Can You Use The Sezzle Virtual Card Anywhere

Imagine this: you're browsing online, and you spot the perfect pair of boots. They're exactly what you've been looking for, but your paycheck is still a week away. Panic starts to set in – will they be gone by then? Luckily, you remember you have a Sezzle account. But a question lingers: can you actually use your Sezzle virtual card for this purchase, on this website?

This scenario is increasingly common as more and more people turn to buy now, pay later (BNPL) services. The question of where and how you can use these virtual cards, like the one offered by Sezzle, is crucial for understanding their true utility and maximizing their benefits.

Understanding Sezzle's Virtual Card

The core question many users have is whether their Sezzle virtual card offers universal acceptance or comes with limitations.

To answer this directly: you can use the Sezzle virtual card anywhere Sezzle is accepted as a payment method. This means the card’s functionality is tied to Sezzle's partnerships with retailers.

However, it's important to note that this doesn't mean it works everywhere credit cards are accepted, only at specific Sezzle-partnered merchants.

How Sezzle Works

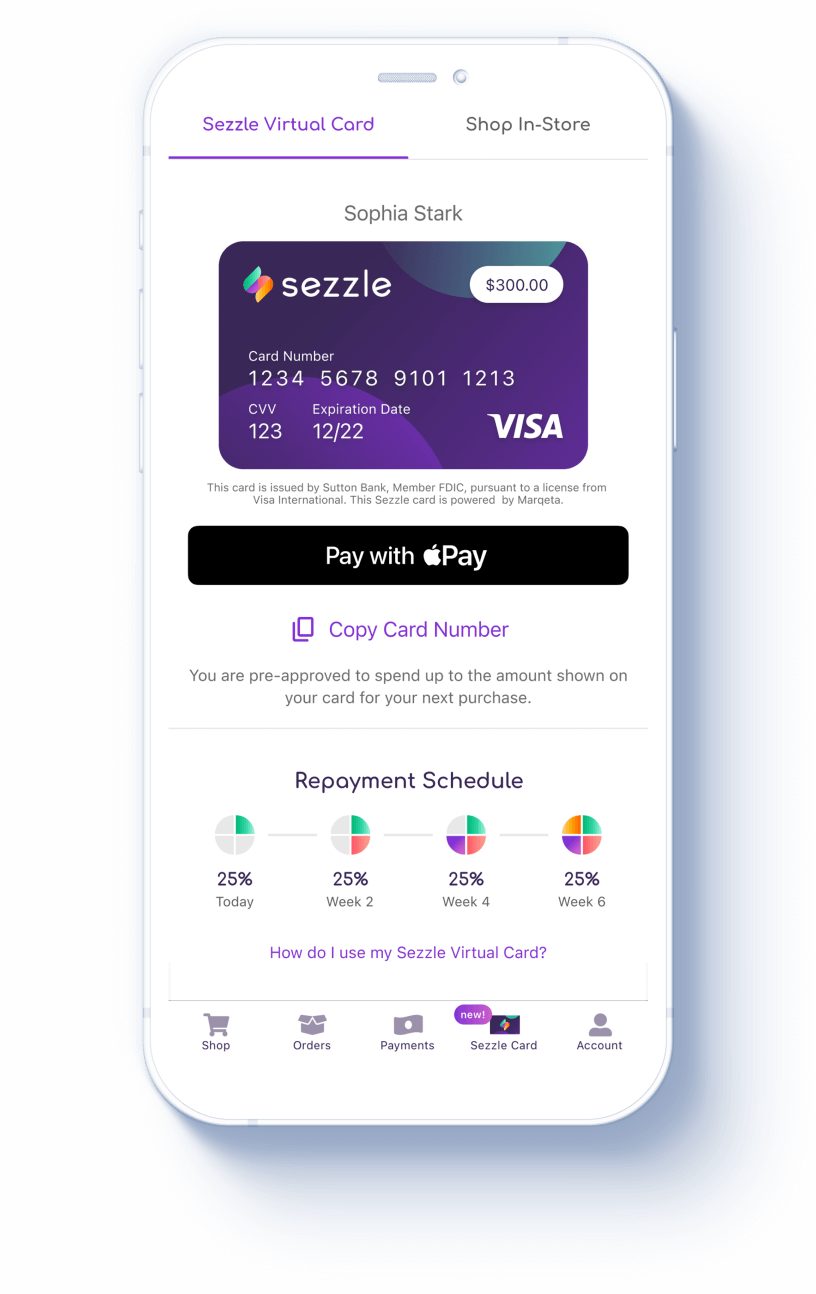

Sezzle operates by partnering with online and in-store retailers. When you make a purchase with Sezzle, you typically pay 25% of the total cost upfront. The remaining balance is then divided into three additional installments, spread out over six weeks, with no interest if you pay on time.

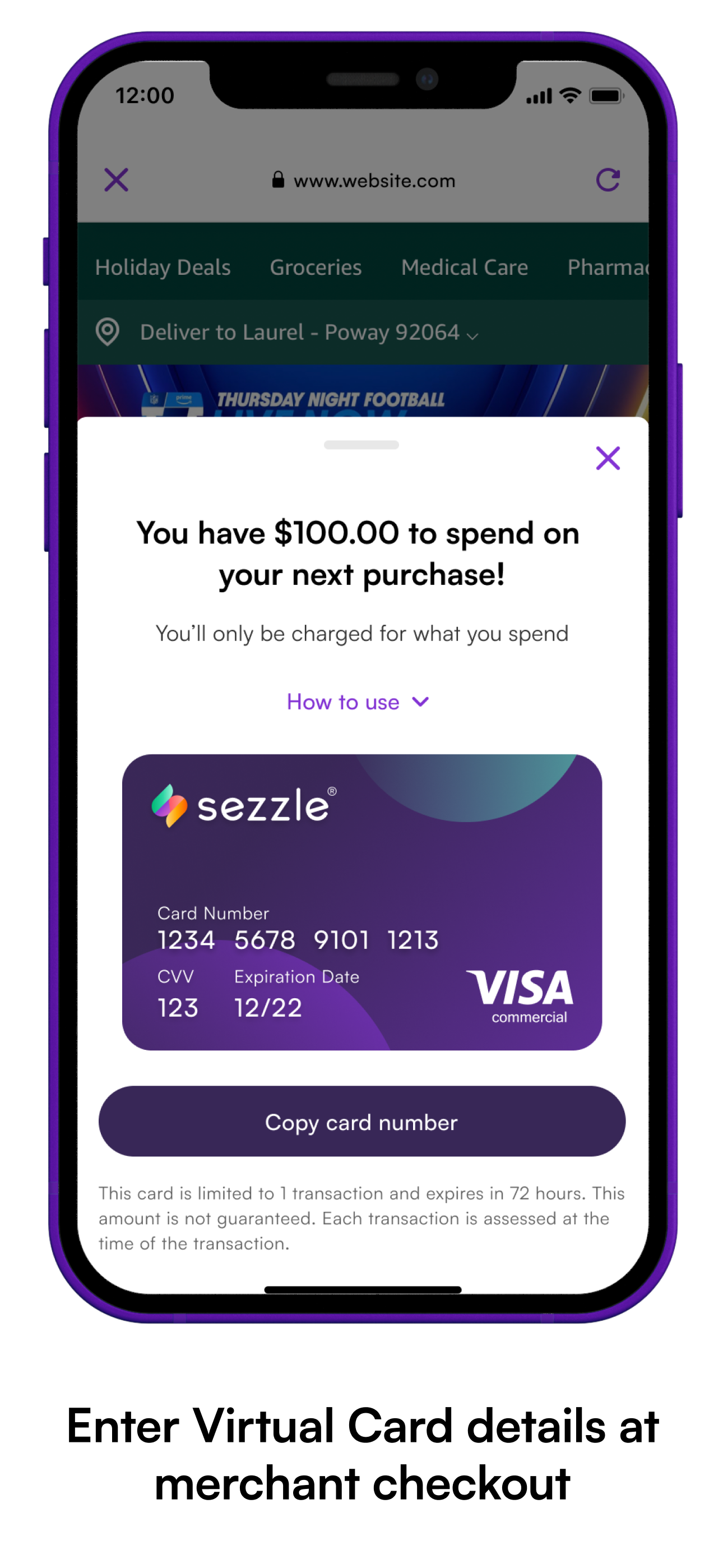

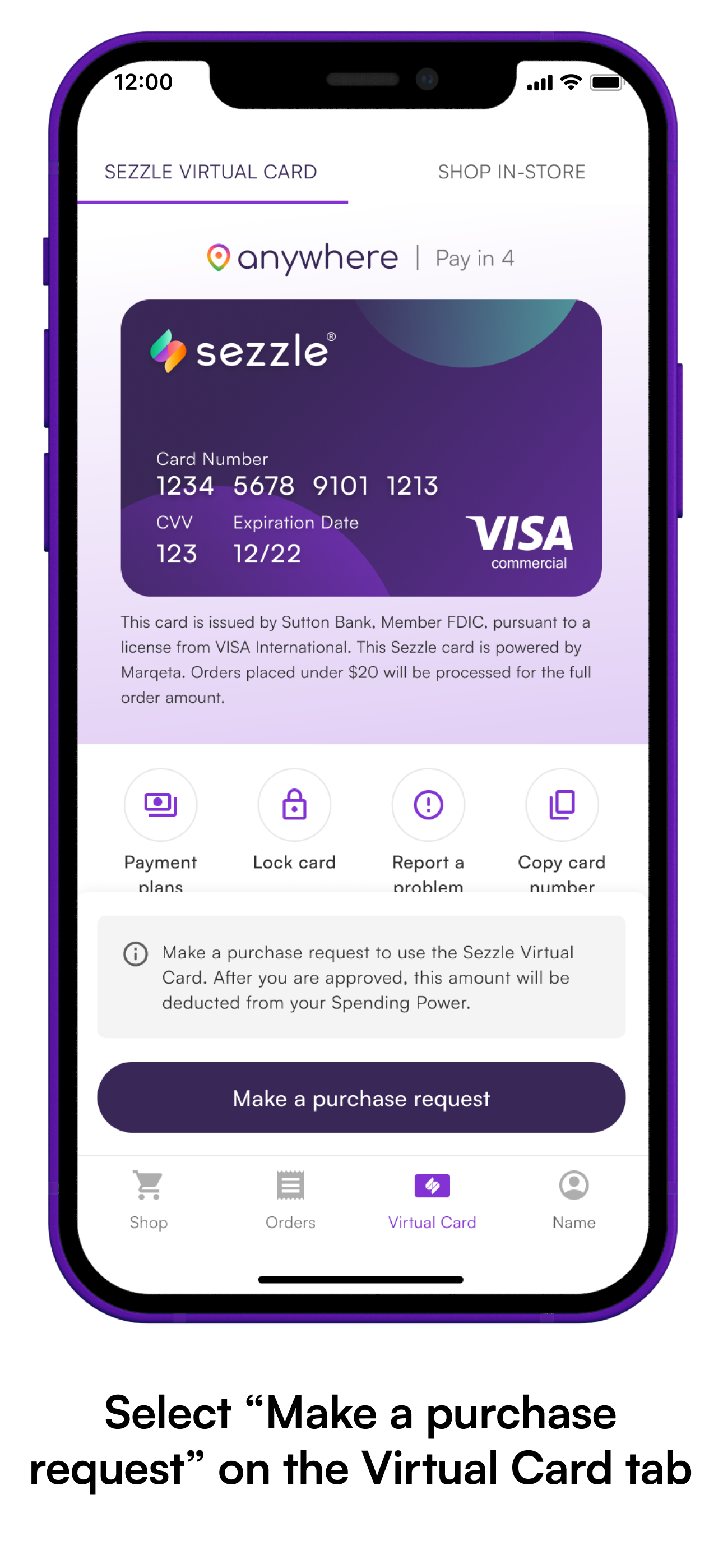

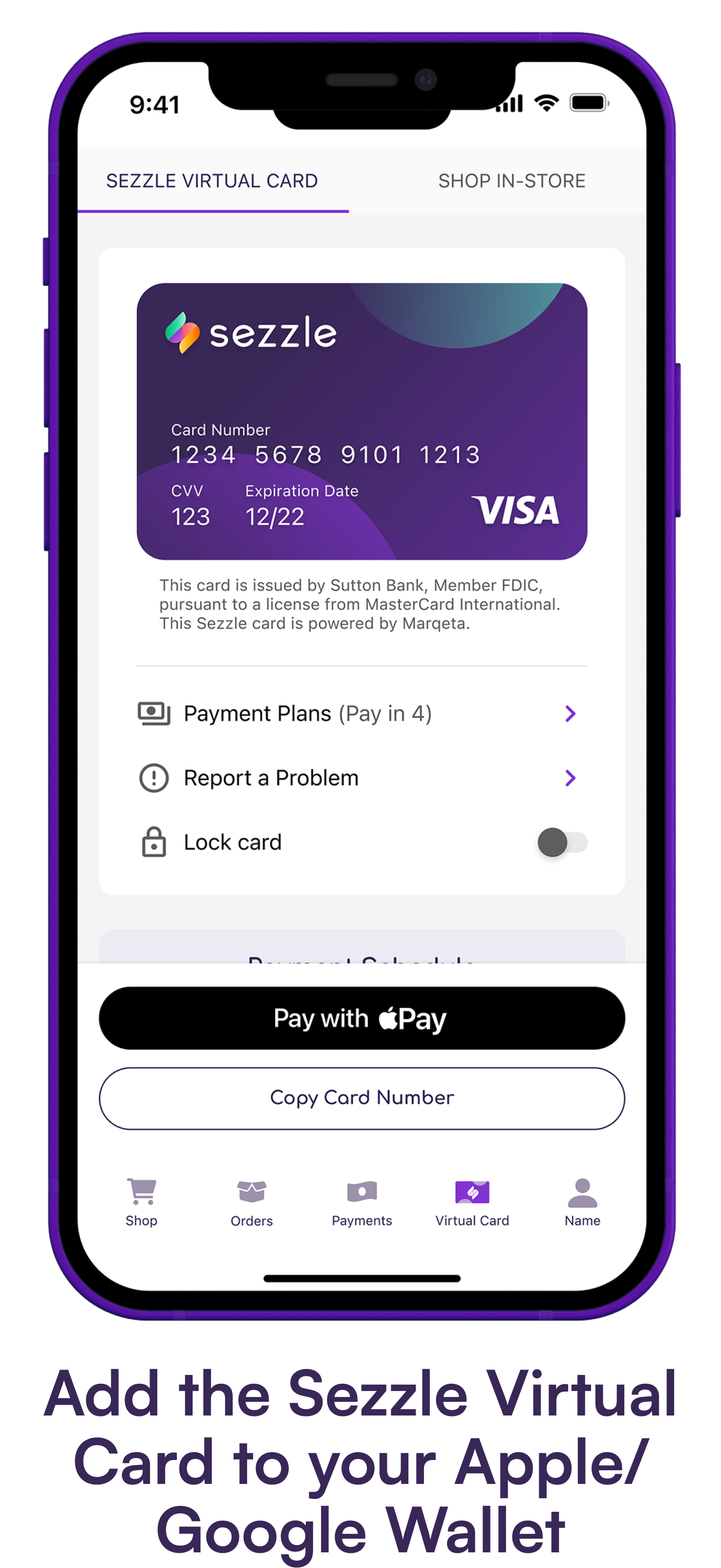

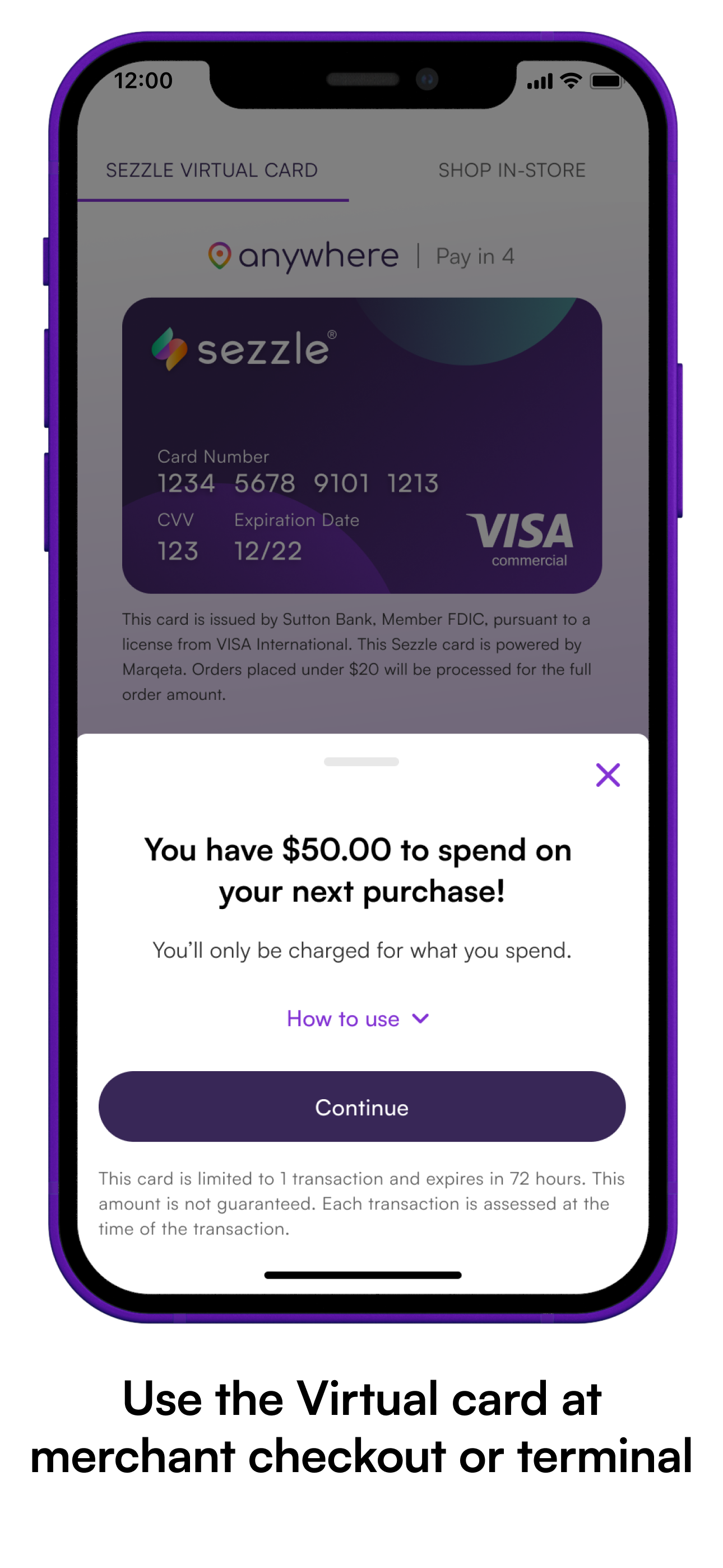

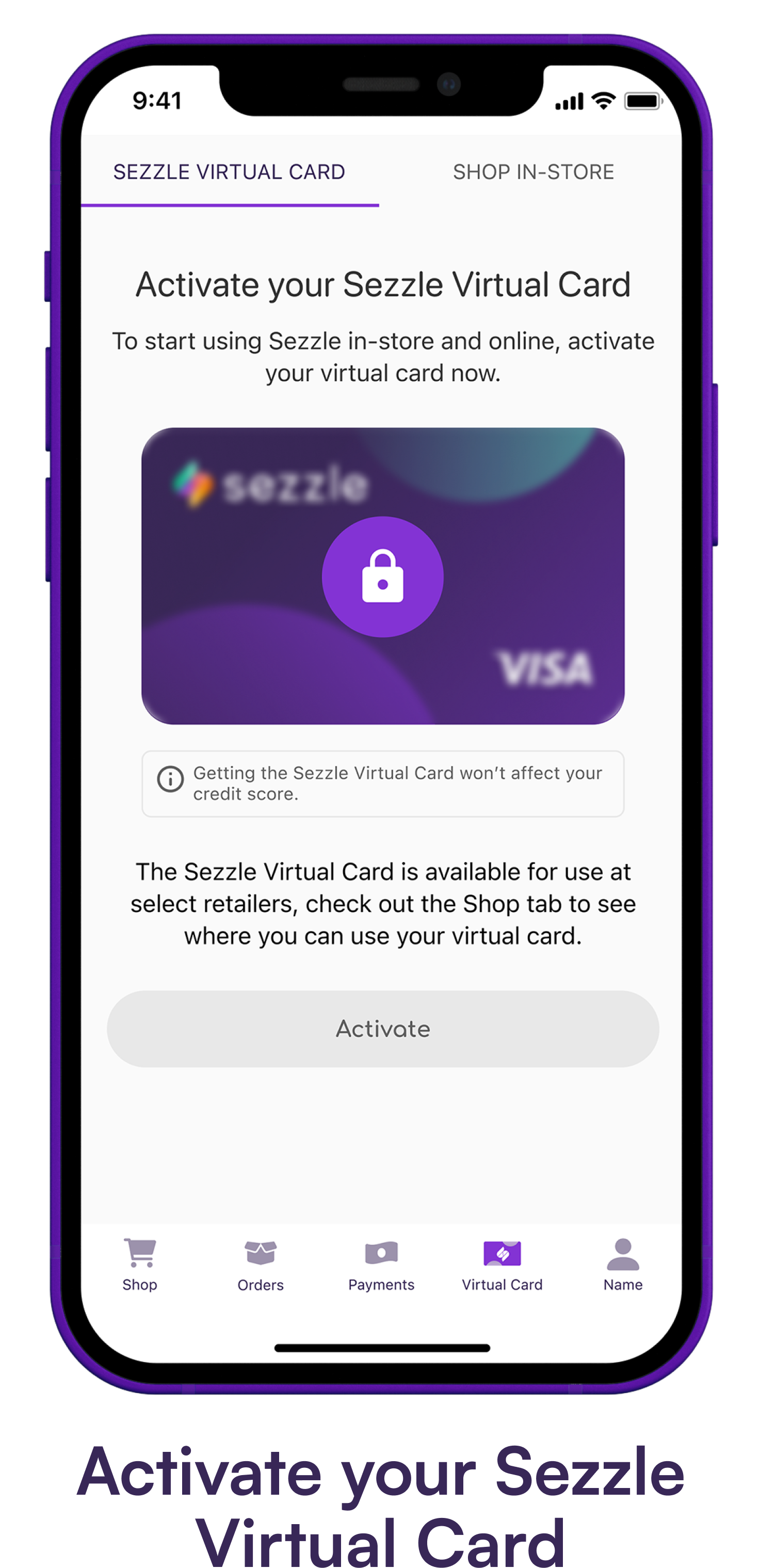

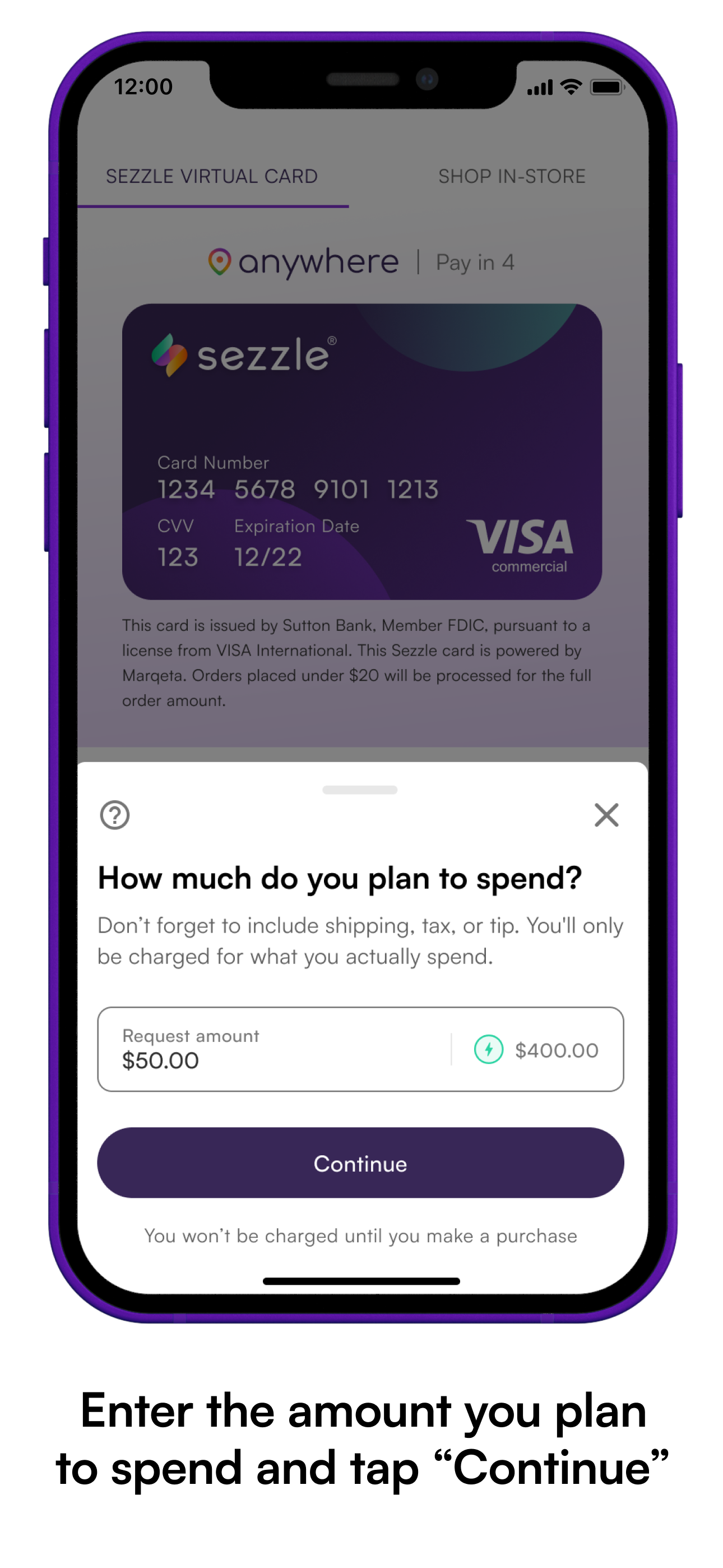

The Sezzle virtual card is essentially a digital payment method tied to your Sezzle account.

When you shop at a Sezzle partner, you can select Sezzle at checkout and use the virtual card details to complete the purchase.

Sezzle Acceptance: Online and In-Store

Sezzle's acceptance is growing rapidly, but it's not yet as ubiquitous as traditional credit cards. Many online retailers, especially those catering to younger demographics, have integrated Sezzle into their payment options. You can typically find a Sezzle badge or logo at the checkout page if they are a partner.

In-store acceptance is also expanding, with more brick-and-mortar stores adopting Sezzle to attract customers seeking flexible payment options. To check if a physical store accepts Sezzle, you can use the Sezzle app or website to locate partner merchants near you.

Always confirm the retailer's acceptance of Sezzle before making a purchase, especially in physical stores, to avoid disappointment.

Navigating the Limitations

While Sezzle can be a convenient payment tool, understanding its limitations is essential.

The primary limitation is that you can only use the Sezzle virtual card at retailers that have partnered with Sezzle. Unlike a credit card, it's not a universally accepted payment method.

This restriction means you'll need to plan your purchases accordingly and check for Sezzle acceptance before assuming you can use it.

Potential Scenarios Where Sezzle Won't Work

Consider these scenarios where your Sezzle virtual card might not be accepted: at a small, local business that hasn't partnered with Sezzle; on a website that only accepts major credit cards or PayPal; or for specific types of purchases, such as certain subscriptions or recurring payments that are not supported by Sezzle.

It's always best to verify before assuming.

Another potential limitation is your available spending power within your Sezzle account. This limit is determined by Sezzle based on factors like your credit history, payment behavior, and purchase history with Sezzle. If your purchase exceeds your spending power, you won't be able to use your Sezzle virtual card, even at a partnered retailer.

Checking Sezzle Acceptance

The easiest way to determine if a retailer accepts Sezzle is to look for the Sezzle logo or payment option during checkout on their website. You can also use the Sezzle app or website to search for partnered retailers in your area or online.

Some retailers also display a Sezzle badge on their product pages or promotional materials to indicate their acceptance of Sezzle payments.

If you're unsure, you can always contact the retailer directly to confirm if they accept Sezzle.

The Broader Buy Now, Pay Later Landscape

Sezzle is just one player in the rapidly growing buy now, pay later (BNPL) industry. Companies like Afterpay, Klarna, and Affirm offer similar services, allowing consumers to split their purchases into installments.

The BNPL model has gained popularity, especially among younger consumers, due to its convenience and interest-free payment options (when payments are made on time). According to a report by Statista, the BNPL market is expected to continue growing significantly in the coming years, driven by increasing consumer adoption and expanding retailer partnerships.

However, the rise of BNPL has also raised concerns about overspending and potential debt accumulation. It's important to use these services responsibly and be aware of the terms and conditions, including any late fees or penalties.

Responsible Use of BNPL Services

To use Sezzle and other BNPL services responsibly, it's crucial to create a budget and ensure you can comfortably afford the installment payments. Avoid using BNPL for non-essential purchases or to cover expenses you can't otherwise afford.

Make sure to set up reminders or automatic payments to avoid late fees, which can quickly add up and negate the benefits of interest-free financing.

Also, be mindful of the total amount you're borrowing across multiple BNPL platforms. It's easy to lose track of your spending and overextend yourself if you're not careful.

The Future of Sezzle and Virtual Payments

As the BNPL market matures, Sezzle is likely to continue expanding its retailer partnerships and enhancing its virtual card functionality. We might see greater integration with digital wallets and increased acceptance at physical stores. Competition among BNPL providers will likely drive innovation and better user experiences.

The company will also likely focus on financial literacy initiatives to promote responsible use of its platform and help consumers avoid debt traps.

Sezzle, like other BNPL providers, faces increasing scrutiny from regulators who are concerned about consumer protection and the potential for predatory lending practices. Future regulations could impact how Sezzle operates and the terms it can offer to consumers.

Conclusion

The Sezzle virtual card is a handy tool for managing your finances and splitting up payments, but it's not a universal key to unlimited spending. Knowing where you can and can't use it is crucial. By understanding Sezzle's partnerships and limitations, you can make informed decisions and enjoy the benefits of flexible payments without overextending yourself.

Ultimately, the power lies in understanding the parameters and using the tool responsibly, transforming a potential pitfall into a financial stepping stone.