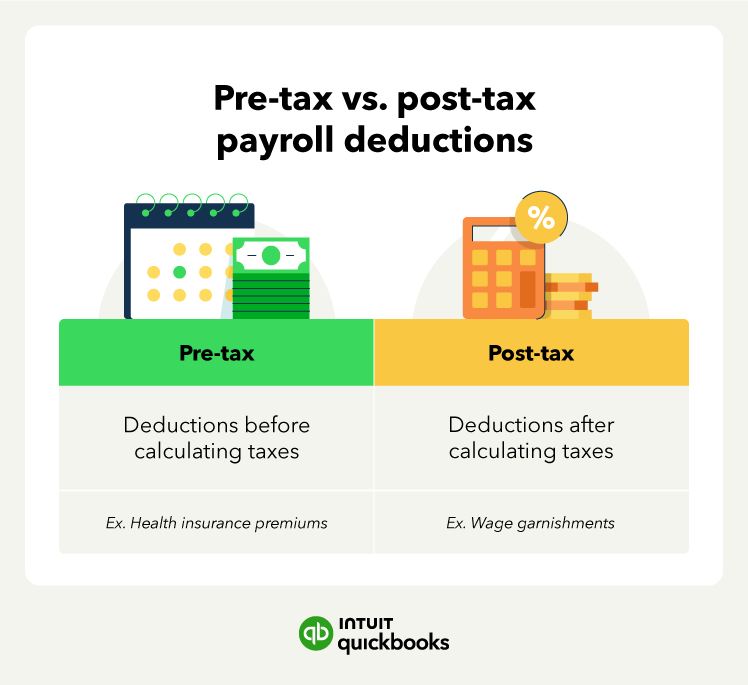

Select the appropriate deduction type from the dropdown menu. Options include: "Retirement Plans", "Insurance", or "Other".

Choose the relevant agency or vendor associated with the deduction. If needed, add a new vendor by clicking "Add new vendor."

Enter the employee and company contribution details. This involves defining calculation types, limits, and rates.

Specify how the deduction should affect taxable wages. Adjust the tax tracking settings as needed.

Save the changes by clicking "OK". Your new deduction is now configured in QuickBooks Payroll.

Managing Existing Deductions

To edit or delete existing deductions, return to the "Deductions" section. Click on the deduction you want to manage.

Make necessary modifications to the settings. Save the changes, or click "Delete" to remove the deduction entirely.

Remember to inform employees of all deduction changes. Maintain transparency to avoid confusion.

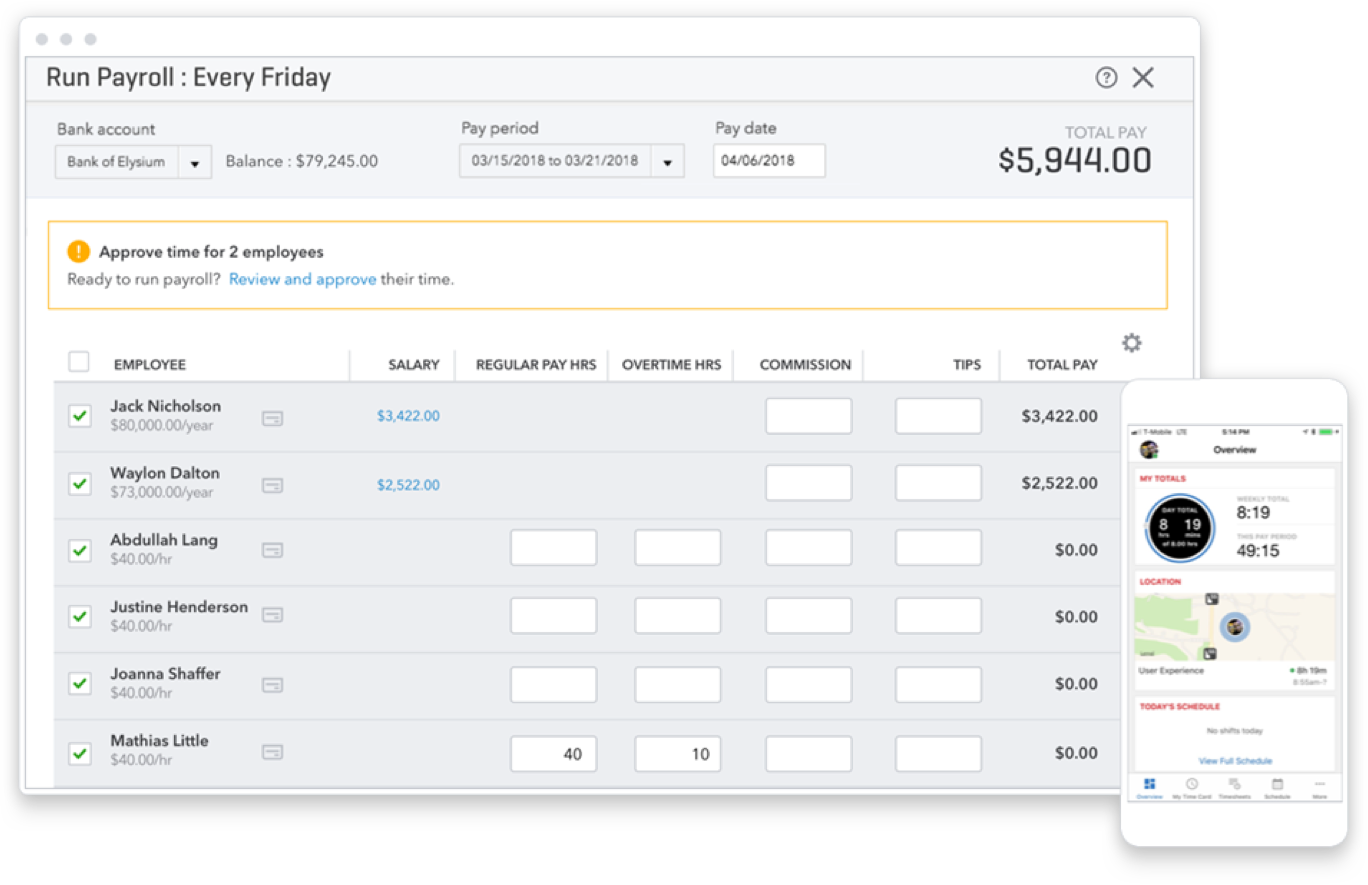

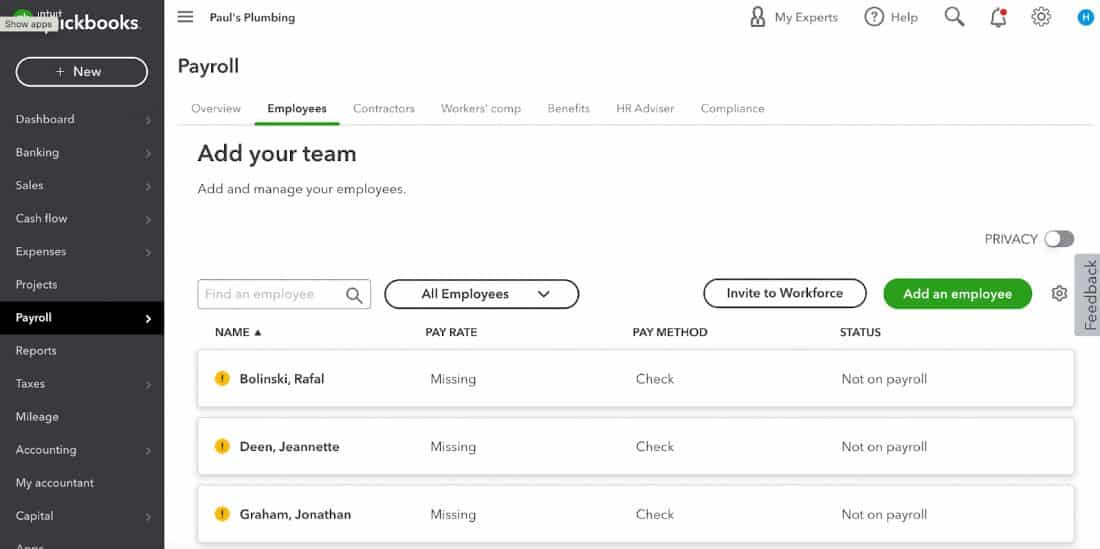

Applying Deductions to Employees

Go to the "Employees" section and select the relevant employee. Click on "Edit" or "Pencil" to modify their profile.

Navigate to the "Pay" section within the employee profile. Locate the "Deductions" area.

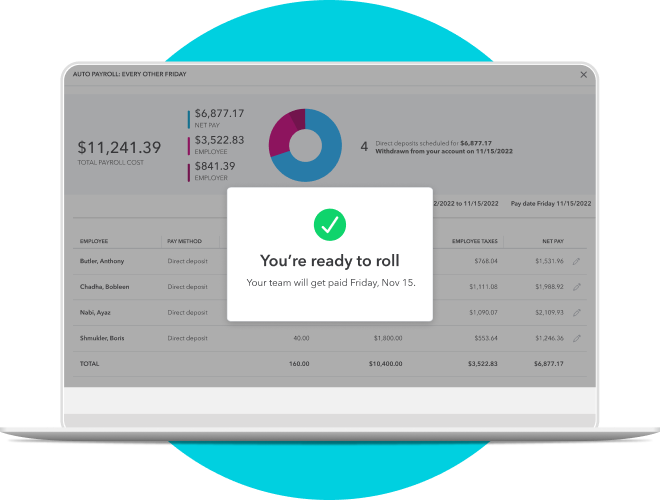

Add the newly created deduction to the employee's profile. Specify the applicable amount or percentage for the deduction.

Save the employee's profile. The deduction will now be applied during payroll processing.

Double-check each deduction for accuracy. Mistakes during payroll can cause compliance problems.

Troubleshooting and Common Issues

Ensure that deduction amounts align with employee agreements. Investigate immediately if you find discrepancies.

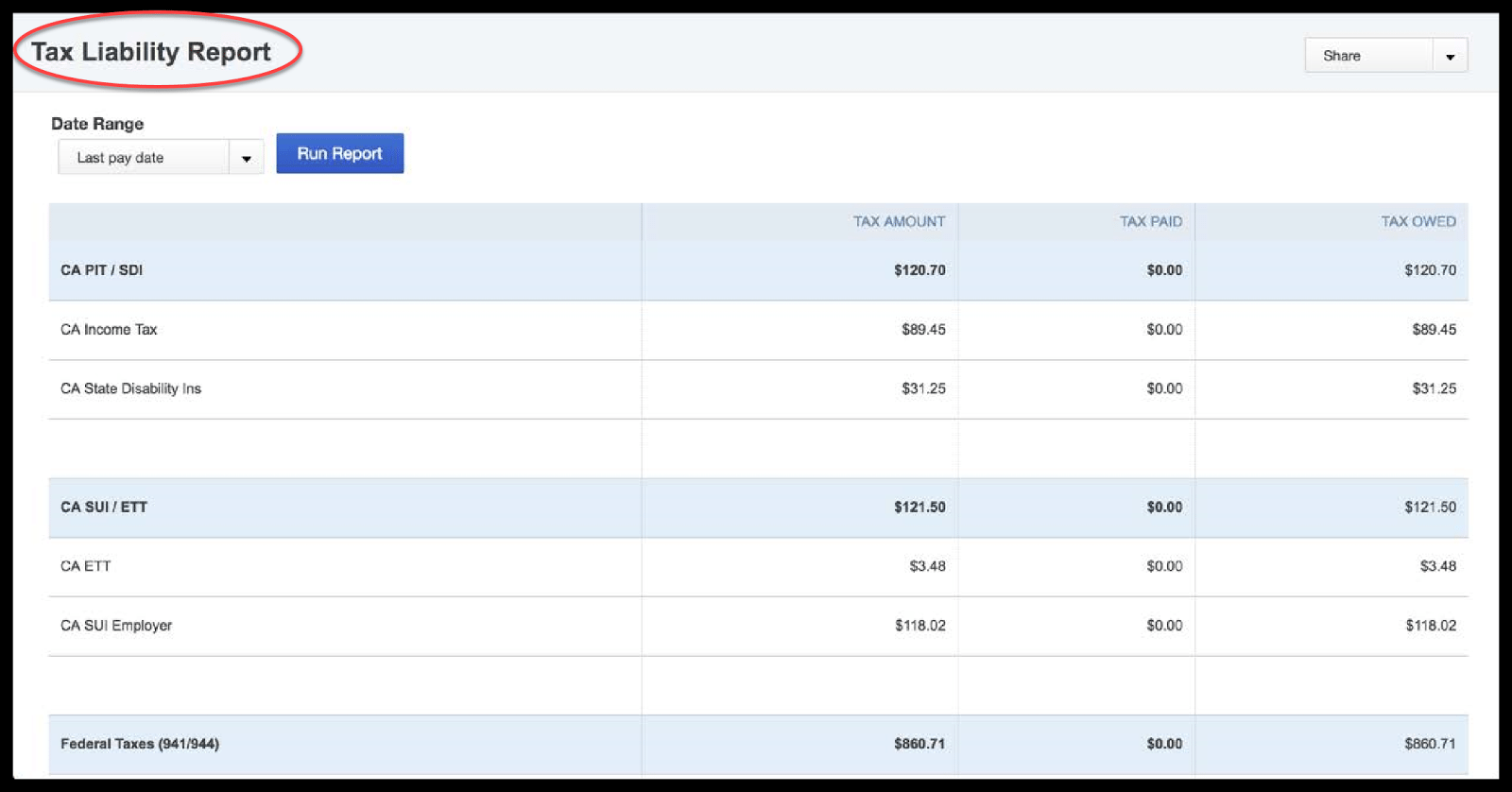

Confirm the accuracy of tax tracking settings for each deduction. Consult with a tax professional if you're unsure.

If deductions aren't appearing on paychecks, verify the employee's profile settings. Also check that active deduction is enabled for them.

Next Steps and Ongoing Developments

Regularly review your deduction setup to ensure compliance with changing regulations. Stay informed about updates.

Consult with a payroll specialist or accountant for customized guidance. Professional advice helps ensure accurate and compliant payroll processing.

Keep an eye on QuickBooks Payroll updates and training resources. These resources offer valuable insights and best practices for managing deductions.