How Much Is An H&r Block Appointment

The aroma of freshly brewed coffee mingled with the scent of crisp paper, a familiar comfort in the bustling H&R Block office. Sunlight streamed through the window, illuminating stacks of tax forms and the friendly faces of tax professionals ready to navigate the complexities of tax season. But before you settle into that chair, a question lingers: how much will this expert guidance actually cost?

Understanding the cost of an H&R Block appointment is crucial for budgeting and making informed decisions about tax preparation. While a precise figure varies based on several factors, this article provides a comprehensive overview of potential fees, services offered, and ways to potentially save money on your tax preparation.

Factors Influencing H&R Block Appointment Costs

The price of an H&R Block appointment isn't a one-size-fits-all number. Several elements contribute to the final cost, reflecting the complexity of your tax situation and the level of service you require.

Firstly, the complexity of your tax return significantly impacts the price. A simple return with standard deductions will naturally be less expensive than a return involving self-employment income, investment properties, or intricate itemized deductions.

Secondly, the specific services you choose play a major role. H&R Block offers a range of services, from basic tax preparation to more comprehensive packages that include audit assistance and year-round tax planning.

Finally, location can subtly influence pricing. Offices in metropolitan areas or regions with a higher cost of living might have slightly higher fees than those in smaller towns.

A Glimpse at Potential Costs

While pinpointing an exact cost requires a personalized consultation, we can explore some general price ranges based on publicly available information and reported averages.

For basic tax preparation, involving simple W-2 income and standard deductions, you might expect to pay somewhere in the range of $100 to $200. This usually covers the essential filing of your federal and state tax returns.

If your tax situation involves itemized deductions, self-employment income (Schedule C), or investment income (Schedule D), the cost will likely increase. Expect to pay anywhere from $200 to $400 or even higher, depending on the intricacy of these schedules.

For more complex tax scenarios, such as those involving rental properties or small business ownership, fees can rise accordingly. In such instances, fees could reach $500 or more, reflecting the specialized knowledge and time required to accurately prepare your return.

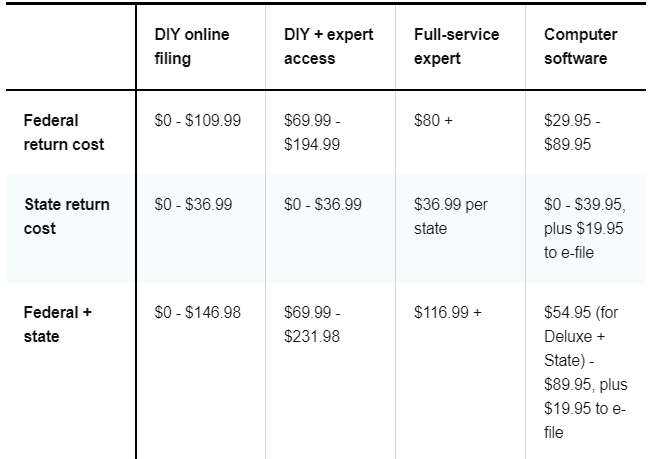

Exploring H&R Block's Service Tiers

H&R Block offers different service tiers designed to cater to varying needs and budgets. Understanding these tiers can help you choose the best option for your unique situation.

Their basic service is suitable for those with straightforward tax situations, focusing on accuracy and efficient filing. As you move up the tiers, you unlock access to more personalized advice, audit assistance, and year-round support.

Premium tiers may also include features like tax planning consultations, which can help you proactively manage your tax liabilities and identify potential savings opportunities for the future.

Tips for Potentially Saving Money

While professional tax preparation provides valuable peace of mind, there are ways to potentially reduce the cost without sacrificing quality.

Firstly, gather all your necessary tax documents before your appointment. Being organized saves your tax preparer time, which could translate to lower fees.

"Preparation is key to a smooth and cost-effective tax filing experience," emphasizes a tax professional from H&R Block.

Secondly, inquire about any available discounts or promotions. H&R Block frequently offers discounts for students, seniors, and members of specific organizations.

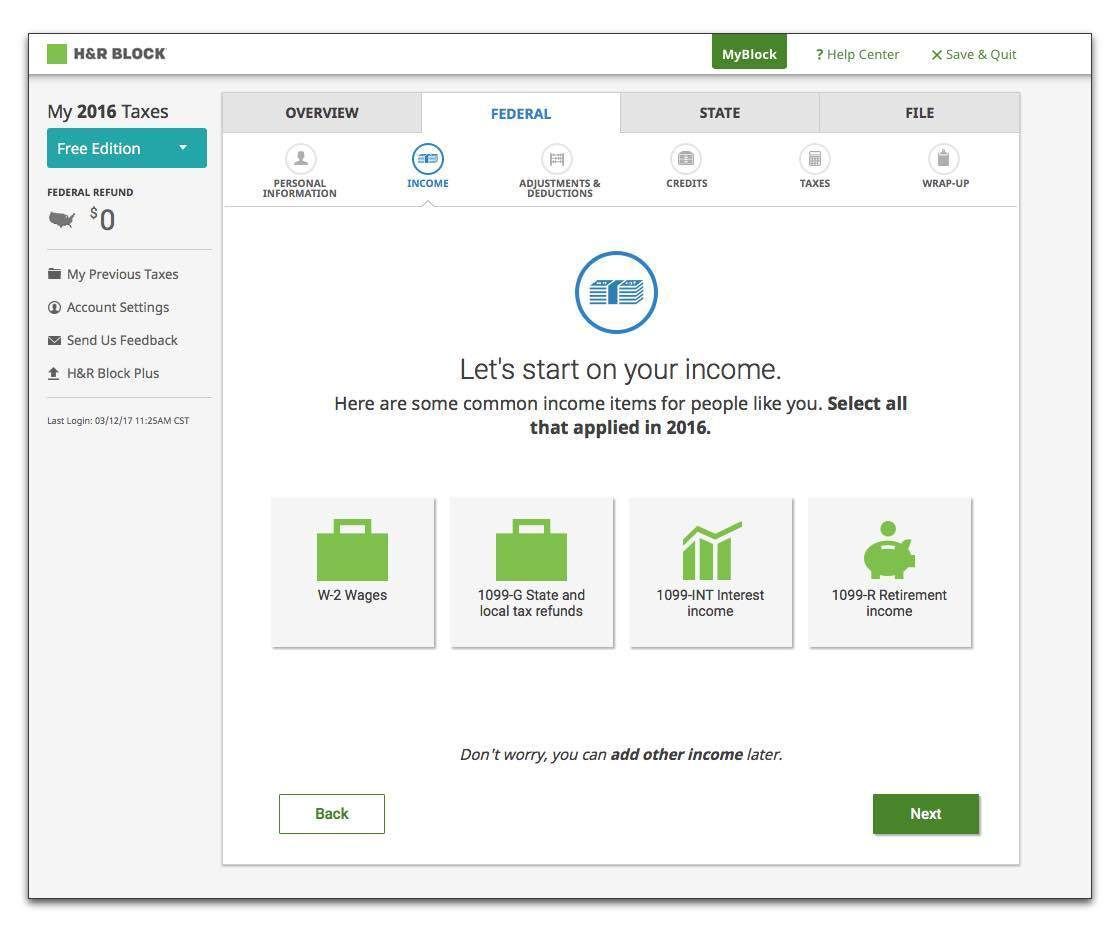

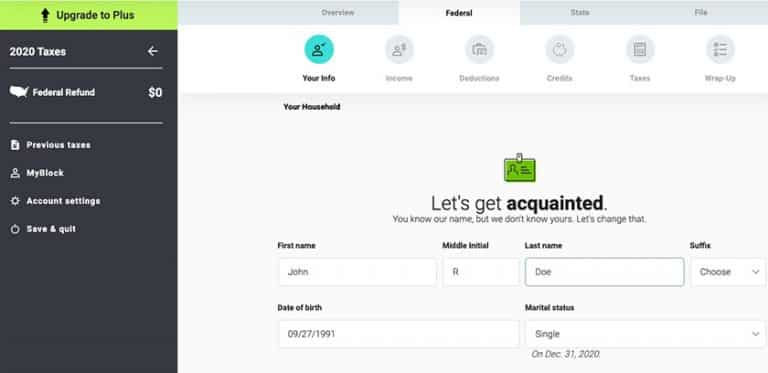

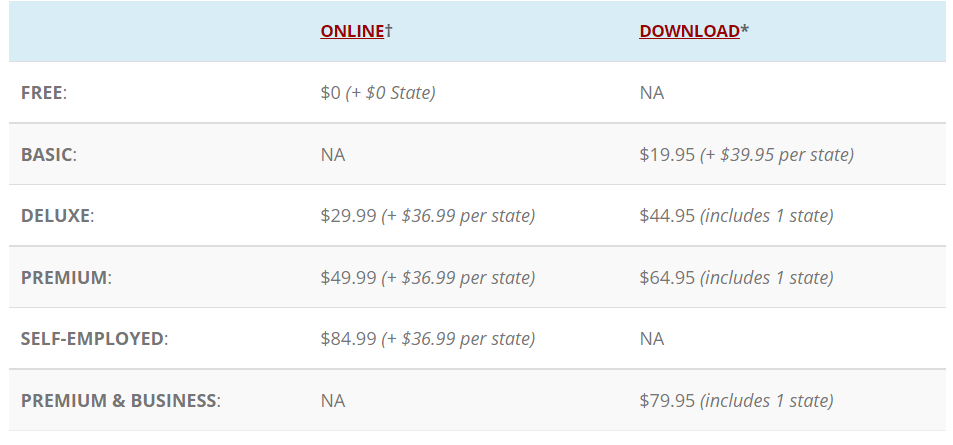

Finally, consider utilizing H&R Block's online tax preparation software if your tax situation is relatively simple. This option can be significantly cheaper than an in-person appointment.

The Value of Expert Guidance

Ultimately, the decision of whether or not to use H&R Block or any professional tax service hinges on your individual circumstances and comfort level.

While the cost of an appointment is a definite consideration, it's also important to weigh the potential benefits. Expert guidance can help you identify deductions and credits you might otherwise miss, potentially saving you money in the long run.

Furthermore, a professional tax preparer can provide peace of mind, ensuring accuracy and minimizing the risk of errors that could lead to audits or penalties. When tax season rolls around, the peace of mind and potential savings might just outweigh the initial cost.