Gold Price Today In Saudi Arabia Jeddah

Jeddah, Saudi Arabia – Gold prices in Jeddah experienced slight fluctuations today, mirroring global market trends influenced by fluctuating interest rates and geopolitical uncertainties. Investors are keenly observing these movements, as gold remains a significant investment avenue and a cultural cornerstone in the Kingdom.

The current gold price landscape in Jeddah is shaped by a confluence of factors: international spot prices, currency exchange rates (specifically the Saudi Riyal against the US dollar), and local market demand. These elements create a dynamic environment that necessitates close monitoring by both seasoned investors and individuals considering gold purchases for personal or ceremonial purposes. This article delves into today's gold rates, analyzes influencing factors, and offers insights for navigating the gold market in Jeddah.

Current Gold Rates in Jeddah (October 26, 2023)

As of today, October 26, 2023, the price of 24-karat gold in Jeddah is trading at approximately 228.50 Saudi Riyal (SAR) per gram. The 22-karat gold rate is around 209.50 SAR per gram, while 18-karat gold is priced at about 171.50 SAR per gram. These prices are indicative and may vary slightly depending on the retailer and the specific gold product.

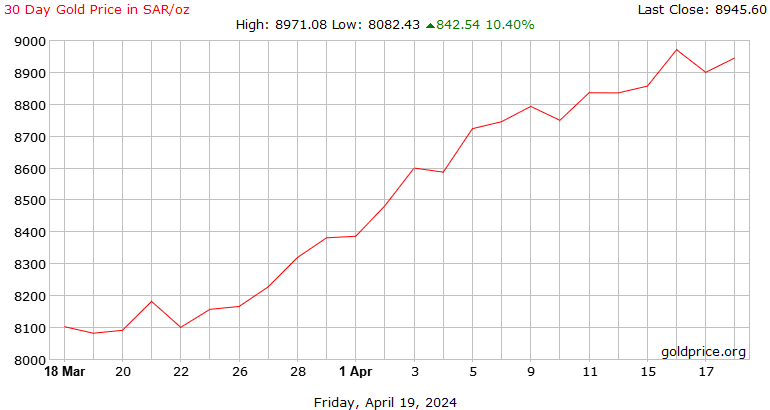

The current rates reflect a minor increase compared to the beginning of the week. This uptick is largely attributed to a slight weakening of the US dollar against other major currencies, making gold relatively more attractive to investors holding those currencies.

Factors Influencing Gold Prices

Several key factors exert considerable influence on the price of gold in Jeddah and globally. These include international spot prices, currency exchange rates, and domestic demand.

International Spot Prices

The most significant factor is the international spot price of gold, which is quoted in US dollars per ounce. Any fluctuations in the global spot price directly impact the local gold rates in Saudi Arabia.

Recent geopolitical tensions in the Middle East and Eastern Europe, coupled with concerns about global economic slowdown, have contributed to increased demand for gold as a safe-haven asset. This, in turn, has exerted upward pressure on prices.

Currency Exchange Rates

The Saudi Riyal is pegged to the US dollar, meaning the exchange rate between the two currencies remains relatively stable. However, fluctuations in the US dollar's value against other major currencies can indirectly affect gold prices in SAR.

A weaker US dollar makes gold cheaper for buyers using other currencies, potentially increasing demand and pushing prices higher. Conversely, a stronger US dollar can make gold more expensive for international buyers.

Domestic Demand

Demand for gold in Saudi Arabia is influenced by several factors, including cultural traditions, investment trends, and economic conditions. Gold jewelry is a traditional gift for weddings and other special occasions, contributing to consistent demand.

Increased investment in gold as a hedge against inflation and economic uncertainty also drives up demand. Conversely, lower economic growth or increased interest rates on alternative investments may dampen demand.

Expert Opinions and Market Outlook

According to market analysts at Al Rajhi Capital, gold prices are likely to remain volatile in the near term. This volatility is driven by ongoing geopolitical risks and uncertainty surrounding future interest rate hikes by the US Federal Reserve.

"Investors should exercise caution and closely monitor global economic indicators and geopolitical developments," stated a recent report by Al Bilad Investment Company. "Diversification remains a key strategy for mitigating risk in the current market environment."

Implications for Consumers and Investors

For consumers in Jeddah considering purchasing gold jewelry or bullion, it is crucial to compare prices from multiple retailers. Also, be aware of the prevailing market rates and any additional charges or premiums.

Investors should consider their risk tolerance and investment objectives before making any decisions. Gold can be a valuable addition to a diversified portfolio, but it is not without risk. Consulting with a financial advisor is highly recommended.

Conclusion

Gold prices in Jeddah remain sensitive to global economic and geopolitical events. While the short-term outlook suggests continued volatility, gold's long-term appeal as a safe-haven asset and a store of value persists. Staying informed and exercising caution are crucial for navigating the gold market in Jeddah effectively.