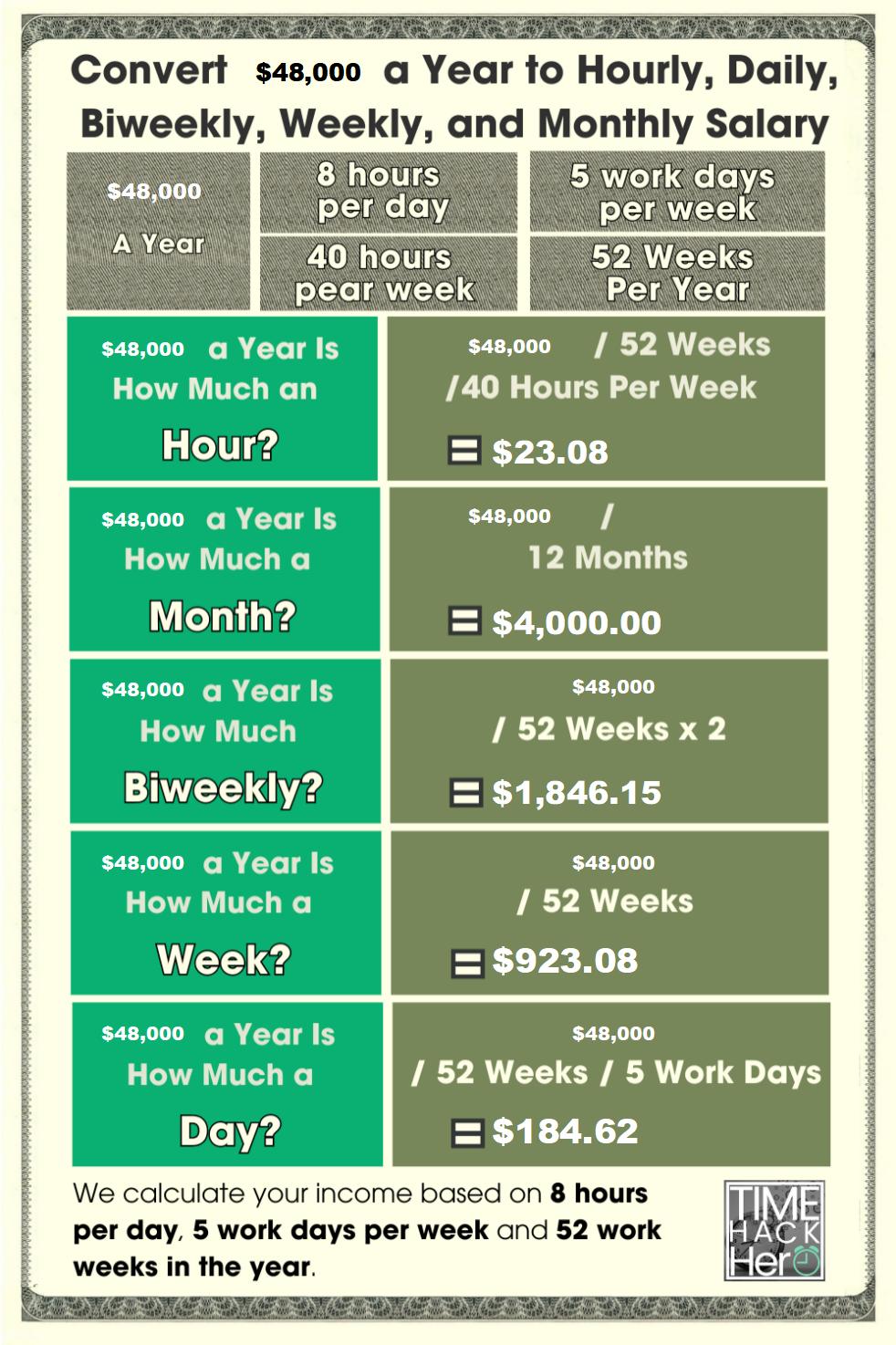

How Much Per Hour Is 48000 A Year

Are you scrambling to figure out your hourly wage based on a $48,000 annual salary? We break down the numbers, revealing exactly what you earn per hour.

Calculating your hourly rate from an annual salary is crucial for understanding your financial standing, budgeting, and evaluating job offers. This article provides a clear and concise breakdown of how to determine your hourly wage when earning $48,000 a year.

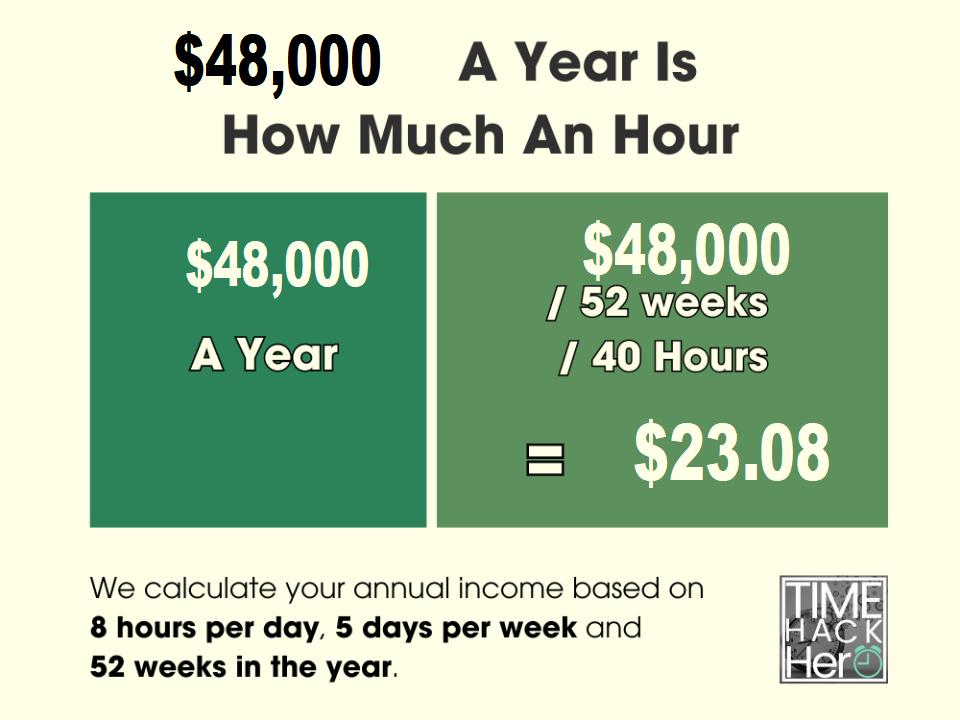

The Straightforward Calculation

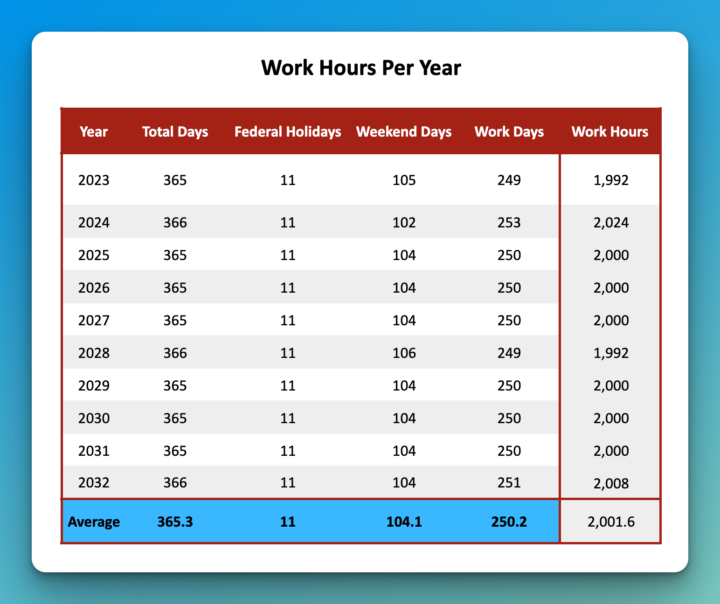

The calculation hinges on how many hours you work per year. The most common standard is a 40-hour work week.

This translates to 2,080 working hours annually (40 hours/week * 52 weeks/year).

To find your hourly wage, simply divide your annual salary by the total number of working hours: $48,000 / 2,080 hours.

The Result: Your Hourly Rate

Based on a standard 40-hour work week, a $48,000 annual salary equates to an hourly wage of $23.08.

This number provides a clear picture of your earnings per hour before taxes and other deductions.

Knowing this figure is crucial for comparing different job opportunities and negotiating salaries.

Varying Work Hours Impact

The calculation changes if your work week deviates from the standard 40 hours.

For example, a 37.5-hour work week, common in some industries and government positions, impacts the hourly rate.

With a 37.5-hour week, your annual working hours are 1,950 (37.5 hours/week * 52 weeks/year).

Adjusted Hourly Rate: 37.5-Hour Week

With a 37.5 hour work week, $48,000 divided by 1,950 hours results in an hourly wage of approximately $24.62.

Therefore, fewer working hours per week translate to a higher hourly rate to maintain the same annual salary.

Accounting for Paid Time Off (PTO)

Paid time off, including vacation and sick days, can subtly affect your true hourly rate.

If you receive several weeks of PTO, your actual working hours are reduced, slightly increasing your equivalent hourly wage.

The impact is generally minor, but it's worth considering for a precise calculation.

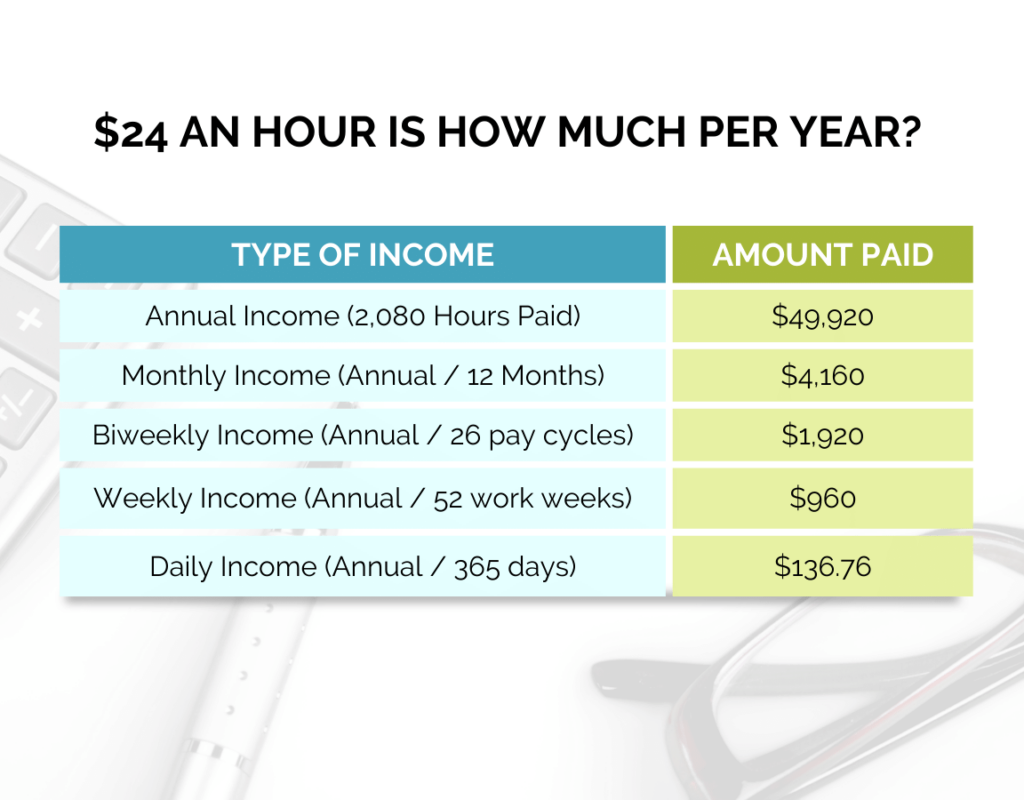

Example: Impact of Two Weeks PTO

Assuming two weeks (80 hours) of PTO, your annual working hours become 2,000 (2,080 - 80).

The hourly rate then becomes $48,000 / 2,000 = $24.00.

This calculation provides a more accurate reflection of your compensation when considering time off.

State and Local Minimum Wage

It is crucial to compare your calculated hourly wage with state and local minimum wage laws.

According to the U.S. Department of Labor, the federal minimum wage is $7.25 per hour, but many states and cities have higher minimums.

If your calculated hourly rate falls below the applicable minimum wage, your employer is legally obligated to pay you the higher amount.

Staying Informed

It is your responsibility to verify the minimum wage in your area to ensure you are being paid legally.

Resources like the National Conference of State Legislatures provide comprehensive information on state minimum wage laws.

Beyond the Numbers: Benefits and Deductions

While calculating your hourly rate provides valuable insight, remember it is just one part of the total compensation package.

Benefits like health insurance, retirement plans, and paid time off significantly contribute to your overall compensation.

Consider these factors when evaluating job offers and negotiating salaries.

Deductions: Taxes and More

The calculated hourly rate is before taxes and other deductions.

Federal income tax, state income tax (if applicable), Social Security, and Medicare will all be deducted from your paycheck.

Understanding these deductions is crucial for budgeting and managing your finances.

Final Thoughts and Next Steps

Calculating your hourly wage from a $48,000 annual salary is straightforward, but requires accurate accounting of your working hours.

Using a standard 40-hour work week, the hourly rate is $23.08, but this can vary depending on your specific work schedule and benefits.

Double-check your local minimum wage laws and factor in the value of benefits to get a complete picture of your compensation. Stay informed and advocate for fair wages!