How To Buy A Business With No Money Down

The dream of owning a business without putting down a significant personal investment seems like an impossible feat for many aspiring entrepreneurs. However, a range of strategies exists that allow determined individuals to acquire a company with little to no money down. These methods, while complex and requiring diligent effort, are gaining traction as alternative paths to business ownership.

This article will explore these strategies, outlining the key considerations and potential pitfalls associated with acquiring a business with minimal upfront capital. Understanding these nuances is crucial for anyone considering this unconventional approach to entrepreneurship.

Understanding the Landscape of No-Money-Down Acquisitions

The concept of buying a business with no money down hinges on creative financing and negotiation skills. It's not a magic bullet, but rather a combination of techniques that shift the risk and burden of financing from the buyer to the seller or other financial institutions. Several approaches can be used, each with its own set of requirements and challenges.

Seller Financing: A Common Starting Point

One of the most prevalent methods is seller financing, where the seller essentially acts as the bank. Instead of receiving the entire purchase price upfront, the seller agrees to receive payments over time, often with interest. This is a win-win situation if the seller believes in the business's future potential and is willing to share in the risk.

Sellers might choose this route for several reasons, including tax advantages or a desire to ensure the business's continued success under new ownership. However, securing seller financing requires building trust and demonstrating a clear understanding of the business and a solid plan for its future.

Leveraged Buyouts (LBOs): Utilizing the Business's Assets

Leveraged buyouts (LBOs) involve using the assets and cash flow of the business being acquired to secure financing. This is typically done through a combination of debt and equity, with the debt often collateralized by the business's assets.

LBOs are more common with larger, more established businesses with predictable cash flows. Success depends on the business's ability to generate sufficient cash flow to cover the debt payments.

Earnouts: Proving Your Worth

An earnout agreement allows the buyer to pay a portion of the purchase price based on the future performance of the business. This motivates the buyer to improve the business and assures the seller that they are getting a fair price based on potential future value.

Earnouts are particularly useful when the business's current value is uncertain or dependent on the buyer's ability to improve its performance. Clearly defining the metrics for triggering the earnout payments is crucial to avoid disputes.

Assuming Existing Debt: Taking on the Liabilities

In some cases, it may be possible to acquire a business by assuming its existing debt. This effectively transfers the responsibility for repaying the debt to the new owner.

Careful due diligence is essential to understand the terms and conditions of the existing debt and to ensure that the business can realistically service the debt. This approach can reduce the need for upfront capital, but it also increases the financial risk.

The Importance of Due Diligence and Negotiation

Regardless of the chosen strategy, thorough due diligence is paramount. This involves a comprehensive review of the business's financial records, legal documents, and operational procedures.

Understanding the business's strengths, weaknesses, and potential risks is essential for making informed decisions and negotiating favorable terms. Engaging with legal and financial advisors is highly recommended.

Negotiation skills are also critical for success. Buyers must be able to articulate their vision for the business, demonstrate their ability to manage it effectively, and negotiate favorable terms that minimize their upfront investment.

Potential Risks and Challenges

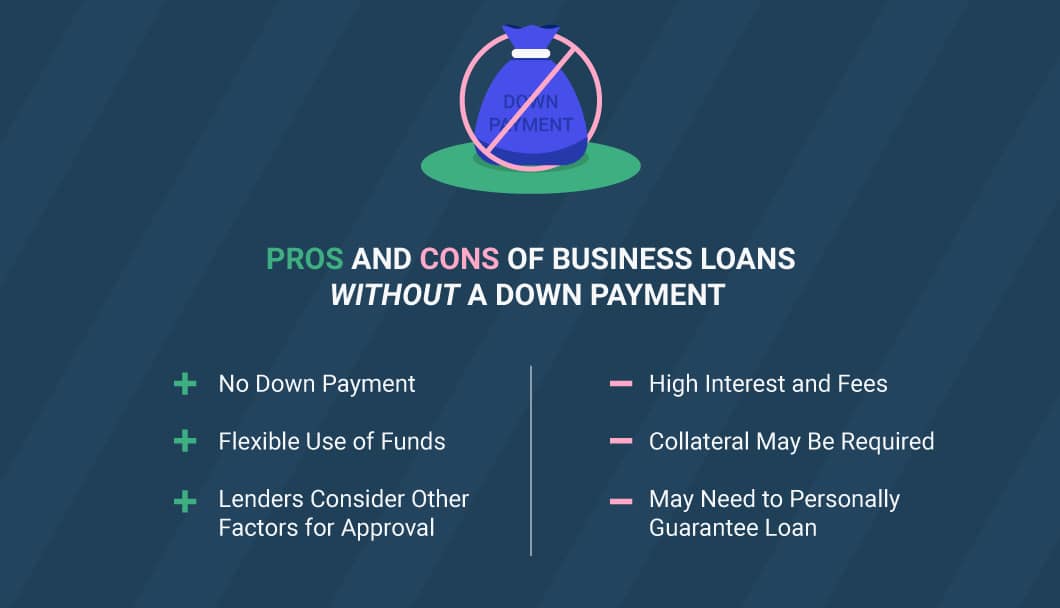

Acquiring a business with no money down is not without its risks. The buyer may face higher interest rates or more restrictive loan terms due to the perceived higher risk.

Furthermore, the pressure to generate cash flow to meet debt obligations can be intense, potentially leading to financial strain. A well-defined business plan and strong management skills are essential to mitigate these risks.

Finally, disagreements with the seller, especially in seller-financed deals or earnout arrangements, can arise. Clear and comprehensive legal agreements are crucial to protect both parties.

The Future of No-Money-Down Acquisitions

As traditional financing becomes more challenging, creative acquisition strategies like no-money-down deals may become increasingly popular. However, the success of these transactions depends on careful planning, diligent execution, and a strong understanding of the associated risks.

For aspiring entrepreneurs with limited capital, these strategies offer a potential pathway to business ownership. But, success hinges on a realistic assessment of their capabilities and a commitment to overcoming the inherent challenges.

Ultimately, acquiring a business with no money down is not just about minimizing upfront investment; it's about building a sustainable and profitable enterprise. The future of the business, and the success of the buyer, relies on a solid foundation of planning, negotiation, and unwavering commitment.