How To Avoid Fees On Crypto Com

For cryptocurrency enthusiasts using the Crypto.com platform, navigating the fee structure can be a significant concern. High fees can erode profits, especially for frequent traders or those making smaller transactions. Understanding and implementing strategies to minimize these charges is crucial for maximizing returns and optimizing the overall Crypto.com experience.

This article provides a practical guide on how to avoid or reduce fees on Crypto.com. We'll delve into various methods, from utilizing the CRO token to strategically planning your transactions. By understanding these strategies, users can potentially save a substantial amount of money over time.

Understanding Crypto.com's Fee Structure

Crypto.com employs a tiered fee structure based on your 30-day trading volume. The higher your trading volume, the lower the fees you pay. This applies to both the Crypto.com App and the Crypto.com Exchange.

Withdrawal fees also vary depending on the cryptocurrency and the network being used. Be aware of these fees before initiating any withdrawals.

Using the CRO Token for Reduced Fees

One of the most effective ways to reduce fees on Crypto.com is by staking and using the CRO token, the platform's native cryptocurrency. Staking CRO provides several benefits, including lower trading fees and increased rewards on Crypto Earn and Crypto Credit.

The amount of CRO you stake determines your tier and the corresponding fee reduction. The more CRO you stake, the greater the discount on trading fees.

For example, staking a substantial amount of CRO can move you up to a higher tier, significantly reducing your maker and taker fees on the Crypto.com Exchange. Holding CRO in your Crypto.com App wallet can also unlock enhanced features and rewards.

Utilizing the Crypto.com Exchange

The Crypto.com Exchange generally offers lower fees compared to the Crypto.com App. If you are an active trader, transferring your funds to the Exchange can be a cost-effective strategy.

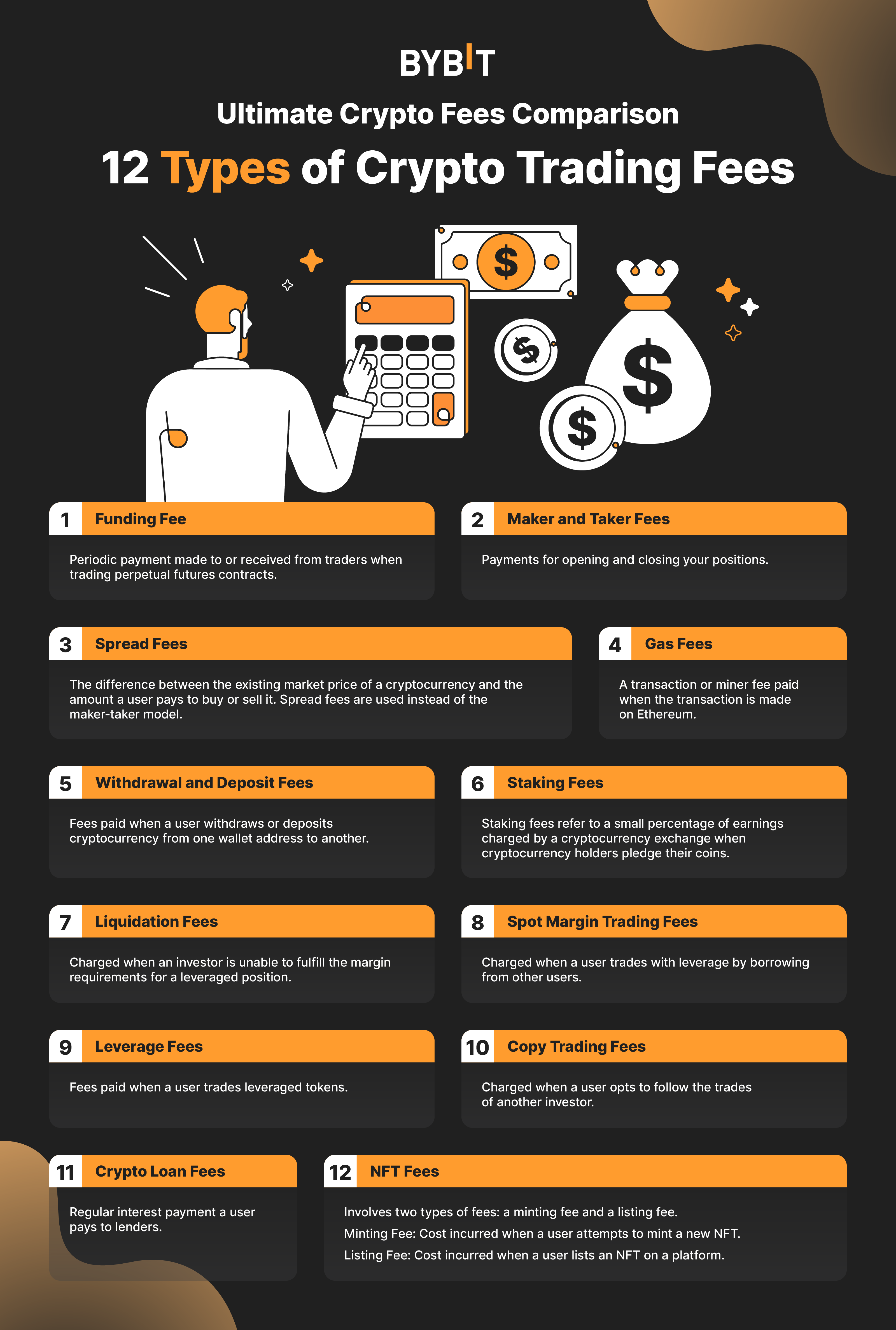

The Exchange uses a maker-taker fee model. Makers are those who place limit orders that are not immediately filled, while takers are those who place market orders that are filled immediately.

Makers typically pay lower fees than takers, incentivizing users to provide liquidity to the platform.

Strategic Trading Practices

Consider consolidating smaller trades into larger, less frequent transactions to minimize the impact of fees. Each trade, regardless of size, incurs a fee, so reducing the number of trades can save you money.

Plan your trades in advance and avoid impulsive decisions. This will help you avoid unnecessary transactions and associated fees.

Utilize limit orders instead of market orders whenever possible to take advantage of the lower maker fees on the Crypto.com Exchange.

Avoiding Withdrawal Fees

Be mindful of the withdrawal fees associated with different cryptocurrencies. These fees vary depending on the network congestion and the specific coin.

Consider using cryptocurrencies with lower withdrawal fees if you need to move funds off the platform frequently. Research the withdrawal fees for different coins before making a deposit or purchase.

If possible, avoid withdrawing small amounts frequently. Instead, consolidate your withdrawals into larger, less frequent transactions to minimize the impact of withdrawal fees.

Leveraging Crypto.com Earn and Crypto Credit

While Crypto.com Earn and Crypto Credit don't directly reduce trading or withdrawal fees, they can help offset these costs by generating passive income or providing access to loans at competitive rates.

By staking your cryptocurrencies in Crypto.com Earn, you can earn interest on your holdings. This interest can help offset the fees you pay on other transactions.

Using Crypto Credit allows you to borrow against your cryptocurrency holdings, potentially avoiding the need to sell your assets and incur trading fees.

Staying Informed About Fee Changes

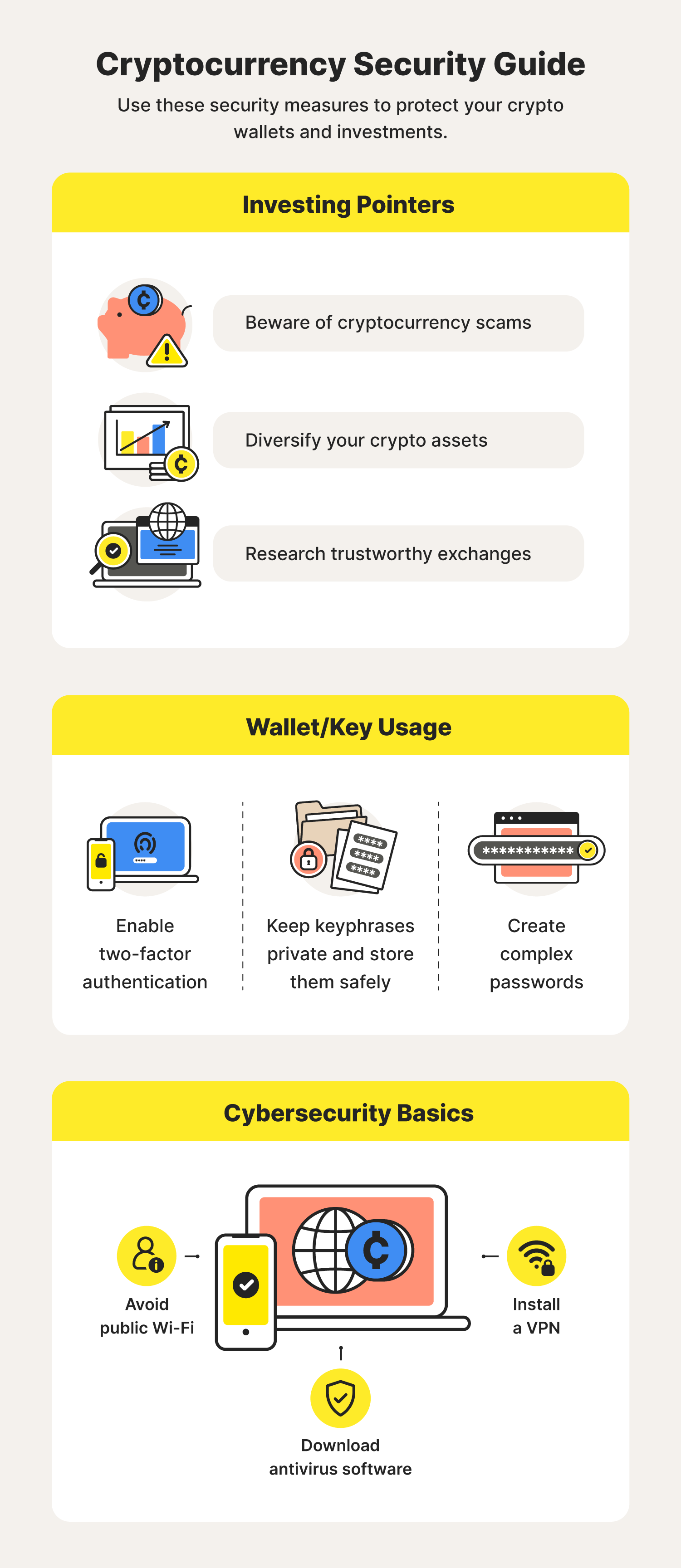

Crypto.com, like all cryptocurrency platforms, may periodically update its fee structure. It is essential to stay informed about these changes to adjust your strategies accordingly.

Regularly check the Crypto.com website and app for announcements regarding fee changes. Subscribe to the official Crypto.com newsletter or follow their social media channels for updates.

Actively monitoring fee changes allows you to adapt your trading and investment strategies to minimize the impact of these changes on your overall profitability.

Conclusion

Navigating the fee structure on Crypto.com effectively requires a combination of strategic planning, utilization of the CRO token, and staying informed about platform updates. By implementing the strategies outlined in this article, users can significantly reduce their fees and maximize their returns on the Crypto.com platform.

Remember to always do your own research and carefully consider your individual circumstances before making any financial decisions. Understanding the nuances of the fee structure and adapting your strategy accordingly can lead to substantial savings over time.

Ultimately, minimizing fees on Crypto.com is about being an informed and strategic user. By taking the time to understand the platform's fee structure and implement the appropriate strategies, you can unlock the full potential of Crypto.com while keeping your costs to a minimum.