How Much Income Tax Should I Pay On $130 000

Time is money! Knowing your income tax liability on a $130,000 salary is crucial for financial planning and avoiding surprises. Here's a breakdown of what you can expect to pay, fast and simple.

This guide cuts through the complexity, providing a clear estimate of your federal and state income tax obligations on a $130,000 annual income, helping you budget effectively and optimize your tax strategy.

Federal Income Tax: The Basics

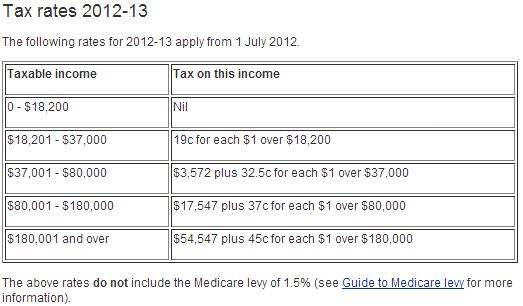

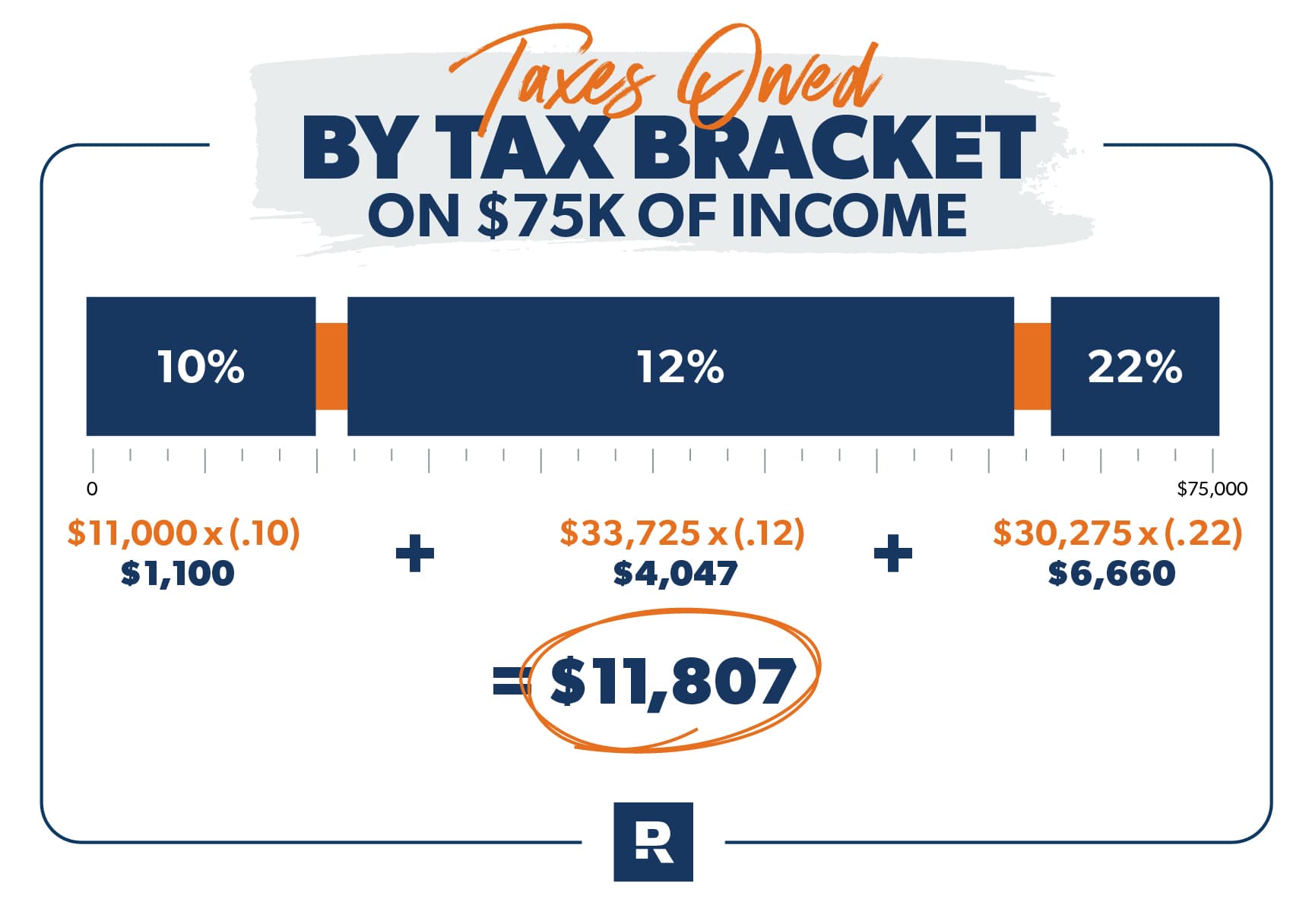

The U.S. federal income tax system is progressive, meaning higher incomes are taxed at higher rates. For the 2023 tax year (filed in 2024), a $130,000 income falls into multiple tax brackets.

These brackets range from 10% to 35%, depending on your taxable income after deductions and adjustments. Your taxable income is your gross income minus deductions like the standard deduction or itemized deductions, and any adjustments to income.

Let's look at estimated federal income tax with the standard deduction. The standard deduction for single filers in 2023 was $13,850. For married filing jointly, it was $27,700.

Single Filer: If you're single, your taxable income would be $130,000 - $13,850 = $116,150. Your federal income tax liability would be approximately $17,713.50 based on the 2023 tax brackets.

Married Filing Jointly: If you're married filing jointly, your taxable income would be $130,000 - $27,700 = $102,300. Your federal income tax liability would be approximately $9,856 based on the 2023 tax brackets.

Key Considerations:

Tax Credits: Don't forget about tax credits! Credits like the Child Tax Credit or the Earned Income Tax Credit can significantly reduce your tax bill.

Itemized Deductions: If your itemized deductions (like medical expenses, state and local taxes) exceed the standard deduction, itemizing may save you money.

Pre-Tax Deductions: Contributing to a 401(k) or health savings account (HSA) reduces your taxable income and therefore lowers your tax liability.

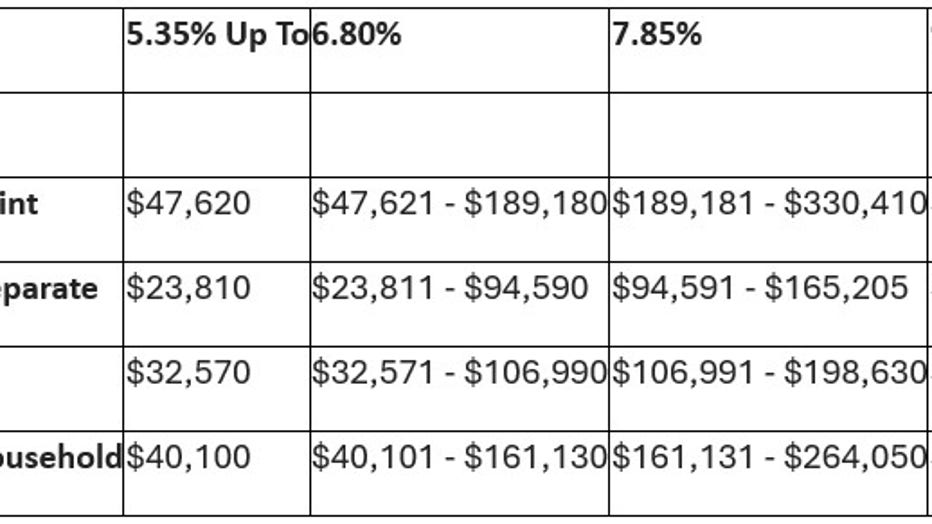

State Income Tax: A Patchwork of Rates

State income tax varies dramatically depending on where you live. Some states have no income tax, while others have rates ranging from below 1% to over 10%.

No Income Tax States: States like Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have a state income tax. Residents in these states won't have state income tax obligations.

California: California has a progressive income tax system. For a single filer with a $130,000 income, the state income tax liability could be around $6,243.

New York: New York also has a progressive income tax. A single filer earning $130,000 could owe around $6,029 in state income tax.

Texas: A resident of Texas, with no state income tax, pays $0. This will affect your final amount due.

Finding Your State's Rate:

The best way to determine your specific state income tax liability is to consult your state's Department of Revenue website. Tax calculators are often available.

Websites like the Tax Foundation or Avalara offer summaries of state tax rates and structures.

Remember to consider local taxes, like city or county income taxes, if applicable in your area.

Social Security and Medicare Taxes (FICA)

In addition to income taxes, you'll also pay Social Security and Medicare taxes, collectively known as FICA taxes. These are mandatory payroll deductions.

The Social Security tax rate is 6.2% on earnings up to a certain limit ($160,200 for 2023). The Medicare tax rate is 1.45% on all earnings.

Calculation: For a $130,000 income, you'd pay $130,000 * 0.062 = $8,060 in Social Security tax and $130,000 * 0.0145 = $1,885 in Medicare tax.

Your employer also contributes an equal amount to Social Security and Medicare, so the total contribution is double the amount you pay.

Estimated Total Tax Burden: A Range

Based on the above calculations, here's a possible range of your total tax burden on a $130,000 income, depending on your filing status and location:

Single Filer (Federal Only): Federal income tax ($17,713.50) + Social Security ($8,060) + Medicare ($1,885) = $27,658.50.

Married Filing Jointly (Federal Only): Federal income tax ($9,856) + Social Security ($8,060) + Medicare ($1,885) = $19,801.

Remember to add your state income tax to these figures if you live in a state with an income tax. This range is an estimation. Consulting a tax professional is recommended.

Next Steps: Optimize Your Tax Strategy

Don't leave money on the table! Now that you have a clearer picture of your tax obligations, take steps to optimize your tax strategy.

Consult a Tax Professional: A qualified tax advisor can provide personalized advice based on your specific financial situation and help you identify deductions and credits you may be eligible for.

Adjust Your Withholding: Make sure your W-4 form is up-to-date to avoid underpayment penalties. Use the IRS withholding estimator tool to fine-tune your withholding.

Plan for the Future: Start planning early! Tax planning is a year-round process. Being proactive can save you money and stress in the long run.

.jpg)

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)