How Much Equity Is Required For A Reverse Mortgage

Imagine Sarah, a retired school teacher, sipping her morning coffee on her sun-drenched porch. Her home, filled with memories of laughter and family gatherings, is now a sanctuary. However, like many retirees, Sarah faces the challenge of a fixed income meeting rising expenses. Could a reverse mortgage be the key to unlocking her home's potential, turning equity into financial security? The question on her mind: How much equity does she actually need?

Understanding the equity requirements for a reverse mortgage is crucial for homeowners aged 62 and older seeking financial flexibility in retirement. This article breaks down the factors influencing the necessary equity, including age, home value, interest rates, and the specific reverse mortgage product, empowering readers to make informed decisions about their financial futures.

What is a Reverse Mortgage?

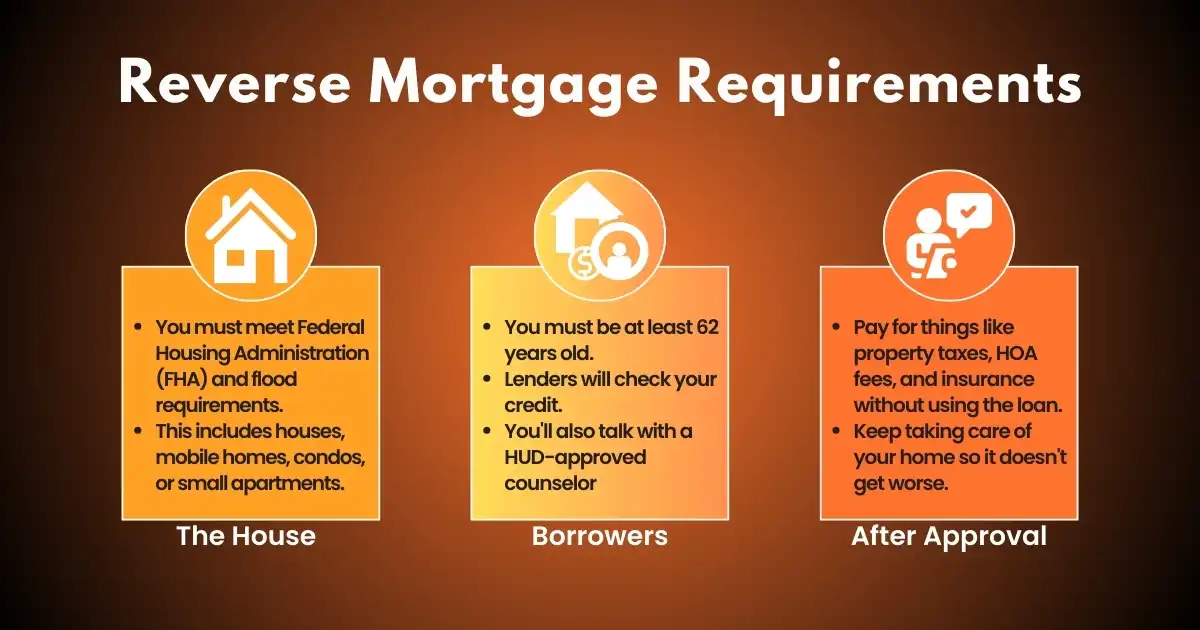

A reverse mortgage, officially known as a Home Equity Conversion Mortgage (HECM), is a loan available to homeowners 62 years or older.

Unlike a traditional mortgage where you make monthly payments to the lender, with a reverse mortgage, the lender makes payments to you. The loan amount, plus interest and fees, is repaid when you sell the home, move out permanently, or pass away.

How Reverse Mortgages Differ from Traditional Mortgages

Traditional mortgages build equity over time through monthly payments.

Reverse mortgages, on the other hand, reduce equity over time as the loan balance grows.

This crucial distinction requires careful consideration and understanding before entering into a reverse mortgage agreement.

The Role of Equity in Reverse Mortgages

Equity, the difference between your home's appraised value and any outstanding mortgage balances, plays a pivotal role in determining your eligibility and loan amount for a reverse mortgage.

Lenders need to ensure that enough equity exists to cover the loan balance, accrued interest, and fees when the home is eventually sold.

The higher the equity, the greater the potential loan amount available to the borrower.

Factors Influencing Equity Requirements

Several factors influence the amount of equity required for a reverse mortgage.

These include the borrower's age, current interest rates, the appraised value of the home, and the type of reverse mortgage product selected.

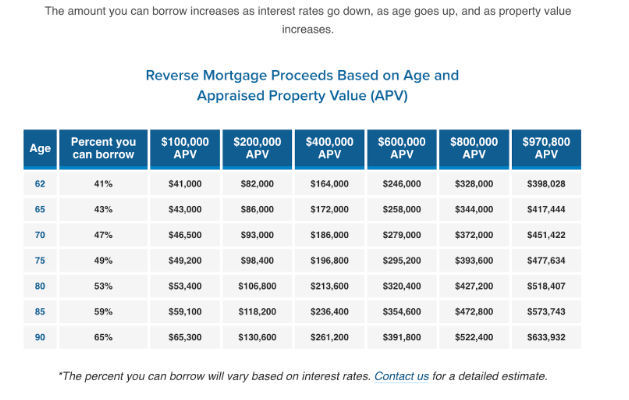

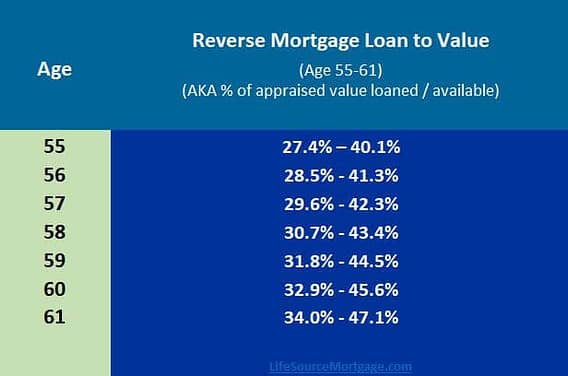

Age of the Borrower

Generally, older borrowers qualify for larger loan amounts.

This is because lenders anticipate a shorter loan term and, therefore, less accumulated interest over time.

This directly impacts the amount of required equity; older borrowers with the same home value might need slightly less equity compared to younger borrowers.

Interest Rates

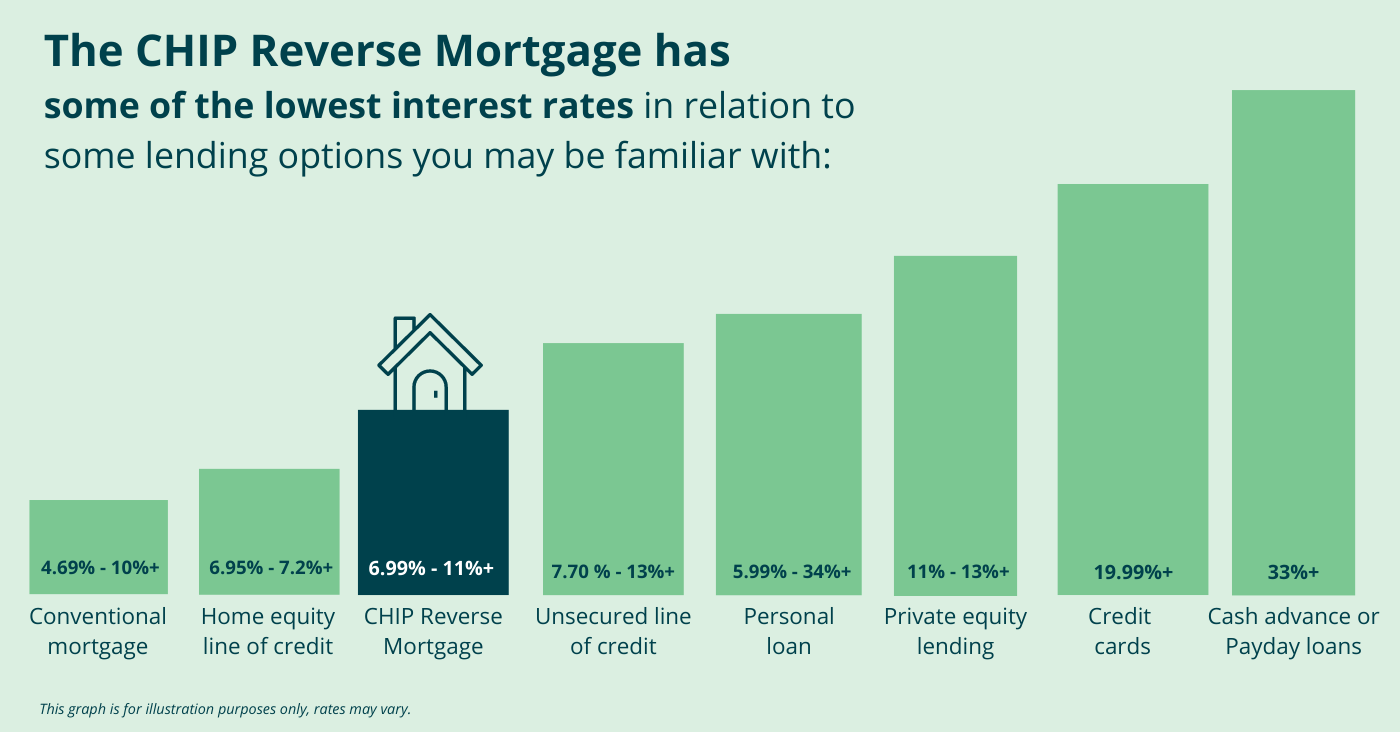

Interest rates play a significant role in determining the loan amount.

Higher interest rates mean the loan balance will grow more quickly, requiring more initial equity to offset the increased risk for the lender.

Conversely, lower interest rates may allow for a smaller equity cushion.

Home Value

The appraised value of the home is a primary factor.

A higher home value generally translates to a larger potential loan amount, provided sufficient equity exists.

However, the lender will also consider the loan-to-value (LTV) ratio, ensuring the loan amount doesn't exceed a certain percentage of the home's value.

Type of Reverse Mortgage

The most common type of reverse mortgage is the HECM, insured by the Federal Housing Administration (FHA).

HECMs have specific guidelines regarding equity requirements and loan limits.

Proprietary reverse mortgages, offered by private lenders, may have different requirements and loan amounts.

Estimating Required Equity

Determining the precise amount of equity required for a reverse mortgage can be complex, but here's a general idea.

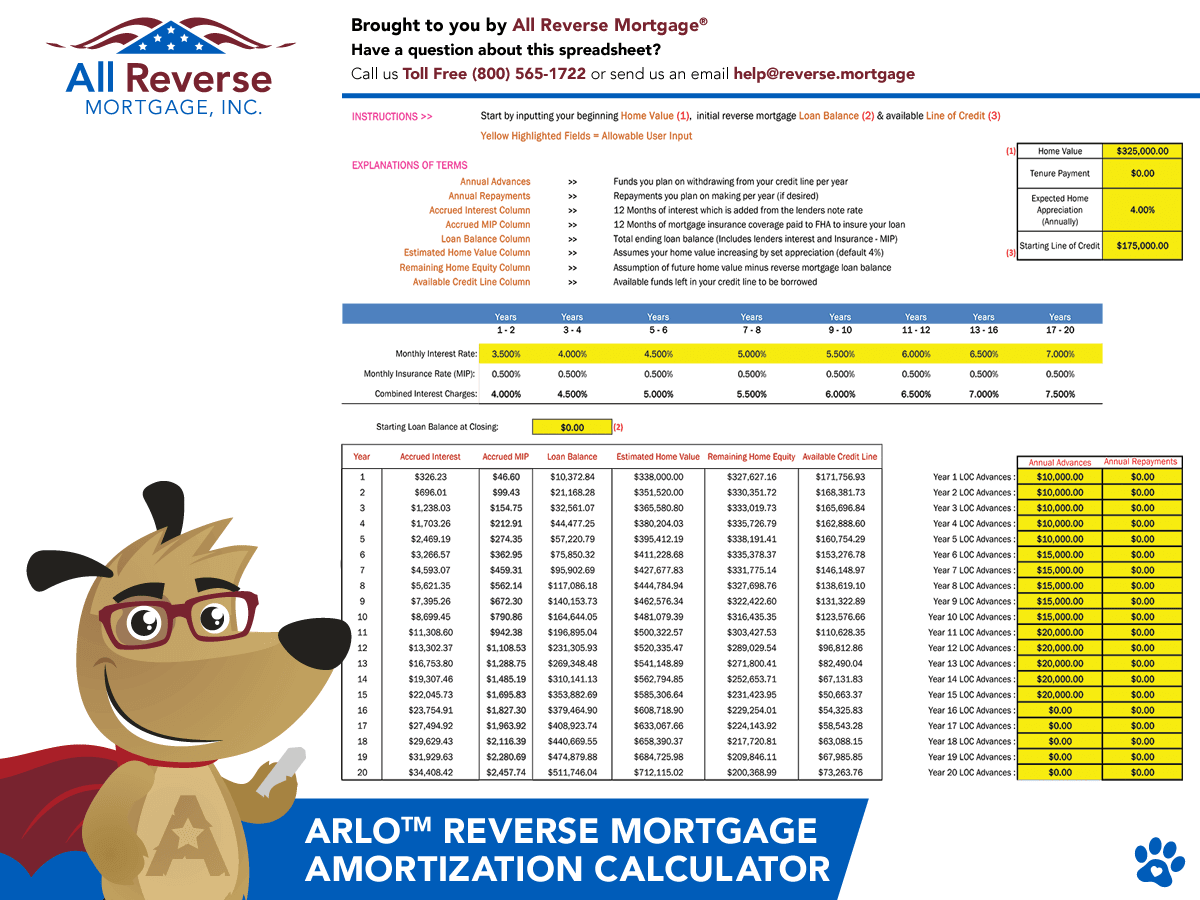

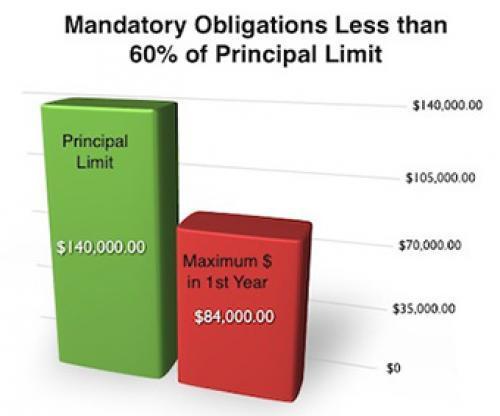

Lenders use a principal limit factor (PLF) based on the borrower's age, interest rates, and the home's appraised value to calculate the initial loan amount.

The PLF represents the percentage of the home's value a borrower can access.

As of November 2024, for example, a 75-year-old homeowner with a $400,000 home and prevailing interest rates might have a PLF of around 60%. This translates to a potential initial loan amount of $240,000.

To estimate the required equity, subtract the potential loan amount from the home's appraised value: $400,000 (home value) - $240,000 (loan amount) = $160,000 (required equity).

However, this is a simplified calculation. Always consult with a qualified mortgage professional for an accurate assessment.

Protecting Your Equity with a Reverse Mortgage

While a reverse mortgage can provide financial relief, it's crucial to understand how it impacts your equity.

The loan balance grows over time, potentially reducing the equity available to heirs.

However, borrowers are typically non-recourse, meaning they (or their estate) are never responsible for repaying more than the home's value, even if the loan balance exceeds it.

Counseling and Education

HUD-approved counseling is mandatory for all HECM borrowers.

Counselors provide unbiased information about reverse mortgages, helping borrowers understand the terms, risks, and alternatives.

This counseling ensures borrowers make informed decisions that align with their financial goals.

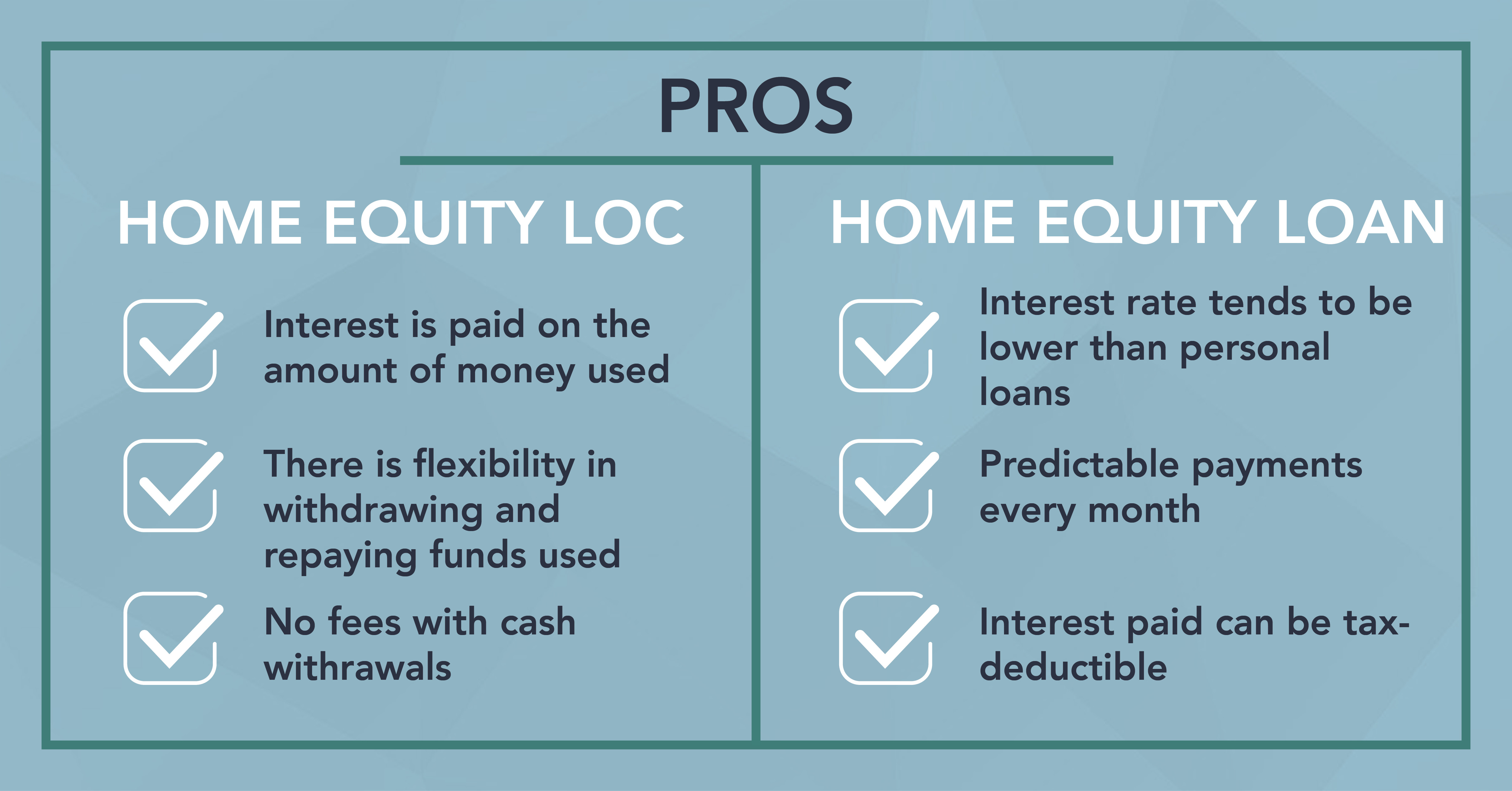

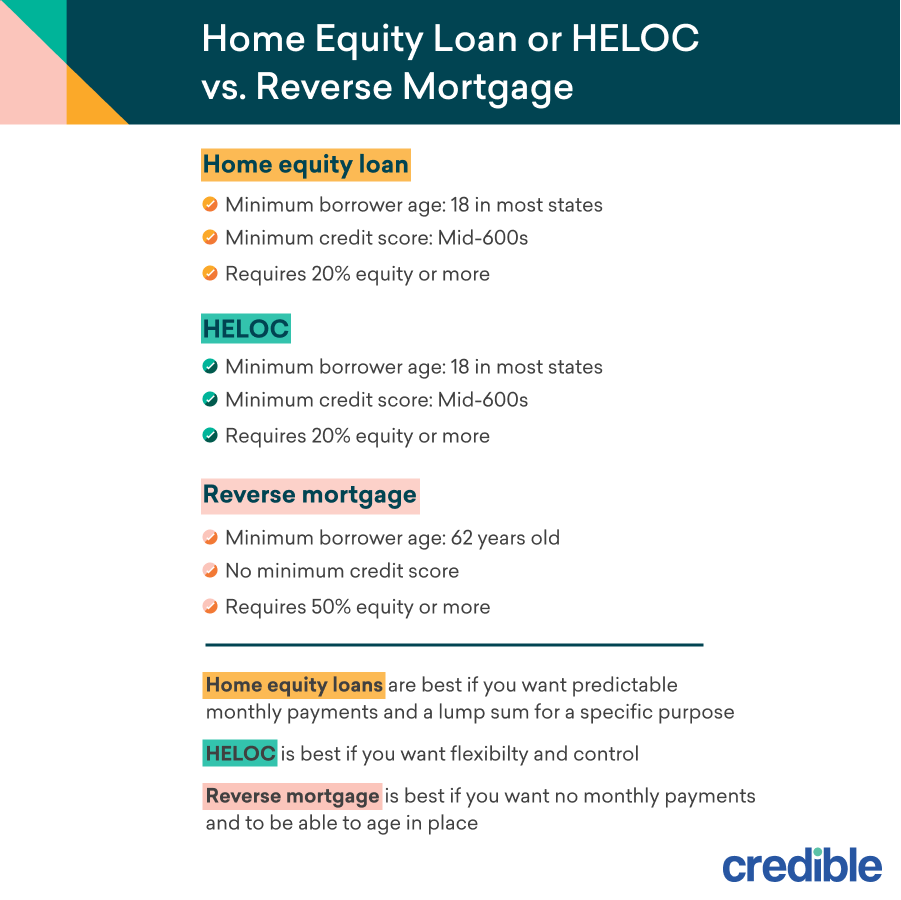

Alternatives to Reverse Mortgages

Before pursuing a reverse mortgage, explore other options.

These might include downsizing, tapping into savings, or exploring government assistance programs.

Carefully weigh the pros and cons of each option to determine the best fit for your individual circumstances.

The Future of Reverse Mortgages

Reverse mortgages are evolving to meet the changing needs of retirees.

Innovations in product design and stricter lending regulations are enhancing consumer protection and ensuring long-term sustainability.

As the population ages, reverse mortgages will likely continue to play a significant role in retirement planning.

Reverse mortgages can be a powerful tool for accessing home equity and improving financial security in retirement.

Understanding the equity requirements, potential benefits, and associated risks is essential for making informed decisions.

Sarah, now armed with this knowledge, can confidently assess her options and determine whether a reverse mortgage is the right choice for her future, allowing her to enjoy her sun-drenched porch with peace of mind.