H And R Block Emerald Advance

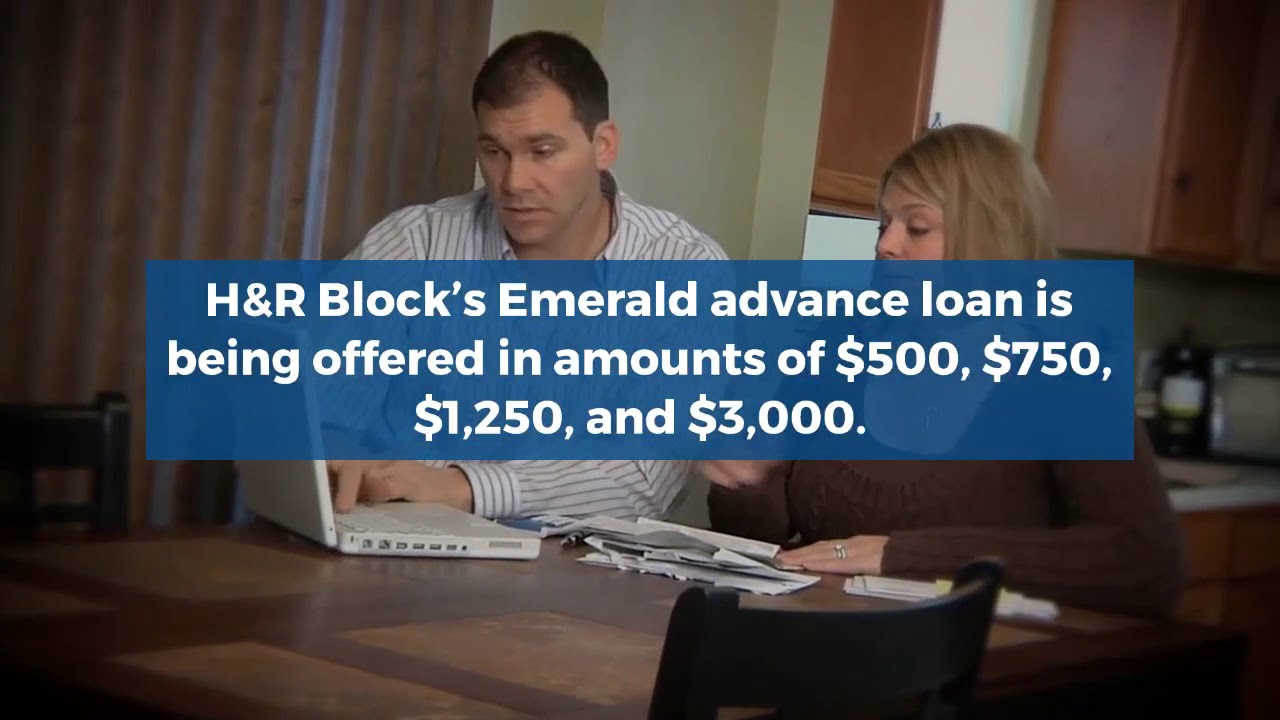

H&R Block's Emerald Advance line of credit is facing increasing scrutiny following reports of fluctuating credit limits and unclear fee structures, leaving many customers struggling to manage their finances during tax season.

The Emerald Advance, designed to provide early access to funds for tax preparation and potential refunds, is under fire for practices that critics argue exploit vulnerable taxpayers.

Growing Concerns Over Emerald Advance Terms

Reports are surfacing across the country of borrowers experiencing sudden and unexpected decreases in their Emerald Advance credit limits.

This reduction often occurs after tax preparation fees have already been deducted, leaving borrowers with significantly less access to the promised funds.

Customers are reporting feeling misled and trapped by the seemingly arbitrary changes.

Who is Affected?

The primary demographic affected appears to be lower-income individuals and families who rely on H&R Block for tax preparation services and seek immediate financial assistance through the Emerald Advance.

Many of these individuals may have limited access to traditional credit options, making them particularly vulnerable to the terms and conditions of alternative financial products.

Consumer advocacy groups are raising concerns that H&R Block is disproportionately impacting this demographic.

What are the Issues?

The central issue revolves around the lack of transparency in the Emerald Advance terms and conditions, particularly regarding credit limit adjustments.

Borrowers claim they were not adequately informed about the possibility of sudden decreases or the factors that could trigger such changes.

Furthermore, the fee structure associated with the Emerald Advance, including interest rates and late payment penalties, is being criticized as excessively high.

Where is this Happening?

These issues are not isolated to a specific region; reports of problems with the Emerald Advance are emerging nationwide, impacting customers across various states.

Online forums and social media platforms are filled with complaints from borrowers sharing their experiences and seeking advice.

The widespread nature of these concerns suggests a systemic problem with the product and its marketing.

When Did These Issues Begin?

While complaints about the Emerald Advance have existed for some time, there has been a noticeable increase in reports and attention surrounding the product during the current tax season.

The heightened demand for financial assistance during this period likely amplifies the impact of any issues with the credit line.

Several consumer watchdogs are investigating cases that go back years, suggesting a long standing problem with the product.

How Does This Impact Borrowers?

The fluctuating credit limits and high fees associated with the Emerald Advance can create significant financial hardship for borrowers.

Unexpected decreases in available funds can disrupt household budgets and make it difficult to cover essential expenses.

The high interest rates and penalties can also lead to a cycle of debt, further exacerbating the financial strain on vulnerable individuals.

H&R Block's Response

H&R Block has issued a statement acknowledging the concerns surrounding the Emerald Advance and stating that they are committed to providing transparent and fair financial solutions to their customers.

They maintain that the terms and conditions of the Emerald Advance are clearly disclosed and that credit limit adjustments are based on individual borrower circumstances and creditworthiness.

However, critics argue that the disclosures are insufficient and that the criteria for credit limit adjustments remain opaque.

Legal and Regulatory Scrutiny

Several consumer advocacy groups are calling for increased regulatory oversight of the Emerald Advance and other similar financial products.

They are urging state and federal agencies to investigate H&R Block's practices and ensure that borrowers are protected from predatory lending practices.

Legal experts suggest that class-action lawsuits are possible if widespread violations of consumer protection laws are found.

What's Next?

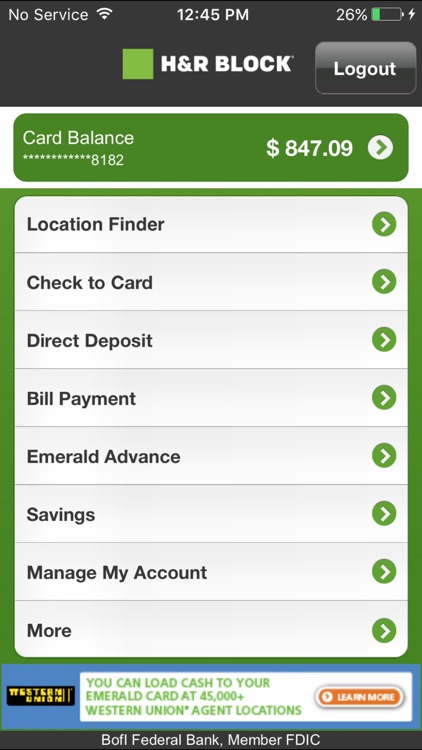

Consumers experiencing issues with the Emerald Advance are advised to document their experiences and file complaints with the Consumer Financial Protection Bureau (CFPB) and their state's attorney general.

Several organizations are offering free legal assistance to borrowers who believe they have been unfairly treated by H&R Block.

Ongoing investigations and potential legal action could lead to significant changes in the terms and conditions of the Emerald Advance and other similar financial products in the future.

(1).png)