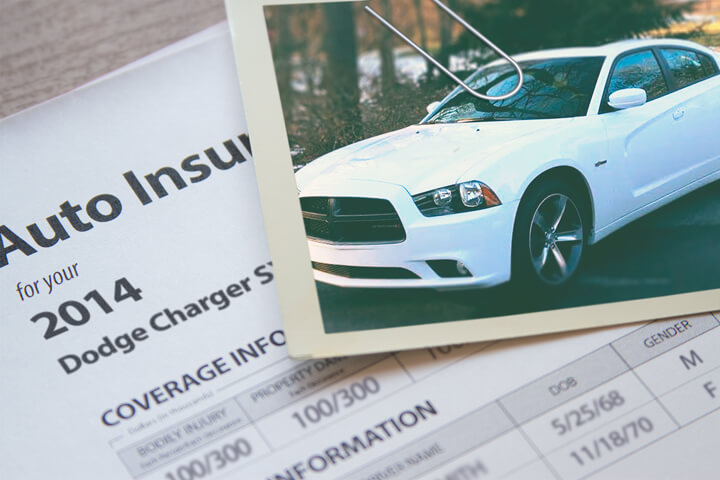

How Much Is The Insurance On A Dodge Charger

The Dodge Charger, a vehicle celebrated for its powerful performance and aggressive styling, often comes with a hefty price tag beyond its initial purchase. One of the most significant ongoing expenses for Charger owners is car insurance, which can be substantially higher than average. Understanding the factors influencing these premiums is crucial for potential and current owners alike.

This article delves into the complexities of Dodge Charger insurance rates, exploring the key variables that contribute to the cost. We'll examine data from reputable insurance organizations and industry experts to provide a comprehensive overview of what owners can expect to pay. By understanding these elements, consumers can make informed decisions about insuring their vehicles and potentially mitigating expenses.

Why is Dodge Charger Insurance so Expensive?

The primary reason for higher insurance costs associated with the Dodge Charger stems from its classification as a high-performance vehicle. Insurance companies assess risk based on various factors, and the Charger's potent engine and sporty design often translate to higher accident rates and more severe claims.

The Insurance Institute for Highway Safety (IIHS) data often reflects this increased risk, showcasing accident statistics that contribute to the premium calculations. Specifically, the Charger's horsepower and potential for high-speed driving are seen as elevated risks.

Factors Influencing Insurance Premiums

Several elements determine the specific insurance rate for a Dodge Charger. These factors range from the driver's profile to the vehicle's specifications and location.

Driver age, driving history, and credit score all play significant roles. Younger drivers and those with previous accidents or traffic violations will generally face higher premiums. Location is a critical factor, with urban areas typically resulting in higher costs due to increased traffic density and theft rates.

The specific trim level and model year of the Charger also influence insurance rates. High-performance trims like the Hellcat, known for its exceptional power, will generally have the highest premiums. Newer models may also be more expensive to insure due to potentially higher repair costs.

Average Insurance Costs: What to Expect

According to data from organizations such as NerdWallet and The Zebra, the average annual insurance cost for a Dodge Charger can range from $2,000 to over $3,000. This figure can fluctuate significantly based on the factors mentioned earlier.

For instance, a young male driver in a major metropolitan area could easily face premiums exceeding $3,500 annually. Conversely, an experienced driver with a clean record in a rural area might pay closer to the lower end of the spectrum.

Comparing Quotes and Finding the Best Rates

The key to securing affordable insurance for a Dodge Charger lies in comparing quotes from multiple providers. Different insurance companies weigh risk factors differently, leading to varying premiums for the same coverage.

Utilizing online comparison tools and contacting local insurance agents can help identify the most competitive rates. Also, consider adjusting coverage levels and deductibles to find a balance between affordability and adequate protection.

Increasing your deductible, for example, can lower your monthly premium but requires you to pay more out-of-pocket in the event of an accident. Bundling your auto insurance with other policies, such as homeowners or renters insurance, may also qualify you for discounts.

Future Trends in Dodge Charger Insurance

The insurance landscape is continuously evolving, influenced by technological advancements and changing driving patterns. As vehicles become more sophisticated with advanced safety features, insurance companies are increasingly factoring these elements into their risk assessments.

The integration of technologies like automatic emergency braking and lane departure warning systems in newer Charger models may eventually lead to lower insurance premiums. However, the Charger's reputation for high performance will likely continue to be a primary driver of its insurance costs.

Ultimately, owning a Dodge Charger involves considering the long-term costs, with insurance being a substantial component. By understanding the factors that affect insurance rates and actively seeking competitive quotes, drivers can minimize expenses and enjoy their vehicles responsibly.