How To Know When A Business Is Failing

For entrepreneurs and business owners, recognizing the signs of a failing business is crucial for implementing timely interventions or making difficult but necessary decisions. Ignoring these indicators can lead to greater financial losses and ultimately, business closure.

This article explores key warning signs that a business is heading towards failure, drawing on expert insights and financial data to provide a comprehensive guide. Understanding these signals empowers stakeholders to take proactive steps, potentially turning the tide or mitigating the impact of a downturn.

Declining Revenue and Profitability

One of the most obvious signs of a failing business is a consistent decline in revenue. A drop in sales figures, especially when compared to previous years or industry benchmarks, should immediately raise concerns.

Profitability is equally important. Even if revenue remains steady, shrinking profit margins indicate underlying problems, such as rising costs or decreased pricing power.

According to data from the Small Business Administration (SBA), sustained losses over several quarters are a strong predictor of business failure. The SBA emphasizes the importance of regularly reviewing financial statements to identify negative trends early on.

Cash Flow Problems

Cash flow, the lifeblood of any business, reflects the movement of money in and out of the company. Persistent cash flow problems signal an inability to meet short-term obligations.

Delays in paying suppliers, difficulty meeting payroll, and reliance on short-term loans to cover expenses are all red flags. A healthy business should have enough cash on hand to cover its immediate needs and invest in future growth.

A 2023 report by Dun & Bradstreet indicated that 82% of business failures are attributable to poor cash management.

Increasing Debt and Liabilities

Mounting debt can quickly overwhelm a struggling business. An increasing debt-to-equity ratio signals that the company is relying too heavily on borrowed funds, potentially jeopardizing its long-term solvency.

Unpaid taxes, overdue invoices, and growing accounts payable all contribute to financial strain. These liabilities can quickly escalate, leading to legal action and further financial distress.

Excessive borrowing, particularly at high interest rates, can trap a business in a vicious cycle of debt, making recovery extremely difficult.

Loss of Market Share and Customer Churn

A decline in market share suggests that competitors are gaining an edge. Losing customers to rivals indicates dissatisfaction with the product or service offered.

High customer churn rates, particularly in subscription-based businesses, can be devastating. It costs significantly more to acquire new customers than to retain existing ones.

Businesses must actively monitor customer feedback, identify areas for improvement, and adapt to changing market conditions to maintain competitiveness.

Internal Issues and Management Problems

Internal issues, such as high employee turnover, low morale, and poor communication, can negatively impact productivity and performance. These problems often stem from ineffective management or a toxic work environment.

Lack of innovation and failure to adapt to technological advancements can also contribute to decline. Businesses must embrace change and invest in research and development to stay ahead of the curve.

Leadership plays a crucial role in guiding a business through challenging times. Ineffective decision-making, poor planning, and a lack of transparency can erode confidence and exacerbate existing problems.

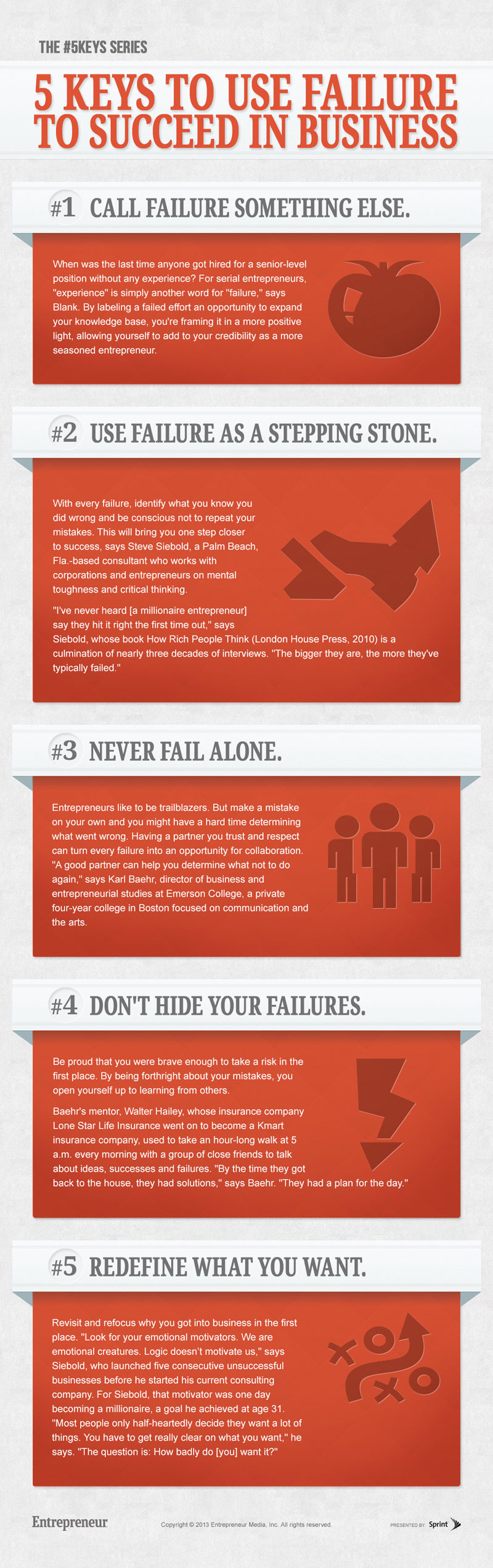

Ignoring the Warning Signs

Perhaps the most critical mistake a business owner can make is ignoring the warning signs. Denial and procrastination can delay necessary interventions and ultimately lead to a more severe outcome.

Seeking Professional Help

It's essential to seek professional advice from accountants, financial advisors, or business consultants at the first sign of trouble. These experts can provide an objective assessment of the situation and recommend appropriate strategies.

Options might include cost-cutting measures, debt restructuring, new marketing initiatives, or even a complete business overhaul.

Making Difficult Decisions

Sometimes, the best course of action is to close the business before it incurs further losses. This is a difficult but responsible decision that can minimize the financial impact on owners, employees, and creditors.

Ultimately, recognizing and addressing the signs of a failing business requires vigilance, honesty, and a willingness to take decisive action. Early intervention is often the key to survival, but even when closure is inevitable, informed decision-making can help mitigate the damage.

.jpg)

![How To Know When A Business Is Failing 5 Top Reasons Why Businesses Fail [INFOGRAPHIC] - Virtuallinda Creative](https://www.virtuallinda.com/wp-content/uploads/2019/05/5-Main-Reasons-Why-Businesses-Fail-VL-sq.png)

![How To Know When A Business Is Failing 7 Signs of a Failing Company [Infographic] - Launchopedia](https://startupetsu.com/wp-content/uploads/2017/06/7_signs-e1499874059670.png)