A Qualified Retirement Plan Provides The Following Tax Advantage

The anxiety of retirement looms large for many Americans, fueled by inflation and economic uncertainty. A significant burden is understanding the complex landscape of retirement savings, especially the tax implications that can significantly impact the longevity of your nest egg. However, one avenue consistently touted for its tax benefits is the qualified retirement plan.

This article delves into the tax advantages offered by qualified retirement plans. It explores how these plans, governed by strict IRS regulations, provide a powerful tool for individuals and employers to accumulate wealth for retirement while minimizing their current and future tax liabilities. We will dissect the mechanisms of tax deferral, potential tax deductions, and the nuances of different plan types, while also addressing potential drawbacks and alternative perspectives on retirement savings strategies.

Understanding Qualified Retirement Plans

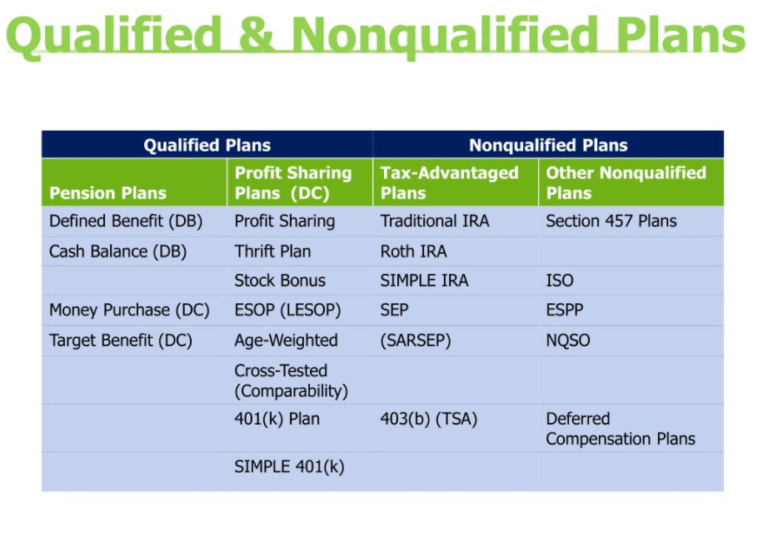

Qualified retirement plans are savings vehicles that meet the requirements of Section 401 of the Internal Revenue Code. Meeting these requirements grants the plan special tax treatment.

Examples include 401(k)s, 403(b)s, traditional IRAs, and defined benefit pension plans, according to the IRS.

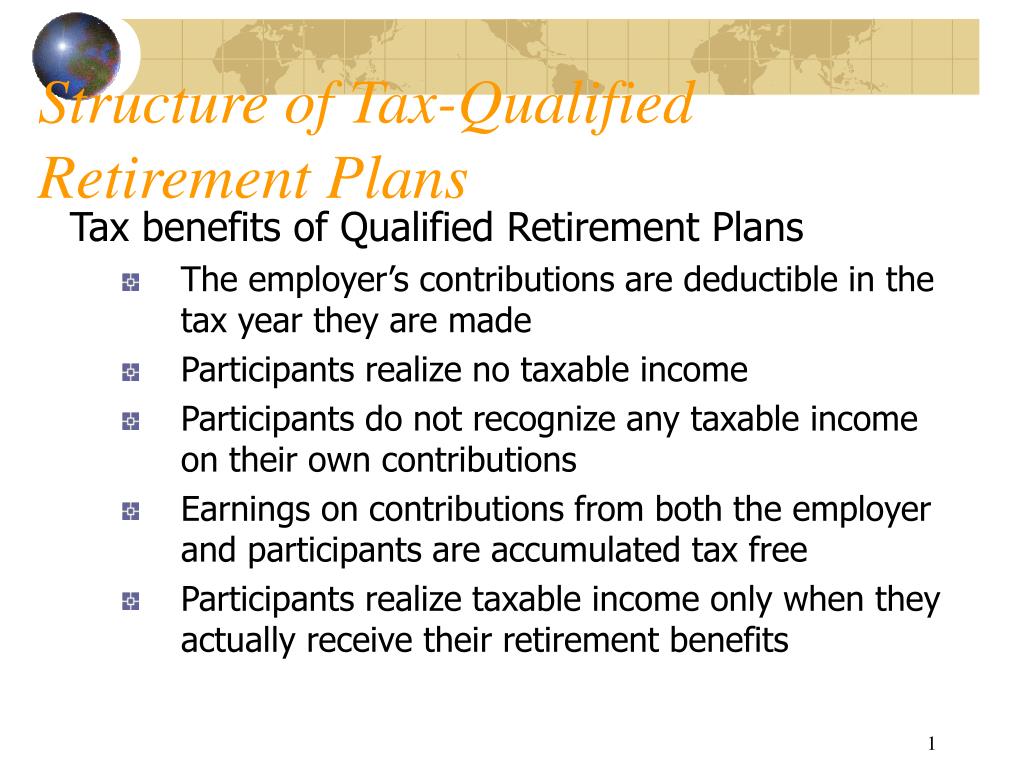

The Primary Tax Advantage: Tax Deferral

The most significant tax advantage of qualified retirement plans is tax deferral. This means you don't pay income taxes on contributions or investment earnings until you withdraw the money in retirement.

This allows your savings to grow exponentially over time, thanks to the power of compounding, as pre-tax contributions are invested and generate returns without being immediately taxed.

According to a 2023 report by the Employee Benefit Research Institute (EBRI), this tax deferral can significantly boost retirement savings over the long term, especially for younger workers.

Potential Tax Deductions

In addition to tax deferral, some qualified retirement plans offer upfront tax deductions. Contributions to traditional IRAs and 401(k)s are often tax-deductible, depending on your income and whether you are covered by a retirement plan at work.

This can lower your taxable income in the year you make the contribution, providing immediate tax relief. The amount you can deduct each year is subject to IRS limits, which can change annually.

Consulting a tax professional is crucial to determine the maximum deductible amount and the specific rules that apply to your situation, as outlined in IRS Publication 590-A.

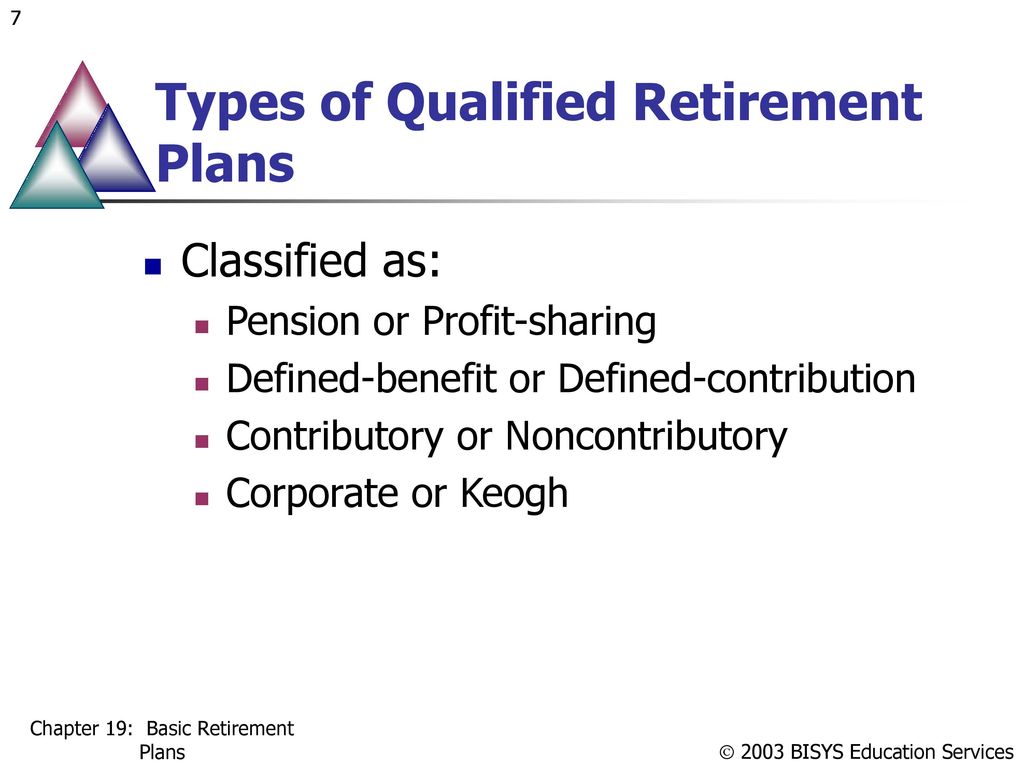

Different Qualified Plan Types, Different Benefits

The tax advantages can vary slightly depending on the specific type of qualified retirement plan. For example, contributions to a Roth IRA are not tax-deductible, but qualified withdrawals in retirement are completely tax-free.

Traditional 401(k)s and IRAs offer upfront tax deductions, while Roth accounts offer tax-free growth and withdrawals. Defined benefit pension plans, primarily offered by employers, guarantee a certain level of income in retirement based on factors like salary and years of service, and the employer typically funds the plan.

Choosing the right plan depends on individual circumstances, financial goals, and risk tolerance. Understanding the differences is crucial for maximizing tax benefits.

Employer Matching Contributions: An Added Bonus

Many employers offer matching contributions to employee 401(k) plans. This is essentially "free money" that further boosts your retirement savings.

Employer matches are typically a percentage of your salary, up to a certain limit. These contributions are also tax-deferred, compounding the benefits of the plan.

Participating in a 401(k) with an employer match is often considered one of the smartest financial moves you can make, as it significantly accelerates your retirement savings and reduces your tax burden.

Potential Drawbacks and Considerations

While qualified retirement plans offer significant tax advantages, there are also potential drawbacks to consider. Early withdrawals are generally subject to a 10% penalty, in addition to income taxes.

This can significantly erode your savings if you need to access the funds before retirement. There are some exceptions to the penalty, such as for certain medical expenses or financial hardships, but these are subject to strict IRS rules.

Also, qualified retirement plans are subject to required minimum distributions (RMDs) starting at age 73 (or 75, depending on your birth year). This means you must start taking withdrawals from your retirement accounts, even if you don't need the money, and these withdrawals are taxed as ordinary income.

Alternative Perspectives and Strategies

While qualified retirement plans are a cornerstone of retirement savings, they are not the only option. Some individuals may prefer to invest in taxable accounts for greater flexibility and access to their funds.

Others may consider real estate or other alternative investments. The best approach depends on individual circumstances and financial goals.

Financial advisors often recommend diversifying your retirement savings across multiple types of accounts to mitigate risk and maximize potential returns, according to a recent article in the Wall Street Journal.

The Future of Retirement Savings

The landscape of retirement savings is constantly evolving, with new legislation and regulations impacting qualified retirement plans. The SECURE 2.0 Act, for instance, made significant changes to retirement plan rules, including increasing the age for RMDs and expanding access to retirement savings plans for part-time workers.

Staying informed about these changes is crucial for maximizing the benefits of qualified retirement plans and ensuring a secure retirement. The role of financial literacy and access to professional advice is also becoming increasingly important.

As people live longer and face greater economic uncertainty, the need for effective retirement savings strategies, including maximizing the tax advantages of qualified retirement plans, will only continue to grow.