How Much Does Smart Dollar Cost Employers

In an era where financial wellness is increasingly recognized as a cornerstone of employee well-being and productivity, employers are exploring various programs to support their workforce's financial health. One such program is SmartDollar, offered by Ramsey Solutions. But understanding the cost associated with implementing SmartDollar is crucial for employers seeking to make informed decisions.

This article delves into the pricing structure of SmartDollar, examining the various factors that influence its cost and exploring its potential impact on both employers and employees. Understanding the return on investment is just as vital as the initial cost.

The Cost of SmartDollar: An Overview

Determining the precise cost of SmartDollar for employers involves several considerations. The pricing is not standardized and can vary significantly depending on the organization's size, the number of employees participating, and the specific features selected within the program.

Subscription Model

SmartDollar generally operates on a subscription-based model. This means employers pay a recurring fee, typically annually, to provide access to the program for their employees. The subscription fee covers access to SmartDollar's online resources, tools, and educational content.

The cost per employee usually decreases as the total number of enrolled employees increases. This tiered pricing structure allows larger organizations to achieve economies of scale.

Some companies offer discounts for multi-year agreements.

Factors Influencing Price

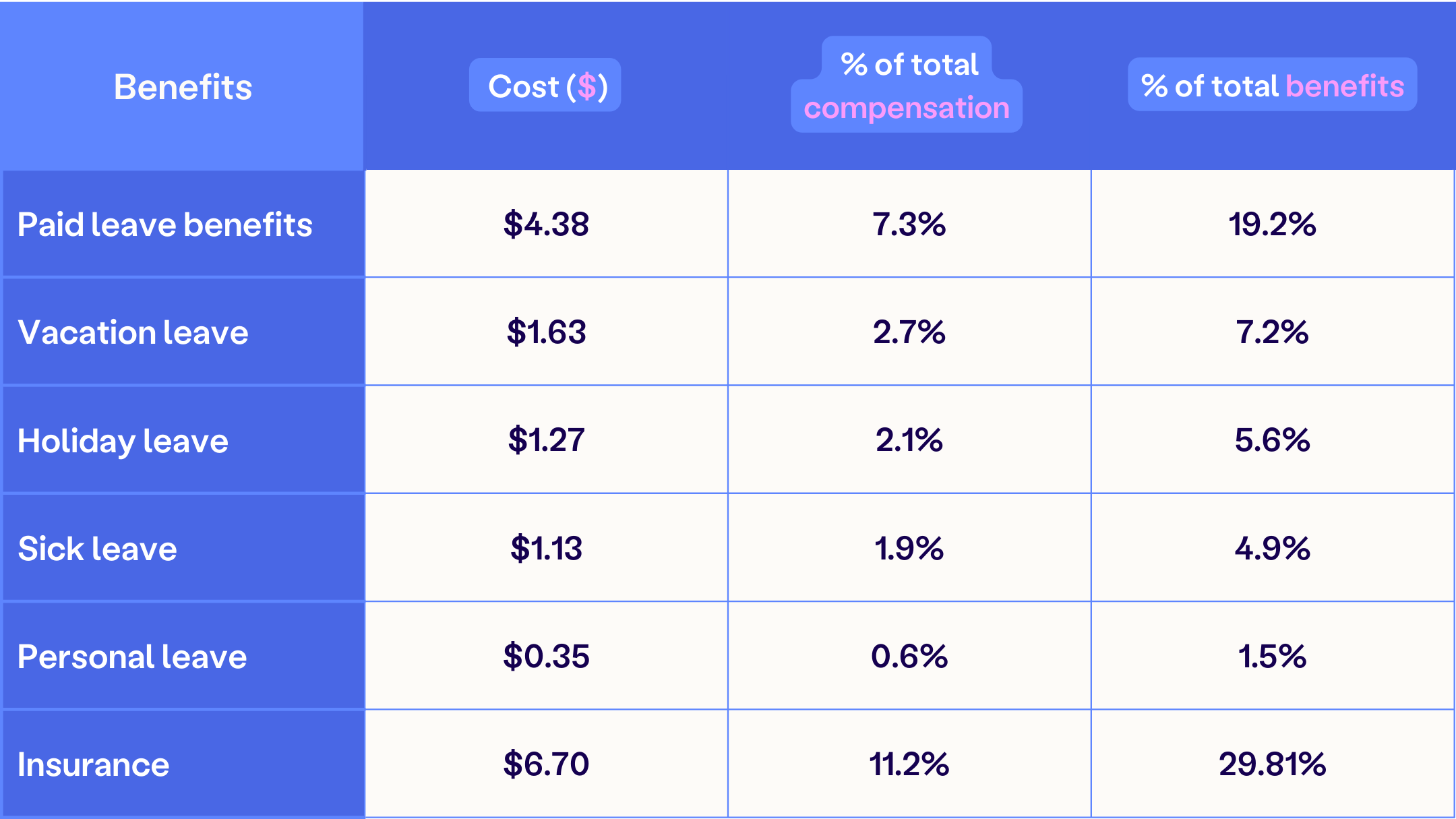

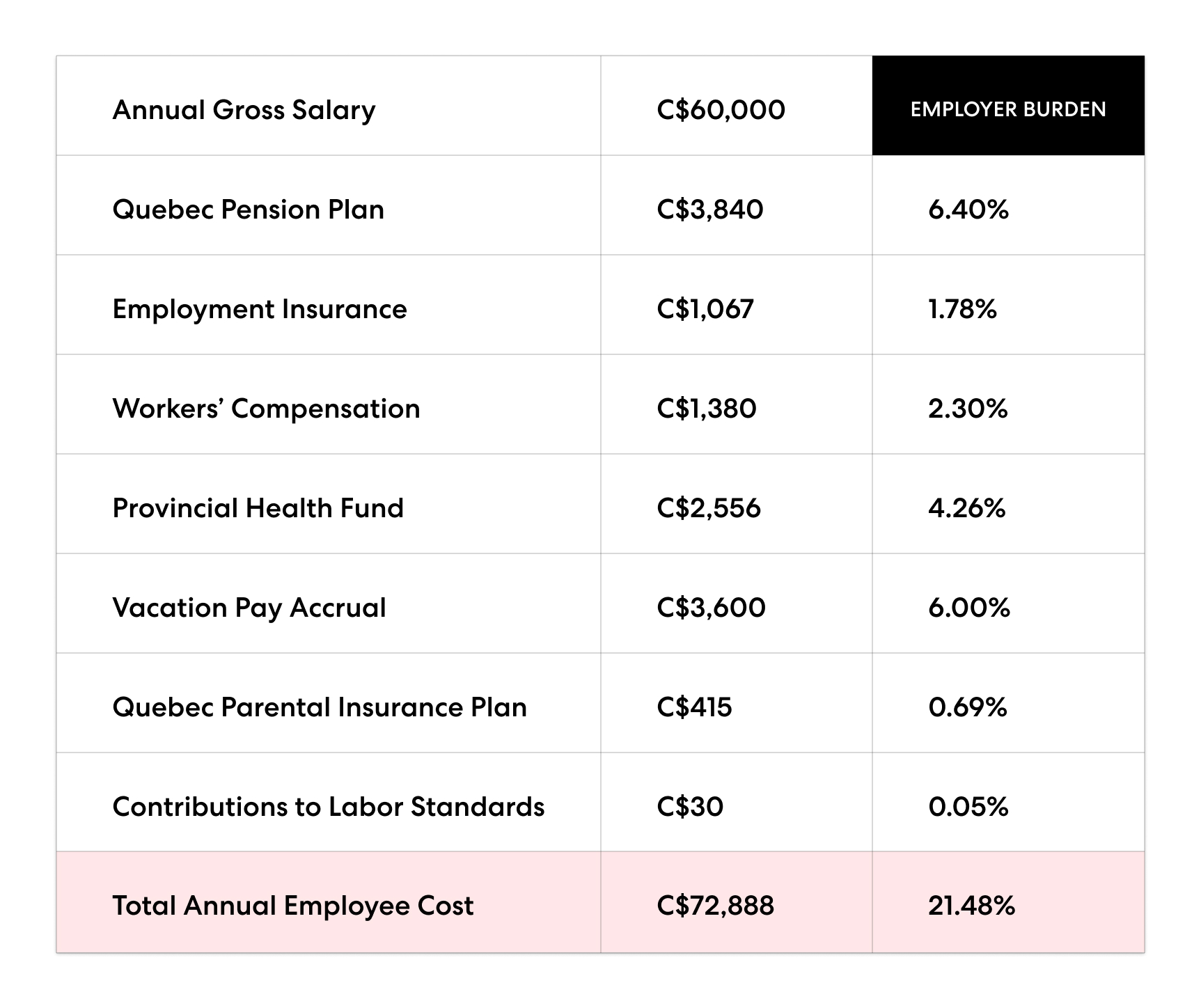

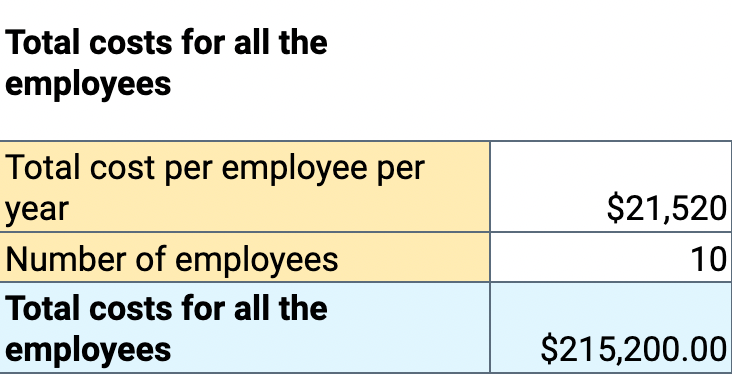

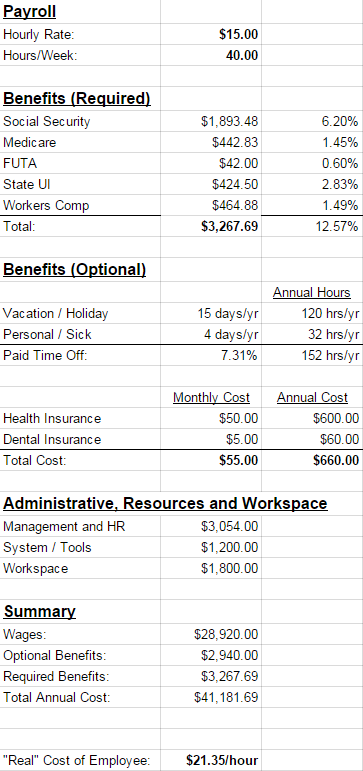

Several factors can influence the overall cost of SmartDollar for employers. These include the number of employees enrolled, the level of customization desired, and any additional services or features selected beyond the basic subscription.

Number of Employees: As mentioned earlier, the cost per employee generally decreases with larger enrollments. Small businesses with fewer employees may pay a higher per-employee rate compared to large corporations.

Customization: Some employers opt for customized versions of SmartDollar that are tailored to their specific industry, company culture, or employee demographics. Customization can add to the overall cost.

Additional Services: SmartDollar offers additional services beyond its core curriculum, such as on-site workshops, webinars, and personalized coaching. These services come at an additional cost.

Contract Length: Longer contract terms may sometimes translate into lower per-year costs.

Benchmarking Against Alternatives

It's also important for employers to benchmark the cost of SmartDollar against other financial wellness programs available in the market. Several alternatives offer similar services, and comparing their pricing structures can help employers make informed decisions.

Alternatives to SmartDollar include offerings from Financial Finesse, LearnLux, and even resources provided by some financial institutions.

The Value Proposition: Return on Investment (ROI)

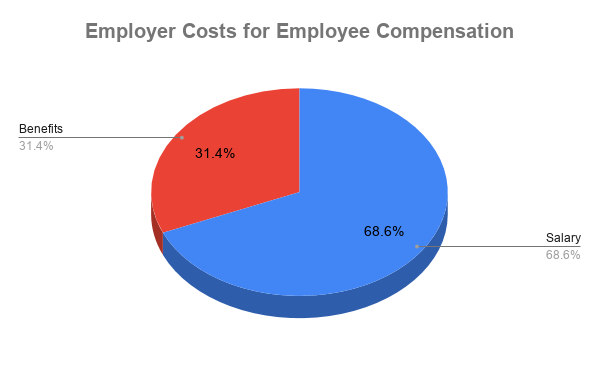

While the cost of SmartDollar is a significant consideration, employers must also evaluate the potential return on investment (ROI) of implementing the program. A successful financial wellness program can lead to increased employee productivity, reduced stress, and improved employee retention.

Increased Productivity: Employees who are less stressed about their finances are more likely to be focused and productive at work.

Reduced Stress: Financial stress can lead to absenteeism and health problems, both of which can impact an organization's bottom line.

Improved Retention: Offering financial wellness benefits can enhance employee loyalty and reduce turnover rates, saving the company recruitment and training costs.

"A financially well employee is a more engaged and productive employee," states Jane Doe, a benefits consultant at Acme Consulting.

Measuring the ROI of a financial wellness program can be challenging, but employers can track metrics such as employee participation rates, changes in employee debt levels, and improvements in employee engagement scores.

A Human-Interest Angle

Beyond the numbers and statistics, the true value of SmartDollar lies in its potential to positively impact the lives of individual employees. Stories of individuals who have used the program to overcome debt, build savings, and achieve their financial goals can be powerful testimonials to its effectiveness.

One example is John Smith, an employee at a manufacturing company who used SmartDollar to pay off his student loan debt. "SmartDollar gave me the tools and knowledge I needed to take control of my finances," Smith says. "It's changed my life."

Conclusion

The cost of SmartDollar for employers is not a one-size-fits-all answer. It depends on various factors, including the number of employees, customization options, and additional services. However, by carefully considering these factors and evaluating the potential ROI, employers can determine whether SmartDollar is a worthwhile investment in their employees' financial well-being.

Ultimately, the decision to implement SmartDollar should be based on a comprehensive assessment of the organization's needs, budget, and goals. The potential benefits of improved employee financial health, reduced stress, and increased productivity can make SmartDollar a valuable asset for both employers and employees.