Winc Inc Prospectus Initial Public Offering

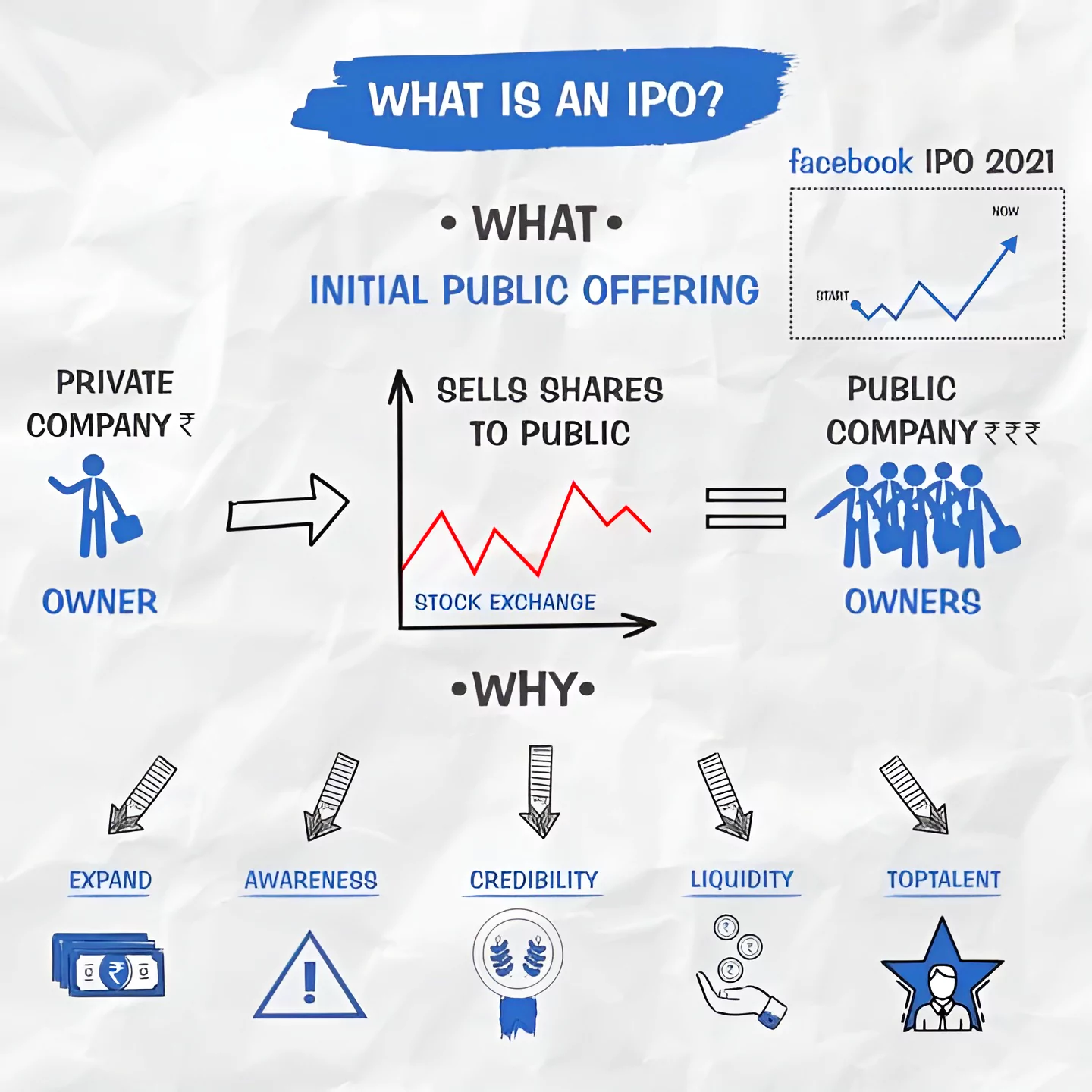

Winc Inc., a direct-to-consumer wine company known for its personalized wine subscriptions, has officially filed a prospectus with the Securities and Exchange Commission (SEC) for an initial public offering (IPO). The move signals Winc's ambition to expand its market reach and further solidify its position in the competitive online wine industry.

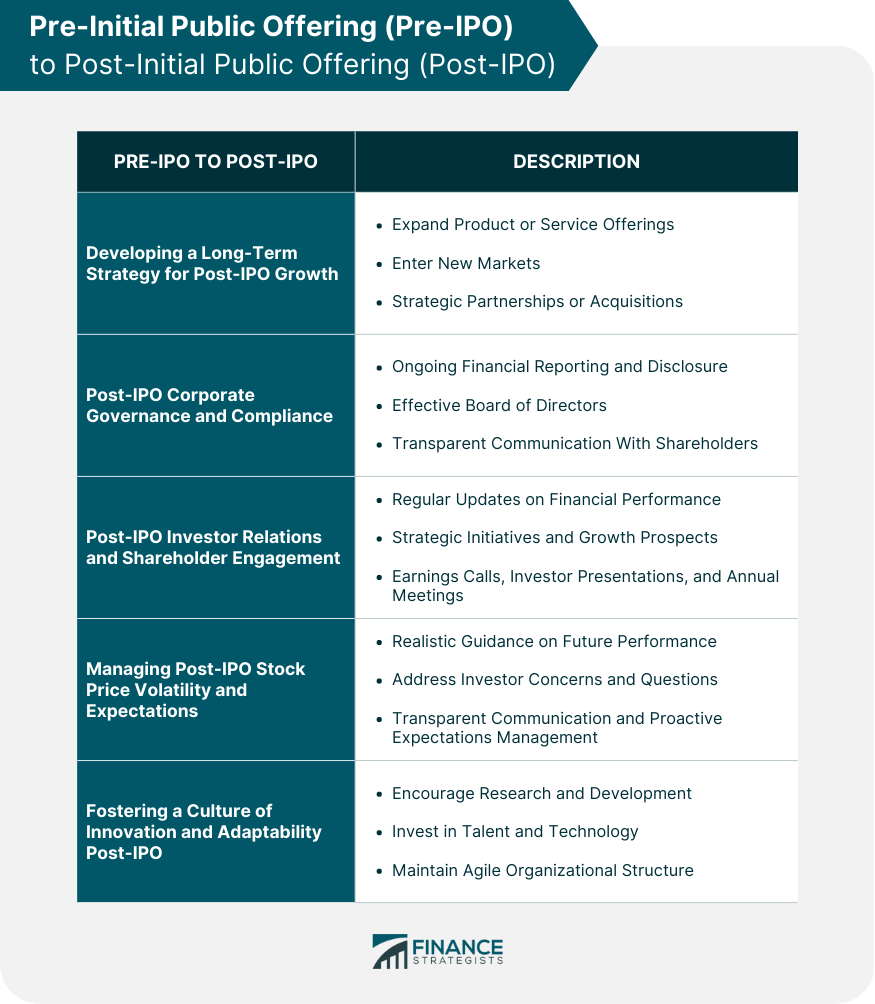

The IPO represents a significant milestone for Winc, potentially providing a substantial capital infusion to fuel growth initiatives. This funding could be used for expanding production capabilities, enhancing marketing efforts, and developing new technological platforms to improve the customer experience.

Key Details of the IPO

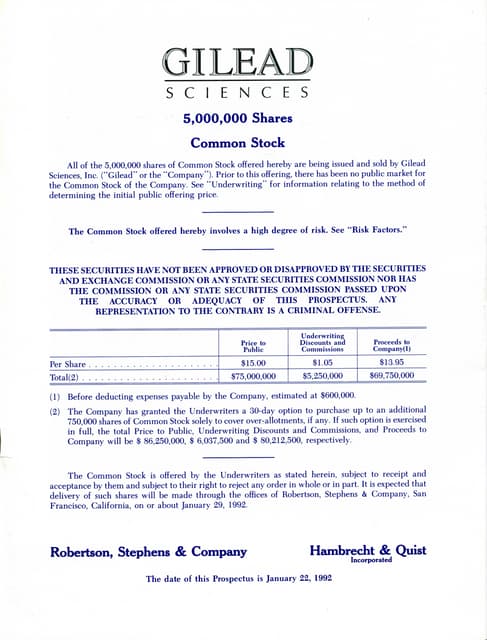

Winc's prospectus outlines the company's plans to list its common stock on a major exchange, although the specific exchange and ticker symbol are yet to be announced. The number of shares to be offered and the price range for the IPO have also not been disclosed in the initial filing.

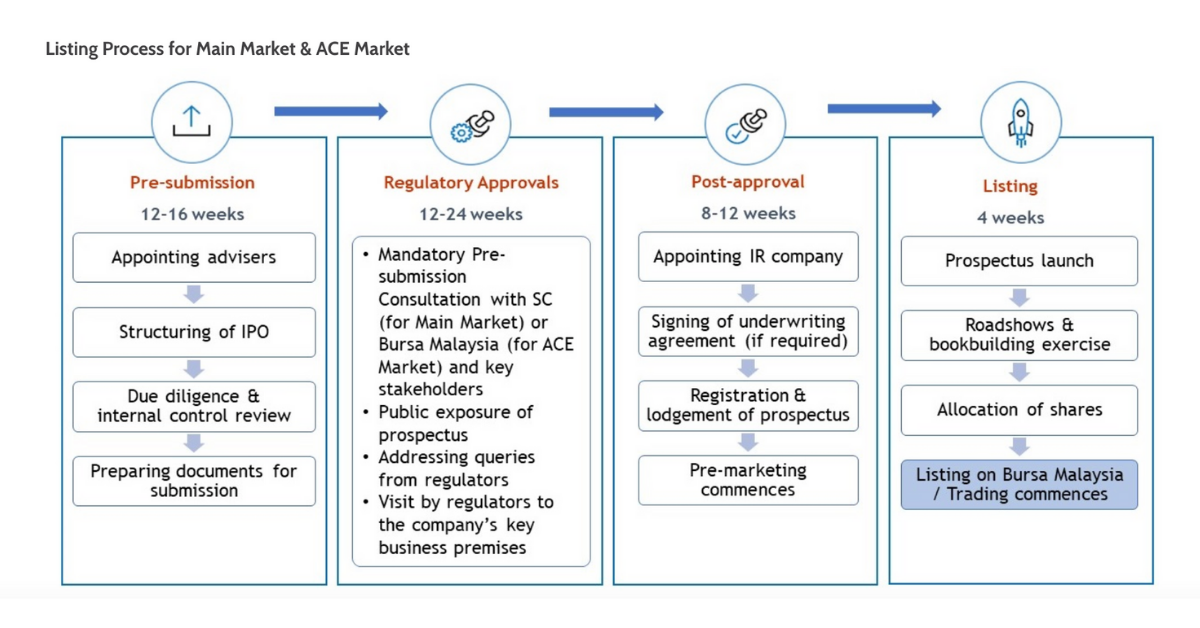

The offering's underwriters, the financial institutions managing the IPO process, will be revealed in subsequent amendments to the prospectus. These underwriters will play a crucial role in marketing the offering to potential investors and determining the final pricing.

Winc's Business Model

Founded in 2012, Winc distinguishes itself through its data-driven approach to wine selection. The company uses customer feedback and purchase history to curate personalized wine recommendations, aiming to offer a convenient and accessible wine experience.

Winc operates a vertically integrated business model, encompassing wine production, distribution, and direct-to-consumer sales. This allows them to control the quality of their products and build direct relationships with their customers, fostering brand loyalty.

The company’s subscription model is a core element of its strategy, providing recurring revenue and valuable consumer data. Customers receive monthly shipments of wines based on their preferences, creating a personalized and engaging experience.

Market Context and Potential Impact

The online wine market has experienced significant growth in recent years, accelerated by the increasing consumer adoption of e-commerce and a greater willingness to purchase wine online. Winc's IPO comes at a time when investor interest in direct-to-consumer brands remains strong.

The success of Winc's IPO could pave the way for other digitally native wine companies to explore public offerings. This could lead to further innovation and competition in the wine industry, ultimately benefiting consumers through wider product selection and improved service.

However, Winc faces challenges in a competitive landscape, including established wine brands, traditional retailers, and other online wine platforms. Successfully navigating these challenges will be crucial for Winc to achieve long-term growth and profitability as a public company.

"Our vision is to make great wine more accessible to everyone," states a portion of Winc's official statement, "and this IPO is a significant step in realizing that vision."

Potential Impact on Consumers and the Wine Industry

For consumers, Winc's IPO could lead to expanded product offerings, improved customer service, and enhanced technological platforms. The company's commitment to data-driven wine selection could translate into even more personalized and satisfying wine experiences for its subscribers.

The IPO could also spur innovation in the wine industry, as other companies seek to emulate Winc's success. This could lead to the development of new wine varieties, more sustainable production practices, and more creative marketing strategies.

However, potential investors should carefully evaluate Winc's prospectus and consider the risks associated with investing in a newly public company. Factors such as market volatility, competition, and regulatory changes could impact Winc's future performance.

Financial Performance and Future Outlook

Details regarding Winc's financial performance, including revenue, profitability, and growth rates, will be disclosed in the prospectus. These figures will provide investors with valuable insights into the company's current financial health and future growth potential.

The prospectus will also outline Winc's future growth strategies and its plans for utilizing the proceeds from the IPO. This will enable investors to assess the company's long-term vision and its ability to execute its business plan.

Analysts will be closely monitoring Winc's performance post-IPO to assess its ability to maintain its competitive edge and generate sustainable growth in the evolving online wine market.

Conclusion

Winc's IPO marks a pivotal moment for the company and the broader online wine industry. The offering represents a significant opportunity for Winc to accelerate its growth and solidify its position as a leading direct-to-consumer wine provider.

However, investors should carefully evaluate the risks and opportunities associated with the IPO before making any investment decisions. Winc's success as a public company will depend on its ability to execute its business plan, navigate a competitive landscape, and adapt to evolving consumer preferences.

The coming weeks and months will be crucial as Winc moves closer to its IPO and provides further details about its offering. The market will be watching closely to see how Winc performs in its next chapter as a publicly traded company.

+-+First+offering+of+stock+to+the+general+public..jpg)