How Much Is On A Capital One Platinum Card

Imagine you're standing at the checkout, ready to grab that perfect gift, or perhaps cover an unexpected car repair. You reach for your Capital One Platinum card, a sense of calm washing over you. But then that nagging question pops into your head: just how much credit do I actually have available on this card?

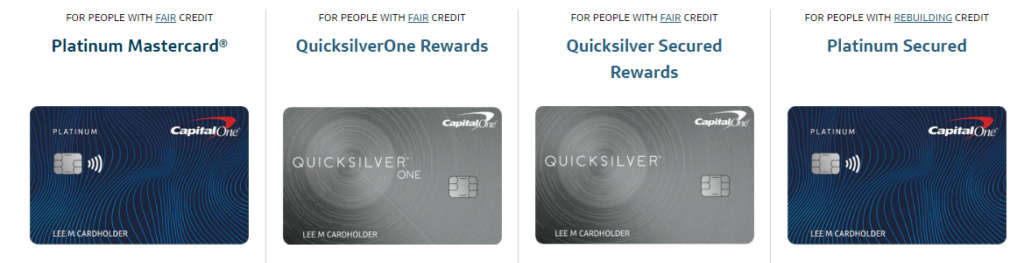

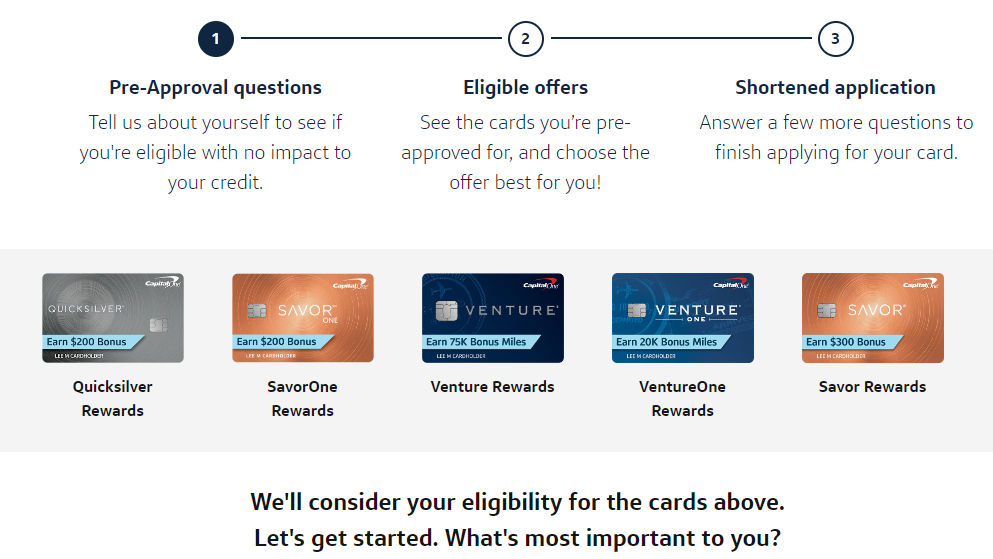

The credit limit on a Capital One Platinum card isn't a one-size-fits-all number; it varies depending on individual creditworthiness and financial circumstances. This article explores the factors influencing your Capital One Platinum card's credit limit and offers insights into maximizing your available credit.

Understanding Credit Limits

The credit limit on your Capital One Platinum card represents the maximum amount you can borrow at any given time. Capital One determines this limit based on a holistic evaluation of your credit profile, including your credit score, income, and overall financial history.

New cardholders often start with lower credit limits, which can increase over time with responsible card use. Demonstrating consistent on-time payments and keeping your credit utilization low are key to showing Capital One you're a reliable borrower.

Factors Influencing Your Credit Limit

Several factors play a crucial role in determining the credit limit you receive on your Capital One Platinum card.

Credit Score

Your credit score is a primary factor. A higher score typically leads to a higher credit limit, reflecting a history of responsible borrowing.

Income and Employment

Capital One assesses your income and employment status to determine your ability to repay the borrowed amount. A stable income source increases your chances of securing a higher credit limit.

Credit History

A longer and positive credit history demonstrates your experience with credit management. This includes the age of your accounts, payment history, and any past credit issues.

Debt-to-Income Ratio (DTI)

Your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income, is also considered. A lower DTI indicates less financial risk.

Average Credit Limits and Ranges

While individual credit limits vary, the Capital One Platinum card generally offers limits ranging from $300 to $3,000, according to numerous credit card review websites and user reports.

However, some cardholders with excellent credit profiles may receive limits exceeding this range. It's important to note that these are just averages, and your specific limit may differ.

Increasing Your Credit Limit

If you're looking to increase your credit limit on your Capital One Platinum card, several strategies can help.

Responsible Card Use

Consistently making on-time payments and keeping your credit utilization low (ideally below 30%) are paramount.

Requesting an Increase

After several months of responsible card use, you can request a credit limit increase online or by contacting Capital One's customer service. Be prepared to provide updated income information and financial details.

Improving Your Credit Score

Addressing any negative marks on your credit report, such as late payments or high credit balances, can improve your credit score and potentially increase your chances of getting a higher limit.

Importance of Responsible Credit Use

Regardless of your credit limit, responsible credit card use is crucial. Overspending and accumulating debt can negatively impact your credit score and financial well-being.

Using your Capital One Platinum card wisely can help you build a positive credit history and achieve your financial goals.

Remember to always pay your balance on time and within your means.

Ultimately, understanding the factors influencing your credit limit empowers you to manage your Capital One Platinum card effectively. This will ensure it remains a valuable tool in your financial toolkit.

![How Much Is On A Capital One Platinum Card Capital One Platinum Mastercard - Full Review [2025]](https://upgradedpoints.com/wp-content/uploads/2023/05/Capital-One-Platinum-vs-Capital-One-Quicksilver-Upgraded-Points-1.jpg)