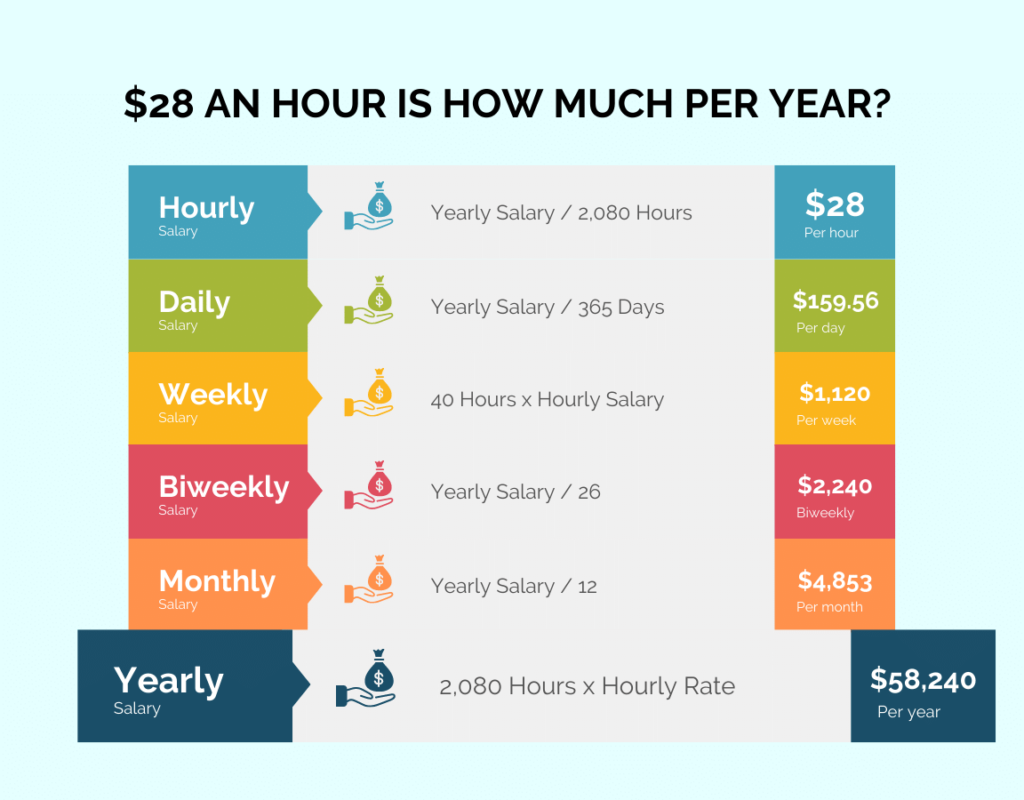

How Much Is 28 Hr Annually

The Department of Labor (DOL) is facing increasing scrutiny over a proposed rule change that could significantly impact the overtime eligibility of millions of American workers. The crux of the issue? Whether an additional 28 hours annually will trigger overtime pay.

This article breaks down the potential consequences of this seemingly small number, examining who stands to gain, who might lose, and what the immediate future holds for this contentious proposal.

The 28-Hour Threshold: A Closer Look

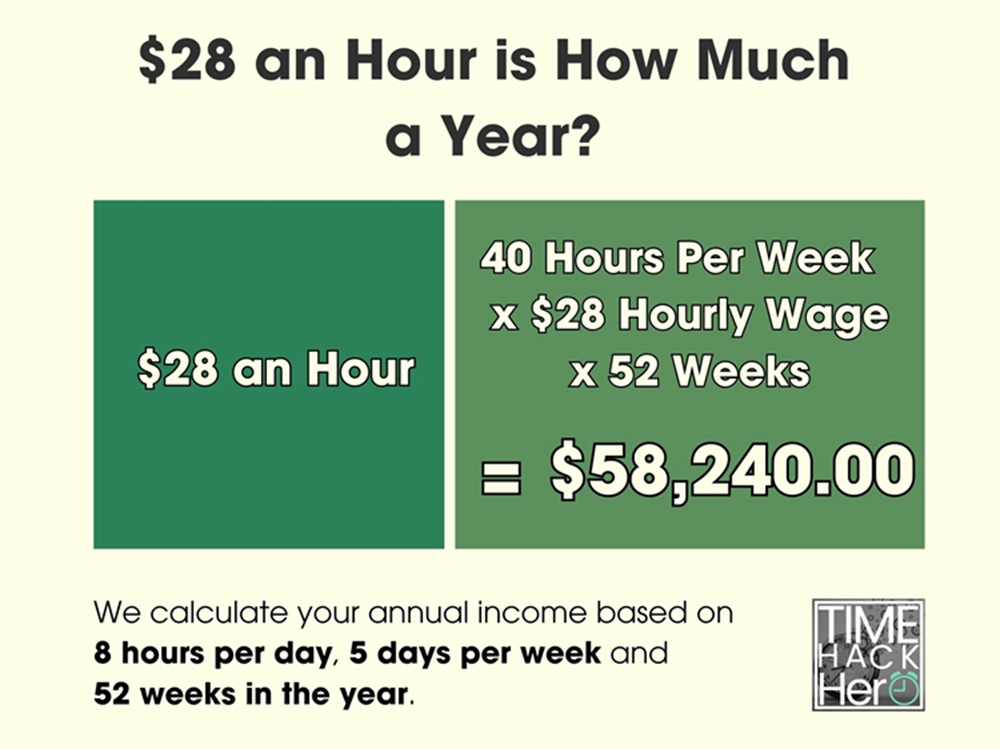

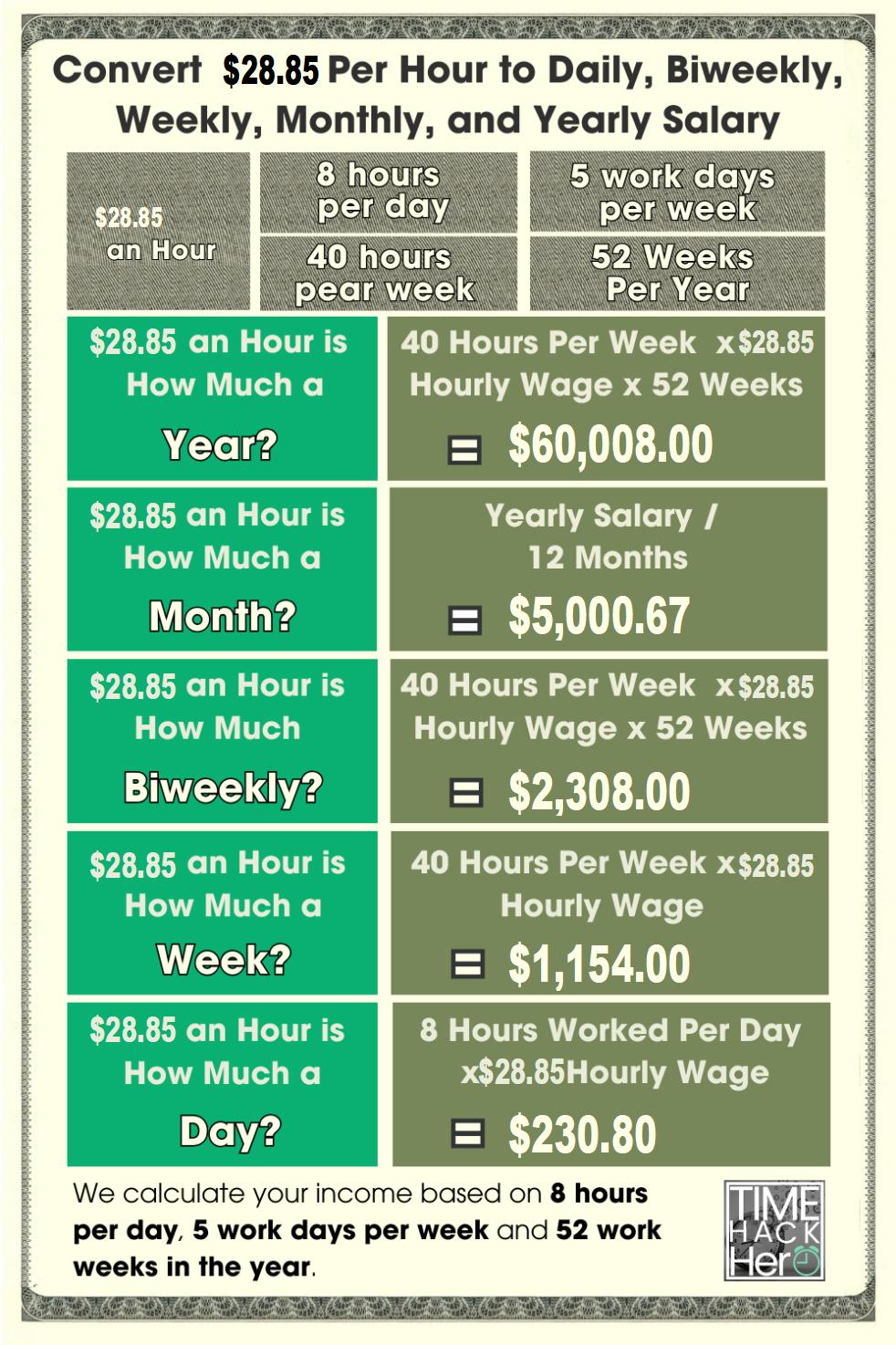

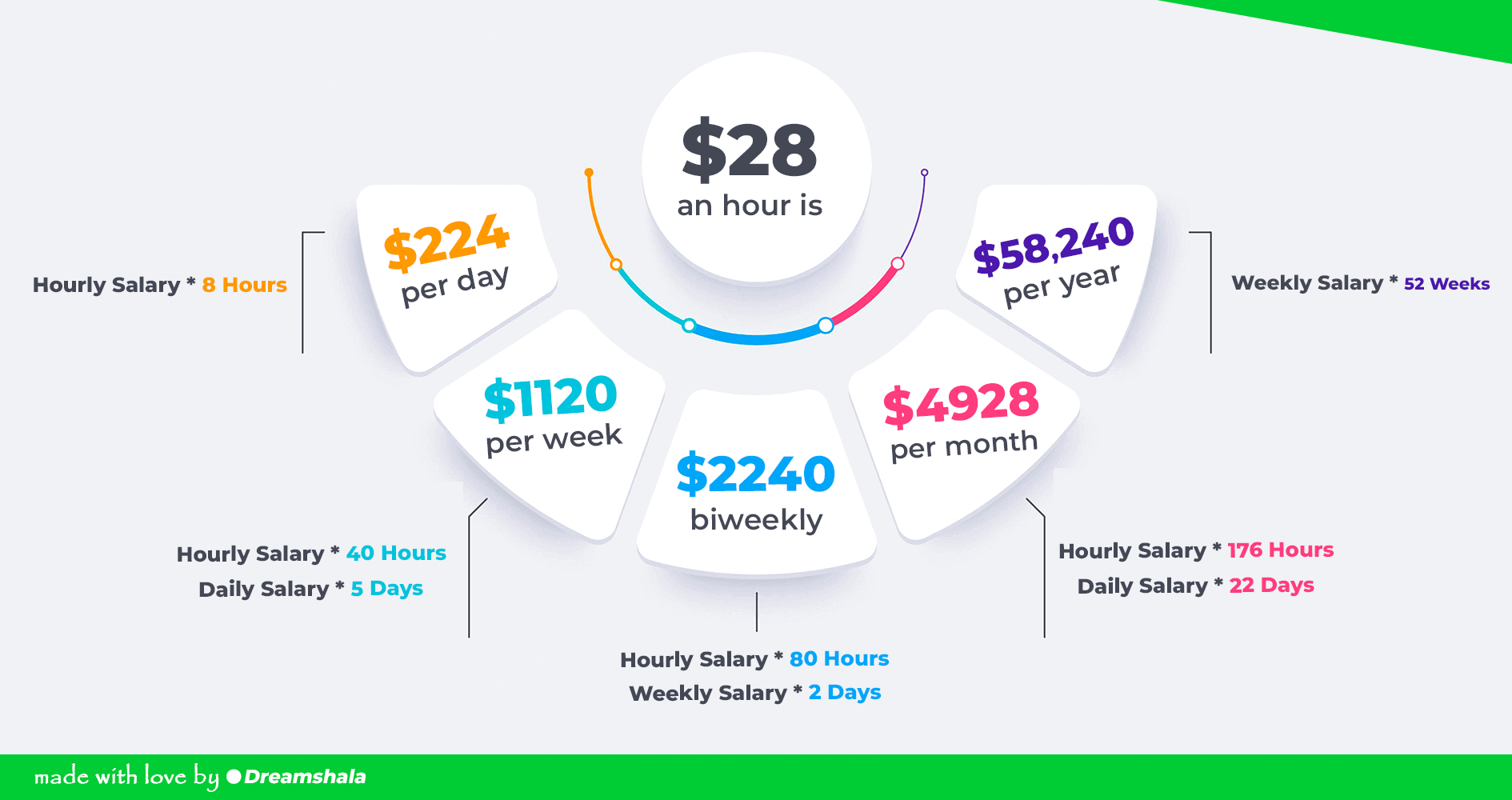

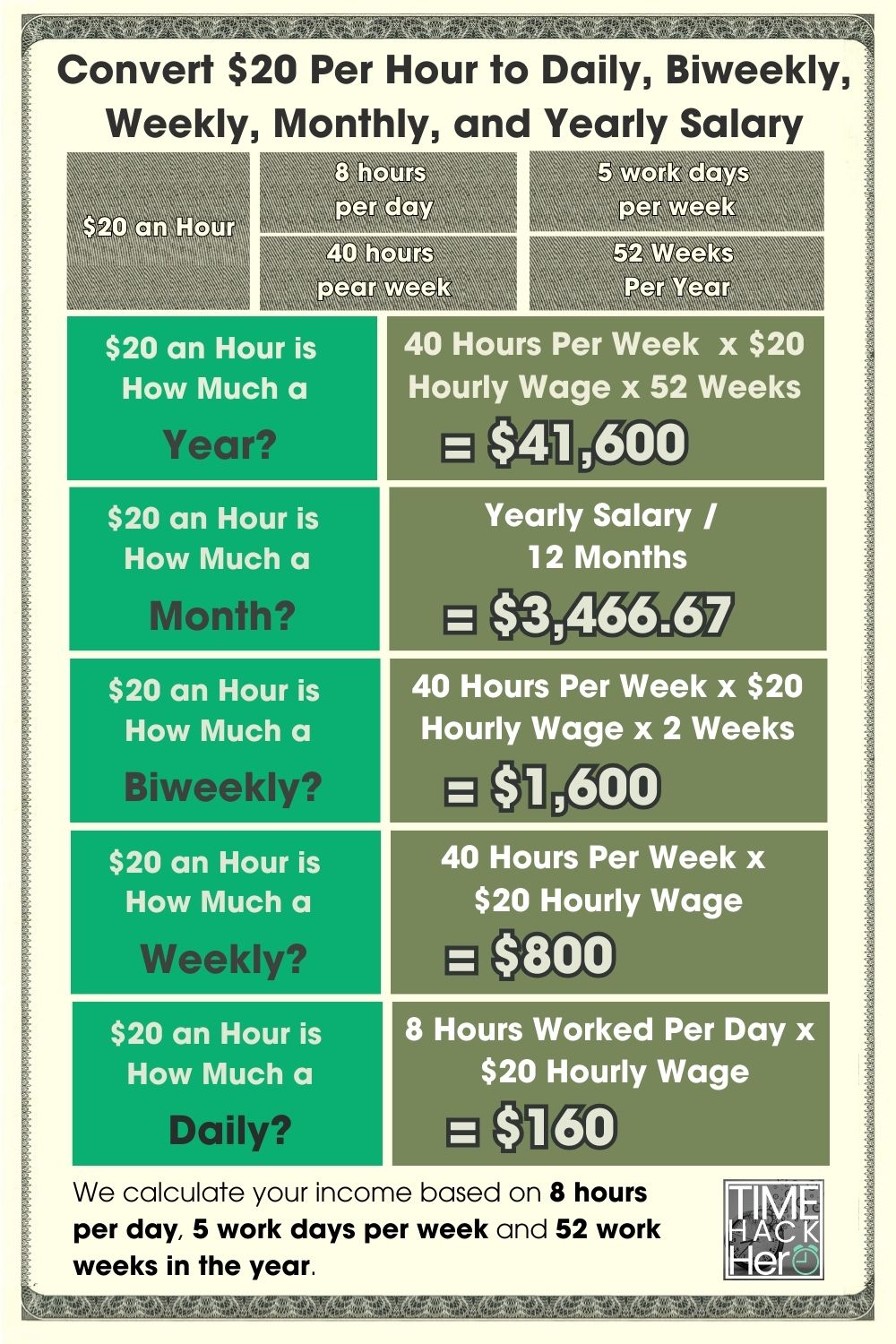

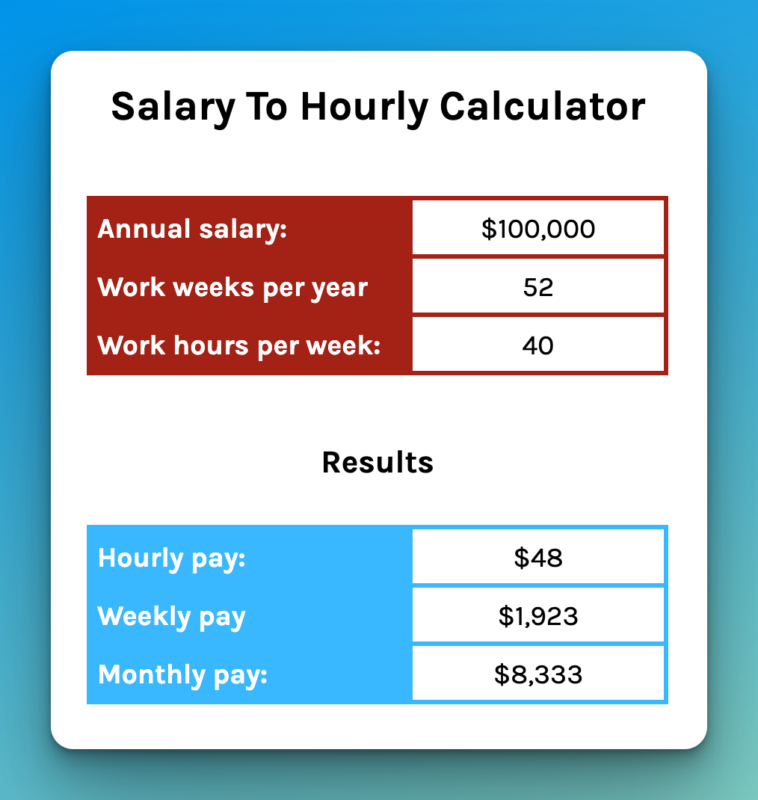

Currently, the federal overtime rule mandates overtime pay (1.5 times the regular rate) for employees who work more than 40 hours in a workweek. The debate centers on whether *28 additional hours annually* is a meaningful trigger for adjustments to overtime policies and, if so, how this impacts various sectors.

The proposed changes are not directly tied to individual employees working exactly 40 hours and 28 minutes per week. Rather, the implications relate to broader calculations and the *annualized salary threshold* used to determine overtime eligibility.

Who's Affected?

The primary target of the debate is salaried employees. They earn above the current threshold set by the DOL. This proposal could extend overtime protection to those earning slightly more. This is depending on how the 28 hours is used in the new rule.

Small businesses are worried about the costs of this change. They may need to change their staffing models. Some might need to decrease work hours for some of their employees.

The Current Landscape

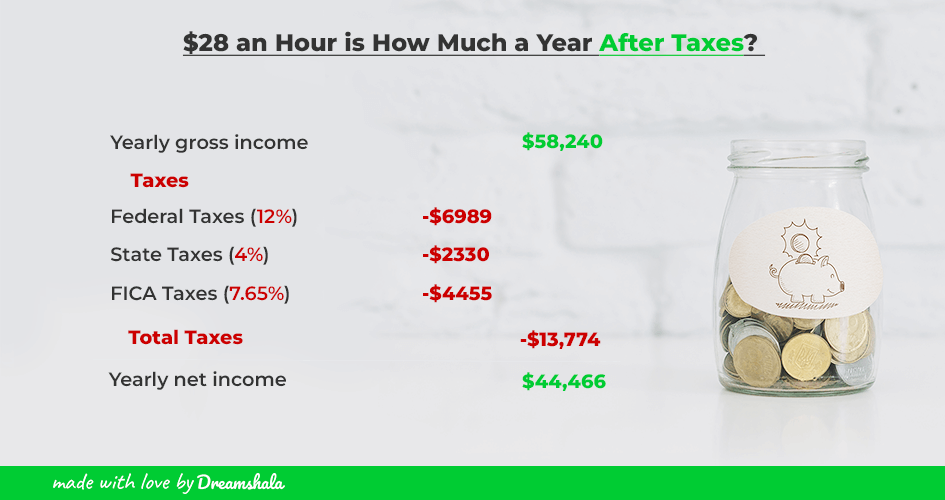

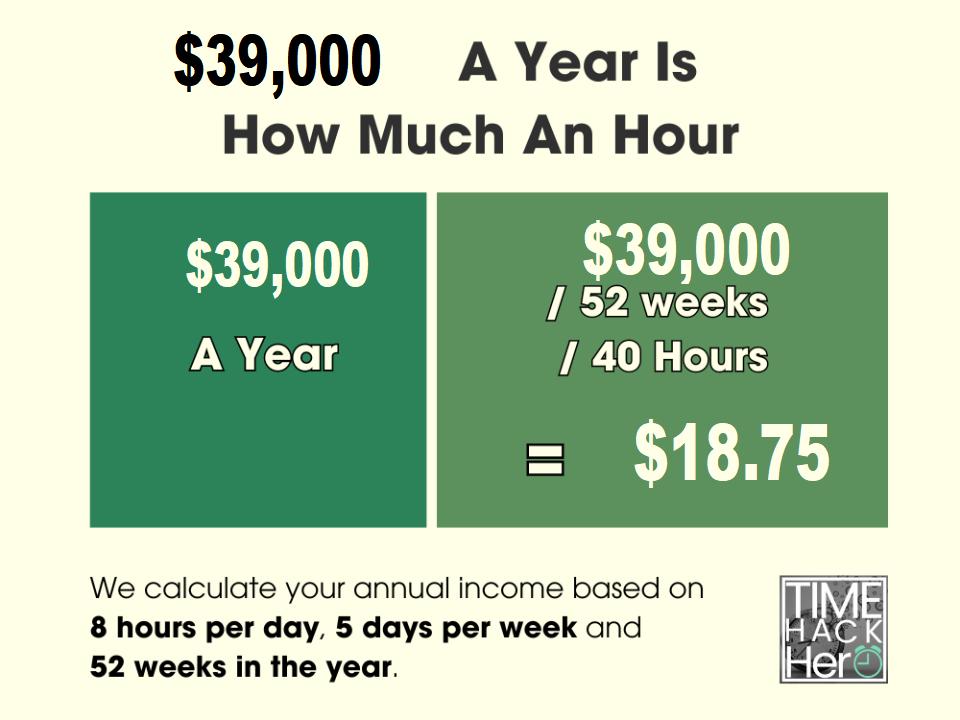

As of [insert current date], the salary threshold for overtime eligibility stands at $35,568 per year, as established in 2019. The proposed change, and how the 28 hours factor into it, could shift this line significantly. This will make numerous employees eligible for overtime.

Data from the Economic Policy Institute estimates that a meaningful increase in the salary threshold could impact millions of workers. A detailed analysis of the economic impact of this change is ongoing.

The Argument For and Against

Proponents of a stricter overtime rule, including labor unions and worker advocacy groups, argue that it's essential to protect workers from exploitation and ensure fair compensation. The addition of 28 hours, in theory, could enhance this protection.

Critics, primarily business organizations, contend that raising the overtime threshold places an undue burden on employers, particularly small businesses. They say this forces them to reduce employee hours or cut back on benefits.

The Chamber of Commerce has been a vocal opponent. They cite potential negative impacts on job creation and overall economic growth.

The DOL's Stance

The Department of Labor maintains that any adjustments to the overtime rule are aimed at ensuring fair wages and promoting economic security for American workers. They are still deciding on the threshold adjustment.

The DOL is reviewing public comments and conducting economic analysis. This will happen before making a final decision on the proposed rule.

Calculating the Impact: Examples

For an employee earning just above the current salary threshold, a change triggered by the 28-hour factor could mean the difference between being classified as exempt or non-exempt. This could result in a significant increase in annual earnings through overtime pay.

Consider a salaried worker who earns $36,000 annually. They work an average of 41 hours per week. Under the current rule, they are not eligible for overtime. A change sensitive to those additional 28 hours could alter this.

The specific calculation would depend on the exact methodology used by the DOL. It is how the 28 hours are incorporated into the new regulations.

Next Steps and Ongoing Developments

The public comment period for the proposed rule has closed. The DOL is currently reviewing the feedback received. A final ruling is expected in the coming months.

Businesses and workers alike should closely monitor the developments. Preparing for potential changes to overtime eligibility is important. This includes reviewing employee classifications and updating payroll systems.

Stay tuned for further updates as this story develops.