Which Of The Following Products Requires A Securities License

Imagine a bustling marketplace, not of fruits and vegetables, but of financial instruments. Colorful charts dance across screens, whispers of investment opportunities fill the air, and hopeful individuals seek guidance on navigating the complexities of wealth-building. But amidst this vibrant scene, a critical question lingers: Who is qualified to offer advice and sell these financial products?

This article delves into the crucial topic of securities licenses, clarifying which financial products necessitate holding one. Understanding these requirements is vital for both professionals offering investment services and individuals seeking trustworthy financial advice.

We'll explore the landscape of regulated financial products, examining the specific licenses needed to engage in their sale and advisory. This knowledge empowers investors to make informed decisions and ensures accountability within the financial industry.

The Foundation: What is a Security?

Before diving into the licenses, let's define what constitutes a security. A security, in financial terms, represents an ownership position in a public company (stock), a creditor relationship with a governmental body or corporation (bond), or rights to ownership as represented by an option.

The Securities and Exchange Commission (SEC) plays a pivotal role in defining and regulating securities in the United States.

Examples of securities include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and variable annuities.

Which Products Require a Securities License?

Generally, if a product is considered a security, anyone selling it or offering advice about it needs a securities license.

However, the specific license required depends on the type of security and the nature of the activity.

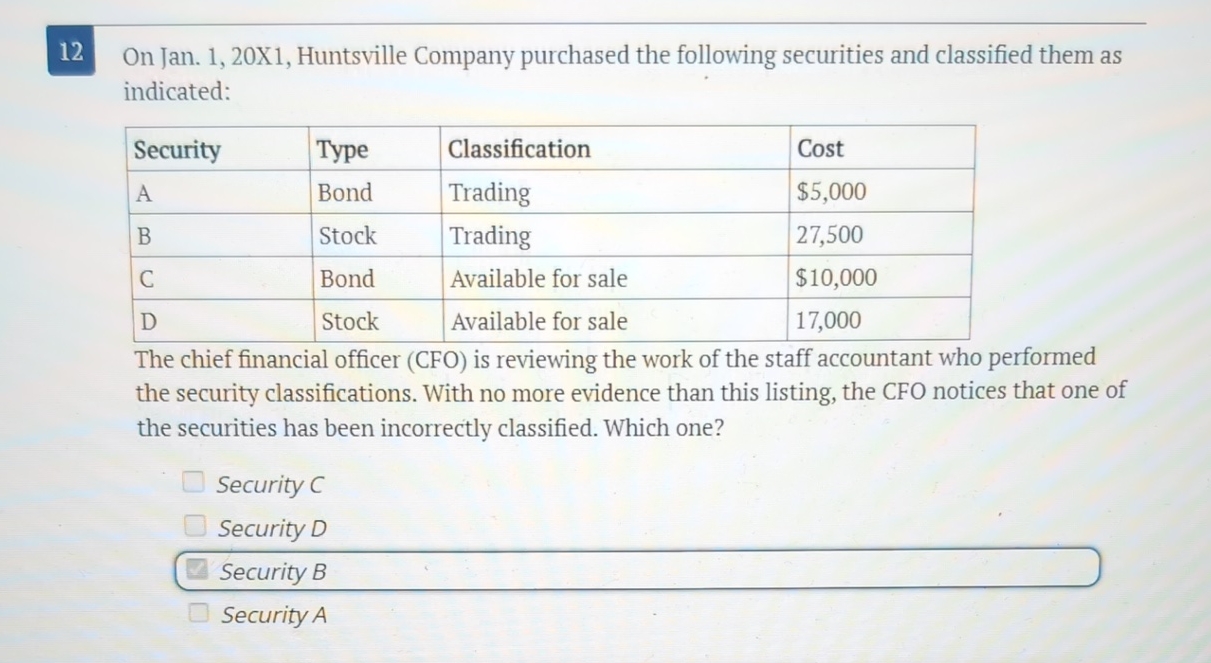

Stocks and Bonds

Selling individual stocks and bonds typically requires a Series 7 license, the General Securities Representative license. This license allows individuals to solicit, purchase, and/or sell a broad range of securities products.

In addition to the Series 7, most states require a Series 63 license (Uniform Securities Agent State Law Examination) or a Series 66 license (Uniform Combined State Law Examination). These licenses cover state-specific regulations and ethical responsibilities.

Brokers trading these must pass these exams, which are administered by the Financial Industry Regulatory Authority (FINRA).

Mutual Funds and ETFs

Selling mutual funds and ETFs also usually necessitates a Series 7 license. In some cases, a Series 6 license (Limited Representative-Investment Company and Variable Contracts Products) may be sufficient if the individual only sells packaged products like mutual funds and variable annuities.

However, the Series 7 offers broader opportunities.

Again, a Series 63 or Series 66 license is typically required at the state level.

Variable Annuities

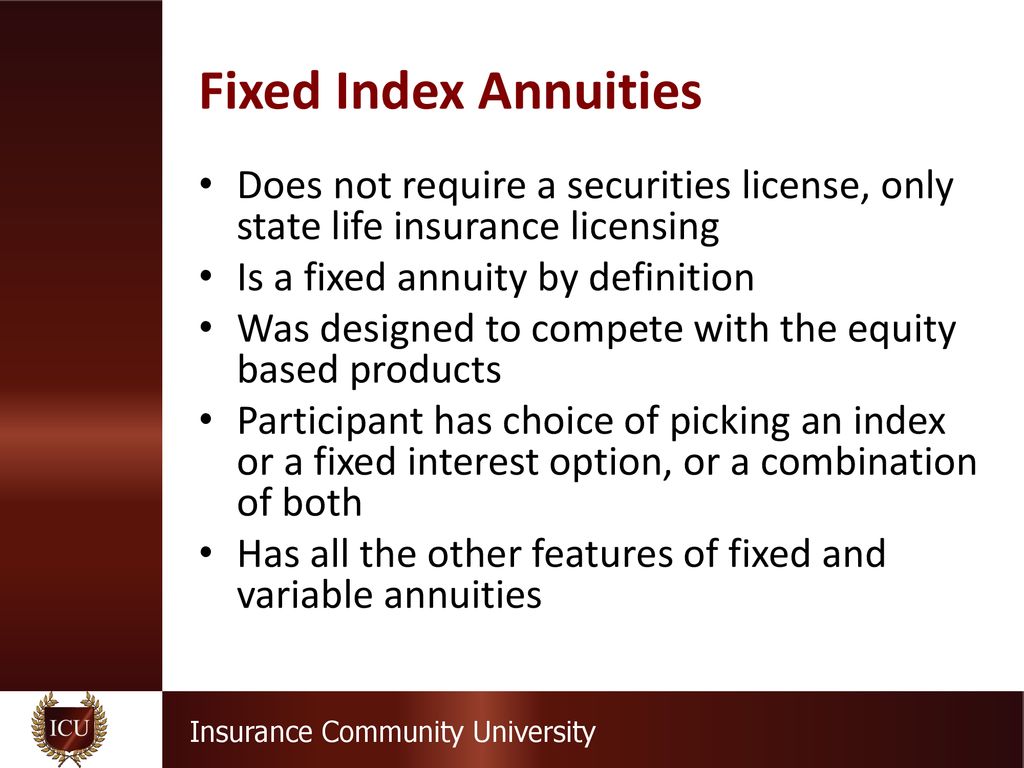

Variable annuities, which are insurance contracts with an investment component, present a slightly different situation. Selling these products requires both a securities license (Series 6 or 7) and a state insurance license.

This is because variable annuities are considered both securities and insurance products.

The dual licensing ensures that the individual understands both the investment aspects and the insurance features of the product.

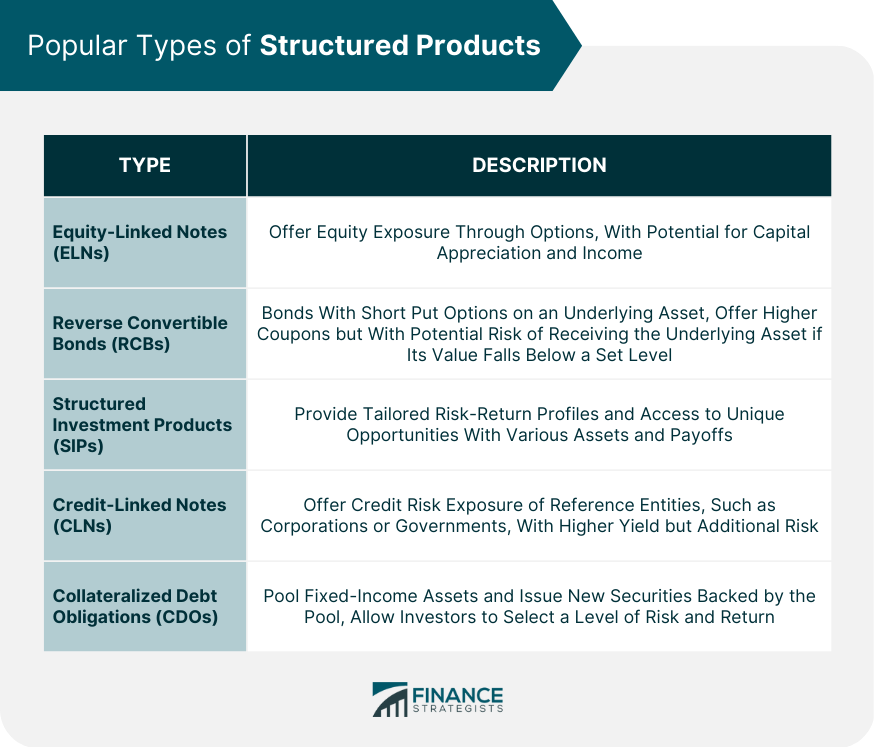

Private Placements

Private placements, which are securities offerings exempt from registration with the SEC, also require a securities license to sell. Although these offerings are not publicly traded, they are still considered securities and fall under the purview of securities regulations.

The rules and regulations surrounding private placements can be complex, requiring specialized knowledge and expertise.

Therefore, individuals involved in selling private placements must hold the appropriate securities licenses.

Products That Generally Don't Require a Securities License

While a wide range of financial products falls under securities regulations, some exceptions exist. These products are typically regulated by other agencies or are not considered investments in the same way as securities.

Understanding these exceptions is equally important to avoid confusion and ensure compliance.

Fixed Annuities

Fixed annuities, unlike variable annuities, offer a guaranteed rate of return. They are considered insurance products and are regulated by state insurance commissioners, not the SEC.

Therefore, selling fixed annuities generally requires a state insurance license, but not a securities license.

The focus is on the guaranteed interest rate and the insurance company's ability to pay out benefits.

Life Insurance

Similar to fixed annuities, life insurance policies are primarily insurance products and are regulated by state insurance departments. Selling life insurance requires a state insurance license.

While some life insurance policies may have investment components, the primary purpose is to provide financial protection in the event of death.

Therefore, a securities license is not typically required to sell life insurance.

Real Estate

While real estate can be a significant investment, it is not considered a security. Real estate transactions are governed by state real estate laws, and real estate agents are licensed by state real estate commissions.

Selling real estate requires a real estate license, not a securities license.

However, certain real estate-related investments, such as Real Estate Investment Trusts (REITs), are considered securities and require the appropriate securities licenses to sell.

Commodities

Direct investment in commodities, such as gold or oil, typically does not require a securities license. However, trading commodity futures contracts or options on commodities does require a specific license, usually a Series 3 license (National Commodities Futures Examination).

Commodities futures are derivative instruments and are regulated differently than traditional securities.

The Commodity Futures Trading Commission (CFTC) oversees the commodities markets.

The Importance of Due Diligence

For individuals seeking financial advice or investment opportunities, it's crucial to verify that the person offering the services holds the appropriate licenses. FINRA's BrokerCheck is a valuable tool for checking the background and credentials of brokers and investment advisors.

This database provides information on a professional's registration status, employment history, and any disciplinary actions.

Protecting your financial future starts with ensuring you're working with a qualified and trustworthy professional.

The Consequences of Operating Without a License

Engaging in securities activities without the required licenses can have severe consequences. These can include fines, cease-and-desist orders, and even criminal charges.

Regulatory bodies like the SEC and FINRA actively enforce securities laws to protect investors and maintain the integrity of the financial markets.

Compliance with licensing requirements is not just a legal obligation, but also an ethical responsibility.

Conclusion

Navigating the world of financial products and licenses can seem daunting, but understanding the basics is essential for both professionals and investors. By knowing which products require a securities license, individuals can ensure they are operating legally and ethically, and investors can make informed decisions when seeking financial guidance.

The ultimate goal is to foster a financial marketplace built on trust, transparency, and sound advice.

As the financial landscape continues to evolve, staying informed about licensing requirements and regulations will remain a critical element of responsible financial practice.