How To Budget For A Small Buisness

For small business owners, meticulous budgeting isn't just good practice; it's often the bedrock of survival and sustainable growth. Navigating the complex financial landscape requires a proactive approach, one that anticipates potential pitfalls and strategically allocates resources.

This article provides a comprehensive guide to building an effective budget, empowering entrepreneurs to take control of their finances and steer their ventures toward success. This includes understanding the fundamental components, utilizing available resources, and adapting to the ever-changing business environment.

Understanding the Basics

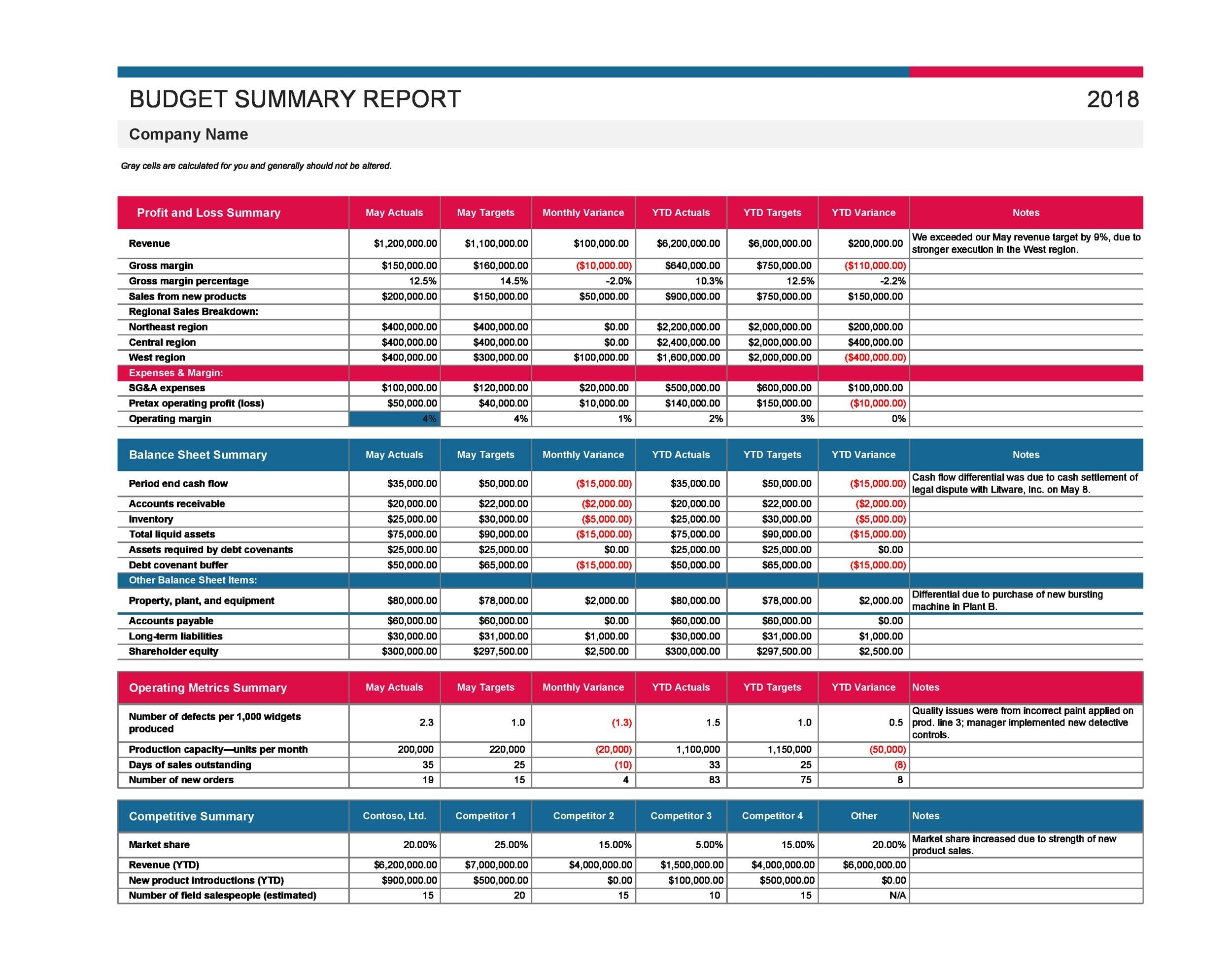

A small business budget is a financial roadmap, outlining projected revenues and expenses over a specific period, typically monthly, quarterly, or annually. It's a vital tool for monitoring cash flow, identifying potential shortfalls, and making informed decisions about investments, hiring, and marketing.

According to the Small Business Administration (SBA), a well-structured budget allows business owners to proactively manage their finances rather than reactively responding to crises. Budgeting helps to ensure that a business has the financial resources to meet its obligations and pursue its goals.

Key Components of a Small Business Budget

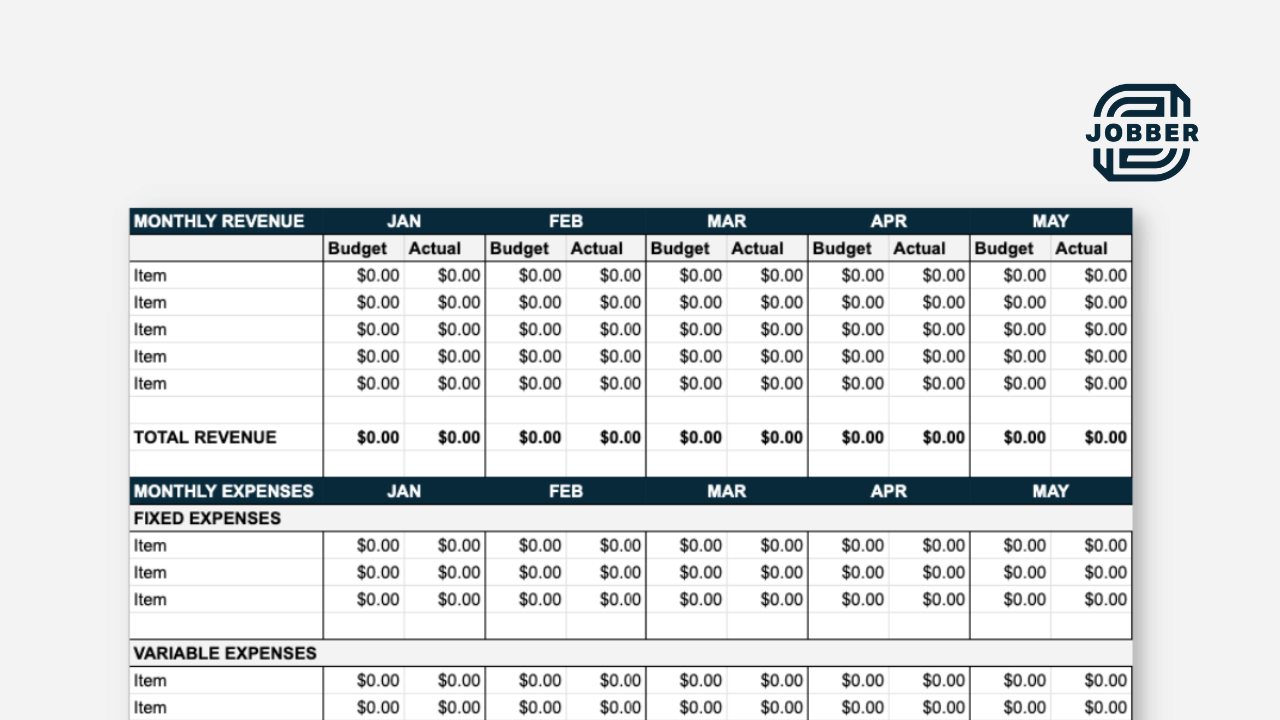

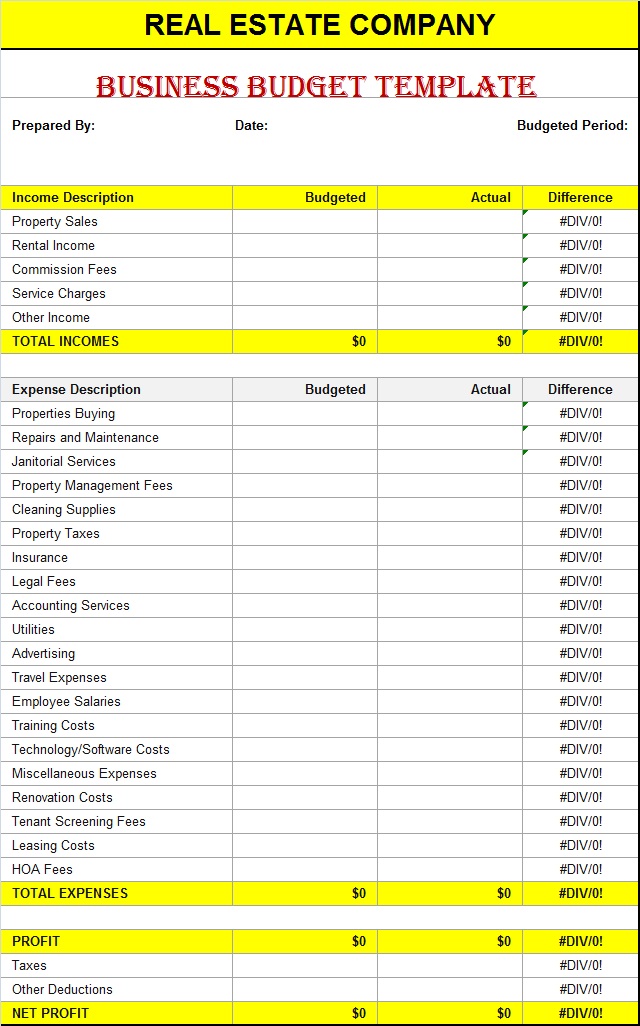

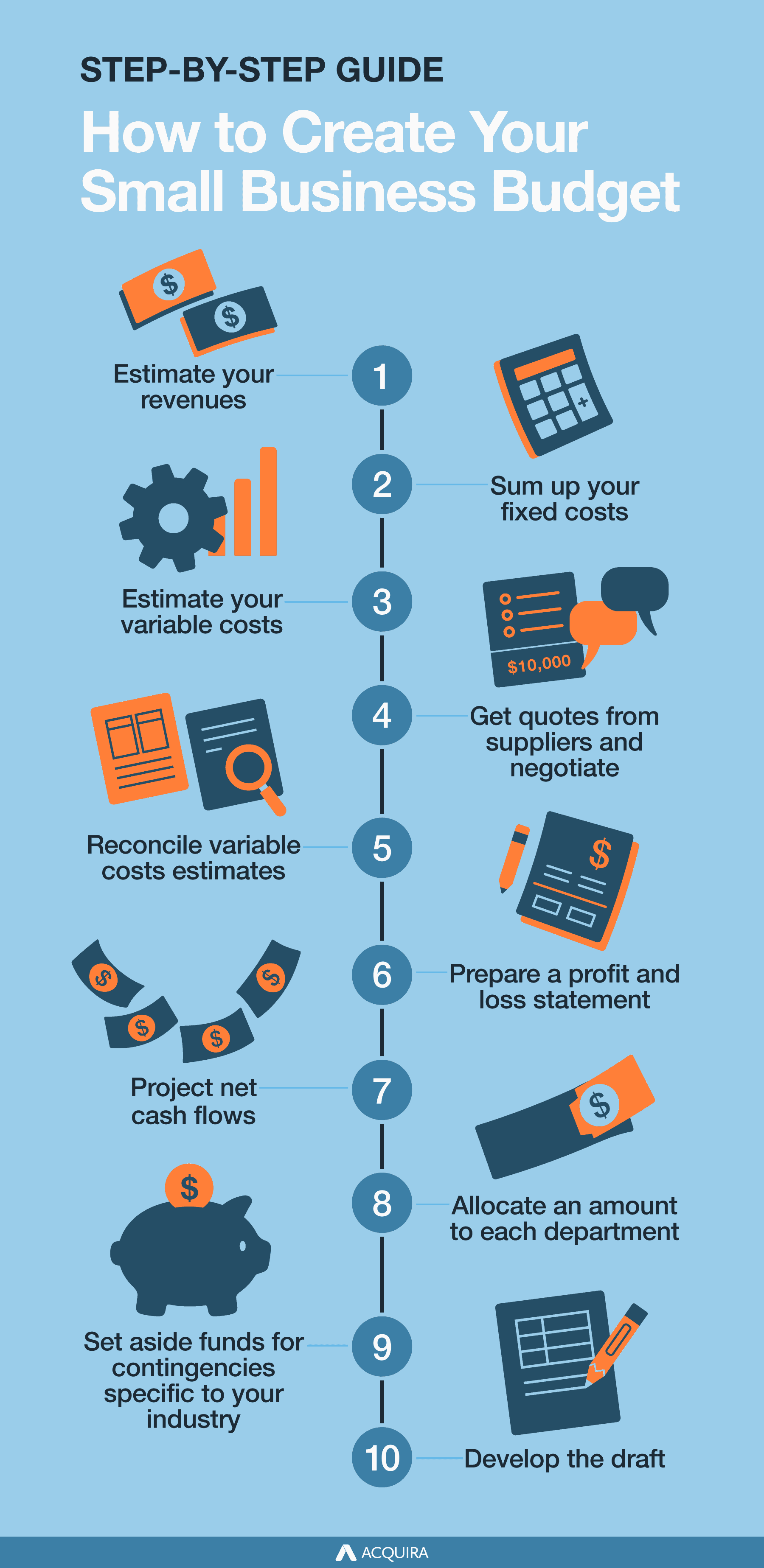

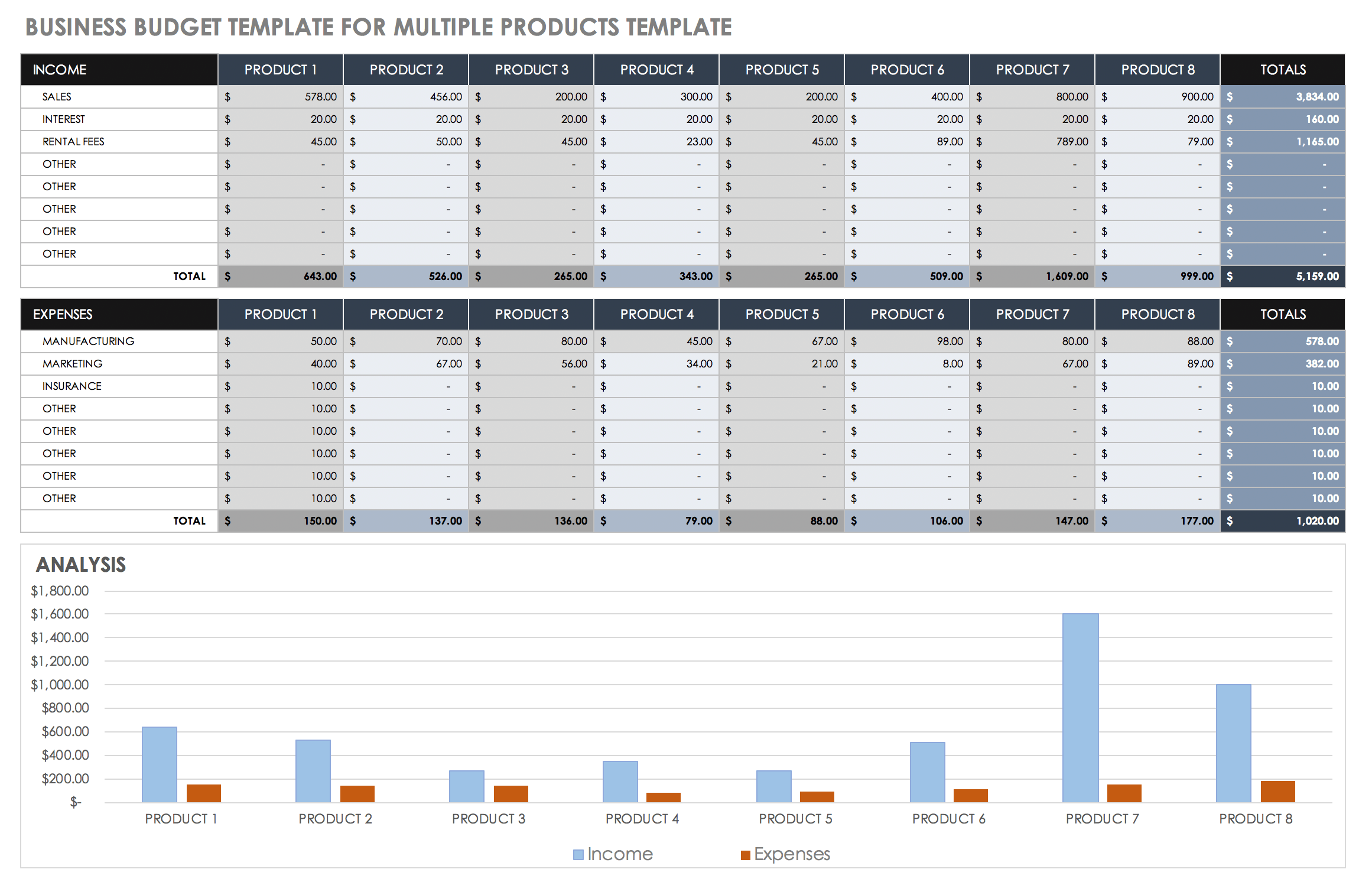

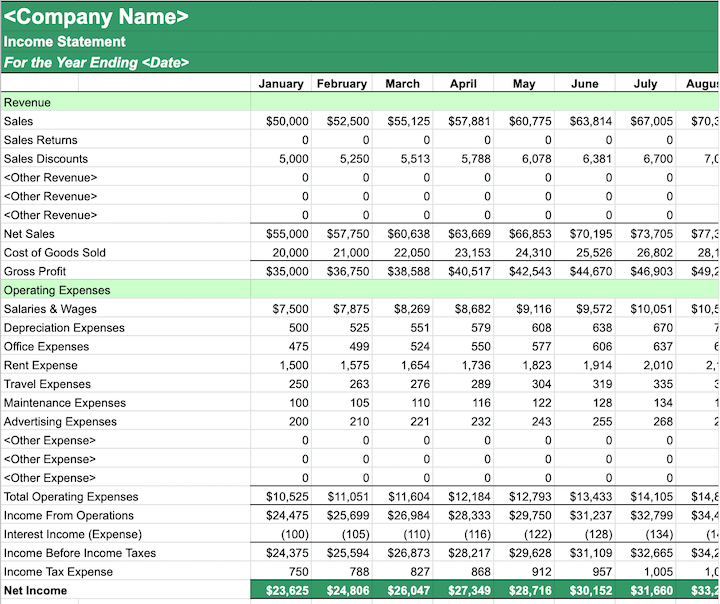

Effective budgeting begins with a thorough assessment of income streams. Projecting sales revenue accurately is crucial, often relying on historical data, market trends, and realistic growth expectations.

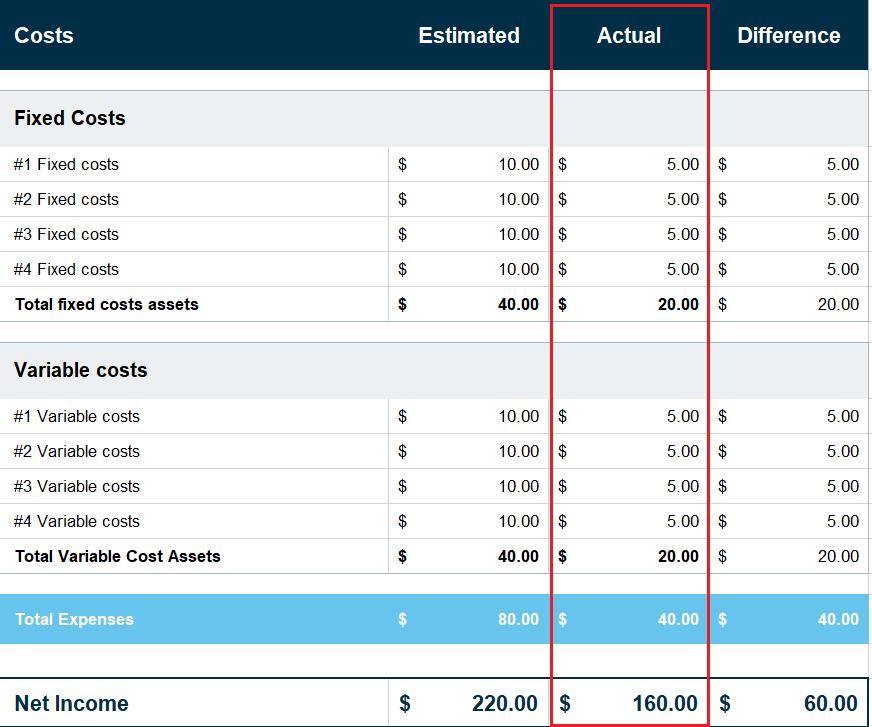

Fixed costs, such as rent, salaries, and insurance premiums, should be accounted for. Variable costs, which fluctuate based on production levels or sales volume, must be carefully estimated.

Cost of Goods Sold (COGS), if applicable, requires consideration, as well as marketing and advertising expenses. Unexpected expenses often crop up; it’s wise to factor in a contingency fund.

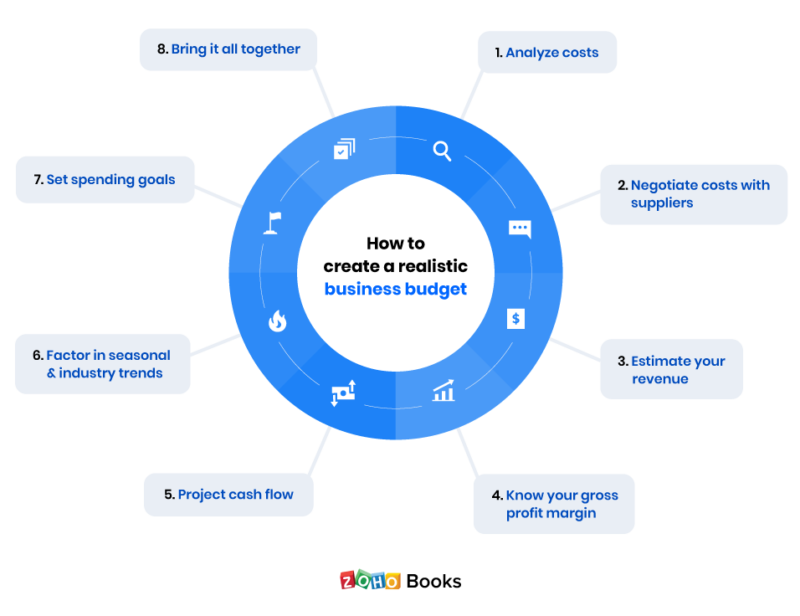

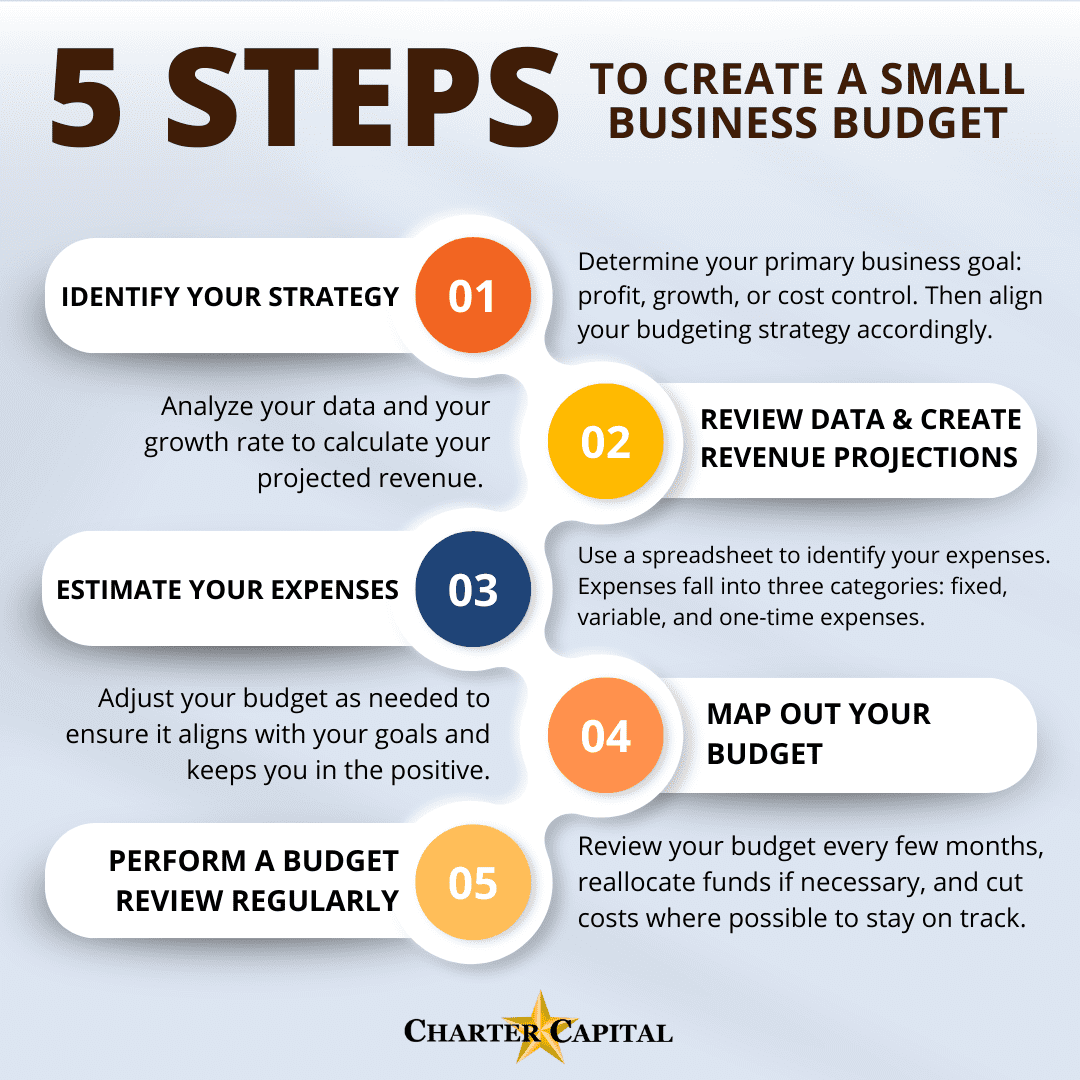

Step-by-Step Budgeting Process

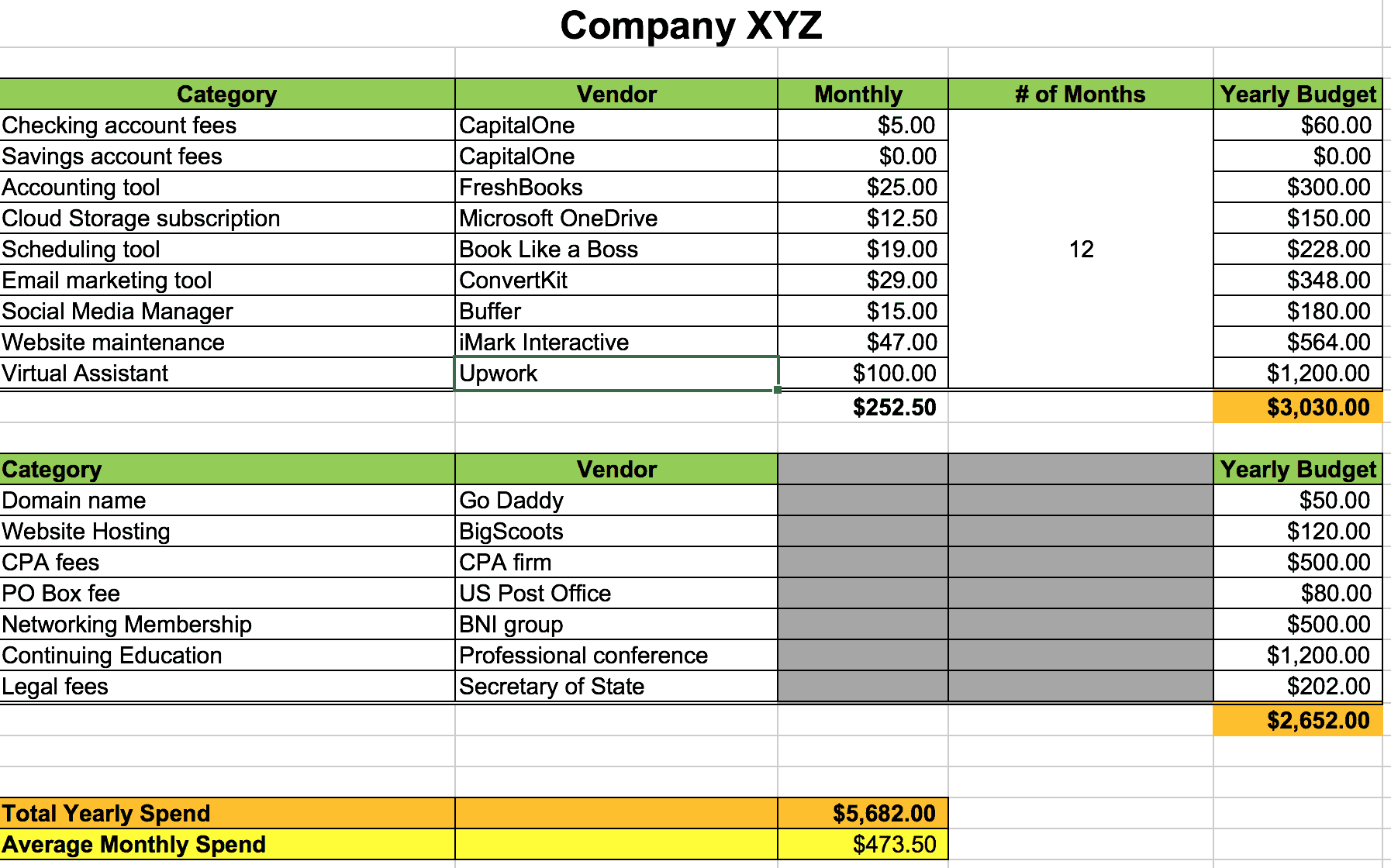

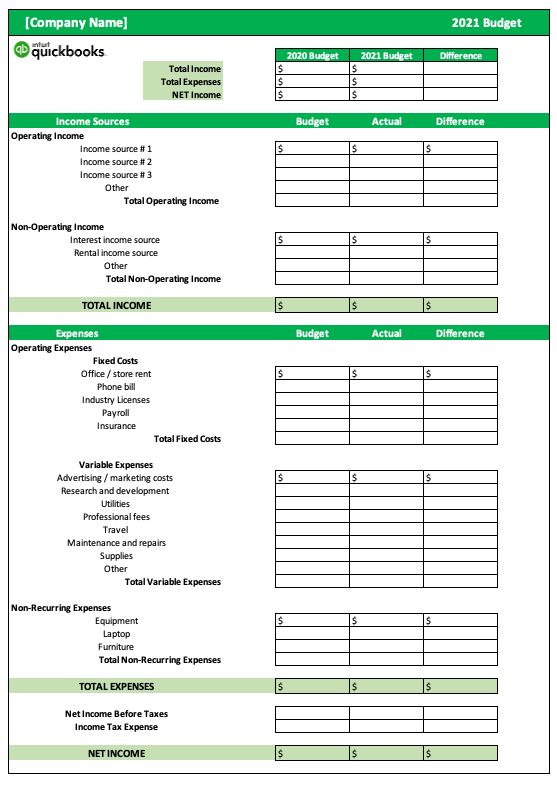

Start by gathering all relevant financial information, including bank statements, sales reports, and expense records. Tools like spreadsheet software (e.g., Microsoft Excel or Google Sheets) can be invaluable for organizing and analyzing this data.

Next, project your sales revenue based on historical data, market research, and anticipated growth. Be realistic and consider potential market fluctuations or seasonal variations.

List all your fixed expenses (rent, salaries, insurance) and variable expenses (materials, utilities, marketing). Differentiate between necessary and discretionary spending.

Budgeting Tools and Resources

Numerous budgeting software options cater specifically to small businesses. These tools often automate tasks, provide insightful reports, and integrate with accounting software.

The SBA offers free resources and counseling services to help small businesses develop effective budgets. SCORE, a non-profit organization, provides mentorship and workshops on financial management.

Local community colleges and business organizations frequently offer courses and workshops on small business budgeting. These resources provide valuable insights and practical skills.

Staying on Track and Adapting

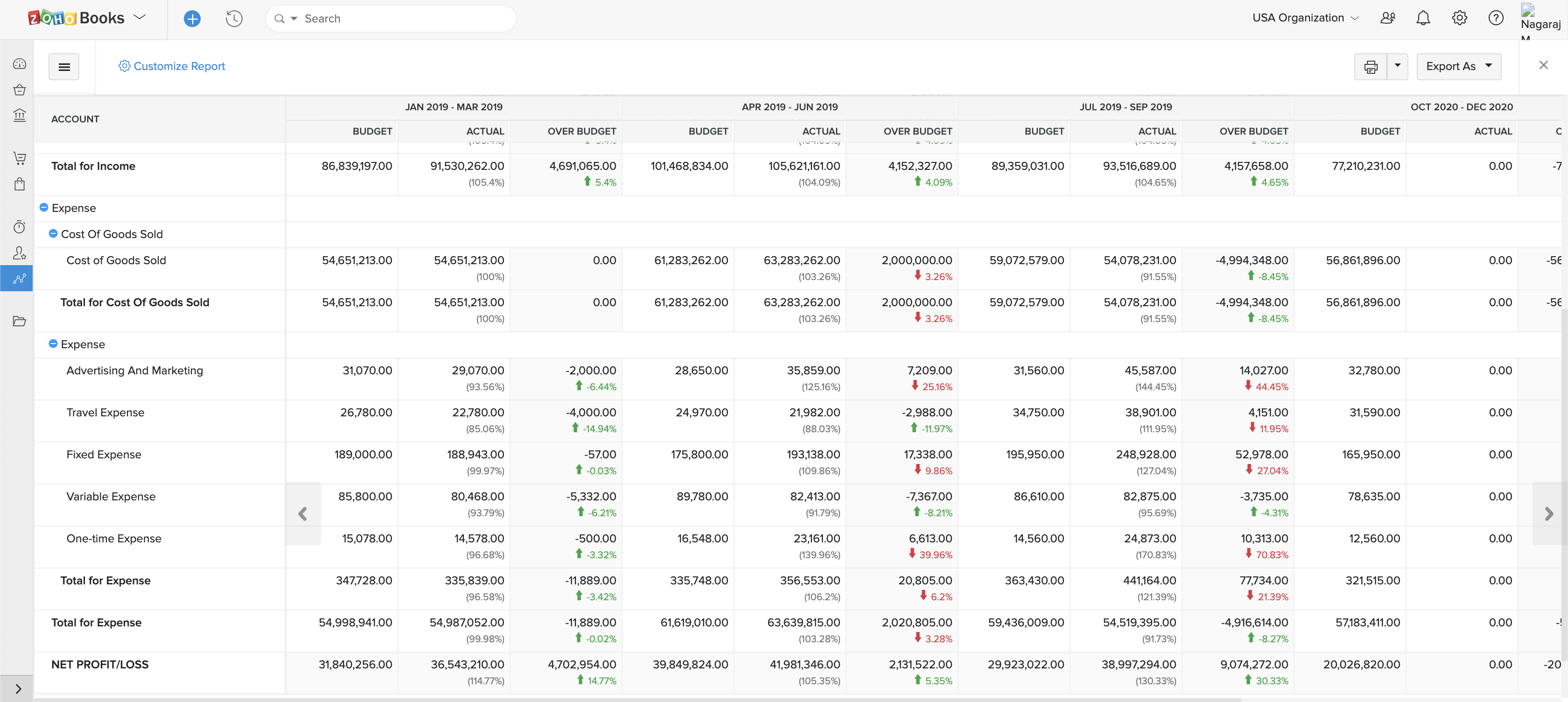

A budget isn't a static document; it should be regularly reviewed and adjusted based on actual performance. Compare your budgeted figures with your actual results to identify discrepancies and areas for improvement.

Regularly monitor your cash flow, as cash shortages can quickly cripple a small business. Adjust your budget as needed to reflect changes in market conditions, customer demand, or operating costs.

Flexibility is key; prepare for unexpected expenses and adapt your budget to seize new opportunities or weather unforeseen challenges. A robust budget will help guide you toward profitability and sustainability.