What Cash Advance Works With Ssi

Urgent financial needs can strike anyone, but for individuals receiving Social Security Income (SSI), navigating emergency funding options is fraught with challenges. The limited and fixed nature of SSI presents unique hurdles when seeking a cash advance.

This article clarifies the complex landscape of cash advances for SSI recipients, highlighting viable options and crucial considerations to avoid predatory lending practices.

Understanding SSI and Cash Advances

SSI is a needs-based program providing financial assistance to individuals with limited income and resources who are aged, blind, or disabled. This income is often the sole source of support, making financial stability paramount.

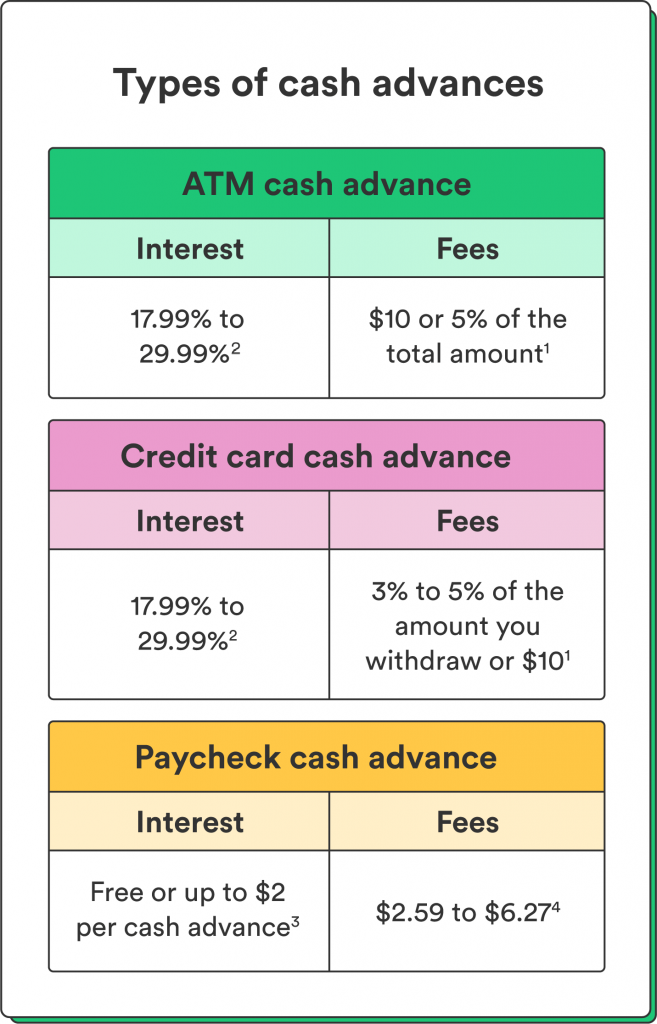

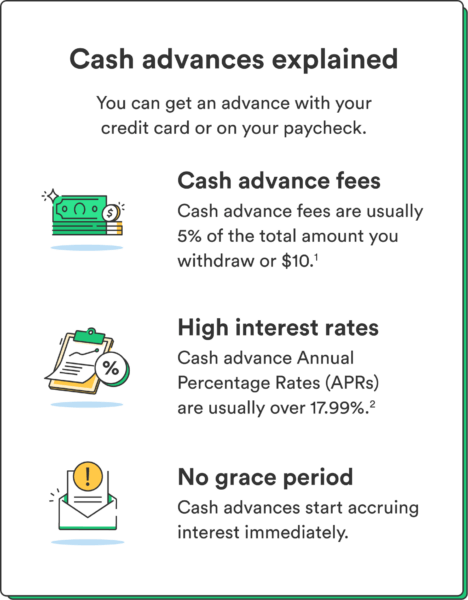

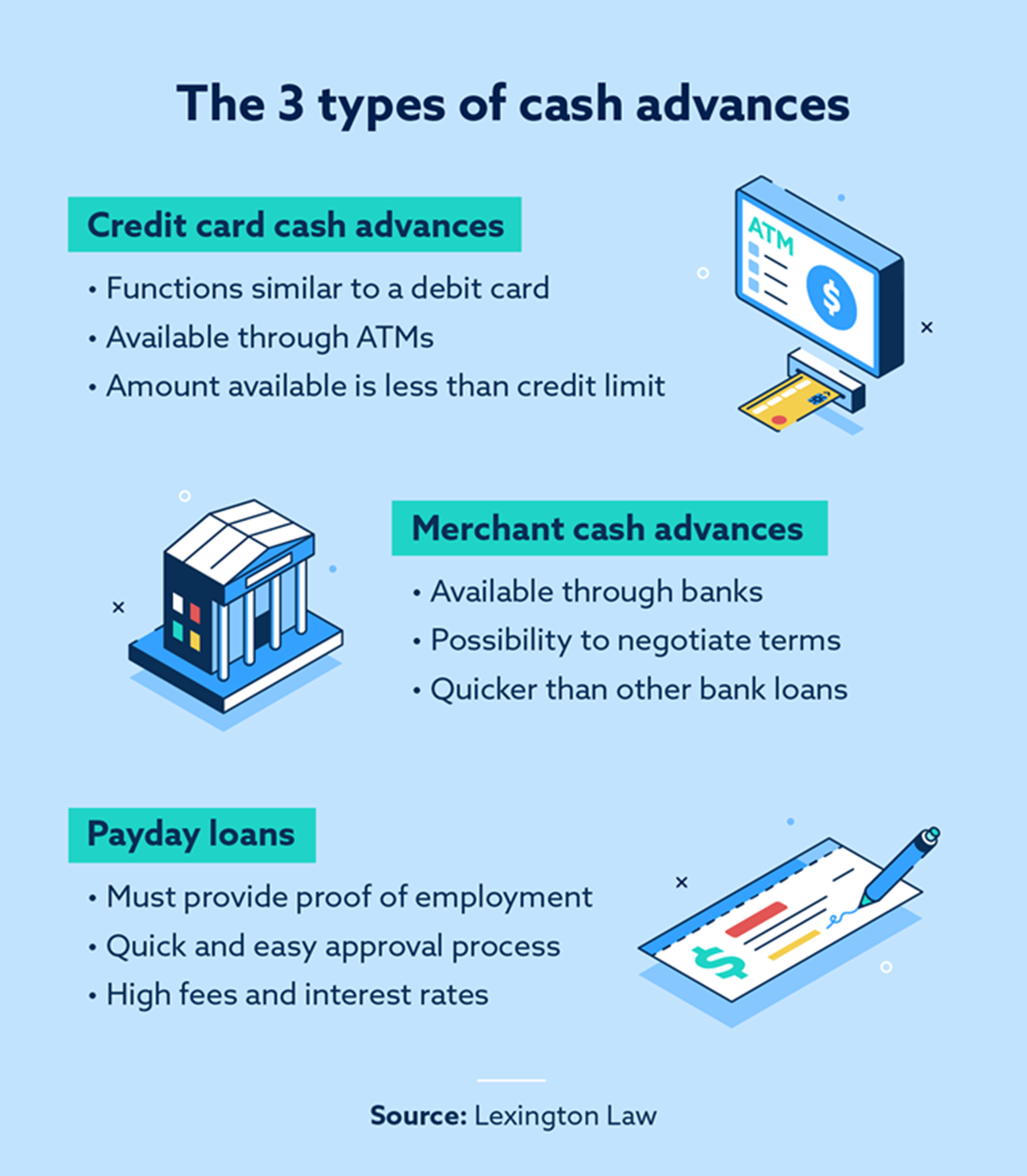

Cash advances, including payday loans and installment loans, offer quick access to funds but often come with exorbitant interest rates and fees. These can trap vulnerable individuals in a cycle of debt.

Why Traditional Cash Advances Are Problematic

Traditional payday loans, typically requiring repayment within two weeks, are particularly dangerous for SSI recipients. The short repayment window often coincides with the next SSI payment, leaving individuals short and forced to renew the loan.

High interest rates, frequently exceeding 300% APR, exacerbate the financial strain. This creates a debt trap difficult to escape.

Many lenders require a bank account and proof of income, which SSI recipients can provide. However, the repayment terms are often unsustainable.

Viable Cash Advance Alternatives for SSI Recipients

While traditional cash advances pose significant risks, some safer alternatives exist.

Consider SSI-specific loans offered by some credit unions or non-profit organizations. These loans are designed with lower interest rates and more flexible repayment terms.

Explore Emergency SSI advances through the Social Security Administration. In certain dire situations, an advance on your SSI payment may be possible, although this is subject to stringent eligibility requirements and is not a standard offering.

Government and Non-Profit Assistance Programs

Numerous government and non-profit programs offer financial assistance to low-income individuals, including SSI recipients.

The Supplemental Nutrition Assistance Program (SNAP) provides food assistance. The Low Income Home Energy Assistance Program (LIHEAP) helps with energy costs. Local charities often offer emergency assistance with rent, utilities, and other essential needs.

Contacting 211 is a vital step. 211 connects individuals with local health and human service programs, providing access to crucial resources that can prevent the need for cash advances.

Credit Unions and Community Banks

Credit unions and community banks often offer more favorable loan terms compared to payday lenders. They may provide small-dollar loans with lower interest rates and longer repayment periods.

Becoming a member of a credit union can unlock access to financial counseling services and other resources designed to promote financial stability. Building a relationship with a local financial institution can be beneficial in times of need.

Red Flags and Precautions

Be wary of lenders advertising "guaranteed approval" or requiring upfront fees. These are often signs of predatory lending practices.

Always carefully review the terms and conditions of any loan before signing. Understand the interest rate, fees, and repayment schedule.

Never borrow more than you can realistically afford to repay. Seek advice from a financial counselor if you are unsure.

Data on SSI and Financial Vulnerability

According to the Social Security Administration, the average monthly SSI payment in 2023 was around $914. This demonstrates the limited financial resources of many recipients.

Research from the Consumer Financial Protection Bureau (CFPB) highlights the disproportionate impact of payday loans on vulnerable populations, including those on fixed incomes like SSI.

The CFPB data indicates that borrowers often renew payday loans multiple times, leading to significant debt accumulation.

Conclusion: Seeking Safe Solutions

For SSI recipients facing urgent financial needs, traditional cash advances are generally not a safe or sustainable solution. Exploring alternative options, such as SSI-specific loans, government assistance programs, and credit union loans, is crucial.

Contacting 211, seeking financial counseling, and carefully reviewing loan terms are essential steps to protect yourself from predatory lending. Monitor the Social Security Administration website for updates on emergency assistance programs.

Ongoing advocacy for policies that protect vulnerable populations from predatory lending practices is vital. Stay informed and seek assistance from reputable organizations.