How Much Money Do Insurance Companies Make A Year

Insurance giants are raking in billions, but how much exactly? The industry's profitability is under scrutiny as premiums rise while payouts sometimes lag.

This report dives into the annual earnings of major insurance companies, revealing the staggering sums they accumulate and raising questions about fairness and regulation.

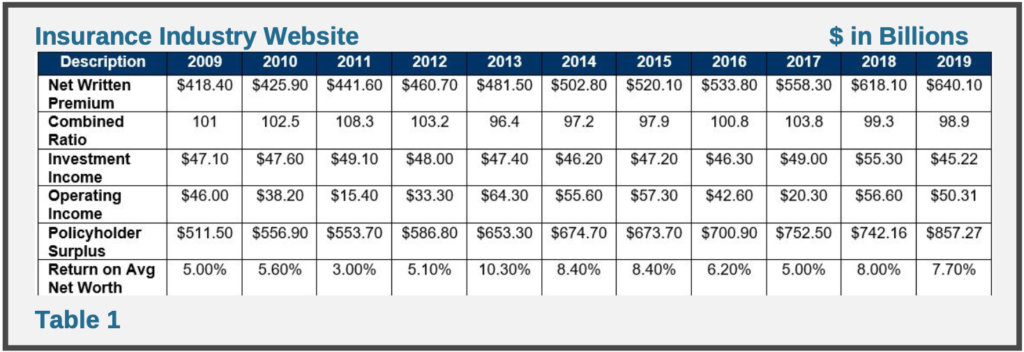

The Big Picture: Industry-Wide Profits

The global insurance industry is a behemoth. According to a 2023 report by Allianz, global insurance premiums reached nearly $7 trillion.

Profit margins vary significantly by sector and region. Property and casualty (P&C) insurers face volatile profits due to natural disasters, while life insurers often enjoy more stable long-term gains.

Key Players and Their Earnings

UnitedHealth Group, a dominant force in health insurance, reported a net income of over $17 billion in 2022, as stated in their annual report.

Berkshire Hathaway, which owns GEICO and other insurance companies, saw its insurance businesses contribute substantially to its overall profits, reaching billions annually, per their filings.

Progressive, a major auto insurer, often boasts impressive combined ratios, signaling high profitability. The combined ratio represents the sum of incurred losses and expenses divided by earned premiums. A ratio below 100% indicates profit.

Factors Driving Profitability

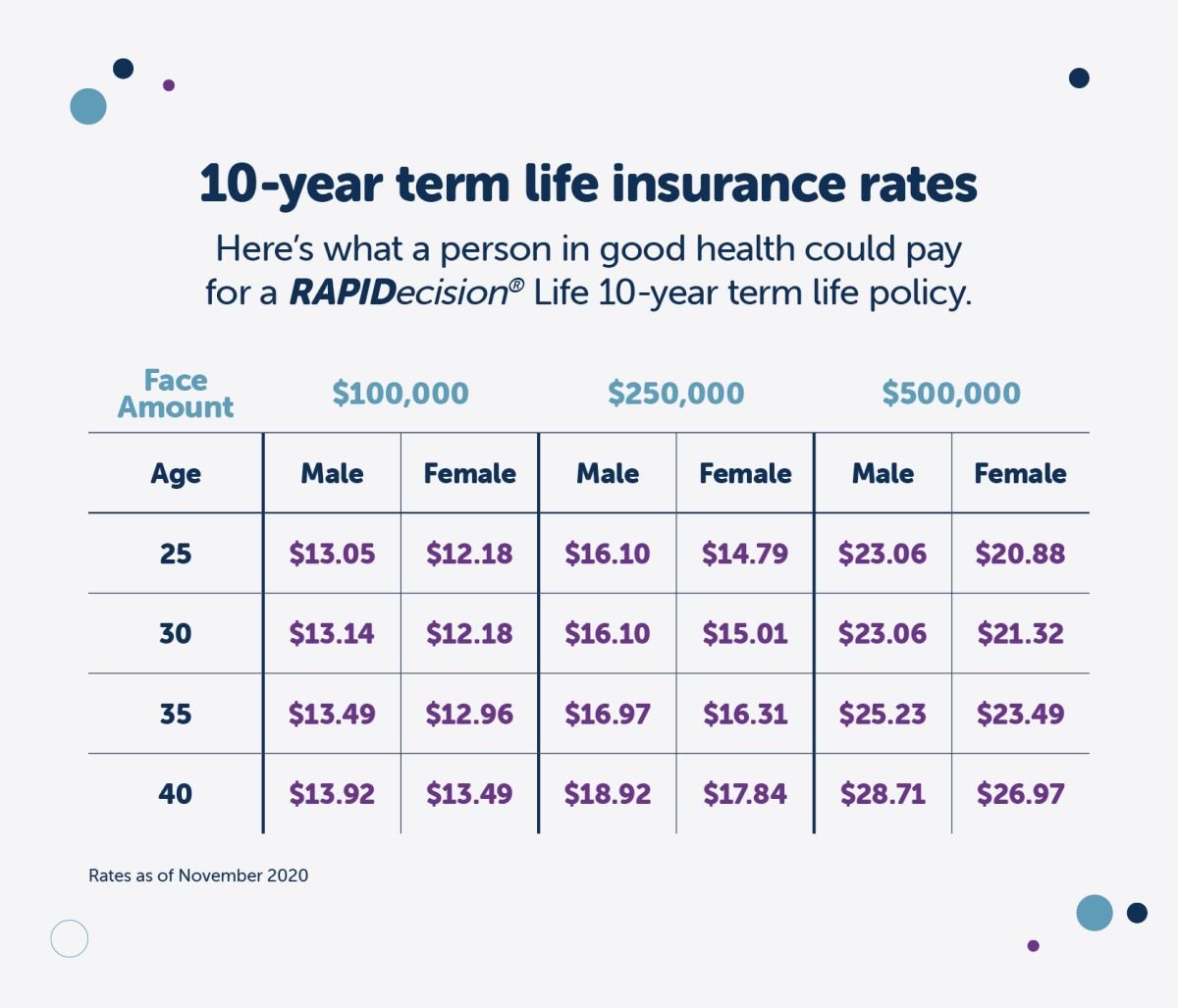

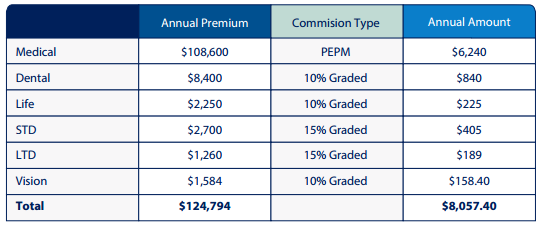

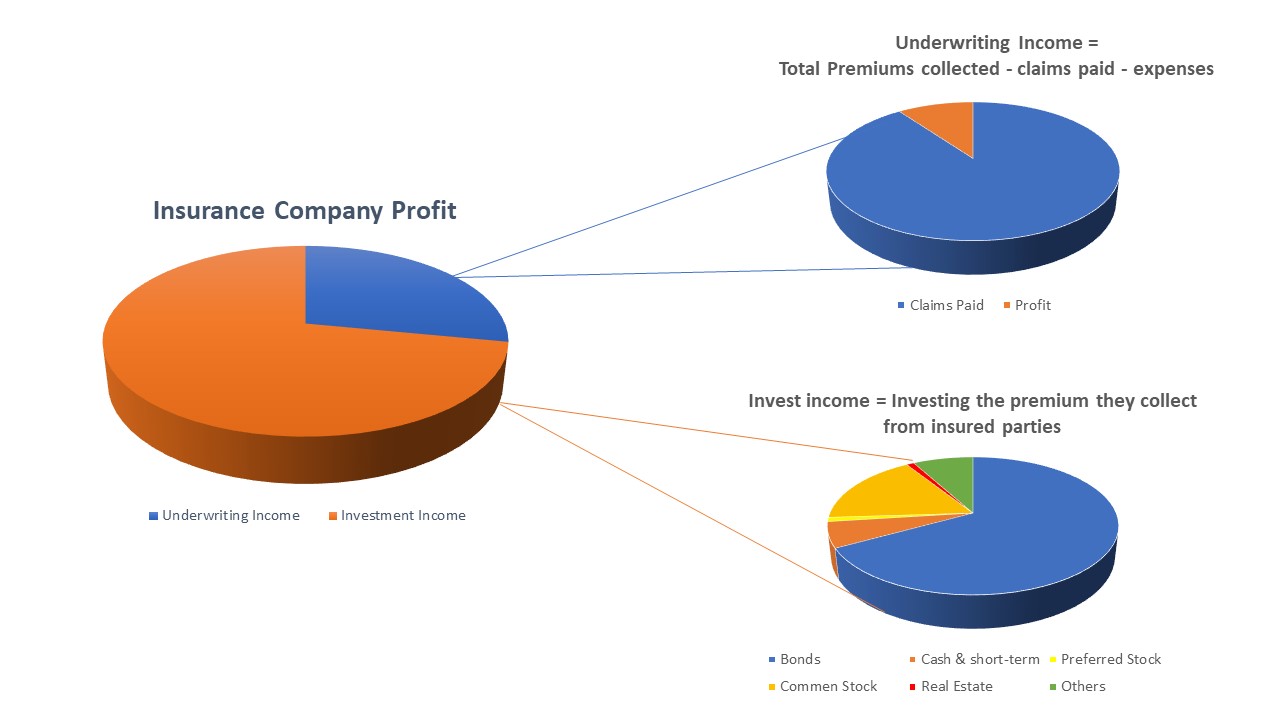

Underwriting practices are crucial. Insurers meticulously assess risk to set premiums that outweigh potential payouts.

Investment income plays a significant role. Insurance companies invest premiums to generate additional revenue, significantly boosting their bottom lines.

Effective cost management is essential. Streamlining operations and controlling expenses directly impact profitability.

Regulation and Scrutiny

State insurance regulators play a crucial role. They oversee insurance companies to ensure solvency and fair practices.

Consumer advocacy groups are increasingly vocal. They push for greater transparency and affordability in insurance markets.

The National Association of Insurance Commissioners (NAIC) provides guidance. It serves as a forum for state regulators to coordinate efforts.

Concerns and Controversies

Premium hikes often outpace inflation. Consumers feel squeezed as insurance costs rise.

Claim denials spark outrage. Policyholders frequently report difficulties receiving payouts.

Executive compensation raises eyebrows. Top insurance executives often receive multi-million dollar pay packages, fueling criticism.

What's Next?

Ongoing debates surround healthcare reform. Changes to the Affordable Care Act (ACA) could significantly impact health insurer profits.

Technology is transforming the industry. Insurtech startups are disrupting traditional models, potentially affecting profitability and market share.

Increased transparency is on the horizon. Regulators are pushing for more detailed financial disclosures from insurance companies, which will enable more accurate analysis of profitability in the future.

:max_bytes(150000):strip_icc()/what-main-business-model-insurance-companies.asp-FINAL-092abcf238d348c4975e1021489191e6.png)