Which Statement Regarding Universal Life Insurance Is Correct

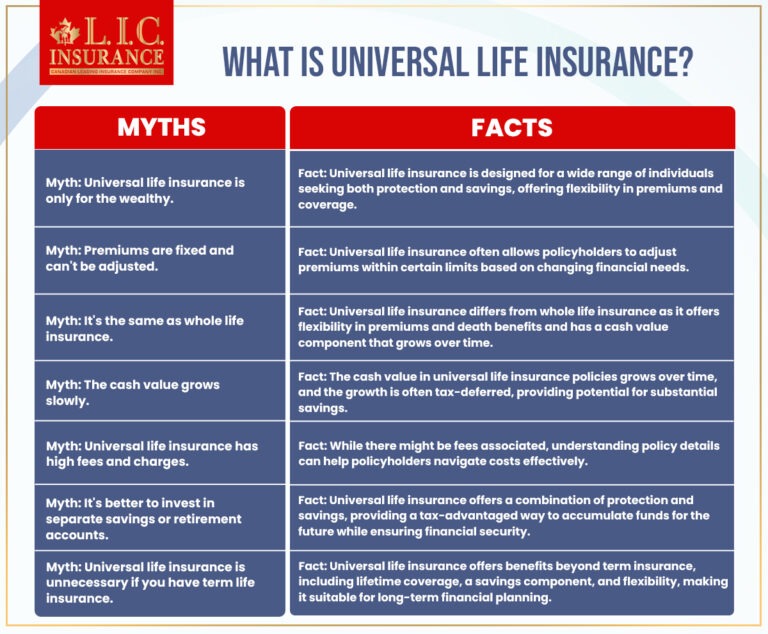

Universal life insurance policyholders face a critical need for immediate understanding as a wave of misinformation threatens financial security. Conflicting statements about policy mechanics are causing widespread confusion and potential losses, demanding clarity.

This article cuts through the noise, offering a precise breakdown of key universal life (UL) features and correcting the most prevalent misconceptions. We aim to arm policyholders with the knowledge to protect their investments and make informed decisions about their future.

Understanding Universal Life Insurance: Key Components

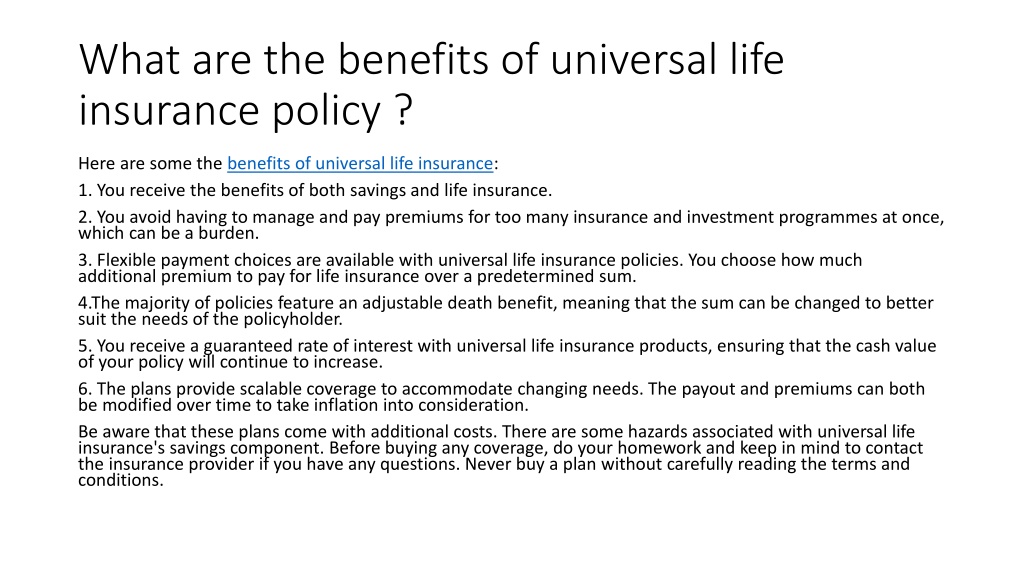

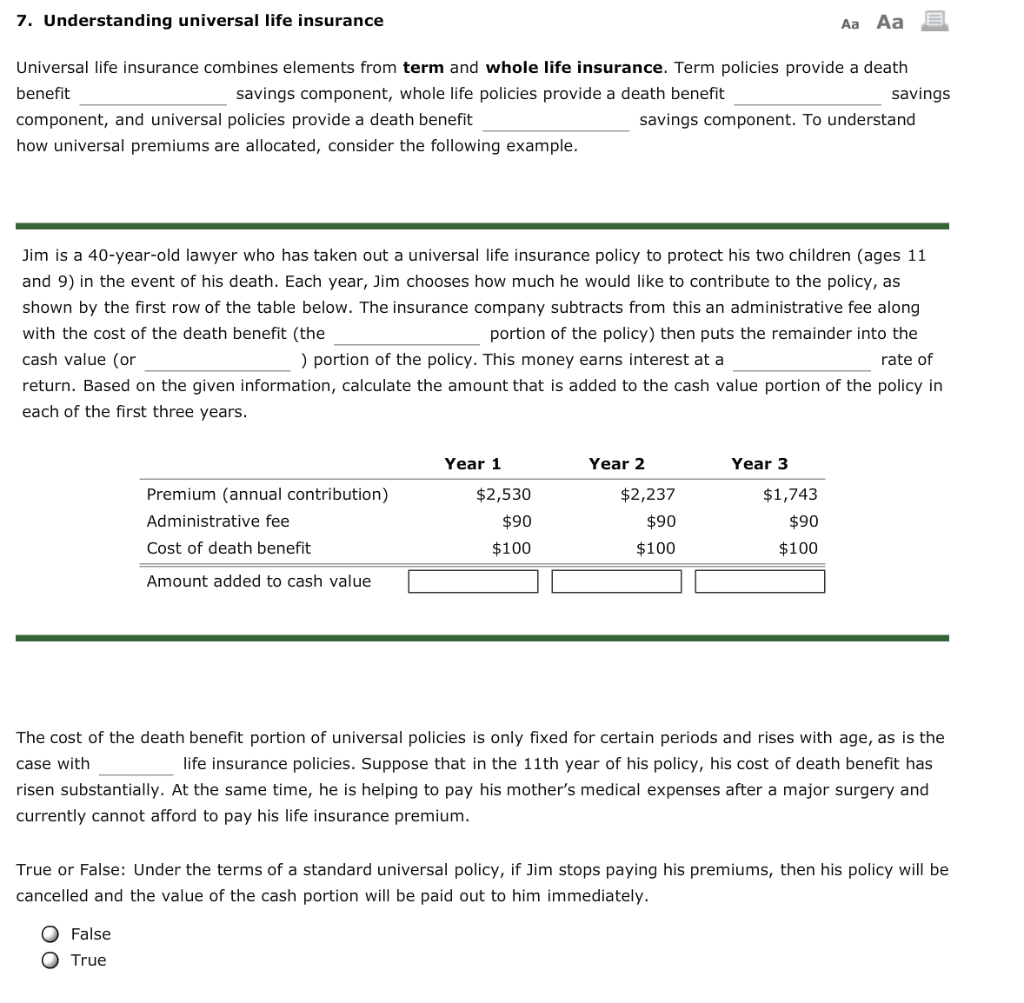

Universal life insurance is a type of permanent life insurance offering flexible premiums and adjustable death benefits. Unlike term life, it accumulates cash value over time.

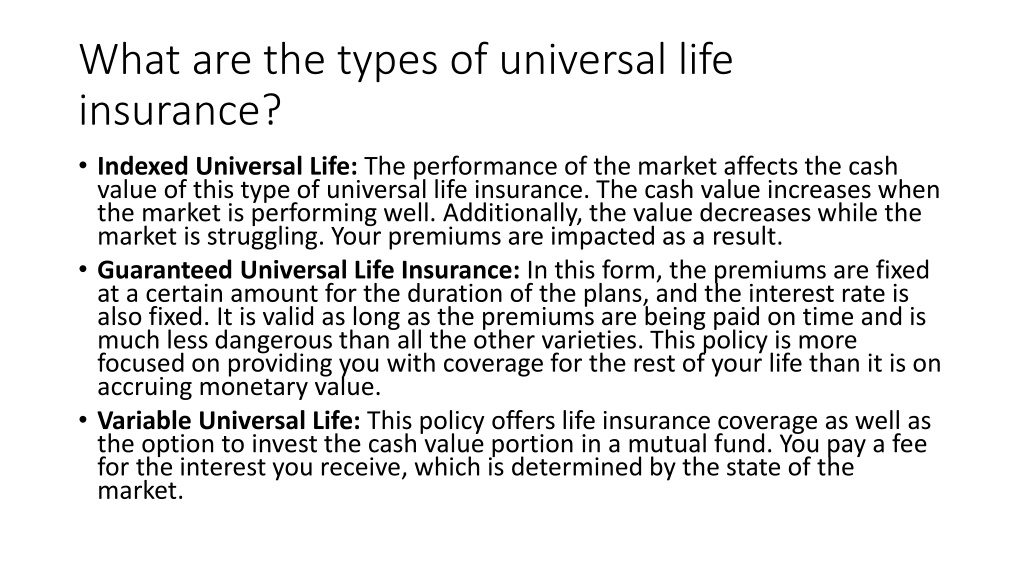

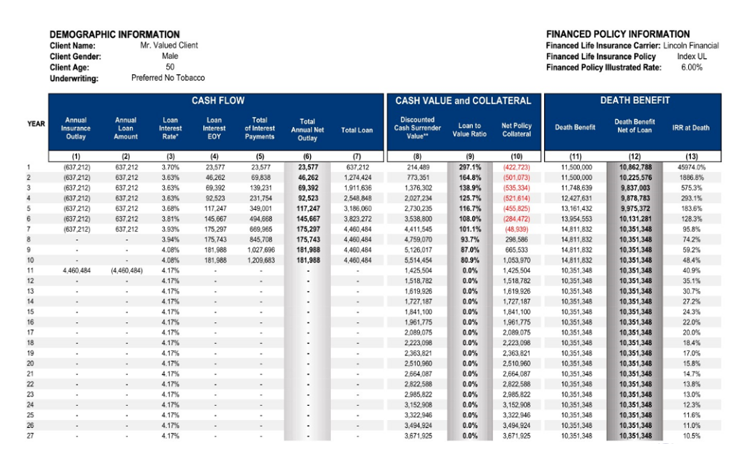

A critical element is the cash value account, which grows tax-deferred based on prevailing interest rates or market performance, depending on the specific UL policy. This cash value can be accessed via policy loans or withdrawals, although these actions can reduce the death benefit and potentially trigger taxes.

The Correct Statement: Interest Crediting

The correct statement regarding universal life insurance is that interest is credited to the cash value account based on current interest rates, subject to a minimum guaranteed rate specified in the policy. This is not a fixed rate for the life of the policy.

Many incorrectly believe that the initial interest rate quoted when purchasing the policy is guaranteed for the entire duration. This misunderstanding can lead to significant financial disappointment.

Debunking Common Misconceptions

A frequent misconception is that UL policies offer guaranteed returns similar to a certificate of deposit. This is false.

Interest rates fluctuate based on market conditions, although a minimum guaranteed rate provides some downside protection. Policyholders should regularly review their policy statements and understand the current crediting rate.

Another common error lies in assuming that premiums remain fixed. While UL offers flexibility in premium payments, insufficient payments can jeopardize the policy.

If the cash value is depleted due to withdrawals, loans, or insufficient premium payments, the policy can lapse, leaving beneficiaries without the intended death benefit. Policyholders must actively manage their policies to ensure they remain in force.

Impact of Misinformation: Who is Affected?

The confusion surrounding UL policies affects a broad range of individuals, from young families seeking long-term financial protection to retirees relying on cash value for supplemental income.

Those who purchased policies years ago, relying on outdated information, are particularly vulnerable. Changes in interest rates and policy fees can significantly impact the performance of their UL policies.

Where is the Problem Occurring?

The problem stems from a combination of factors, including complex policy documents, aggressive sales tactics by some insurance agents, and a lack of ongoing education for policyholders. Insurance companies must be more transparent in communicating policy details and potential risks.

This issue is nationwide, but states with large populations of retirees or those with a history of variable rate investments are experiencing higher levels of concern.

Taking Action: Protecting Your Investment

Policyholders must take proactive steps to understand their UL policies. This includes reviewing policy documents carefully, paying particular attention to the guaranteed minimum interest rate, and assessing the impact of withdrawals and loans.

Consider seeking independent financial advice from a fee-only advisor who is not affiliated with the insurance company that issued the policy. They can provide an unbiased assessment of your policy and help you make informed decisions.

Contact your insurance provider to request a current illustration of your policy's projected performance under various interest rate scenarios. This will help you understand the potential impact of changing market conditions.

Do not delay. Procrastination can lead to irreversible financial consequences. Take action today to protect your life insurance investment.

Next Steps and Ongoing Developments

Several consumer advocacy groups are calling for greater transparency and standardization in the marketing and administration of UL policies. They are urging state insurance regulators to increase oversight and enforcement.

Legislative initiatives aimed at protecting policyholders are under consideration in several states. These proposals include mandatory disclosures of policy fees and charges, as well as restrictions on aggressive sales tactics.

Policyholders should stay informed about these developments and advocate for policies that protect their rights. The fight for clarity and transparency in the insurance industry is ongoing, and your voice matters.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)