How Often Does Tsly Pay Dividends

Imagine strolling through a vibrant marketplace, the air thick with the aroma of exotic spices and the chatter of merchants. Each stall offers something unique, a promise of potential rewards for the discerning shopper. Now, shift that image to the world of finance, where investment options abound, each with its own rhythm and potential payout. One such option, TSLY, has captured the attention of income-seeking investors, sparking the question: how often does it actually pay dividends?

This article dives deep into the dividend payment schedule of TSLY, exploring its historical performance and offering insights for those considering adding it to their investment portfolio. Understanding the frequency of these payouts is crucial for anyone aiming to generate a consistent income stream from their investments.

Understanding TSLY and its Dividend Structure

TSLY, or the YieldMax TSLA Option Income Strategy ETF, is an exchange-traded fund designed to generate income by using a strategy focused on Tesla (TSLA) options. Its primary objective is to provide current income to investors through monthly distributions.

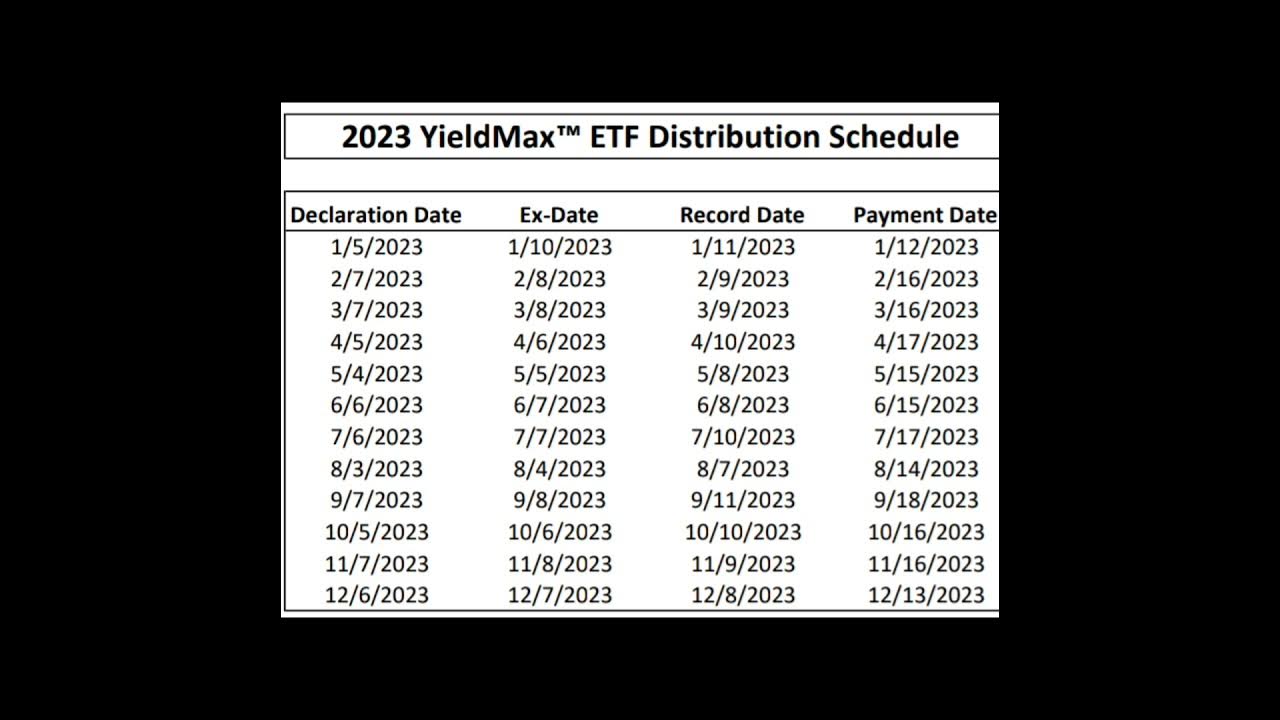

Unlike stocks that may pay dividends quarterly or annually, TSLY aims for a more frequent, monthly payout schedule. This can be particularly attractive to investors who rely on regular income from their investments.

Monthly Dividend Payments: The Standard

The core of TSLY's appeal lies in its commitment to monthly dividend distributions. The fund's strategy involves writing covered call options on Tesla stock, generating income from the premiums received.

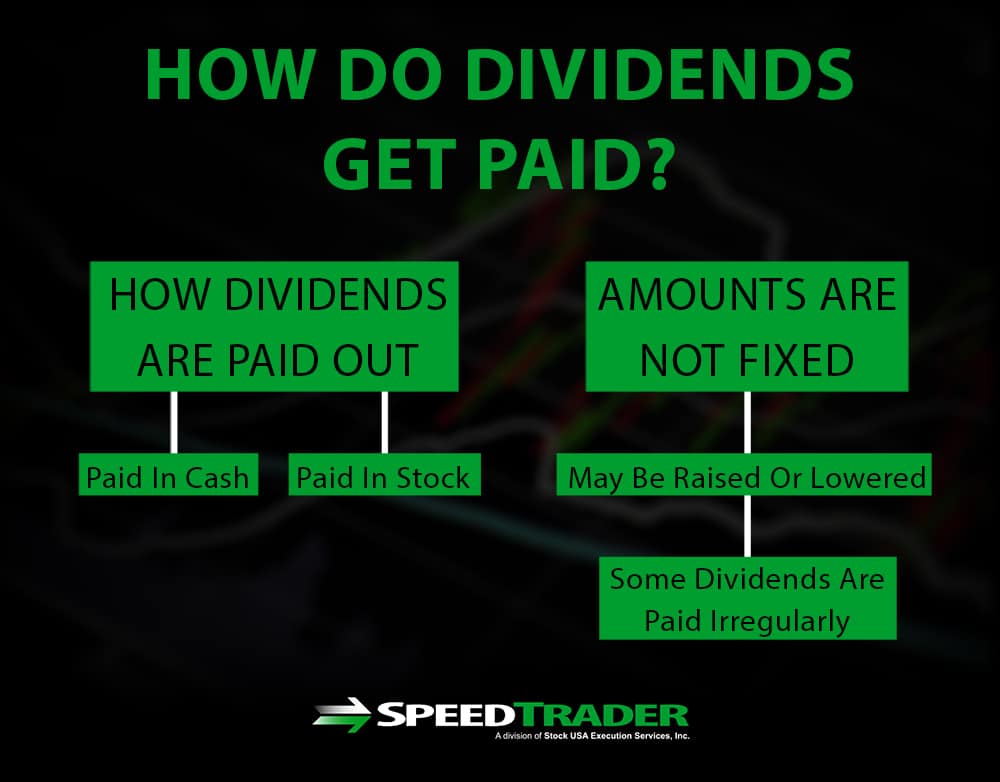

This income, after deducting expenses, is then distributed to shareholders on a monthly basis. The actual amount of the dividend can fluctuate depending on market conditions and the fund's performance.

According to the official YieldMax website and fund prospectuses, the fund's objective is indeed to provide monthly income. This intention is consistently reiterated in their public communications.

Factors Influencing Dividend Frequency

While the intention is to pay dividends monthly, it's important to understand the factors that can influence this schedule. These factors primarily revolve around the ETF's underlying investment strategy and market conditions.

The first critical factor is market volatility. Higher volatility in Tesla stock can lead to increased option premiums, potentially boosting the dividend amount, but it also introduces risk. The second factor is the fund's expense ratio. This affects the amount ultimately available for distribution.

Finally, changes in options strategies used by the fund managers can also impact the yield and dividend payout. Market dynamics dictate strategy shifts, which in turn affect income generation.

Historical Payment Data and Trends

Examining TSLY's historical dividend payment data provides valuable insights into its consistency. While past performance is not indicative of future results, it can offer a sense of what to expect.

By analyzing the historical records, one can observe the variation in dividend amounts month to month. This variability is inherent in the fund's strategy and tied to the performance of Tesla stock and the options market.

Data from financial websites like Yahoo Finance or Seeking Alpha, which track ETF dividend histories, confirm the monthly payment pattern. These platforms provide details on the ex-dividend dates, payment dates, and dividend amounts for each month.

Potential Benefits of Monthly Dividends

The monthly dividend structure of TSLY offers several potential benefits for investors. Most notably, it provides a consistent income stream.

For retirees or those seeking regular income, this can be a significant advantage. Having income arrive each month can help with budgeting and managing expenses.

Furthermore, monthly dividends allow for more frequent reinvestment opportunities. Investors can choose to reinvest these dividends, compounding their returns over time.

Considerations and Risks

While the monthly dividend structure is attractive, it's crucial to consider the risks associated with TSLY. It is important to remember that high yield does not equal high total return.

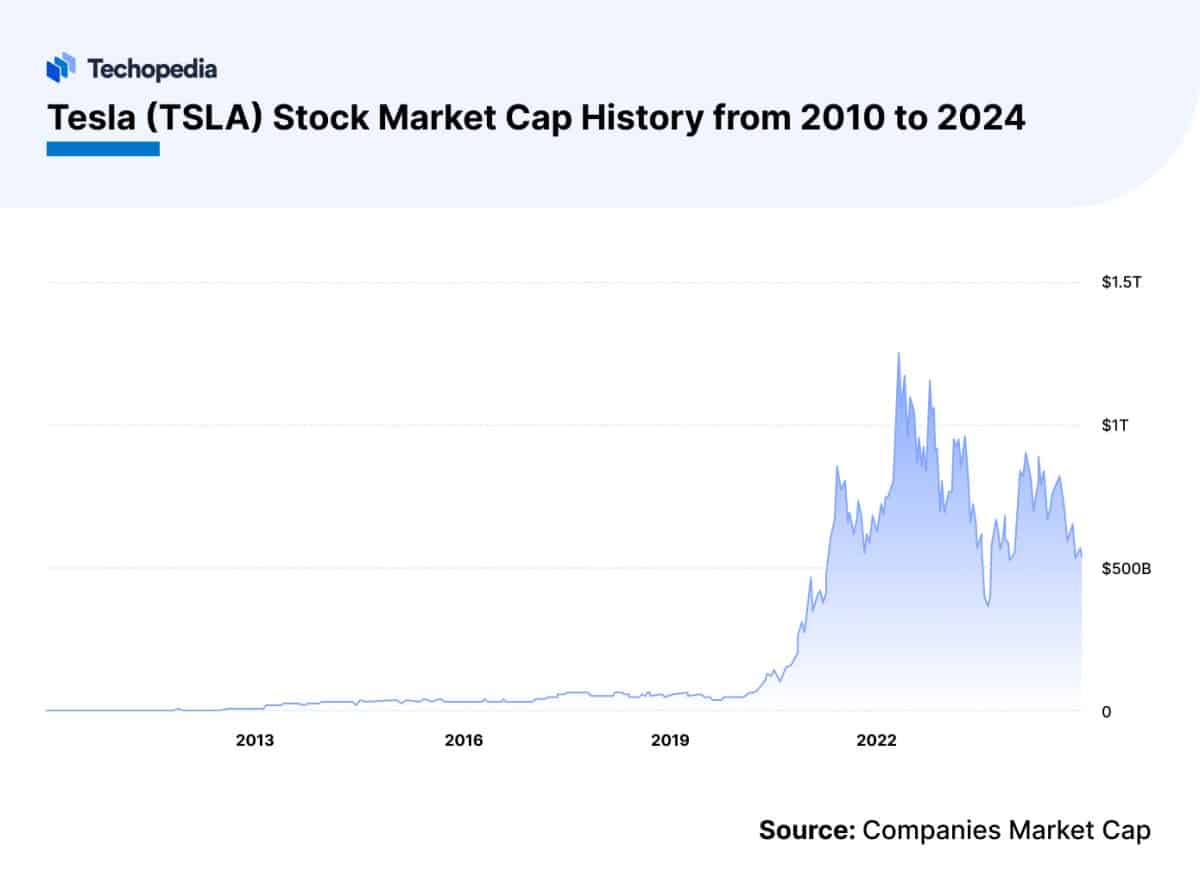

The fund's dependence on Tesla stock means it's subject to the volatility of a single stock. This concentration risk can lead to significant fluctuations in the fund's value.

Additionally, the options-based strategy is complex and may not be suitable for all investors. A thorough understanding of options and the fund's specific strategy is essential before investing.

Diversification is Key

As with any investment, diversification is a key principle to follow when considering TSLY. Allocating a portion of your portfolio to different asset classes and investment strategies can help mitigate risk.

Do not put all your eggs in one basket. Diversification reduces the impact of any single investment's performance on your overall portfolio.

A well-diversified portfolio can provide a more stable and reliable source of income and growth over the long term.

Conclusion: A Consistent Income Stream with Careful Consideration

TSLY offers a unique opportunity for investors seeking monthly dividend income, particularly those interested in the potential of Tesla-linked investments. Its commitment to a monthly payout schedule can be a valuable asset for income-focused portfolios.

However, it's crucial to approach TSLY with a thorough understanding of its strategy, risks, and potential limitations. The dividend yield is enticing, but it should be considered alongside the inherent volatility of the fund and its underlying assets.

Ultimately, whether TSLY is the right investment depends on individual circumstances, risk tolerance, and investment goals. By carefully evaluating these factors, investors can make an informed decision about whether to incorporate TSLY into their portfolio and benefit from its consistent dividend payments.