Bethpage Federal Credit Union Home Equity Loan

In an era defined by fluctuating interest rates and evolving homeowner needs, access to flexible and affordable financing options remains crucial. Bethpage Federal Credit Union, a prominent player in the financial services sector, offers a home equity loan designed to empower homeowners to leverage their property's value. But how does it stack up against a dynamic market, and what should borrowers consider before tapping into their home equity?

This article delves into the intricacies of Bethpage Federal Credit Union’s home equity loan, examining its key features, potential benefits, and associated risks. It provides a comprehensive overview for homeowners contemplating this financial tool, drawing on available data and insights to offer a balanced perspective. We explore interest rates, loan terms, eligibility requirements, and alternative financing solutions, equipping readers with the information needed to make informed decisions.

Understanding Bethpage's Home Equity Loan

Bethpage Federal Credit Union's home equity loan allows eligible homeowners to borrow against the equity they have built in their homes. This equity, representing the difference between the home's current market value and the outstanding mortgage balance, serves as collateral for the loan.

The loan proceeds can be used for various purposes, including home improvements, debt consolidation, education expenses, or unexpected medical bills. It offers a lump sum disbursement, providing immediate access to the borrowed funds.

Key Features and Benefits

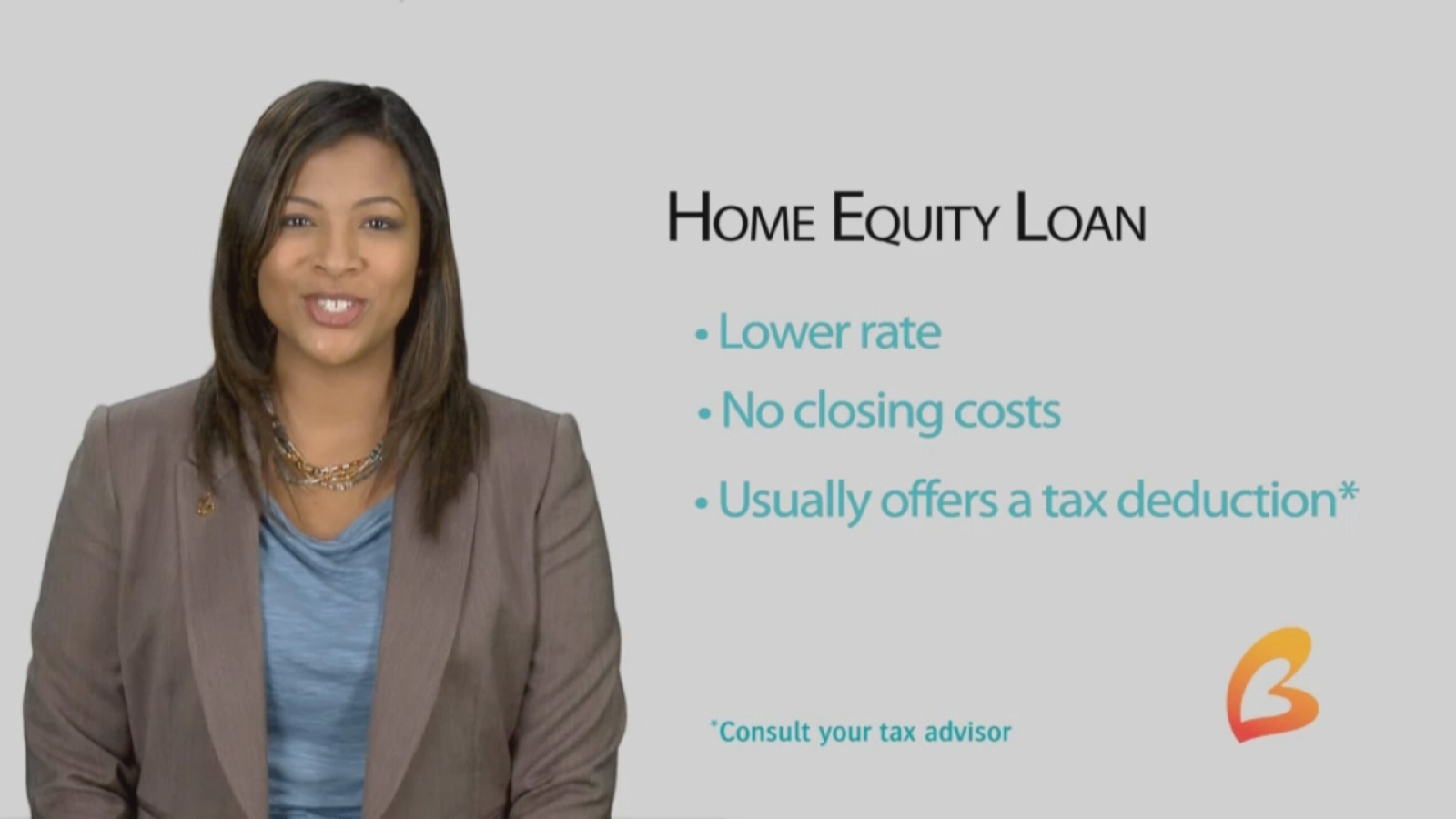

One of the appealing aspects of Bethpage's home equity loan is its competitive interest rates. These rates, typically lower than those associated with credit cards or personal loans, can translate into significant savings over the loan's term.

Furthermore, the interest paid on a home equity loan may be tax-deductible, offering an additional financial advantage (consult a tax advisor for specific guidance). The fixed interest rate provides payment predictability, making budgeting easier for borrowers.

Bethpage offers various loan terms, allowing borrowers to choose a repayment schedule that aligns with their financial capabilities. The application process is designed to be streamlined, with dedicated loan officers available to guide applicants through each step.

Navigating the Fine Print: Rates, Fees, and Eligibility

While the prospect of accessing low-interest funds is enticing, it's essential to thoroughly understand the terms and conditions attached to Bethpage's home equity loan. Interest rates can vary based on credit score, loan-to-value ratio (LTV), and prevailing market conditions.

LTV, calculated by dividing the loan amount by the home's appraised value, plays a significant role in determining eligibility and interest rates. A lower LTV generally translates to a more favorable interest rate.

Beyond the interest rate, borrowers should be aware of potential fees, such as application fees, appraisal fees, and closing costs. These fees can add to the overall cost of the loan, so it’s important to factor them into the decision-making process.

Eligibility Requirements

To qualify for a Bethpage home equity loan, applicants must meet specific criteria, including a satisfactory credit score. A strong credit history demonstrates responsible financial management and increases the likelihood of approval.

Applicants must also provide documentation verifying their income and employment status. This information helps Bethpage assess their ability to repay the loan.

Finally, the home must meet certain appraisal requirements to ensure it provides sufficient collateral for the loan. The home's value is determined by a professional appraisal conducted by a third-party appraiser.

Weighing the Risks and Rewards

Taking out a home equity loan is a significant financial decision that should not be taken lightly. The primary risk is the possibility of foreclosure if the borrower fails to make timely payments.

Since the loan is secured by the home, defaulting on the loan can result in the lender seizing the property. It's crucial to assess your financial stability and ensure you can comfortably manage the monthly payments before borrowing.

On the other hand, a home equity loan can be a powerful tool for achieving financial goals. It can provide access to funds for home improvements that increase the home's value or consolidate high-interest debt into a more manageable payment schedule.

"A home equity loan can be a great option for certain borrowers, but it's crucial to understand the risks and benefits before making a decision," advises Jane Doe, a certified financial planner.

Alternatives to Home Equity Loans

Before committing to a home equity loan, it's prudent to explore alternative financing options. A Home Equity Line of Credit (HELOC) offers more flexibility, allowing borrowers to draw funds as needed during a specified period.

However, HELOCs typically have variable interest rates, which can fluctuate with market conditions. Personal loans, while unsecured, may be suitable for smaller borrowing needs and may not require using your home as collateral.

Cash-out refinancing involves replacing your existing mortgage with a new one for a larger amount, allowing you to access the difference in cash. Each option has its own advantages and disadvantages, so it's crucial to compare them carefully.

Expert Perspectives and Customer Reviews

Industry experts offer varying perspectives on the suitability of home equity loans. Some emphasize the potential risks, particularly for borrowers with shaky finances or uncertain income streams.

Others highlight the benefits of low interest rates and tax deductibility, making it an attractive option for qualified borrowers seeking to finance specific projects. Customer reviews provide valuable insights into the experiences of those who have used Bethpage's home equity loan.

These reviews often highlight the ease of the application process and the helpfulness of Bethpage's loan officers. However, some reviews also mention concerns about fees or the complexity of the loan terms.

The Future of Home Equity Lending

The home equity lending market is constantly evolving, influenced by factors such as interest rate trends, economic conditions, and regulatory changes. As interest rates rise, the demand for home equity loans may decrease as the cost of borrowing increases.

Technological advancements are also playing a role, with online lenders offering streamlined application processes and faster approvals. Bethpage, like other financial institutions, will need to adapt to these changes to remain competitive.

Ultimately, the decision to take out a home equity loan should be based on a careful assessment of your individual financial circumstances, risk tolerance, and long-term goals. Consulting with a financial advisor can provide personalized guidance and help you make an informed decision that aligns with your needs.

:fill(white):max_bytes(150000):strip_icc()/bethpage_federal_credit_union_3x1_FINAL-5c588432c9e77c000102d05d.png)