How To Calculate Income From Continuing Operations

Understanding a company’s financial health requires delving beyond the surface of net income. One crucial metric for investors and analysts is income from continuing operations. This figure provides a clearer picture of a company's core business performance by isolating profits generated from its ongoing activities.

Income from continuing operations reveals the profitability of a company's main business, excluding gains or losses from discontinued operations, extraordinary items, and accounting changes. Calculating it accurately is essential for investors seeking to assess a company's sustainable earning power. This figure is often used in financial modeling and valuation to determine a company's true intrinsic value.

The Formula: A Step-by-Step Guide

The calculation of income from continuing operations starts with the company's revenue.

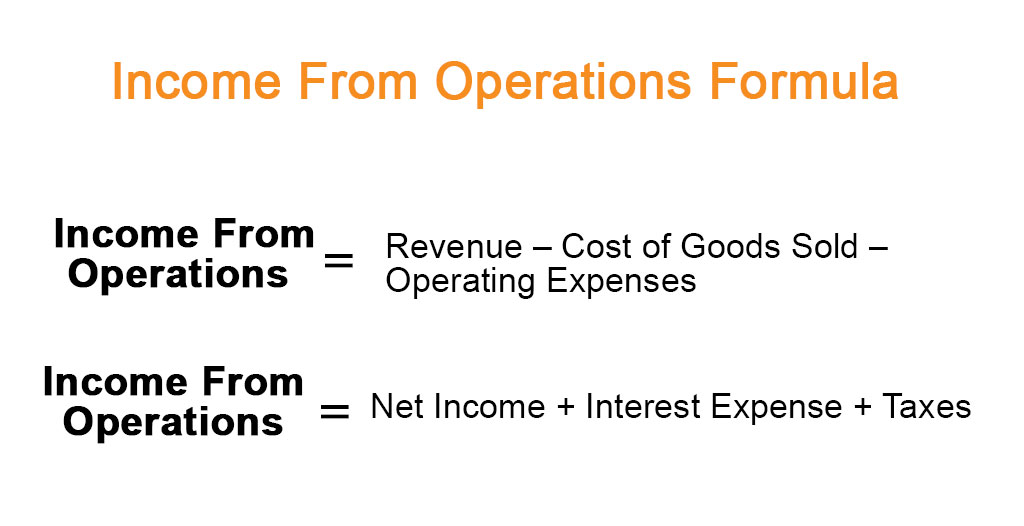

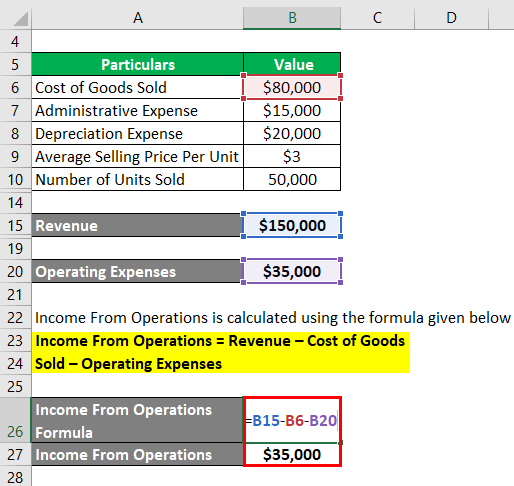

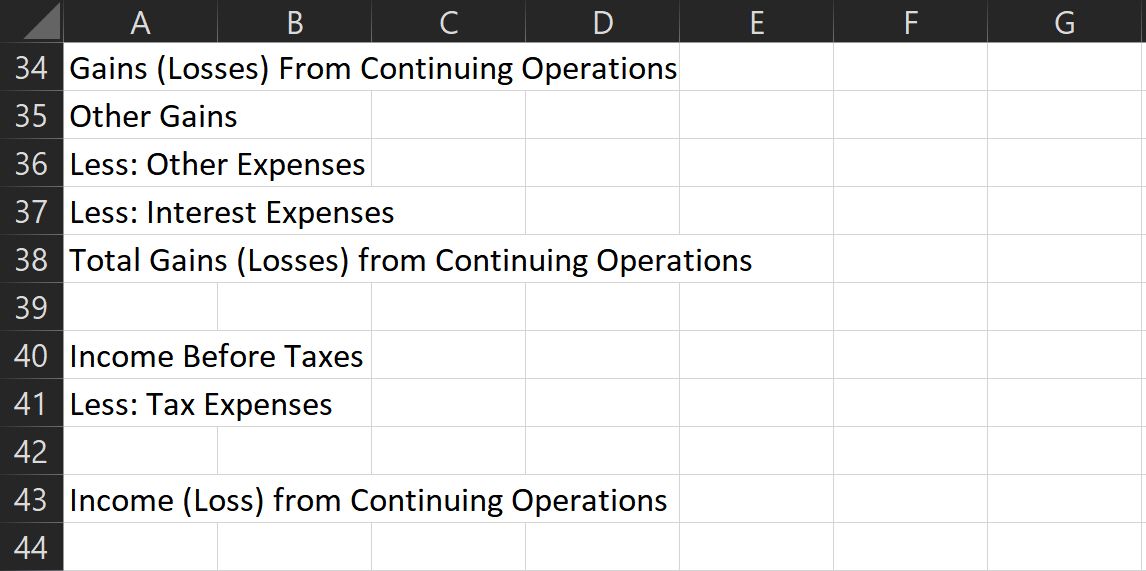

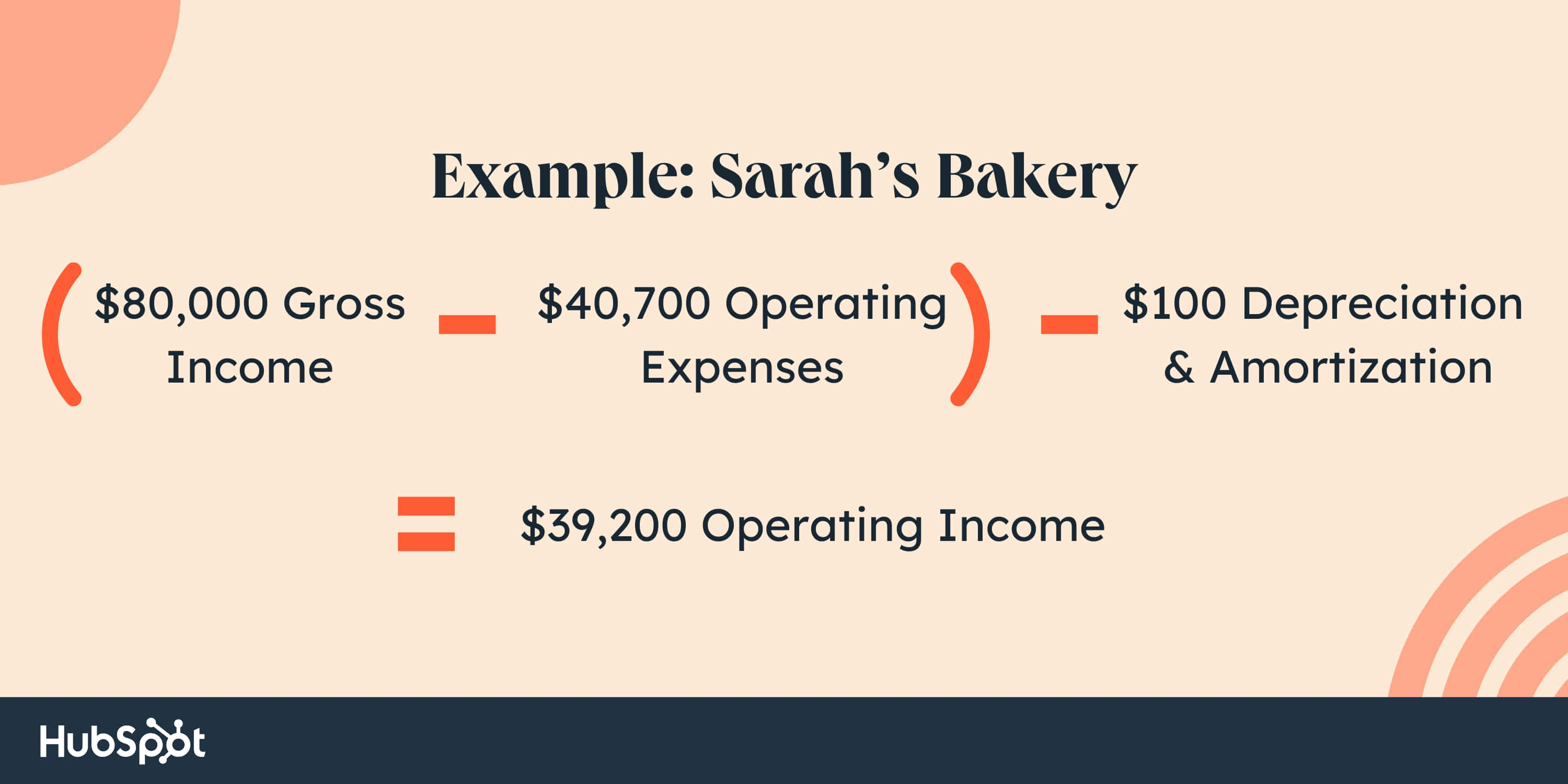

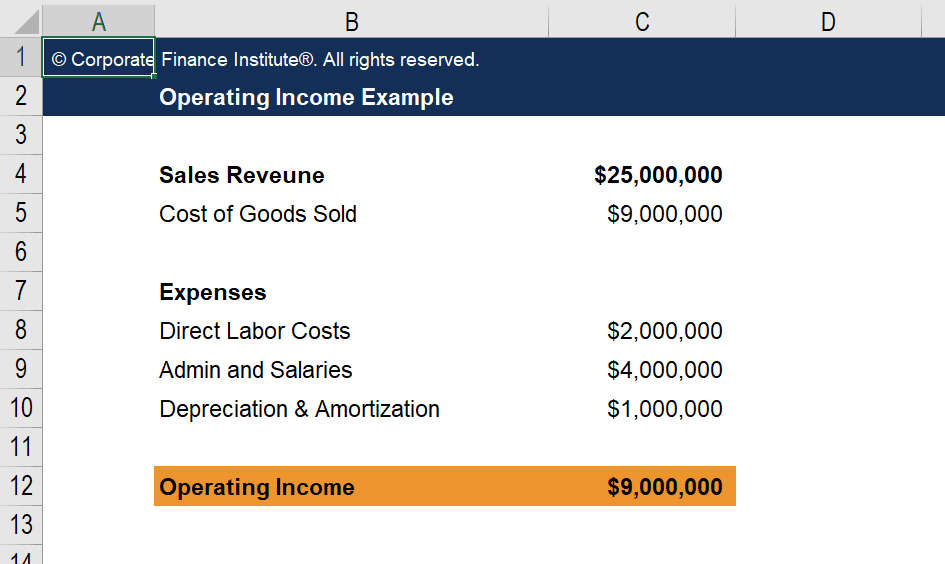

Step 1: Begin with the company's gross profit. This is calculated by subtracting the cost of goods sold (COGS) from total revenue. Gross profit reflects the profitability of a company's production and sales activities before considering operating expenses.

Step 2: Deduct operating expenses from the gross profit. Operating expenses include items such as salaries, rent, marketing costs, and depreciation. This step yields the operating income, also known as earnings before interest and taxes (EBIT).

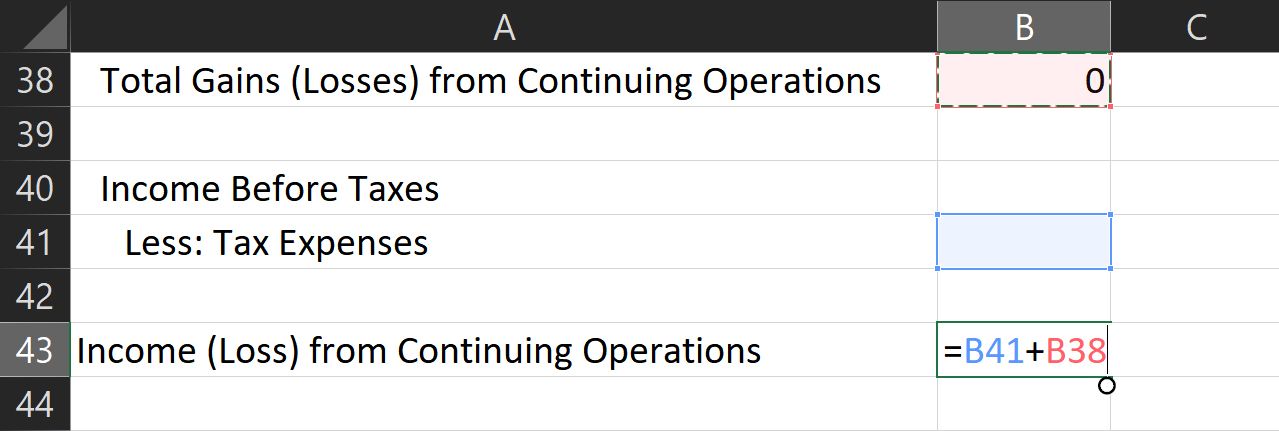

Step 3: Adjust for interest expense. Subtract interest expenses from the operating income to arrive at earnings before taxes (EBT). Interest expense represents the cost of borrowing money and must be accounted for before calculating income taxes.

Step 4: Account for income taxes. Subtract income taxes from the earnings before taxes (EBT) to arrive at the final figure: income from continuing operations. This is the profit generated solely from the company's core business activities, after all relevant expenses and taxes have been paid.

Understanding Discontinued Operations

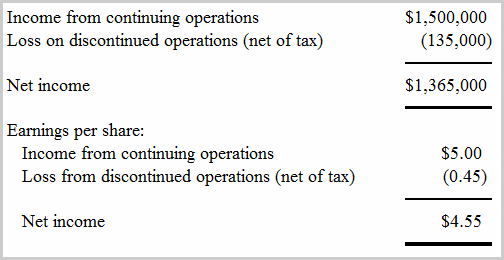

The key difference between net income and income from continuing operations lies in how discontinued operations are treated.

Discontinued operations are business segments that a company has sold, spun off, or otherwise disposed of, and are no longer part of its ongoing activities. The profits or losses from these discontinued segments are reported separately from the income from continuing operations.

When analyzing a company's financial performance, it’s crucial to remove the impact of discontinued operations from the analysis of continuing business performance. This allows investors to focus on the sustainability of the core business.

Where to Find the Numbers

The information needed to calculate income from continuing operations is readily available in a company's income statement.

Publicly traded companies are required to file quarterly (10-Q) and annual (10-K) reports with the Securities and Exchange Commission (SEC). These reports include detailed financial statements, including the income statement.

Investors can find these reports on the company's investor relations website or through the SEC's EDGAR database.

Why It Matters: Investor Perspective

Income from continuing operations is a critical metric for investors because it provides insight into the long-term profitability and sustainability of a company's core business.

Unlike net income, which can be skewed by one-time gains or losses from discontinued operations, income from continuing operations offers a more reliable picture of a company's recurring earnings power.

Analysts and investors often use this figure to project future earnings, value the company, and make informed investment decisions. A consistently growing income from continuing operations suggests a healthy and well-managed business.

Example Scenario

Let's consider a hypothetical company, Tech Solutions Inc. In its income statement, Tech Solutions Inc. reported total revenue of $10 million and a cost of goods sold of $4 million.

This results in a gross profit of $6 million. The company also reported operating expenses of $2 million and interest expenses of $500,000. Finally, income tax expenses were $875,000.

To calculate the income from continuing operations: Subtract the $2 million in operating expenses from the $6 million gross profit (resulting in an operating income of $4 million). Then subtract the $500,000 interest expense (resulting in EBT of $3.5 million). Then subtract the $875,000 in income taxes. Tech Solutions Inc.’s income from continuing operations would be $2,625,000.

Potential Pitfalls and Considerations

While income from continuing operations is a valuable metric, it's important to consider its limitations.

Accounting practices can influence the reported figures, so it's crucial to compare companies within the same industry and evaluate their accounting methods. Additionally, this metric does not account for non-cash items such as depreciation and amortization, which can significantly impact a company's cash flow.

It's essential to consider this metric in conjunction with other financial ratios and metrics, such as cash flow from operations and earnings per share (EPS), to gain a holistic view of a company's financial performance. Relying solely on one metric can lead to incomplete or inaccurate assessments.

Conclusion

Calculating and understanding income from continuing operations is vital for assessing a company's financial health. This metric allows investors to discern the true profitability of a company's core business by excluding the impact of discontinued operations and other non-recurring items. By carefully analyzing this figure, investors can make more informed decisions and gain a deeper understanding of a company's long-term earning potential.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)