How Much Is 18/hr Per Year

Imagine the aroma of freshly brewed coffee filling your kitchen as the sun streams through the window. You’re starting a new job, or perhaps contemplating a career change, a question swirling in your mind: "What does $18 an hour really mean?" It's not just a number; it's about budgeting, dreams, and the life you want to build.

This article unpacks what earning $18 per hour translates to annually, after taxes, and how that figure shapes your financial landscape. We'll explore the implications of this wage, considering different lifestyles, expenses, and the broader economic context. Get ready to transform a simple hourly rate into a tangible picture of your potential financial future.

Understanding the Basics

Before diving into detailed calculations, it’s essential to understand the groundwork. We need to determine the gross annual income derived from an $18 hourly wage. We will also look at how taxes and other deductions affect it.

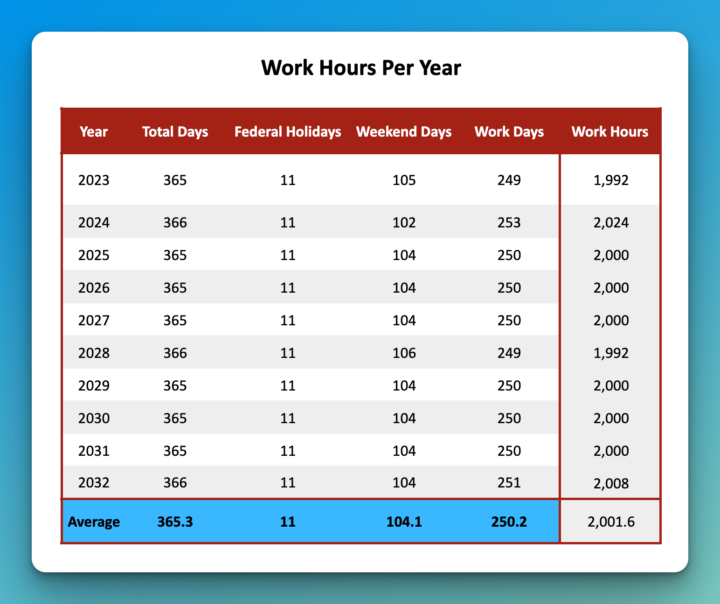

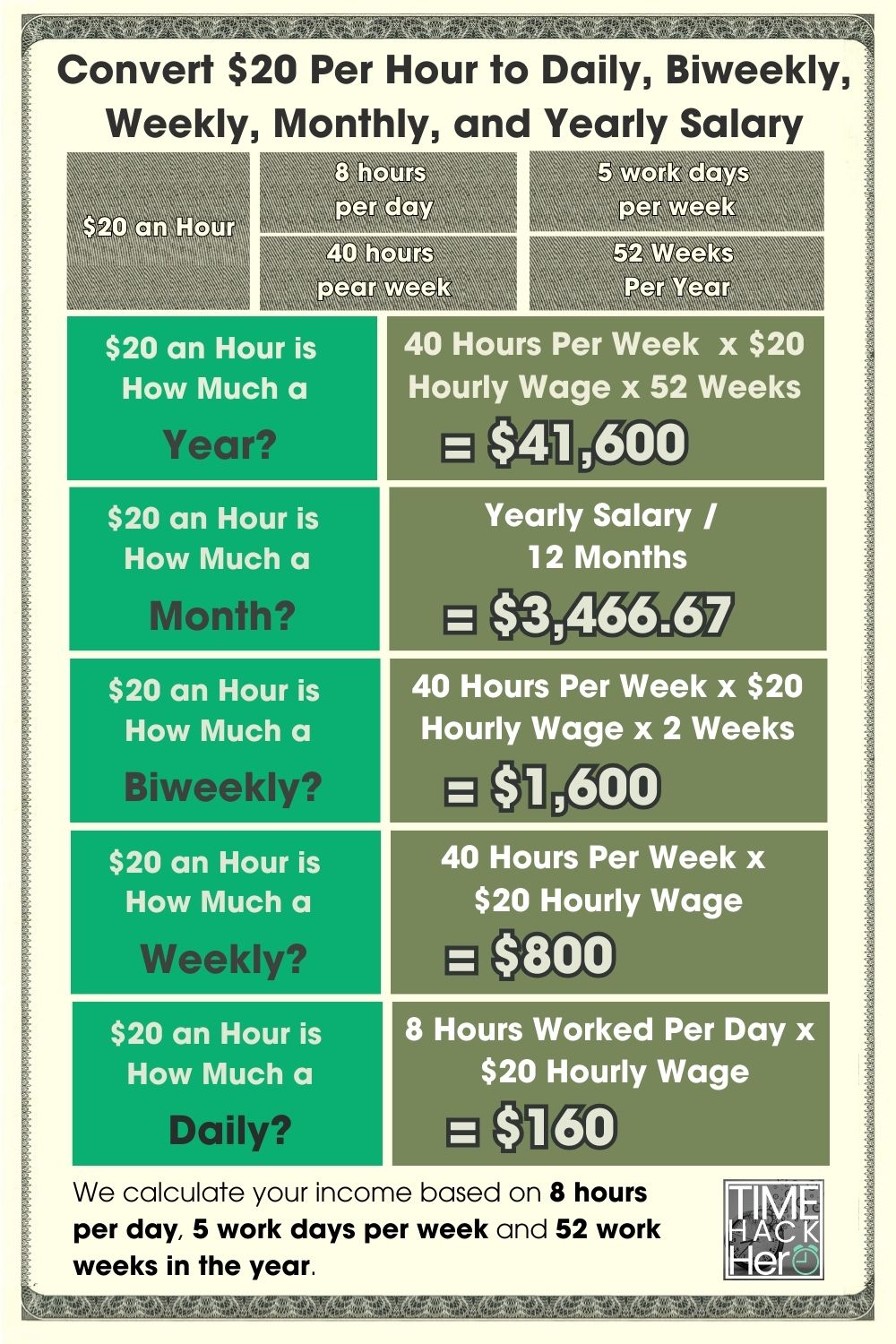

Calculating Gross Annual Income

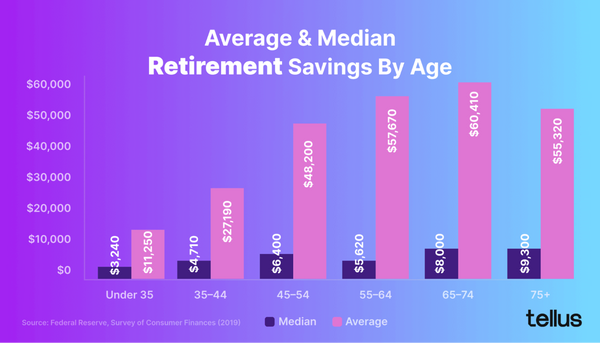

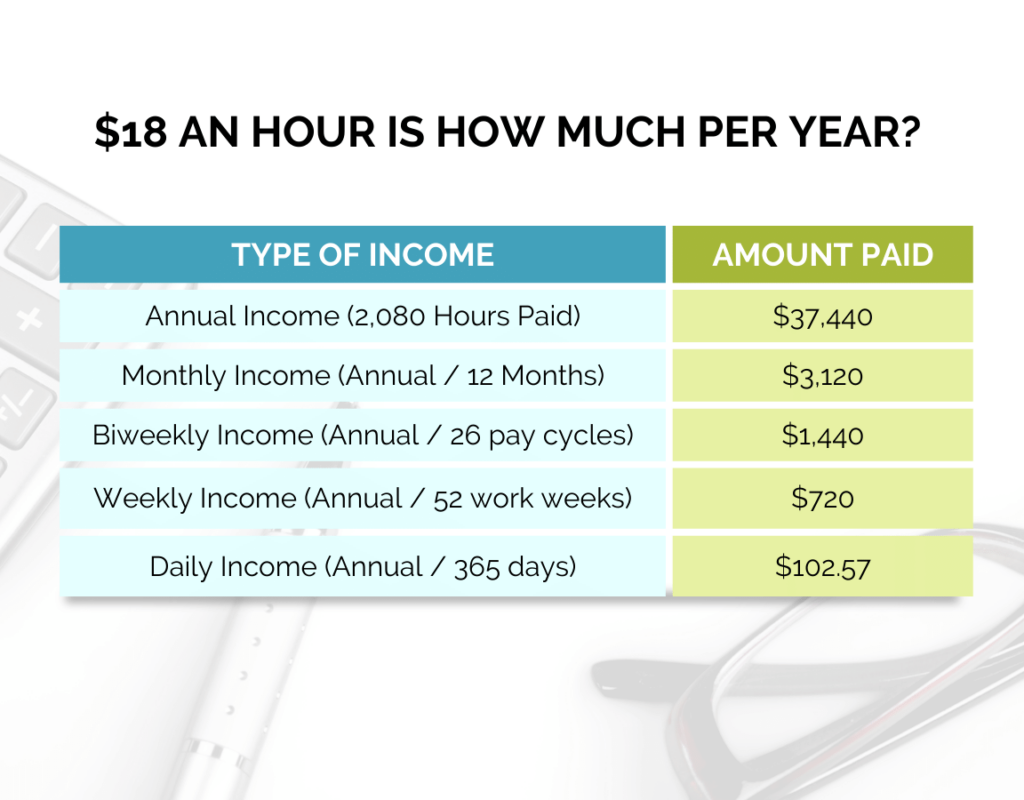

The standard calculation begins with the assumption of a 40-hour workweek. This translates to 2,080 working hours in a year (40 hours/week * 52 weeks/year). Therefore, an individual earning $18 per hour would have a gross annual income of $37,440 ($18/hour * 2,080 hours/year).

This is the starting point. It's crucial to remember that this figure represents the total income *before* any deductions, such as taxes, insurance, and retirement contributions are taken out.

The Impact of Taxes and Deductions

Taxes are a significant factor that reduces the net income, or take-home pay. Federal income tax, state income tax (where applicable), Social Security, and Medicare are common deductions. The specific amount withheld varies based on factors like marital status, number of dependents, and deductions claimed.

Estimating the tax burden requires considering federal and state tax brackets. Using online tax calculators from reputable sources such as the IRS (Internal Revenue Service) and state revenue departments is crucial for accuracy.

"Understanding your tax obligations is crucial for effective financial planning," advises Sarah Johnson, a Certified Financial Planner.

Beyond taxes, other deductions can include health insurance premiums, retirement plan contributions (like 401(k) or IRA), and contributions to health savings accounts (HSAs). These deductions, while reducing immediate take-home pay, often provide long-term benefits and tax advantages.

Real-World Scenarios and Lifestyle Considerations

What does $37,440 actually *buy* in today's world? The answer greatly depends on where you live and your lifestyle choices. The cost of living varies significantly across different regions.

Geographic Variations in Cost of Living

In cities with high costs of living, like New York City or San Francisco, $37,440 might barely cover basic necessities. Rent, transportation, and groceries consume a larger portion of income. Data from organizations like the Bureau of Labor Statistics (BLS) provides valuable insights into regional price variations.

Conversely, in areas with lower costs of living, the same income could afford a more comfortable lifestyle. Smaller towns and rural areas often have cheaper housing and lower overall expenses.

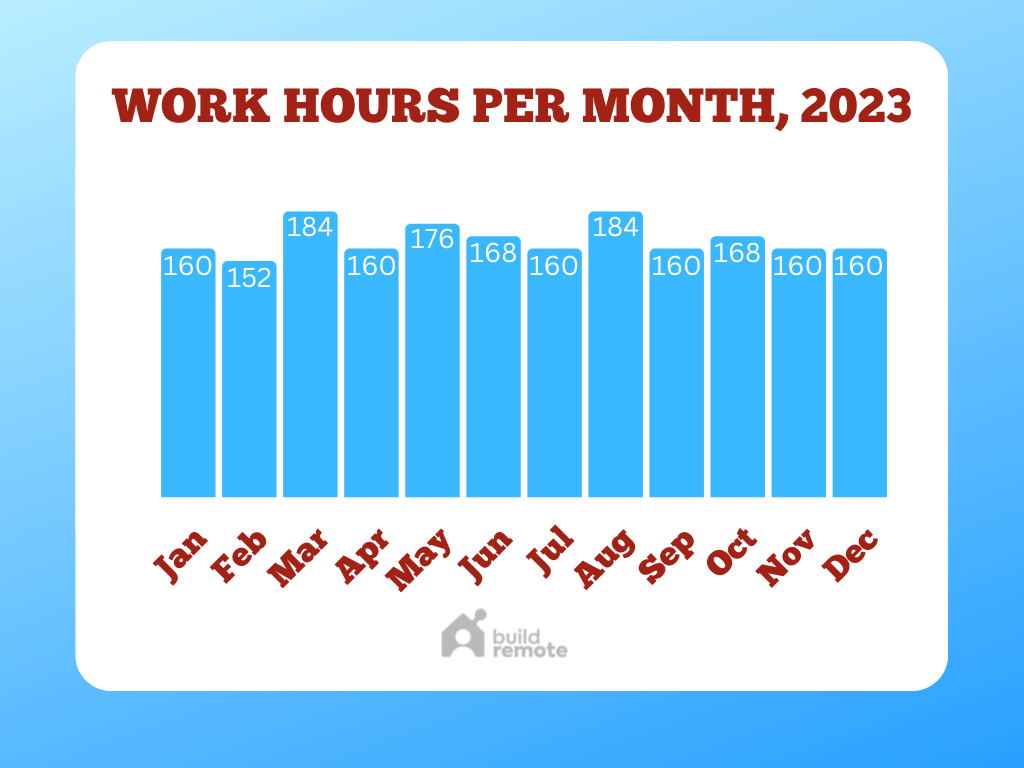

Budgeting and Financial Planning

Effective budgeting is critical for making the most of an $18-per-hour income. A detailed budget should allocate funds for housing, transportation, food, utilities, healthcare, debt repayment, and savings.

The 50/30/20 rule can serve as a helpful starting point. This rule suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. It's important to adjust these percentages based on individual circumstances.

Building a Financial Future

Earning $18 per hour can be a stepping stone toward a more secure financial future. Strategic financial planning and smart choices can significantly improve long-term prospects.

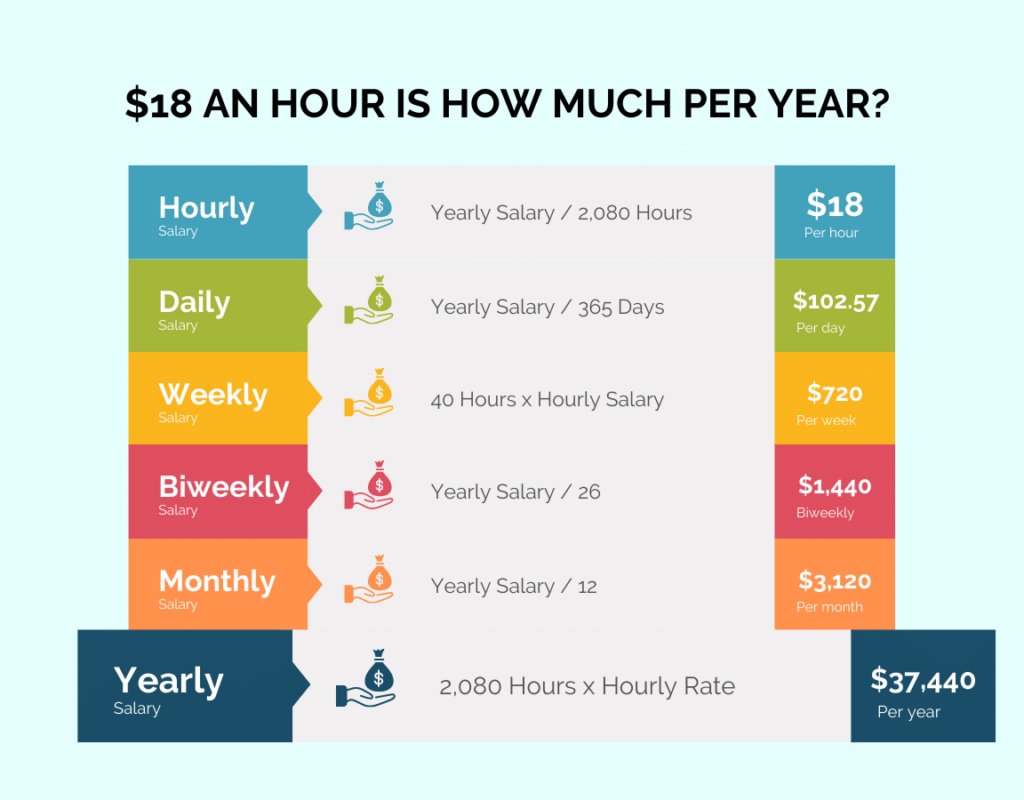

Saving and Investing

Prioritizing saving and investing is crucial. Even small, consistent contributions to retirement accounts, such as 401(k)s or IRAs, can grow substantially over time, thanks to the power of compound interest.

Consider exploring different investment options, consulting with a financial advisor if needed. Diversification, spreading investments across various asset classes, helps mitigate risk.

Education and Career Advancement

Investing in education and skills development can lead to higher-paying jobs. This could involve taking online courses, attending workshops, or pursuing further education.

Explore opportunities for career advancement within your current organization or seek out roles that offer higher compensation and benefits. Building a strong professional network can also open doors to new opportunities.

Challenges and Opportunities

Earning $18 per hour presents both challenges and opportunities. Understanding these aspects is vital for making informed financial decisions and navigating the complexities of the modern economy.

Addressing Financial Challenges

Unexpected expenses, such as medical bills or car repairs, can strain a budget. Building an emergency fund can provide a financial cushion to handle these situations.

Managing debt is another significant challenge. High-interest debt, like credit card debt, can quickly accumulate. Prioritizing debt repayment can free up more income for other financial goals.

Leveraging Opportunities for Growth

Explore opportunities for side hustles or part-time work to supplement income. The gig economy offers numerous possibilities, from freelancing to online tutoring.

Take advantage of employer-sponsored benefits, such as health insurance and retirement plans. These benefits can significantly enhance your overall financial well-being.

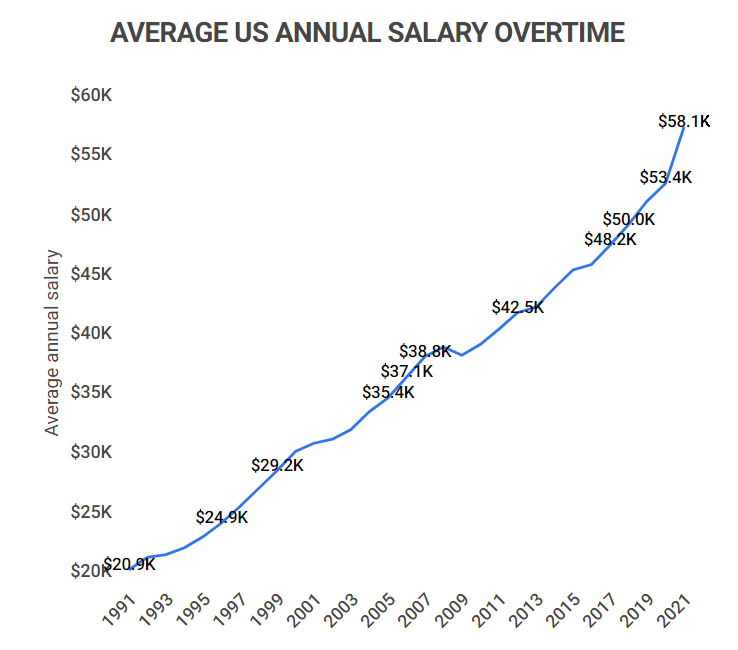

The Bigger Picture: Economic Context

An $18-per-hour wage should also be viewed within the broader economic context. Factors such as inflation, unemployment rates, and government policies can influence the purchasing power of this income.

Inflation and Purchasing Power

Inflation erodes the purchasing power of money over time. As prices rise, the same amount of money buys fewer goods and services. Staying informed about inflation trends and adjusting spending habits accordingly is essential.

Monitoring inflation rates and adjusting your budget is critical in maintaining your financial stability. Resources like the Consumer Price Index (CPI) provided by the BLS can help you stay informed.

Government Policies and Economic Outlook

Government policies, such as minimum wage laws and tax reforms, can impact income and affordability. Keeping abreast of these changes can help you anticipate their potential effects on your financial situation.

The overall economic outlook also plays a role. Strong economic growth can lead to increased job opportunities and wage growth, while economic downturns can create uncertainty and financial challenges.

Final Thoughts

Earning $18 an hour is more than just a number; it's a starting point. It's a foundation upon which to build a life, plan for the future, and achieve your financial goals. It requires careful budgeting, strategic planning, and a willingness to adapt to changing circumstances.

While it may present challenges, it also offers opportunities for growth, learning, and ultimately, financial security. With the right mindset and strategies, $18 per hour can be a stepping stone to a brighter financial future. It's about more than just making a living; it's about building a life.

![How Much Is 18/hr Per Year 20+ Average Monthly Expense Statistics [2023]: Average Household](https://www.zippia.com/wp-content/uploads/2023/06/year-over-year-spending-changes-by-category.jpg)

![How Much Is 18/hr Per Year 20+ Average Monthly Expense Statistics [2023]: Average Household](https://www.zippia.com/wp-content/uploads/2023/06/average-monthly-household-expenses-over-time.png)