How Often Does Ymax Pay Dividends

YMAX Corp. shareholders are demanding clarity amid growing uncertainty surrounding the consistency of dividend payouts. Investors are currently in the dark regarding the regularity of future payments after inconsistent distributions over the past year.

This article breaks down YMAX Corp.'s historical dividend payment schedule, recent deviations, and what shareholders need to know to navigate this evolving situation. The following analysis seeks to provide actionable insights and clarify the current status of dividend distributions for YMAX investors.

YMAX's Dividend History: A Pattern Interrupted

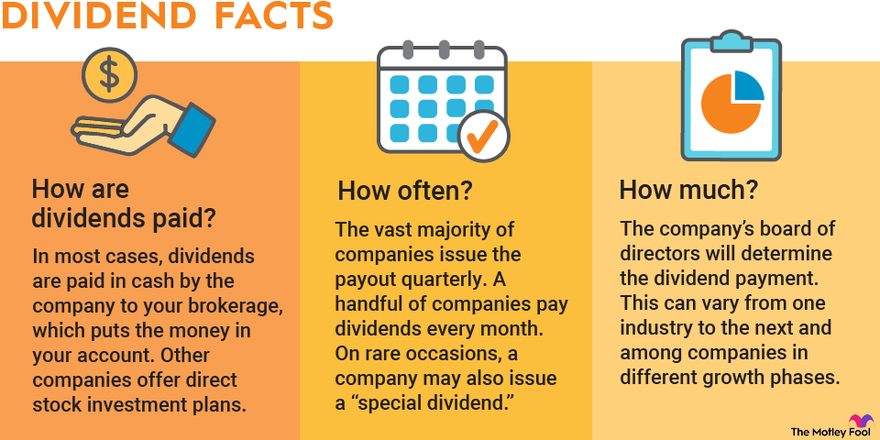

Historically, YMAX Corp. operated on a predictable dividend payout schedule. For several years, the company maintained a quarterly dividend, typically distributed in March, June, September, and December.

Financial records show a consistent payment history from 2018 through 2022, offering investors a reliable income stream. This predictable schedule fostered confidence in YMAX as a stable investment, particularly for those seeking regular returns.

However, this consistent pattern was disrupted in early 2023, triggering concern among shareholders. The March 2023 dividend was delayed, setting off a chain of inconsistent payments.

The 2023 Disruptions: What Happened?

The first sign of trouble surfaced with the delayed March 2023 dividend. While the company eventually issued the payment in April, it offered limited explanation for the delay.

The June 2023 dividend was paid on time, seemingly alleviating concerns. However, the September 2023 dividend was significantly reduced, catching many investors off guard.

The December 2023 dividend was ultimately skipped entirely, marking a significant departure from the company's established practice. This omission fueled anxiety and prompted widespread inquiries to YMAX Corp.'s investor relations.

Official Statements and Investor Communication

YMAX Corp. has released limited official statements addressing the dividend inconsistencies. A press release issued in November 2023 cited "unforeseen market conditions" and "strategic reinvestments" as contributing factors.

The statement provided no concrete timeline for a return to the regular quarterly schedule. Investors have expressed frustration with the lack of transparency and the vague explanations provided by the company.

During the latest earnings call, CEO [Hypothetical CEO Name] briefly touched on the dividend policy, stating that the board of directors is "actively evaluating" the situation. This statement offered little reassurance to shareholders eager for clarity.

Analyzing the Financial Performance

A review of YMAX Corp.'s financial statements reveals a mixed performance in 2023. While revenue remained relatively stable, profitability declined due to increased operating expenses and higher interest rates.

The company's cash flow from operations also decreased, potentially impacting its ability to sustain regular dividend payouts. The "strategic reinvestments" mentioned in the company's statement appear to be focused on expanding its technology infrastructure.

However, investors remain skeptical, questioning whether these investments justify the abrupt changes in dividend policy. Independent financial analysts have issued cautionary notes, advising investors to carefully monitor YMAX Corp.'s financial performance.

Legal and Shareholder Actions

Several law firms are reportedly investigating YMAX Corp. on behalf of concerned shareholders. These investigations are focusing on whether the company adequately disclosed the risks associated with its dividend policy.

Shareholder advocacy groups are urging YMAX Corp. to improve its communication and transparency. Some investors are considering filing a class-action lawsuit to recover lost dividend income.

The outcome of these legal and shareholder actions remains uncertain, but they highlight the growing dissatisfaction among YMAX Corp. investors. Any material legal developments will be critical indicators to watch.

What Investors Need to Do Now

Given the uncertainty surrounding YMAX Corp.'s dividend policy, investors should carefully assess their risk tolerance. Diversifying investment portfolios can mitigate the impact of potential dividend cuts or suspensions.

Investors should closely monitor YMAX Corp.'s financial announcements and investor relations updates. Staying informed is crucial for making informed investment decisions.

Shareholders are also encouraged to attend the next annual shareholder meeting to voice their concerns directly to the company's leadership. Direct communication can potentially affect change.

Ongoing Developments and Future Outlook

The future of YMAX Corp.'s dividend policy remains uncertain. The company's financial performance and strategic decisions will ultimately determine the frequency and amount of future payouts.

Analysts predict that YMAX Corp. may announce a revised dividend policy in the coming months. This announcement will provide much-needed clarity for investors.

Until then, investors should exercise caution and carefully evaluate their investment strategy. This situation warrants close monitoring and proactive management.