Georgia Form 500 Schedule 1 Adjustments To Income

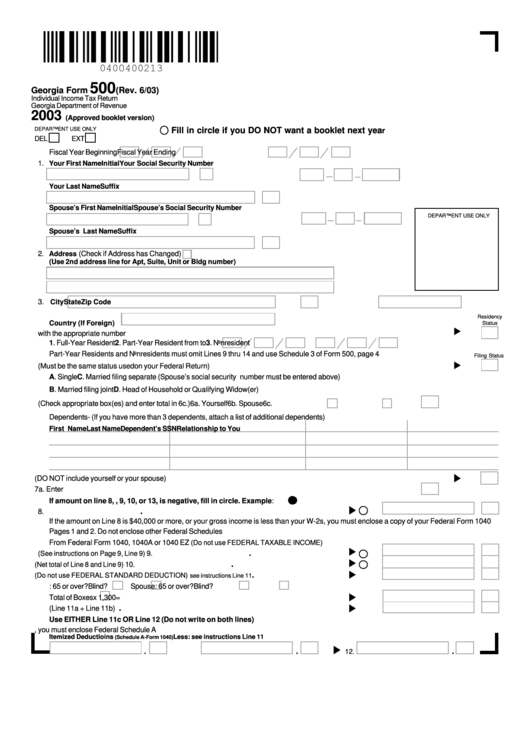

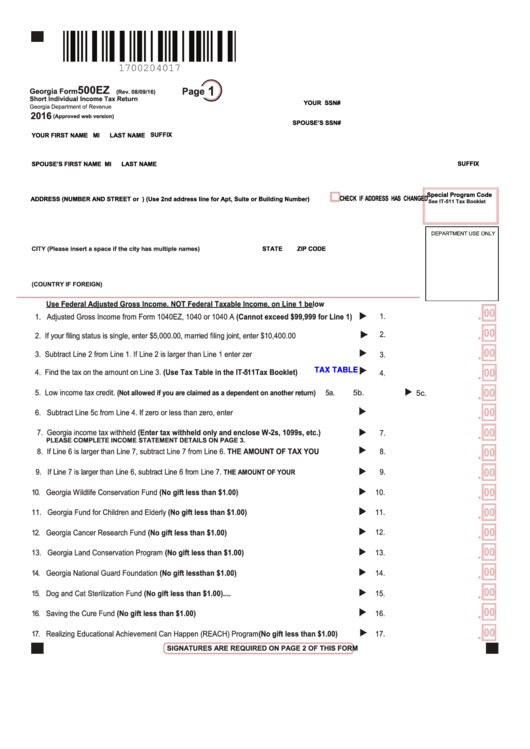

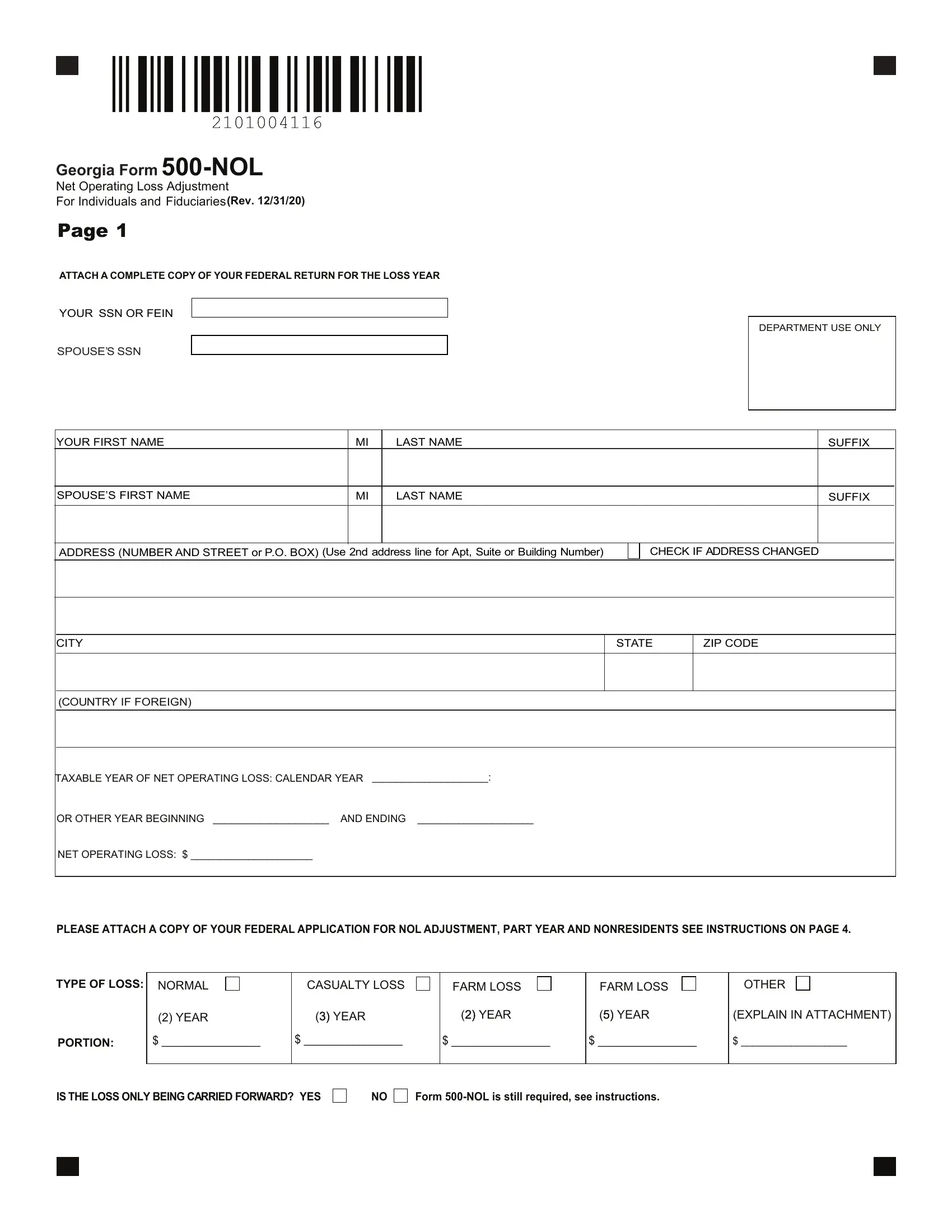

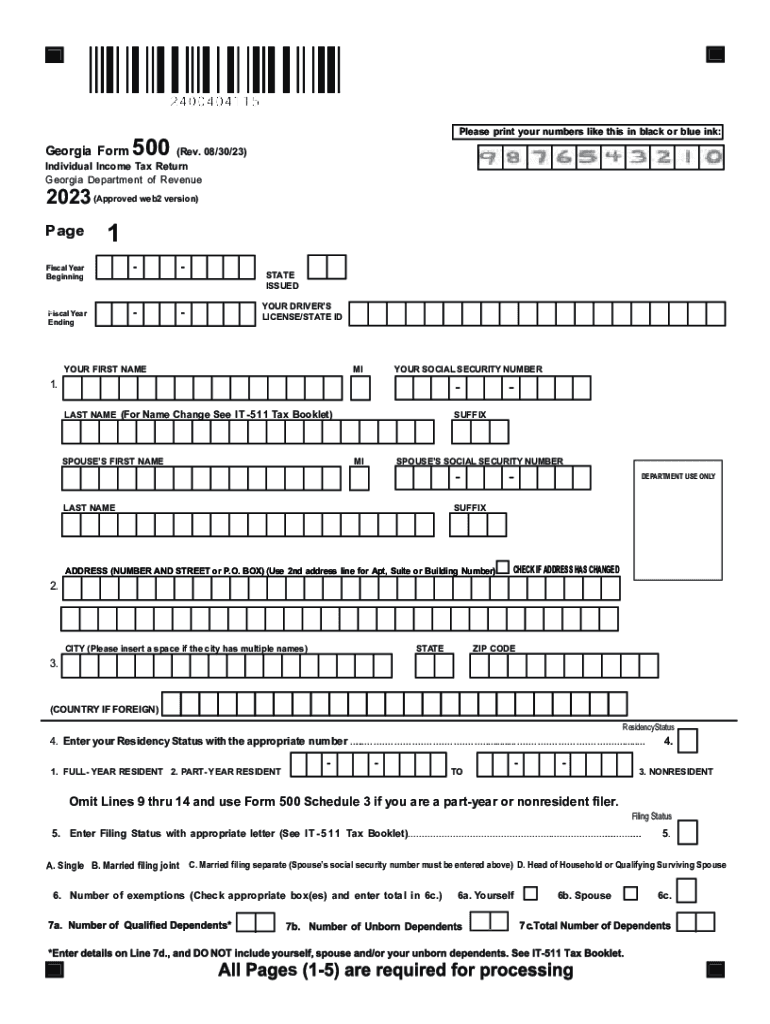

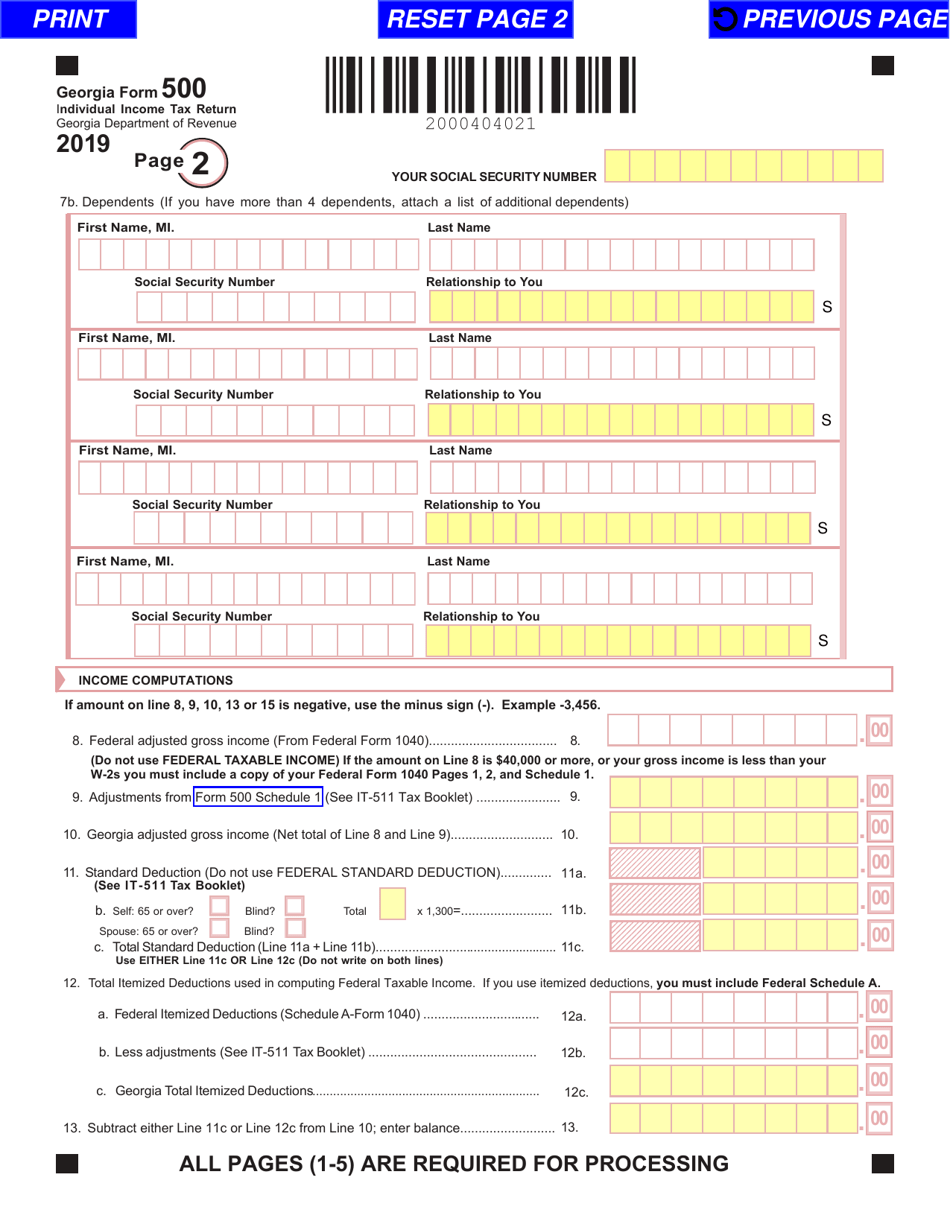

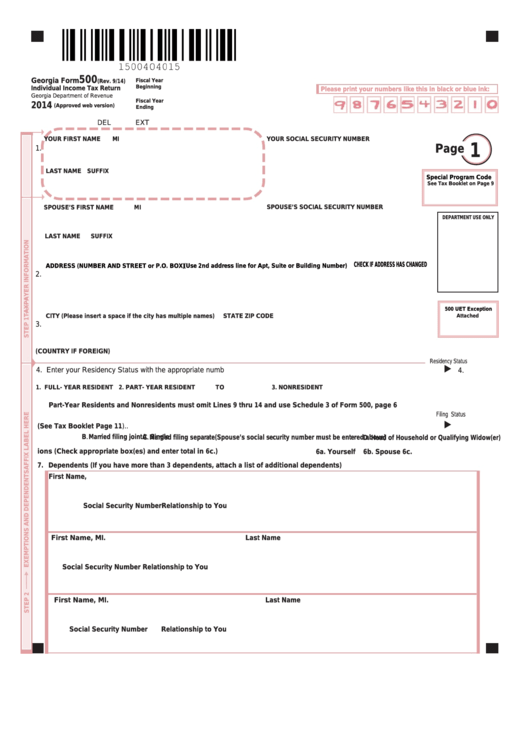

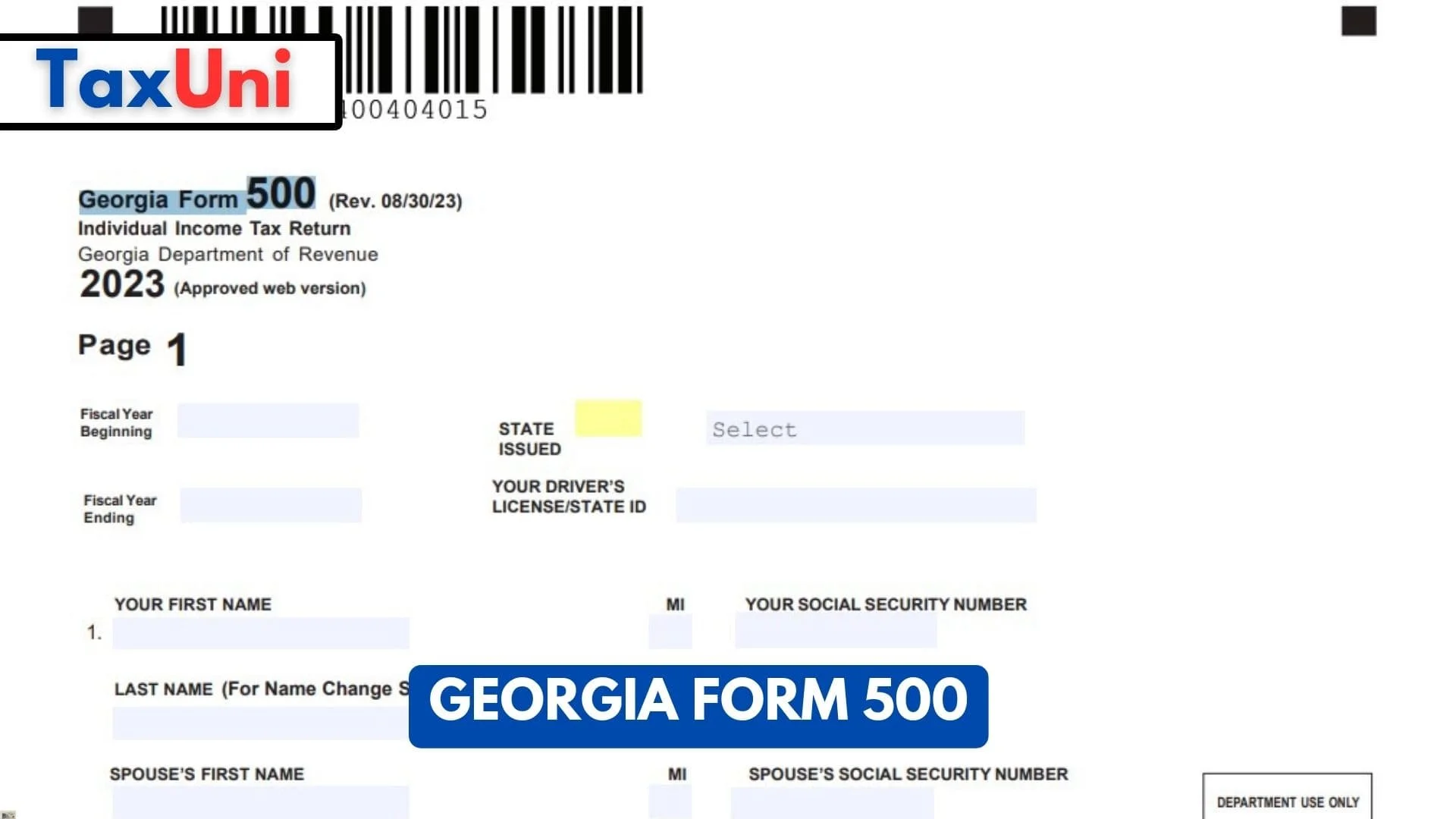

The Georgia Form 500, a cornerstone of the state's individual income tax system, requires careful navigation, particularly Schedule 1: Adjustments to Income. This schedule offers taxpayers opportunities to reduce their taxable income, but understanding the nuances of eligible deductions is crucial to avoid errors and potential audits. Recent changes and interpretations have complicated the landscape, making it essential for Georgians to stay informed.

Schedule 1 of Georgia Form 500 is where taxpayers claim above-the-line deductions, directly lowering their adjusted gross income (AGI). These deductions, unlike itemized deductions on Schedule A, can be claimed regardless of whether the taxpayer itemizes. Misunderstandings about eligibility requirements and calculation methods can lead to inaccurate tax filings. This article delves into the intricacies of Georgia Form 500 Schedule 1, examining key adjustments, recent updates, and strategies for accurate reporting, offering a comprehensive guide for taxpayers and tax professionals alike.

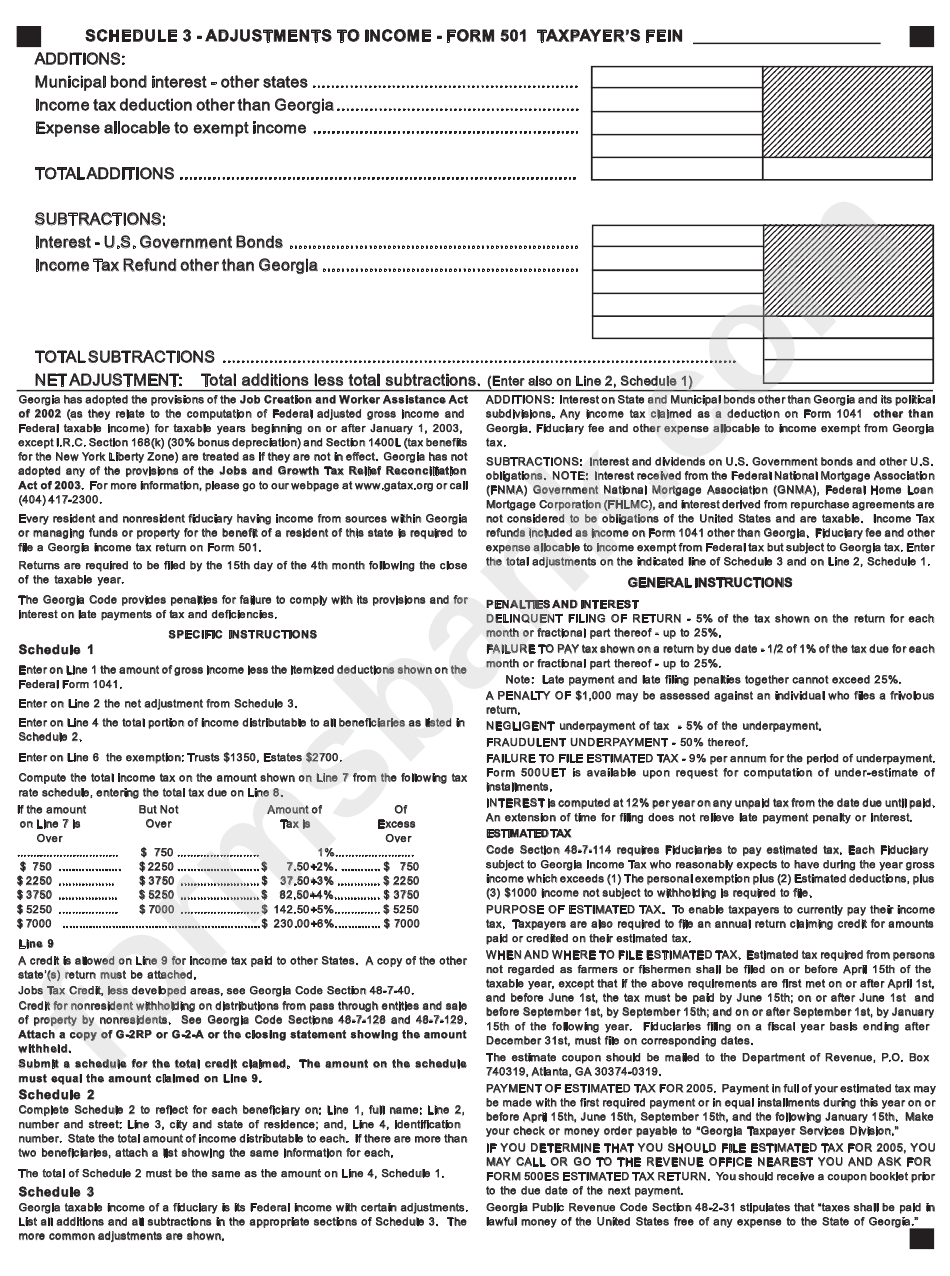

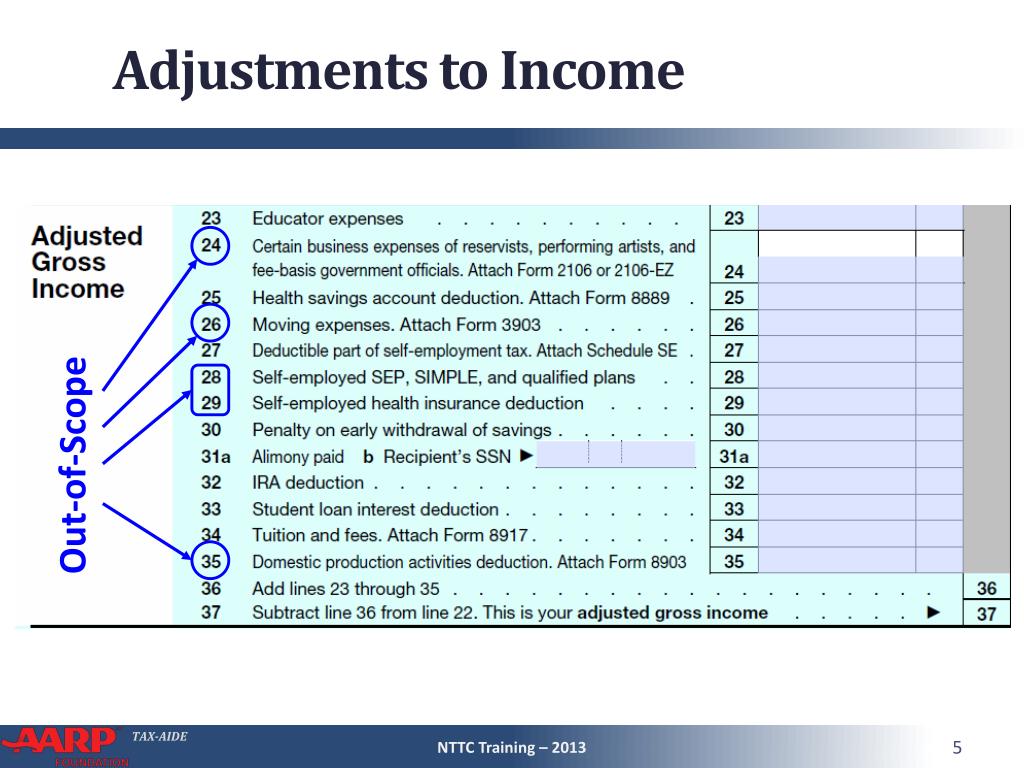

Key Adjustments to Income on Georgia Schedule 1

Several adjustments are commonly claimed on Georgia Schedule 1. These adjustments represent specific expenses or contributions that are deductible from gross income.

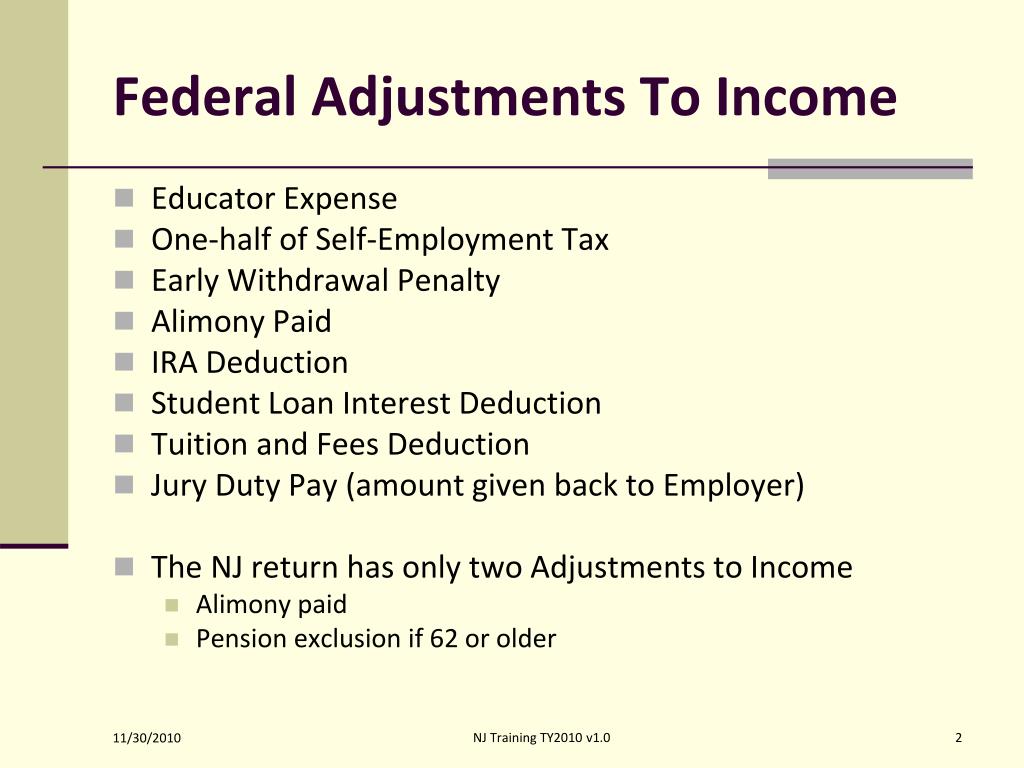

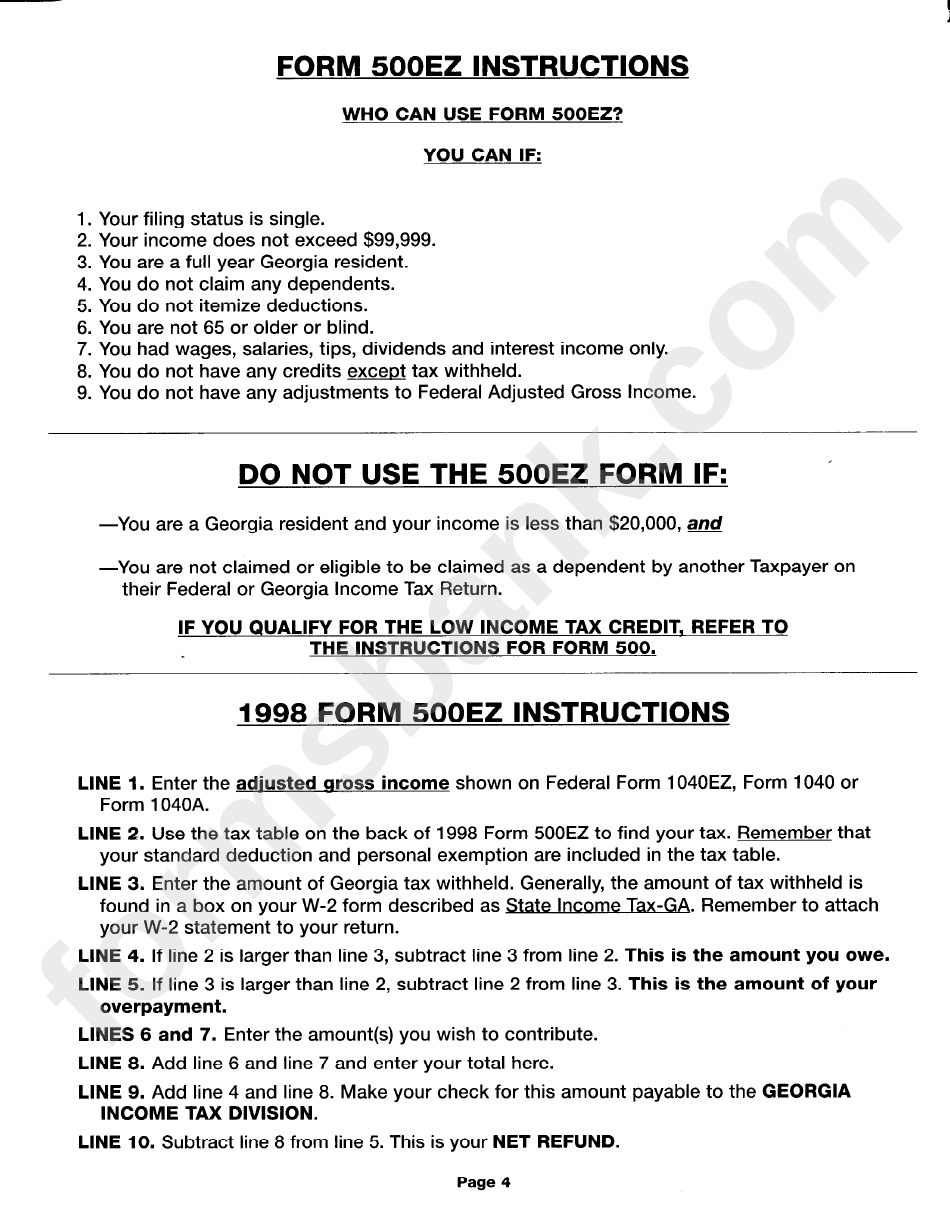

Educator Expenses

Eligible educators can deduct up to $250 of unreimbursed educator expenses. This includes amounts paid for books, supplies, other classroom equipment, and professional development courses.

Eligibility requires working at least 900 hours during the school year at an elementary or secondary school.

Health Savings Account (HSA) Deduction

Taxpayers with a high-deductible health insurance plan can deduct contributions made to a Health Savings Account (HSA). The deduction is limited to the amount of contributions made, subject to annual limits based on age and coverage type.

Contributions made by an employer are not deductible. Careful tracking of contributions is vital to avoid over-deduction.

Self-Employment Tax Deduction

Self-employed individuals can deduct one-half of their self-employment tax liability. This is a crucial adjustment for small business owners and independent contractors.

The deduction helps to offset the burden of paying both the employer and employee portions of Social Security and Medicare taxes. The deductible amount is calculated on Schedule SE of Form 1040 and transferred to Georgia Schedule 1.

IRA Deduction

Contributions to traditional Individual Retirement Accounts (IRAs) may be deductible. The deductibility depends on the taxpayer's filing status, income, and whether they are covered by a retirement plan at work.

Taxpayers covered by a retirement plan at work may have a limited or no deduction based on their income levels. Careful consideration of these limitations is essential.

Student Loan Interest Deduction

Taxpayers can deduct interest paid on qualified student loans, up to a maximum of $2,500. This deduction is phased out based on the taxpayer's modified adjusted gross income (MAGI).

The student loan must have been taken out for the taxpayer, their spouse, or a dependent. Repayment of the loan must have been legally obligated.

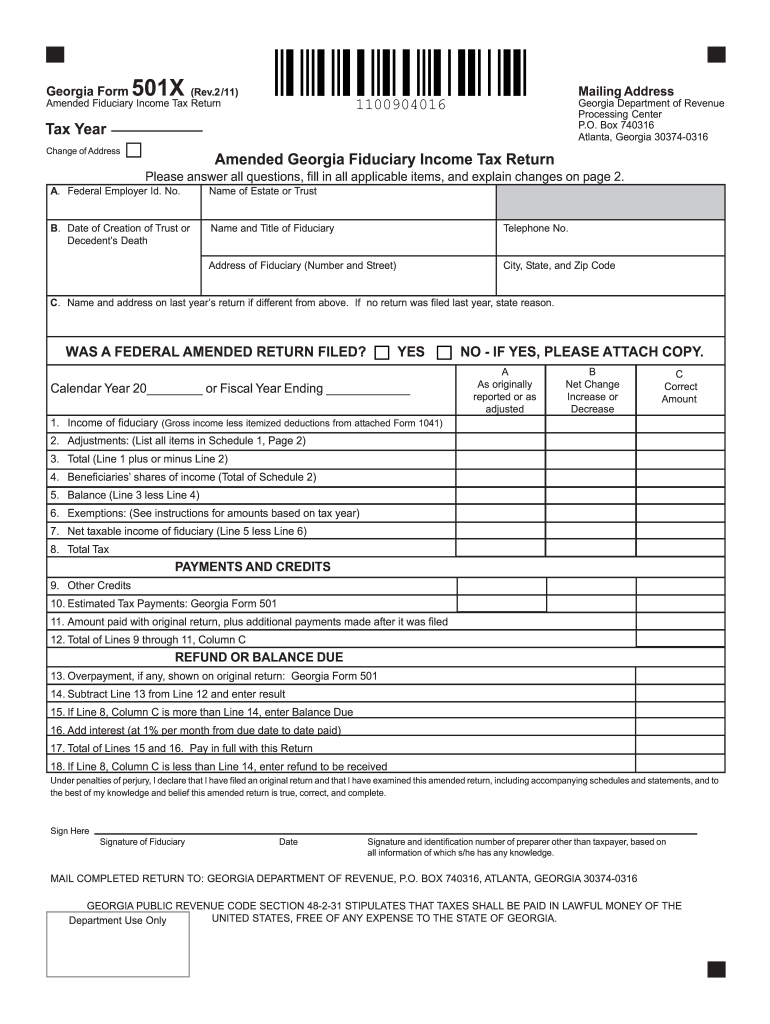

Recent Updates and Changes

Georgia tax laws are subject to change, necessitating continuous updates for taxpayers. Staying abreast of these changes is vital for accurate tax filing.

Legislative Updates

Legislative changes can impact the eligibility and amounts for various deductions on Schedule 1. Taxpayers should consult the official Georgia Department of Revenue website or a qualified tax professional for the most up-to-date information.

Georgia's legislature regularly reviews and modifies tax laws, including those affecting deductions.

Clarifications and Interpretations

The Georgia Department of Revenue occasionally issues clarifications and interpretations regarding specific deductions. These clarifications provide guidance on how certain rules should be applied in specific situations.

Taxpayers should stay informed about these pronouncements to ensure compliance. These clarifications often address complex scenarios.

Common Mistakes and How to Avoid Them

Several common mistakes can occur when completing Georgia Schedule 1. Awareness of these pitfalls can help taxpayers avoid errors and potential audits.

Incorrect Calculation of Self-Employment Tax Deduction

Miscalculating the self-employment tax liability is a frequent error. Taxpayers must correctly complete Schedule SE of Form 1040 before transferring the deductible amount to Georgia Schedule 1.

Failure to account for all self-employment income and expenses can lead to an inaccurate deduction.

Overstating Educator Expenses

Exceeding the $250 limit for educator expenses is another common mistake. Taxpayers should keep accurate records of qualifying expenses to avoid overstating the deduction.

Reimbursed expenses are not deductible and must be excluded from the calculation.

Incorrectly Claiming IRA Deduction

Improperly claiming the IRA deduction, especially for taxpayers covered by a retirement plan at work, is a frequent error. Understanding the income limitations and phase-out rules is essential.

Taxpayers should carefully review the instructions for Form 500 and consult with a tax professional if needed.

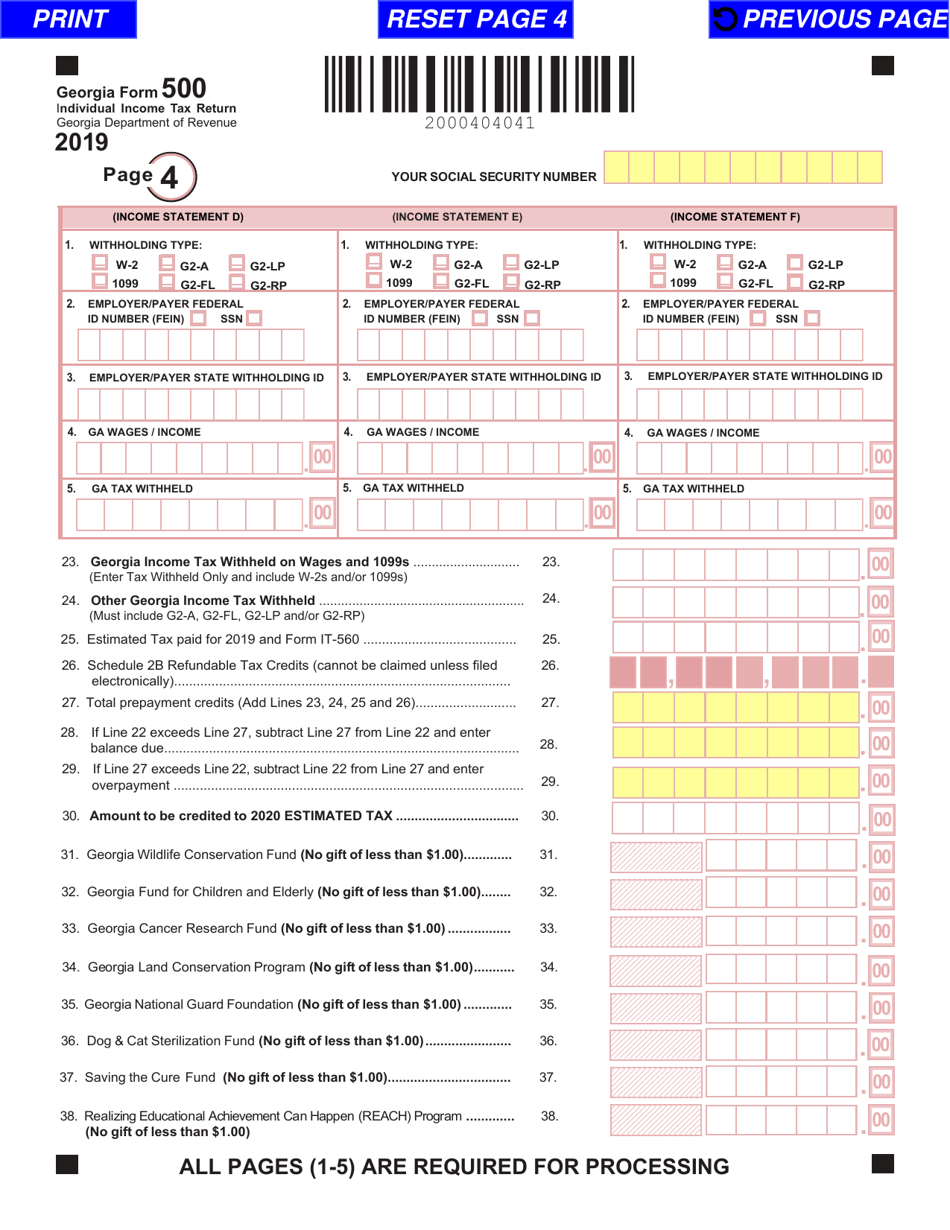

Strategies for Accurate Reporting

Accurate reporting on Georgia Schedule 1 requires careful planning and recordkeeping. Implementing these strategies can help taxpayers ensure compliance.

Maintain Detailed Records

Keeping thorough records of all deductible expenses and contributions is paramount. This includes receipts, invoices, and bank statements.

Organized records facilitate accurate calculation and provide support in case of an audit.

Consult a Tax Professional

Seeking guidance from a qualified tax professional is advisable, particularly for complex tax situations. A tax professional can provide personalized advice and ensure compliance with current laws.

Tax professionals can also help identify overlooked deductions and credits.

Utilize Tax Software

Using reputable tax software can help streamline the filing process and minimize errors. Tax software often includes built-in calculators and prompts to ensure all relevant information is entered correctly.

Software can also alert taxpayers to potential deductions they may have overlooked.

Looking Ahead

The landscape of Georgia income tax, including Schedule 1 deductions, is likely to continue evolving. Taxpayers should remain proactive in staying informed about potential future changes.

By staying informed about changes, maintaining accurate records, and seeking professional advice when needed, Georgia taxpayers can effectively navigate Schedule 1 and optimize their tax outcomes. Accurate reporting not only ensures compliance but also helps taxpayers leverage available deductions to minimize their tax liability.