How Much Downpayment To Buy A Business

Aspiring business owners face a crucial question: how much cash is needed upfront? The answer, unfortunately, isn't simple and depends on numerous factors, requiring careful assessment and strategic planning.

Navigating the financial landscape of business acquisition demands understanding the down payment requirements, which significantly impact the feasibility of the purchase and the future financial health of the enterprise. This article provides essential information for prospective buyers.

Down Payment Basics: A Percentage Game

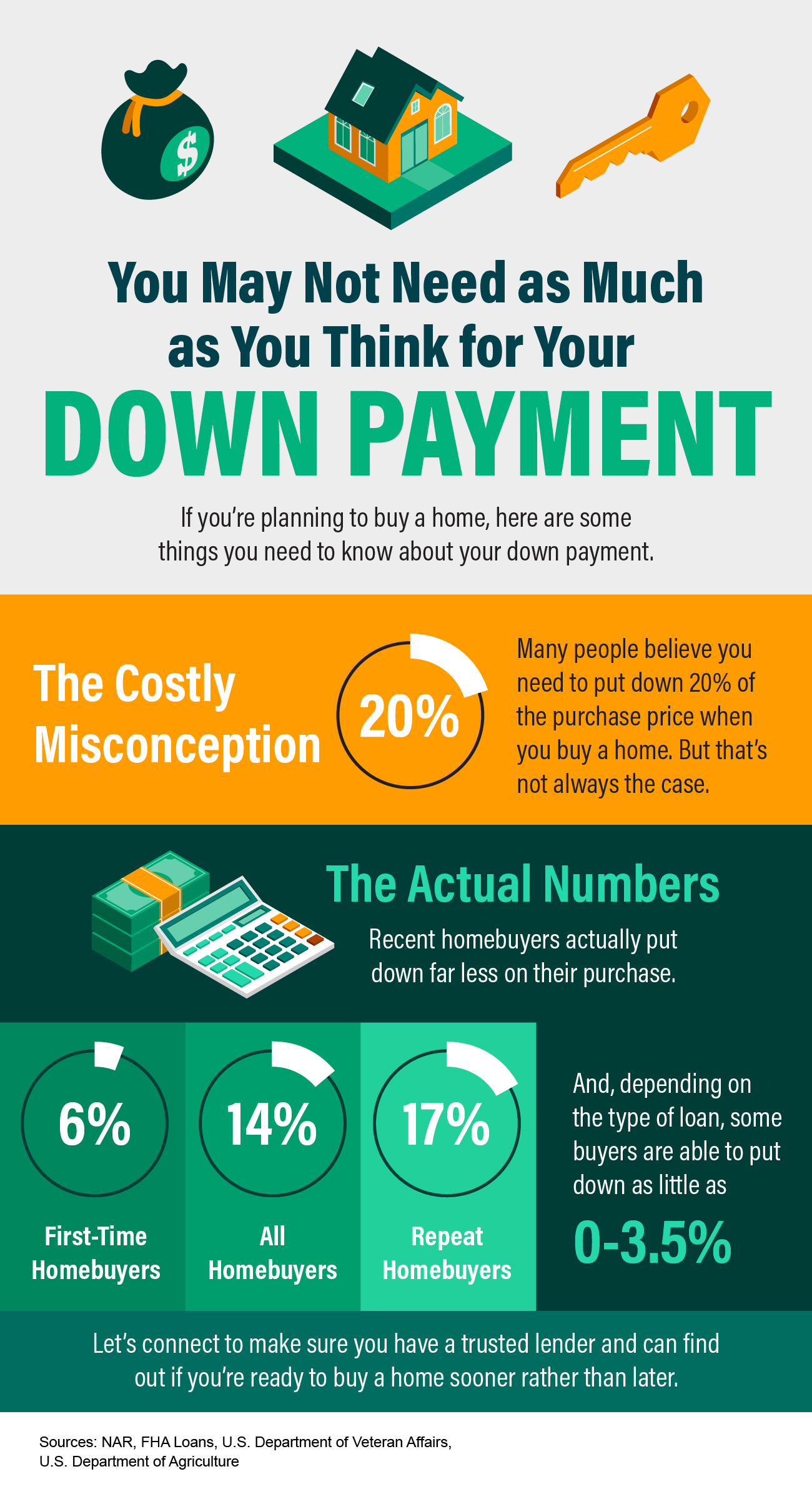

Generally, down payments for business acquisitions range from 10% to 30% of the total purchase price. The specific percentage hinges on factors such as the business's profitability, the stability of its industry, and the buyer's creditworthiness. A strong, established business in a growing sector typically commands a lower down payment.

Conversely, a higher-risk venture will likely require a more substantial upfront investment. Sellers and lenders use the down payment as a gauge of the buyer's commitment and risk tolerance. They want to ensure the buyer has enough "skin in the game."

Key Factors Influencing Down Payment Size

Business Valuation: The Starting Point

The assessed value of the business is the foundation upon which the down payment is calculated. A professional business valuation is crucial for determining a fair market price. Factors like revenue, assets, liabilities, and future earnings potential are all carefully considered.

Overvaluing a business inflates the down payment requirement. Underestimating its worth can jeopardize the deal.

Financing Options: SBA Loans and More

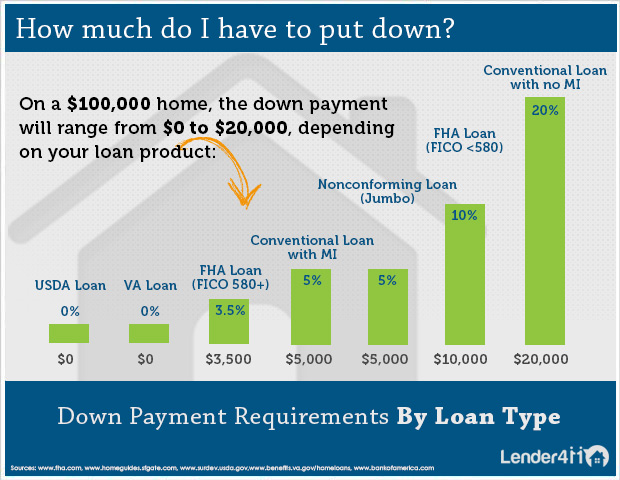

The chosen financing method impacts the down payment significantly. SBA (Small Business Administration) loans, for instance, often require lower down payments than traditional bank loans. However, they come with specific eligibility criteria and application processes.

Alternative financing options, such as seller financing, may offer more flexibility in down payment negotiations. Seller financing can be a attractive tool for buyers struggling to secure traditional loans, as the seller essentially becomes the lender.

Industry and Business Performance

Businesses in high-growth, stable industries typically require lower down payments. Companies with a consistent track record of profitability are also viewed as less risky investments. Conversely, businesses in volatile industries or with declining revenues will likely demand a higher upfront investment.

Lenders and sellers closely scrutinize the business's financial statements and market position. A thorough due diligence process is essential.

Buyer's Financial Profile

The buyer's credit score, financial history, and available assets play a pivotal role. A strong credit score demonstrates responsible financial management. Substantial assets provide a safety net and reassure lenders and sellers.

Personal guarantees are often required, making the buyer's personal finances directly relevant. Building a strong financial profile is critical for securing favorable financing terms.

Negotiation: A Key to Down Payment Success

The down payment amount is often negotiable. Skilled negotiation can significantly reduce the initial financial burden. Buyers can leverage factors like the seller's motivation and the business's current performance to their advantage.

Presenting a well-structured offer with a solid financial plan strengthens the buyer's negotiating position. Consider engaging a business broker or financial advisor to guide the negotiation process.

Real-World Examples and Data

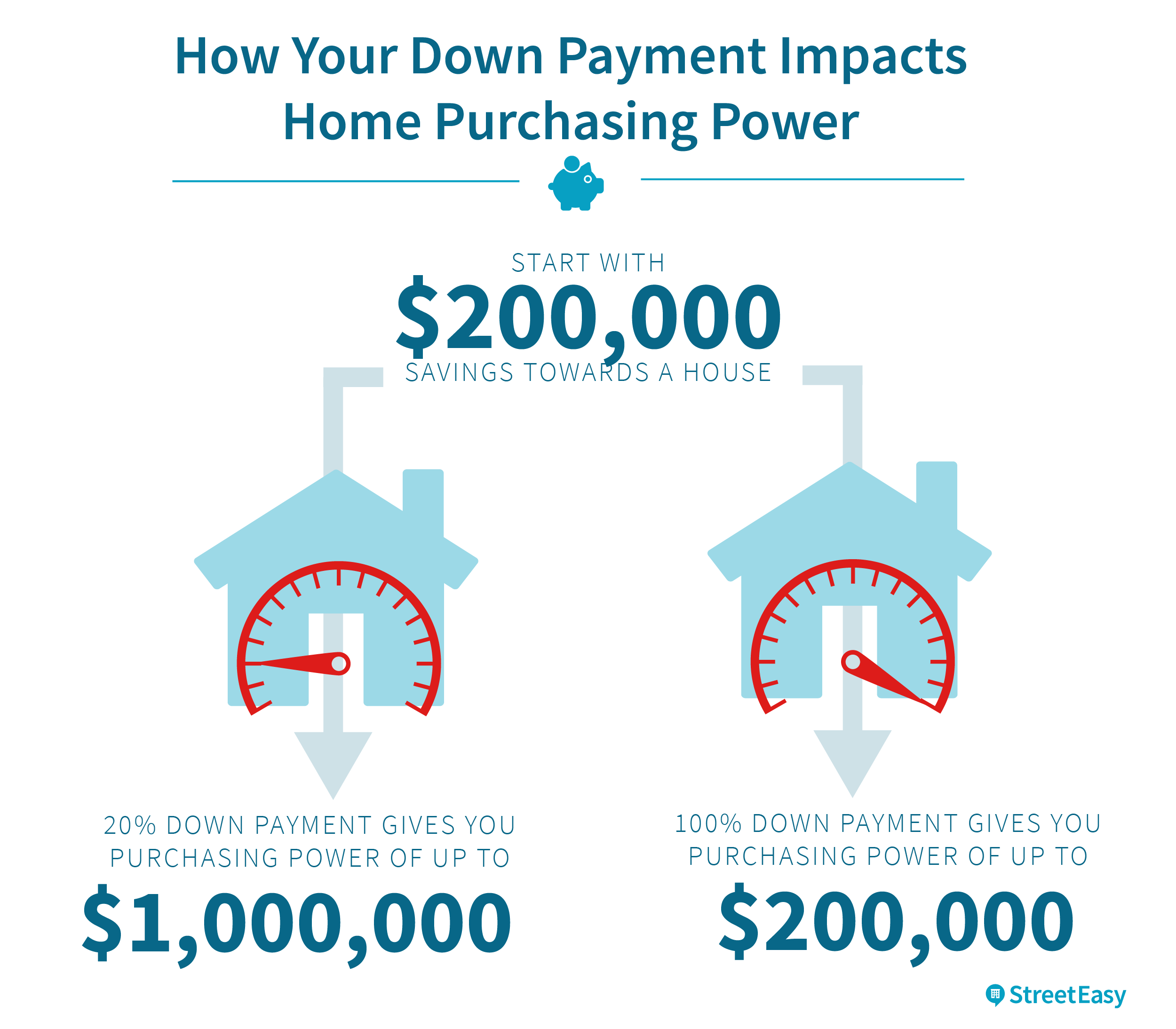

Data from BizBuySell indicates that the median down payment for small business acquisitions in 2023 was approximately 20% of the sale price. However, this figure varies significantly based on the industry and size of the business. Certain industries, such as retail, may see higher down payments due to inventory and operational costs.

Consulting a business broker is beneficial. They often have data from previous transactions that can help you determine the typical down payment percentage for the type of business you want to buy.

Next Steps: Planning and Preparation

Prospective buyers should begin by assessing their financial resources and developing a detailed business plan. Obtain a pre-qualification letter from a lender to understand their borrowing capacity. Engage a business broker or financial advisor to guide you through the acquisition process.

Thorough due diligence is essential before committing to any purchase agreement. Remember: Seek expert advice to avoid costly mistakes.

:max_bytes(150000):strip_icc()/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9-c5b260ea1f384a3ca1741b548106ea45.jpg)

.png)