How Much To Open Your Own Business

Imagine standing on the precipice of a dream, the blueprints of your very own business spread before you. The scent of freshly brewed coffee (perhaps from your future café?) fills the air, mingling with the excitement of what's to come. But amidst the swirling possibilities, a practical question looms: How much will this dream cost?

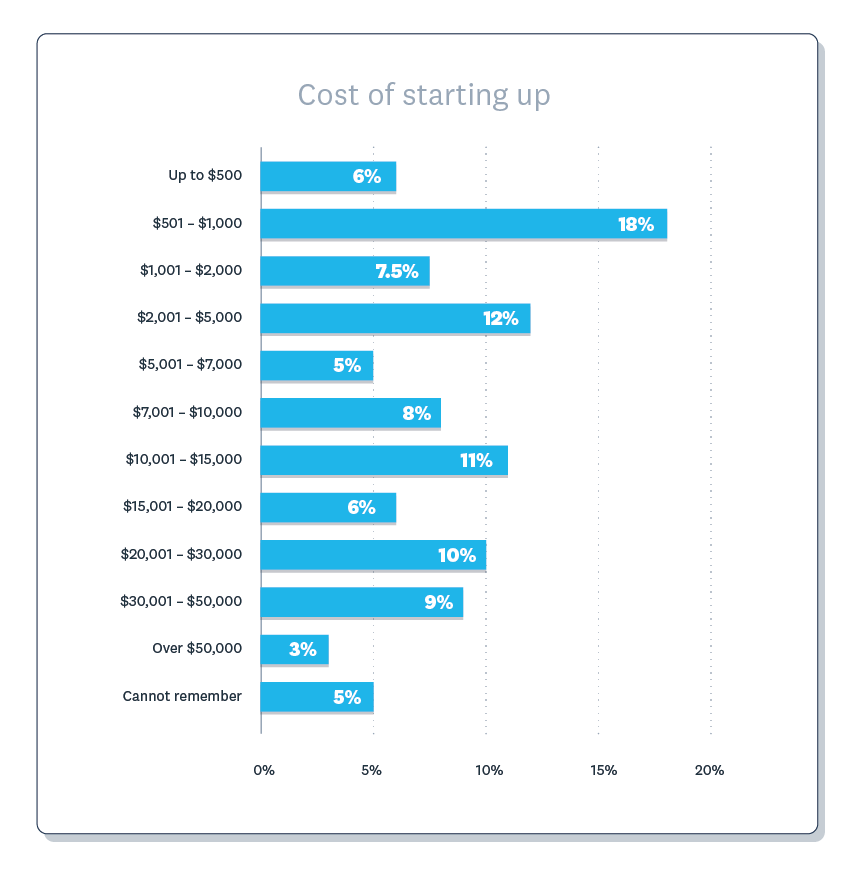

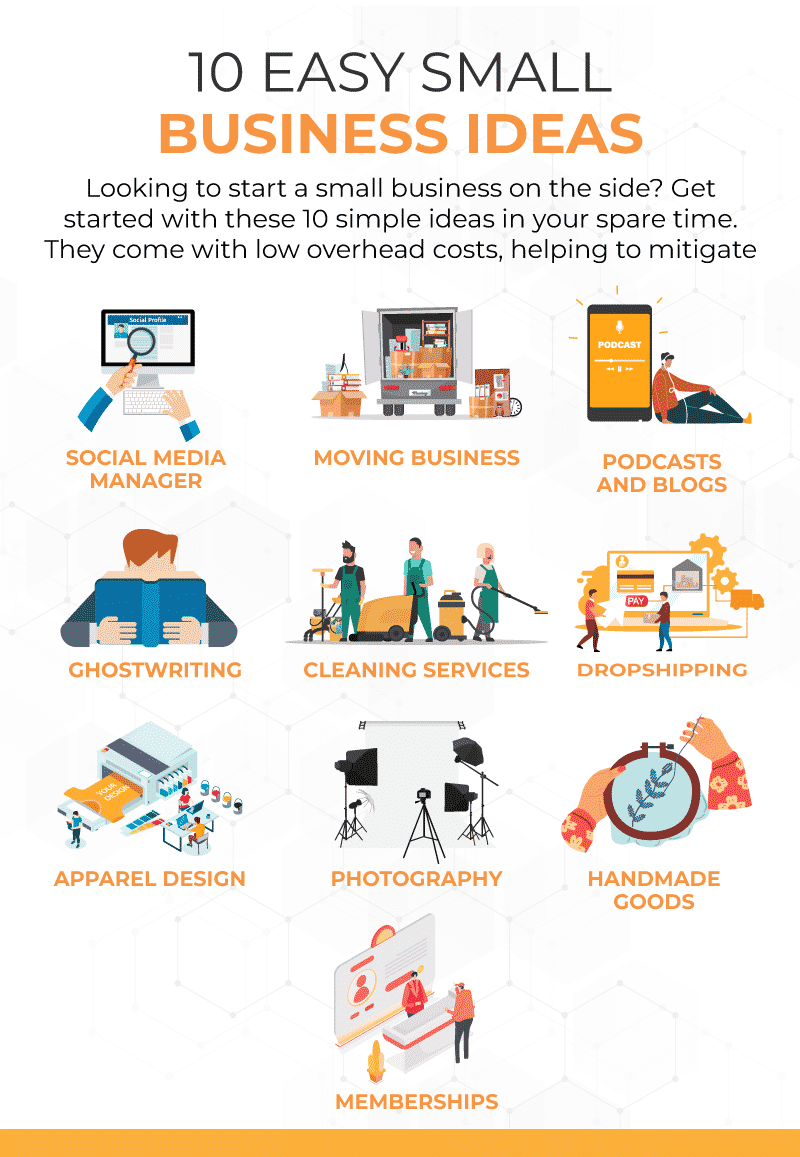

The cost of launching a business varies wildly, from a few hundred dollars for a home-based service to millions for a manufacturing plant. Understanding the key factors that influence these costs, from industry to location to business model, is crucial for realistic planning and securing necessary funding.

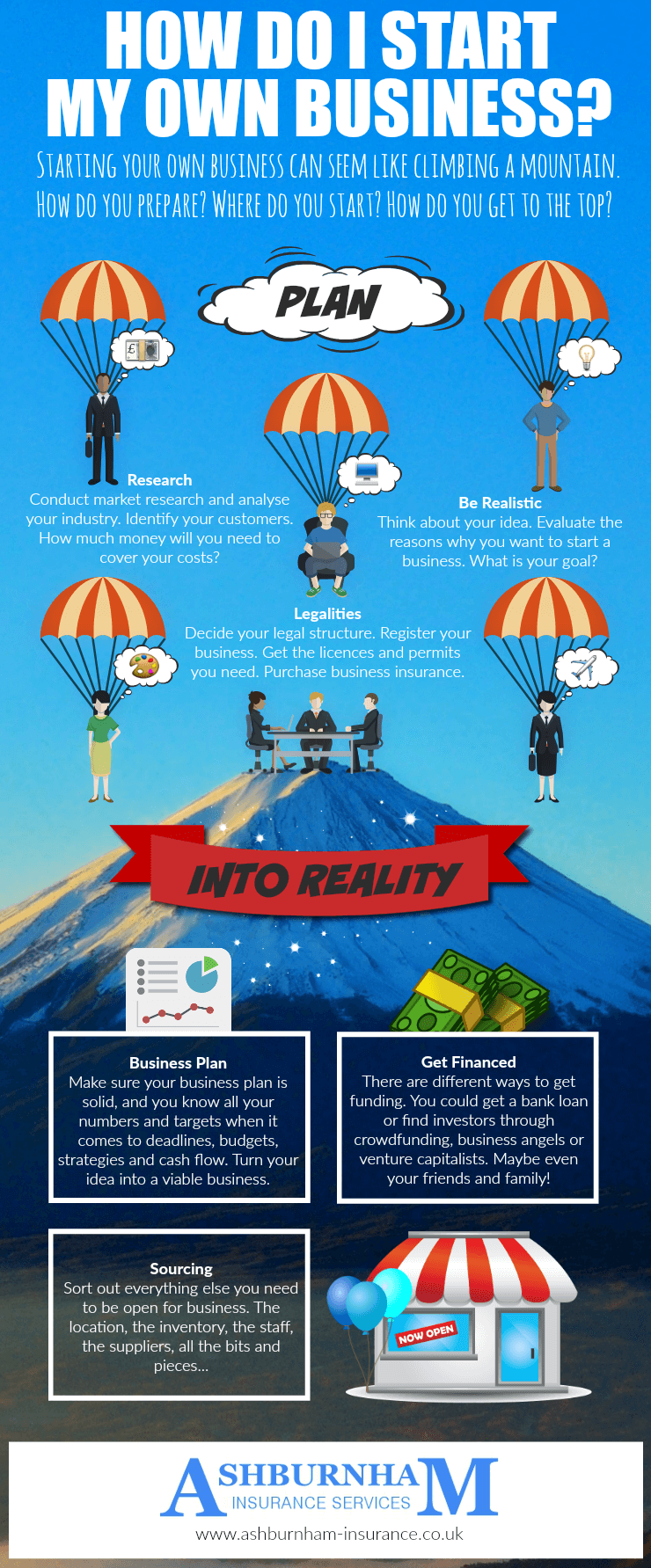

Decoding the Startup Costs: A Detailed Breakdown

Starting a business isn't just about having a great idea; it's about the nitty-gritty details of bringing that idea to life. Let's break down the common expenses you'll likely encounter.

Legal and Regulatory Fees

Before you even open your doors (or launch your website), you'll need to navigate the legal landscape. This involves registering your business, obtaining necessary licenses and permits, and potentially trademarking your brand.

According to the Small Business Administration (SBA), these fees can range from a few hundred dollars for a simple sole proprietorship to several thousand for a more complex corporate structure. Don't forget to factor in ongoing compliance costs.

Office Space and Equipment

Whether you're envisioning a sleek downtown office or a cozy home workspace, securing a physical location comes with costs. Rent, utilities, and necessary renovations quickly add up.

Then there's equipment: computers, furniture, specialized machinery – the list can be extensive. Leasing equipment, especially in the early stages, can be a smart way to conserve capital.

Inventory and Supplies

If you're selling physical products, inventory will be a significant expense. Sourcing quality materials, managing storage, and anticipating demand are all crucial considerations.

Even service-based businesses need supplies. From stationery and software to specialized tools, these costs can impact your cash flow.

Marketing and Advertising

Having a great product or service is only half the battle; you need to let people know about it! Marketing and advertising expenses are essential for attracting customers.

Digital marketing, including website development, social media campaigns, and search engine optimization (SEO), is increasingly vital. Traditional advertising methods, like print and radio, can also be effective, depending on your target audience. A well-crafted marketing strategy can make or break a new business.

Salaries and Wages

If you plan to hire employees, salaries and wages will be a major ongoing expense. Factor in benefits, payroll taxes, and potential training costs.

Even if you're initially flying solo, consider paying yourself a reasonable salary. This helps you track your personal finances and assess the financial viability of your business.

Unexpected Costs and Contingency Funds

No matter how meticulous your planning, unexpected costs are inevitable. A leaky roof, a sudden surge in demand, or a legal dispute can all derail your budget.

That's why it's crucial to set aside a contingency fund – typically 10-20% of your total startup costs – to cover these unforeseen expenses. Being prepared for the unexpected can save your business from financial ruin.

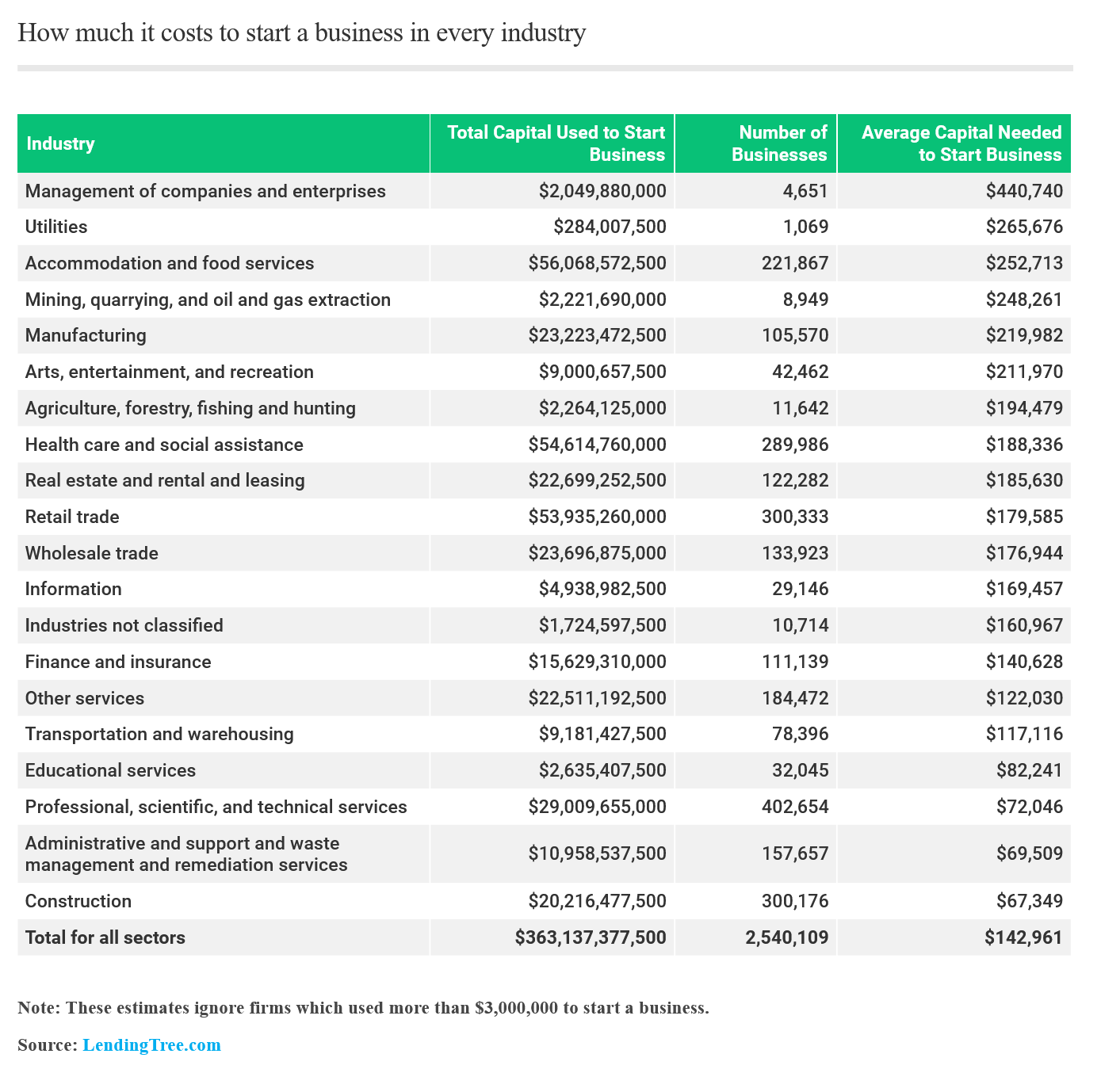

Industry Matters: Comparing Startup Costs Across Sectors

The type of business you're starting will heavily influence your startup costs. A tech startup focused on software development will likely have lower upfront costs than a brick-and-mortar restaurant.

According to a Forbes article, restaurant startups can easily require $100,000 to $500,000, while a service-based business like freelance writing might only need a few thousand. Researching industry-specific benchmarks is key.

Funding Your Dream: Exploring Financing Options

Once you have a clear understanding of your startup costs, you can start exploring funding options. Personal savings, loans, grants, and investors are all potential sources of capital.

Small business loans from banks and credit unions are a common option, but they often require collateral and a strong credit history. The SBA also offers loan programs designed to support small businesses.

Grants, while more difficult to obtain, can provide non-repayable funding. Investors, such as angel investors or venture capitalists, can offer significant capital in exchange for equity in your company.

The Bottom Line: Planning for Success

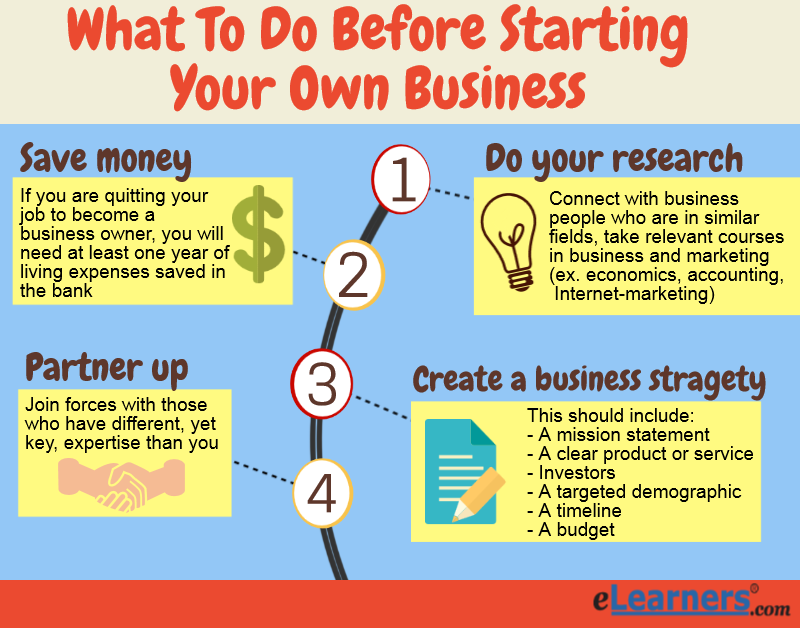

Starting a business is an exciting and challenging journey. While the financial aspects can seem daunting, careful planning and realistic budgeting are essential for success. Don't be afraid to seek advice from experienced entrepreneurs, financial advisors, and industry experts.

Remember, the initial investment is just the beginning. Consistent hard work, adaptability, and a passion for your business are the keys to long-term growth and prosperity.