How Much Does It Cost To Start Your Own Business

The entrepreneurial dream – launching your own business and being your own boss – is a powerful lure. But the cold reality of startup costs often throws a bucket of ice water on those aspirations. How much capital is truly needed to bring a business idea to life? The answer, it turns out, is far from simple.

The price tag for launching a new venture can range from a few hundred dollars for a simple online service to millions for a manufacturing plant or a high-tech startup. Understanding the factors that drive these costs is crucial for anyone contemplating the leap into entrepreneurship. This article will explore the key cost components, funding options, and strategies for minimizing expenses to help aspiring business owners make informed decisions.

The Nut Graf: Decoding Startup Costs

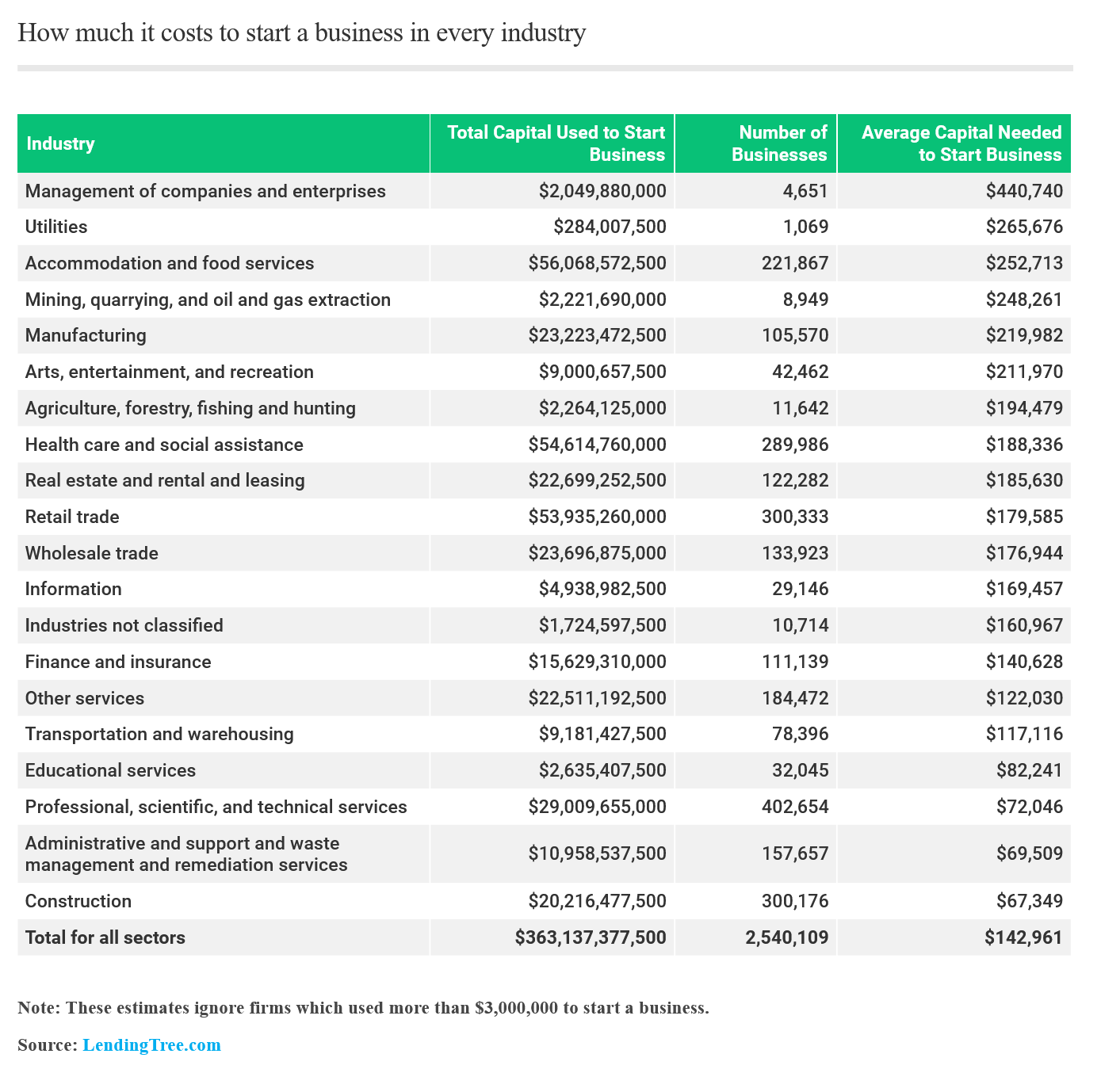

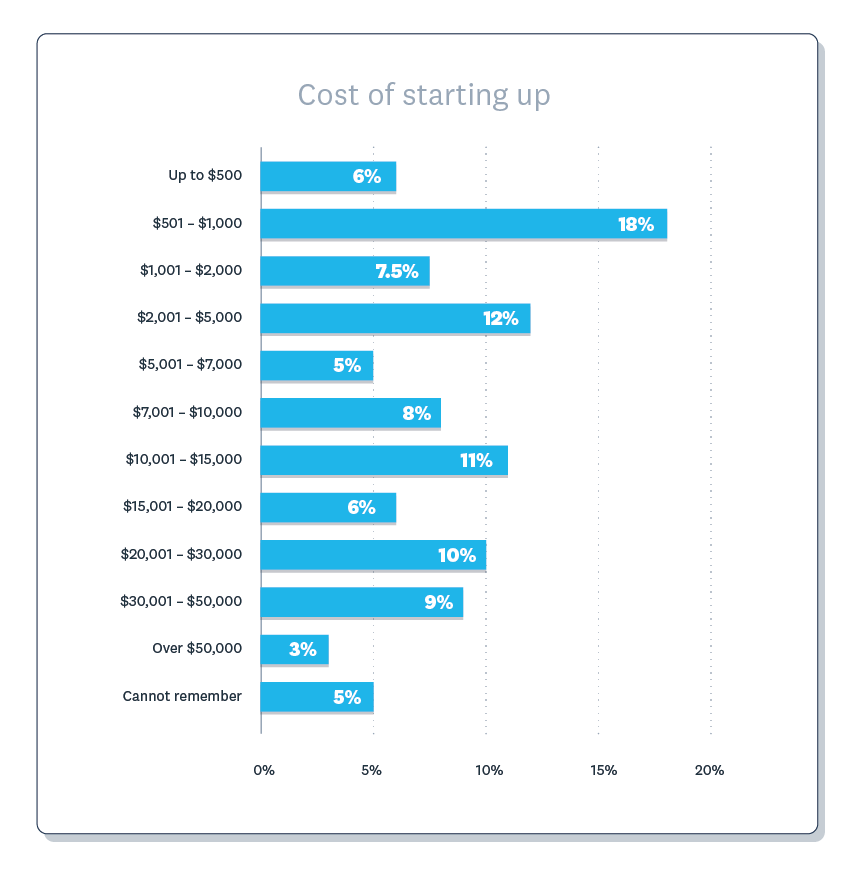

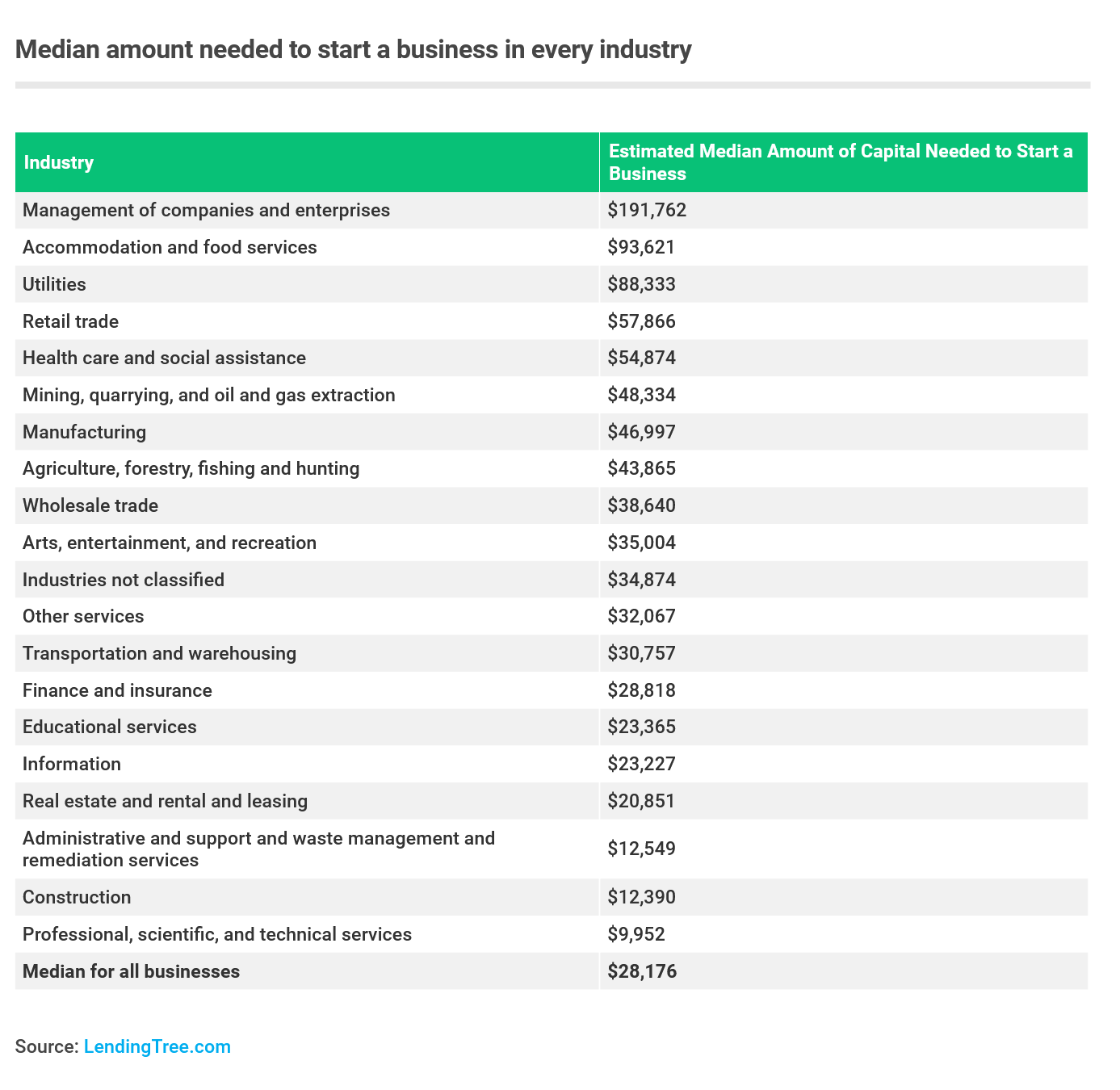

Estimating startup costs requires a detailed analysis of the business model, industry, and geographic location. A recent study by the Small Business Administration (SBA) found that most microbusinesses (businesses with fewer than 10 employees) start with less than $3,000. However, businesses requiring inventory, equipment, or a physical storefront can easily exceed $10,000 or even $100,000.

These figures highlight the vast disparity in startup costs. The key lies in understanding what drives those costs and how to manage them effectively.

Key Cost Components: A Detailed Breakdown

Initial Investments

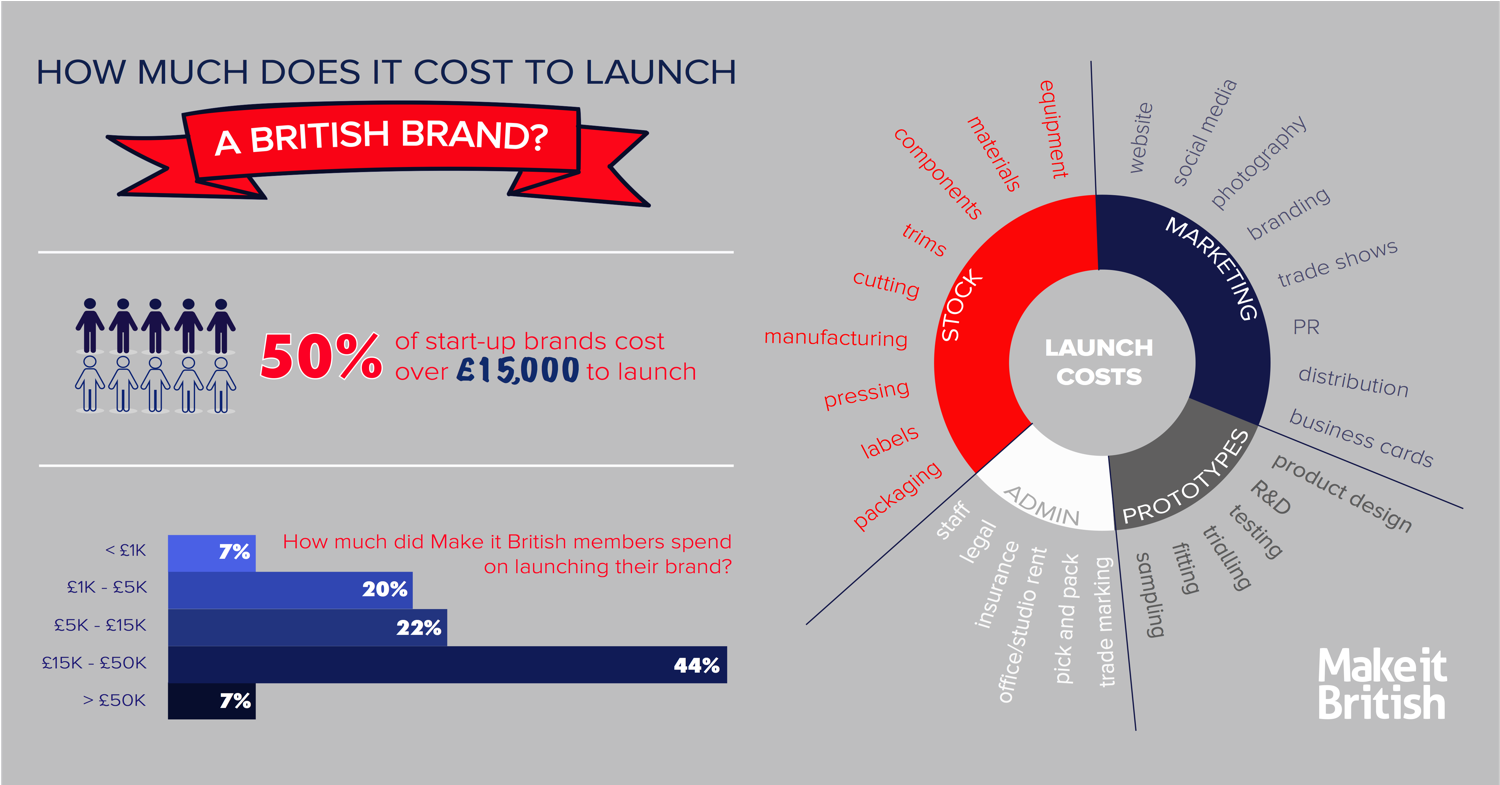

These are one-time expenses necessary to get the business off the ground. This includes legal fees for setting up the business structure (e.g., LLC, corporation), licenses and permits required by local, state, and federal regulations, and initial marketing and branding expenses.

Securing necessary intellectual property, like trademarks or patents, can also add significantly to initial costs. According to the U.S. Patent and Trademark Office, legal fees for securing a patent can range from $5,000 to $15,000.

Operational Expenses

These are ongoing costs that a business incurs regularly. Rent for office or retail space is often a significant expense, especially in urban areas. Utilities, including electricity, water, and internet, are also recurring costs.

Salaries and wages for employees represent a major operational expense for many businesses. "Labor costs are often the largest single expense for small businesses," says Neil Bradley, Executive Vice President and Chief Policy Officer at the U.S. Chamber of Commerce.

Inventory, marketing, and advertising costs also fall under operational expenses. The amount spent on these areas can vary significantly depending on the industry and marketing strategy.

Technology and Equipment

The technology and equipment needs of a business can vary widely depending on the industry. A software company will require robust computer systems and software development tools. A restaurant will need commercial kitchen equipment and point-of-sale systems.

Cloud-based software and services have made it easier and more affordable for businesses to access technology. However, the ongoing subscription costs for these services must be factored into the overall expense.

Funding Options: From Bootstrapping to Venture Capital

Entrepreneurs have a variety of funding options available to them. Bootstrapping, which involves using personal savings and reinvesting profits, is a common approach, especially in the early stages of a business.

Small business loans from banks and credit unions are another popular option. The SBA offers loan guarantee programs that can make it easier for small businesses to qualify for loans.

Angel investors and venture capitalists provide funding in exchange for equity in the company. These investors typically look for businesses with high growth potential.

"Securing funding is one of the biggest challenges facing startups," says Karen G. Mills, former Administrator of the SBA. "A solid business plan and a clear understanding of your funding needs are essential."

Strategies for Minimizing Startup Costs

There are several strategies entrepreneurs can use to minimize startup costs. Starting a business from home can significantly reduce overhead expenses. Leveraging free or low-cost online marketing tools can help reach customers without breaking the bank.

Negotiating favorable terms with suppliers and vendors can also save money. Consider bartering or trading services with other businesses to reduce cash outlays.

Carefully planning and prioritizing expenses is crucial. Focus on the most essential investments and defer non-essential spending until the business is generating revenue.

Looking Ahead: The Evolving Landscape of Startup Costs

The cost of starting a business is constantly evolving, driven by technological advancements and changes in the economic environment. The rise of the gig economy has made it easier for businesses to access freelance talent, reducing the need for full-time employees.

The increasing popularity of e-commerce has lowered the barrier to entry for many businesses. However, competition in the online marketplace is fierce, requiring businesses to invest in effective marketing strategies.

Ultimately, the success of a startup depends not only on access to capital but also on the entrepreneur's vision, determination, and ability to adapt to changing market conditions. The key is to start with a solid plan, manage expenses wisely, and never stop learning.