How To Block J&k Bank Atm Card Online

Imagine this: You're enjoying a serene evening, perhaps sipping tea while scrolling through your phone, when a sudden thought strikes – "Did I misplace my J&K Bank ATM card?" A wave of mild panic washes over you, disrupting the calm. What if someone finds it? The peace of mind you once had is now replaced with a sense of urgency.

This article serves as your comprehensive guide to immediately block your J&K Bank ATM card online, ensuring the safety of your finances and restoring your peace of mind. We will explore the various methods you can use to quickly disable your card and protect yourself from potential fraud.

Understanding the Importance of Immediate Action

Losing your ATM card can be a stressful experience. Swift action is crucial to prevent unauthorized access to your bank account.

According to J&K Bank's official guidelines, customers are responsible for any transactions made before they report the loss or theft of their card. So, time is of the essence.

Methods to Block Your J&K Bank ATM Card Online

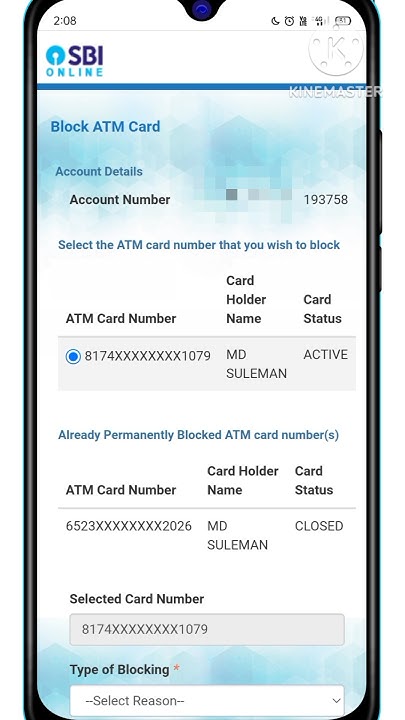

1. Through the J&K Bank Mobile Banking App

The J&K Bank mPAY Delight+ mobile app offers a convenient way to block your ATM card. This method is especially useful if you have your smartphone handy.

Open the app, navigate to the "Cards" section, and select the "Block Card" option. You may be prompted to enter your PIN or other security credentials to confirm your identity before the card is blocked. Once blocked, you will receive a confirmation notification.

2. Via Net Banking

If you have access to the internet banking portal, you can quickly block your card through the website. Log in to your J&K Bank net banking account using your credentials.

Look for the "Debit Card Services" or similar section, where you will find the option to block your ATM card. Follow the instructions provided, and your card will be blocked immediately.

3. Customer Care Helpline

You can also block your J&K Bank ATM card by calling the customer care helpline. J&K Bank provides dedicated customer support numbers for card-related emergencies.

Dial the number provided on the official J&K Bank website or your account statement and follow the instructions given by the customer care representative. Be prepared to provide your account details and other information to verify your identity.

4. SMS Banking

Some banks provide SMS banking facilities to block ATM cards. Check the J&K Bank website for the specific SMS format to block your card.

Typically, you will need to send an SMS to a designated number with a specific keyword and your account details. Make sure you send the SMS from your registered mobile number.

Post-Blocking Steps

After successfully blocking your card, it’s important to take a few more steps. Immediately contact J&K Bank to report the loss or theft of your card.

Request a new card to be issued to you. Consider reviewing your recent transactions to identify any unauthorized activity, and report any discrepancies to the bank.

Staying Safe and Secure

Prevention is always better than cure. To minimize the risk of card-related issues, consider enabling transaction alerts on your account.

This way, you'll receive immediate notifications for any transactions made using your card. Regularly check your bank statements for any suspicious activity.

Losing your ATM card can be unsettling, but knowing that you have the power to quickly block it online can bring immense relief.

The ability to act swiftly in such situations is essential for safeguarding your financial well-being.By utilizing the methods outlined above, you can navigate this situation with confidence and protect your hard-earned money. Remember, staying informed and proactive is key to financial security.