How To Add Personal Money To Business Account

Many small business owners find themselves in a position where they need to inject personal funds into their business account. While this is a common practice, it's crucial to understand the correct procedures to ensure proper accounting and avoid potential legal or tax complications.

Understanding the Basics of Capital Contributions

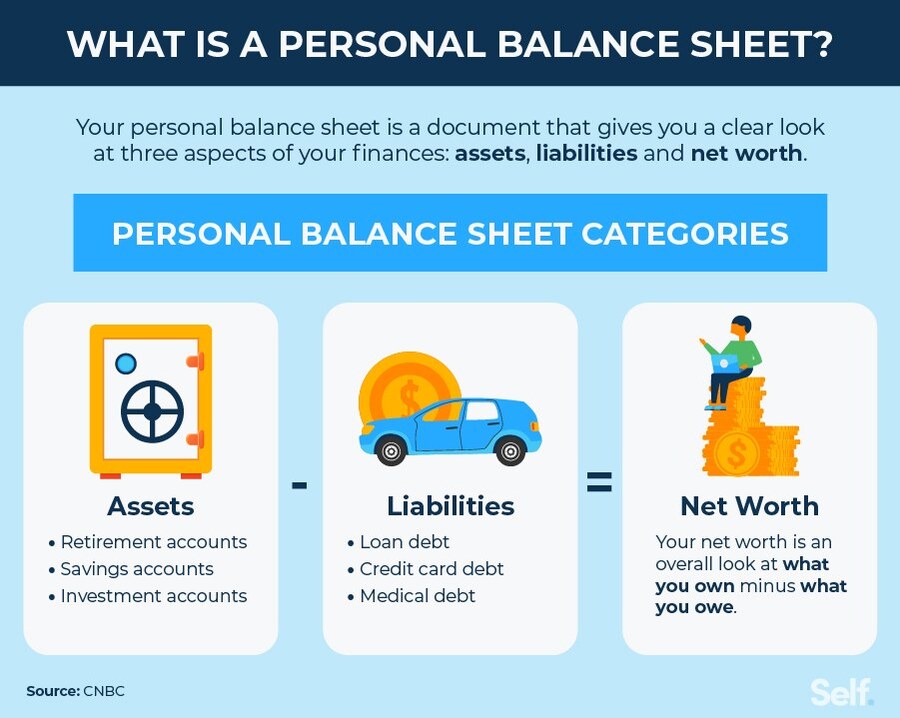

Adding personal money to a business account is generally considered a capital contribution. This is when an owner invests their own money into the business, increasing the business's equity. The process varies slightly depending on the business structure, such as a sole proprietorship, partnership, LLC, or corporation.

The IRS provides guidelines on how different business structures should handle capital contributions. Accurate record-keeping is essential to avoid misclassifying the funds as a loan or revenue.

Step-by-Step Guide to Contributing Personal Funds

The first step is to clearly document the transaction. This includes the date, amount, and purpose of the contribution. A written record, such as a memo or formal agreement, is crucial.

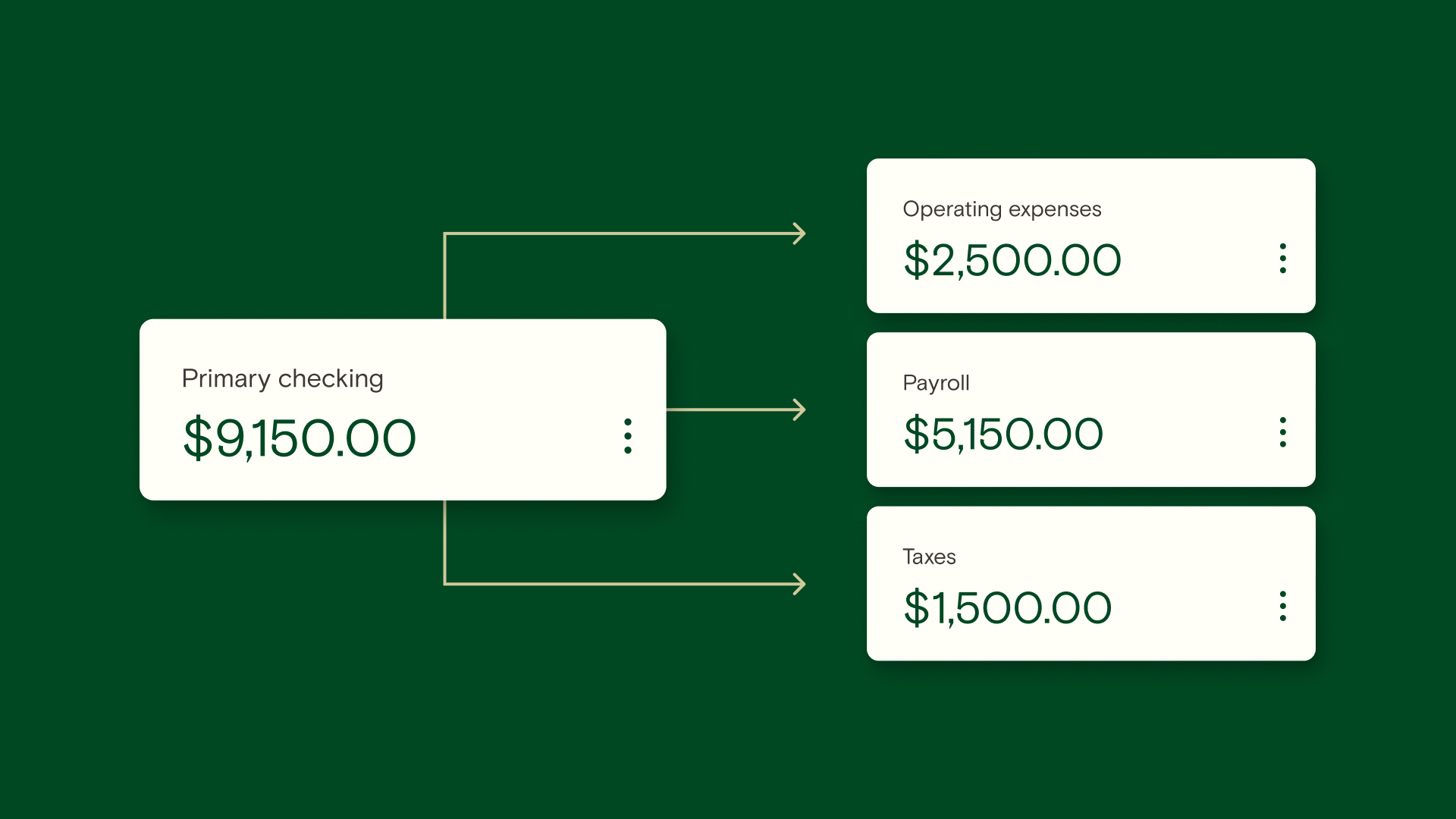

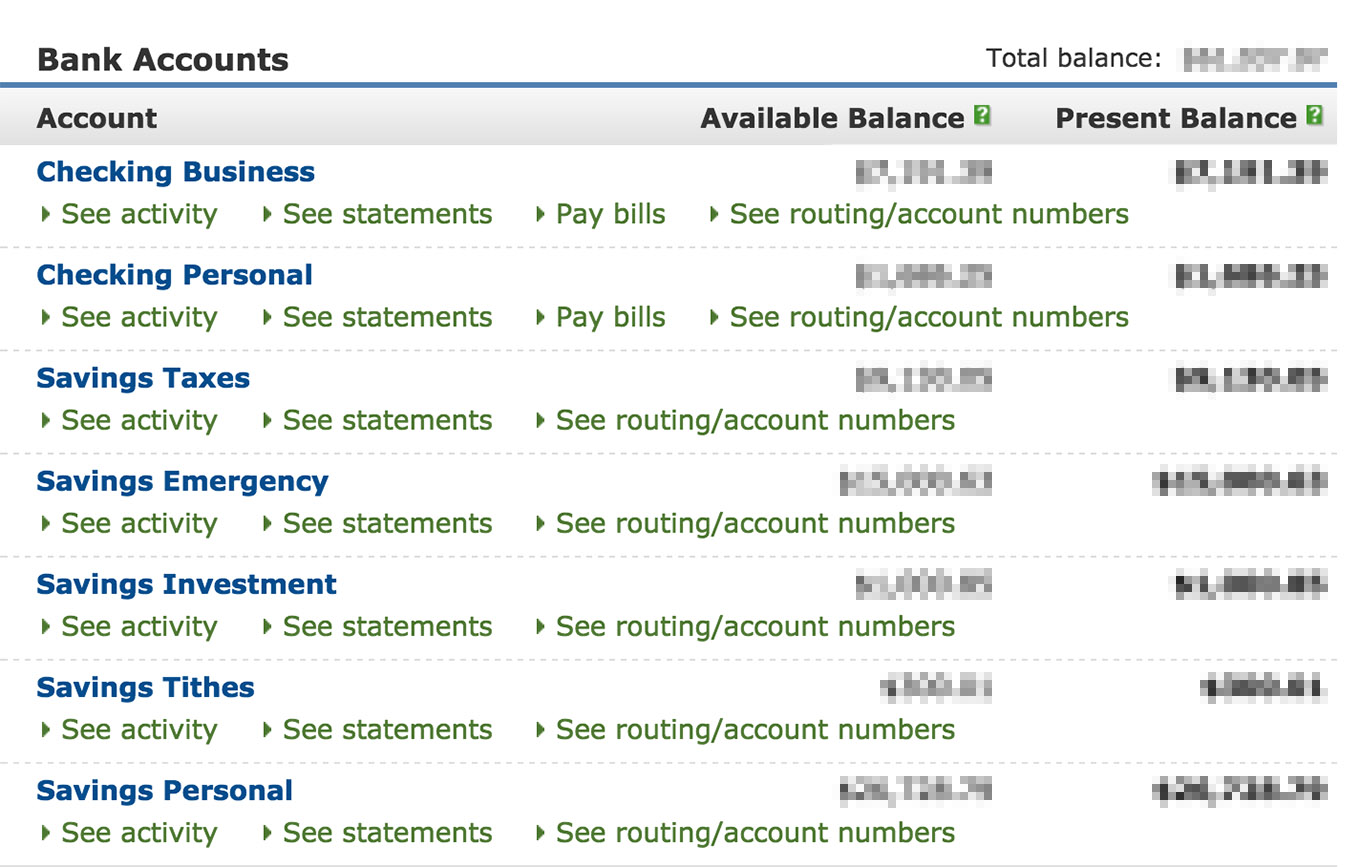

Next, transfer the funds from your personal bank account to the business bank account. Make sure the transfer is clearly labeled as a "capital contribution" or "owner investment." Avoid vague descriptions that could be misinterpreted.

Once the funds are transferred, record the transaction in your business's accounting system. This is typically done by debiting the cash account and crediting the owner's equity account.

Accounting for Different Business Structures

For sole proprietorships, the contribution is straightforwardly recorded as an increase in the owner's equity. The funds are considered a direct investment by the owner.

In partnerships, the partnership agreement should outline how capital contributions are handled. The contribution will typically increase the contributing partner's capital account balance.

Limited Liability Companies (LLCs) offer more flexibility, but similar principles apply. The contribution increases the member's equity in the LLC, and this should be reflected in the LLC's operating agreement and financial records.

For corporations, the process may involve issuing additional shares of stock to the owner in exchange for the capital contribution. This increases the corporation's paid-in capital.

Legal and Tax Implications

Properly documenting capital contributions is critical for tax purposes. The IRS requires accurate records to support the business's financial statements.

Capital contributions are generally not considered taxable income for the business. However, failure to properly document the transaction could lead to the IRS reclassifying the funds as a loan, which could have tax implications.

Consulting with a qualified accountant or tax advisor is recommended to ensure compliance with all applicable regulations. They can provide specific guidance based on your business structure and individual circumstances.

Potential Impact and Considerations

Injecting personal funds can provide a crucial lifeline for a struggling business. It can help cover expenses, fund expansion, or bridge a gap in cash flow.

However, it's important to carefully consider the long-term implications. Contributing personal funds increases your financial risk in the business.

Before making a contribution, evaluate the business's financial health and the likelihood of success. Consider alternative funding options, such as loans or investors.

Important Note: This article provides general information and should not be considered legal or financial advice. Consult with a qualified professional for guidance specific to your situation.

By following these steps and seeking professional advice when needed, business owners can confidently and compliantly add personal money to their business accounts, supporting their ventures while maintaining sound financial practices.