Is Goodwill A Private Foundation For Tax Purposes

Imagine a bustling thrift store, the air thick with the scent of gently used clothing and forgotten treasures. Sunlight streams through the large windows, illuminating racks of colorful garments and shelves stacked high with household goods. A steady stream of shoppers, from bargain hunters to vintage enthusiasts, weave through the aisles, each hoping to find a hidden gem while supporting a good cause. But behind the familiar facade of Goodwill lies a complex question: Is this beloved charity actually a private foundation for tax purposes?

This question, while seemingly technical, has significant implications for how Goodwill operates and how it’s perceived by the public. The classification hinges on factors like funding sources, board structure, and the breadth of its public support.

Understanding whether Goodwill meets the criteria of a public charity or a private foundation is crucial for donors, employees, and the communities it serves.

The Landscape of Charitable Organizations

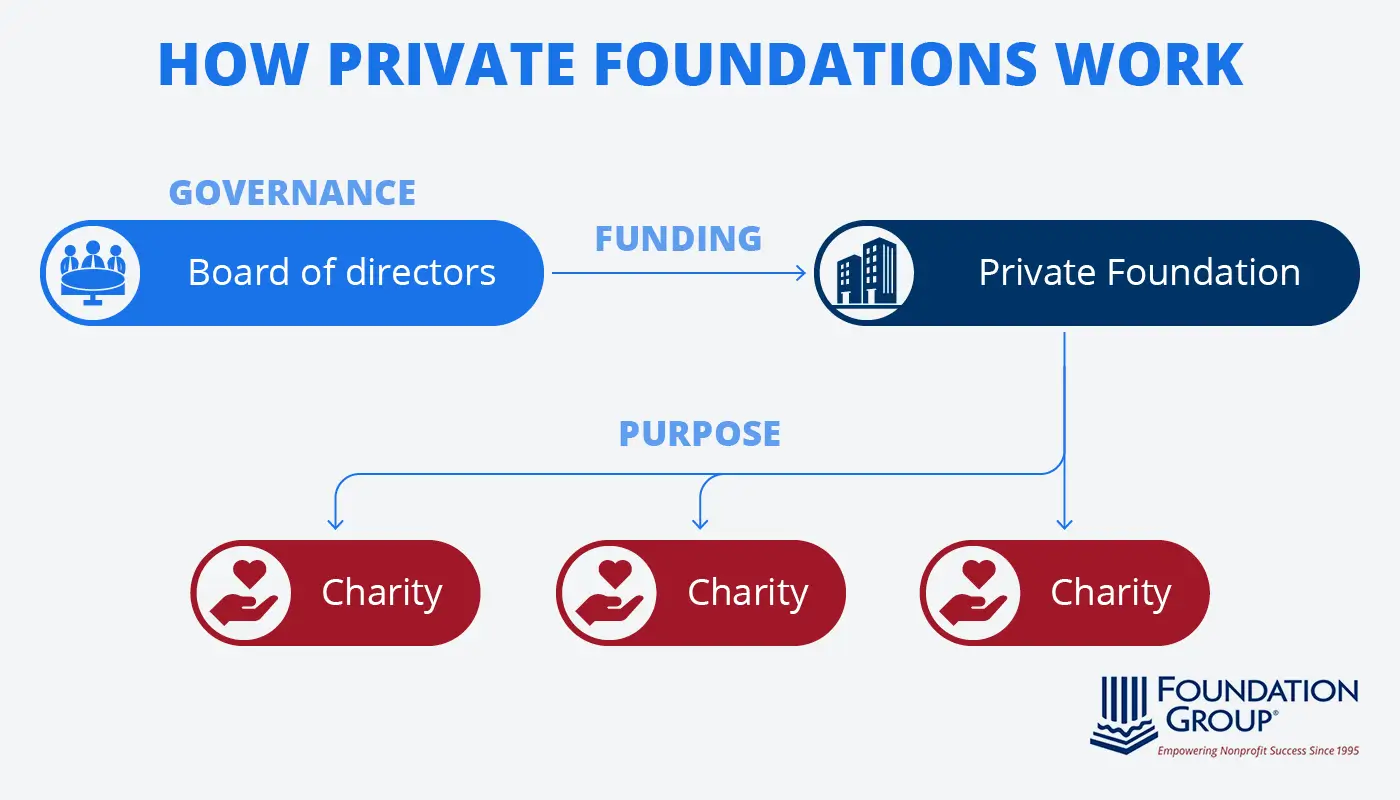

To understand the debate, it's important to grasp the fundamental differences between public charities and private foundations. Public charities, as defined by the IRS, generally receive a substantial portion of their support from the general public or from other public charities.

They engage in activities that directly benefit the community, such as providing education, healthcare, or poverty relief.

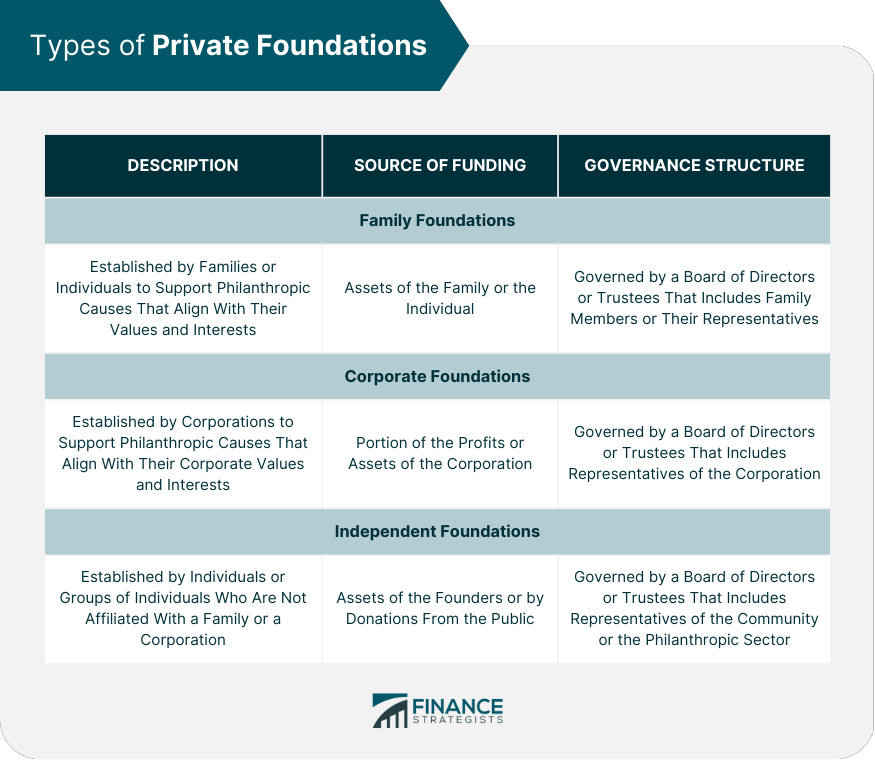

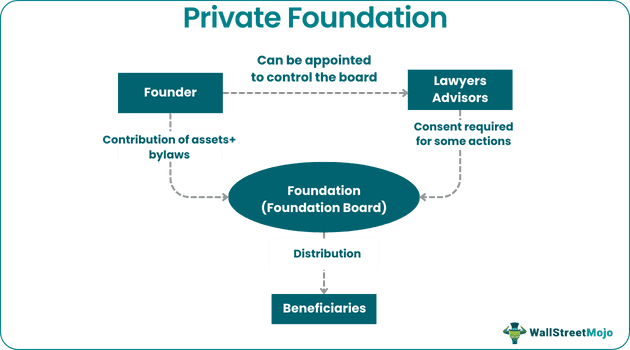

Private foundations, on the other hand, typically receive their support from a single source, such as an individual, family, or corporation.

Their primary purpose is often to make grants to other organizations rather than directly operating charitable programs.

Key Differences in Tax Treatment

The IRS classifies charities as either 501(c)(3) public charities or 501(c)(3) private foundations.

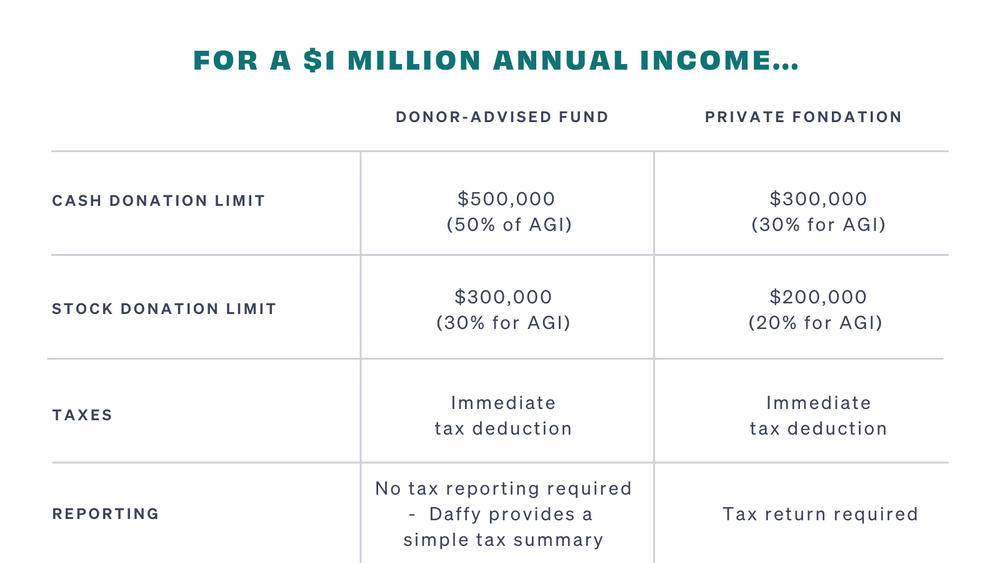

This classification affects tax treatment, with public charities generally enjoying more favorable tax benefits. Contributions to public charities are typically more deductible for donors than contributions to private foundations.

Private foundations are also subject to stricter regulations and excise taxes on investment income and certain activities.

Goodwill: A Closer Look

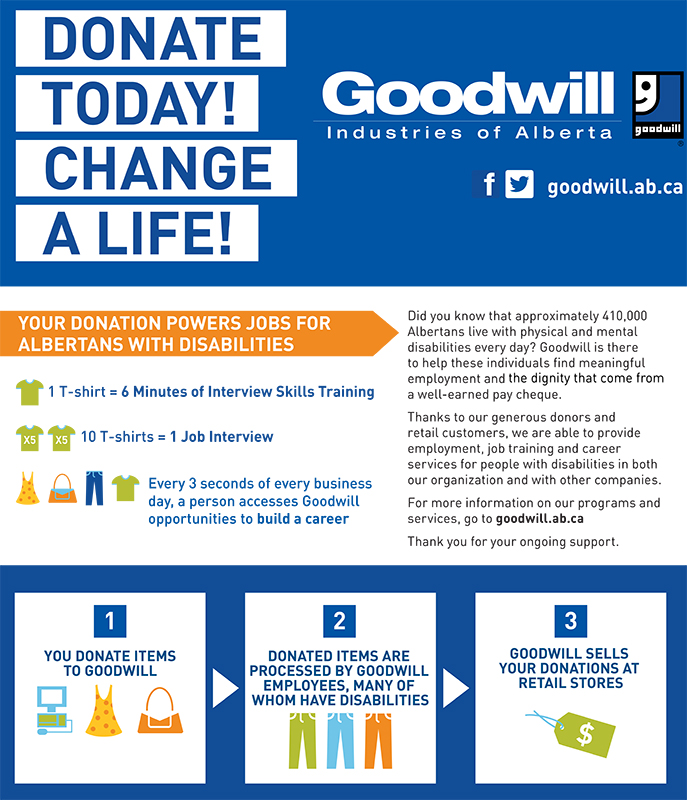

Goodwill Industries International is a network of independent, community-based organizations. Each operates autonomously but adheres to the overall Goodwill mission: to provide job training, employment placement services, and other community-based programs for people who have barriers preventing them from otherwise obtaining a job.

Goodwill derives its revenue from a variety of sources, including the sale of donated goods, government grants, and private contributions. This diverse funding model is a key factor in determining its tax status.

The organization's expansive reach is impressive. They have operations across North America and worldwide.

Arguments for Public Charity Status

Goodwill makes a strong case for its classification as a public charity.

A significant portion of its revenue comes from the sale of donated goods, reflecting broad public support.

Furthermore, Goodwill actively engages in programs that directly benefit the community, such as job training and placement services.

These activities align with the core mission of a public charity: to provide direct services that improve the lives of individuals and communities.

Examining the Criteria

The IRS uses a two-part test to determine whether an organization qualifies as a public charity: the *support test* and the *organizational test*.

The support test requires that an organization receive a substantial portion of its support from the general public or from other public charities.

The organizational test requires that the organization be organized and operated exclusively for charitable purposes.

Goodwill generally meets both of these criteria, given its diverse funding sources and its commitment to providing community-based services.

The Question of Local Control

The decentralized structure of Goodwill presents a unique aspect to this discussion.

Each local Goodwill operates independently, which could influence its specific funding sources and community engagement strategies.

Therefore, the determination of whether Goodwill is a private foundation might need to be assessed at the local level.

This nuanced approach would consider the specific circumstances of each Goodwill organization, ensuring a more accurate classification.

The IRS Perspective

According to publicly available information, the IRS generally recognizes Goodwill Industries International and its affiliated organizations as public charities under section 501(c)(3) of the Internal Revenue Code.

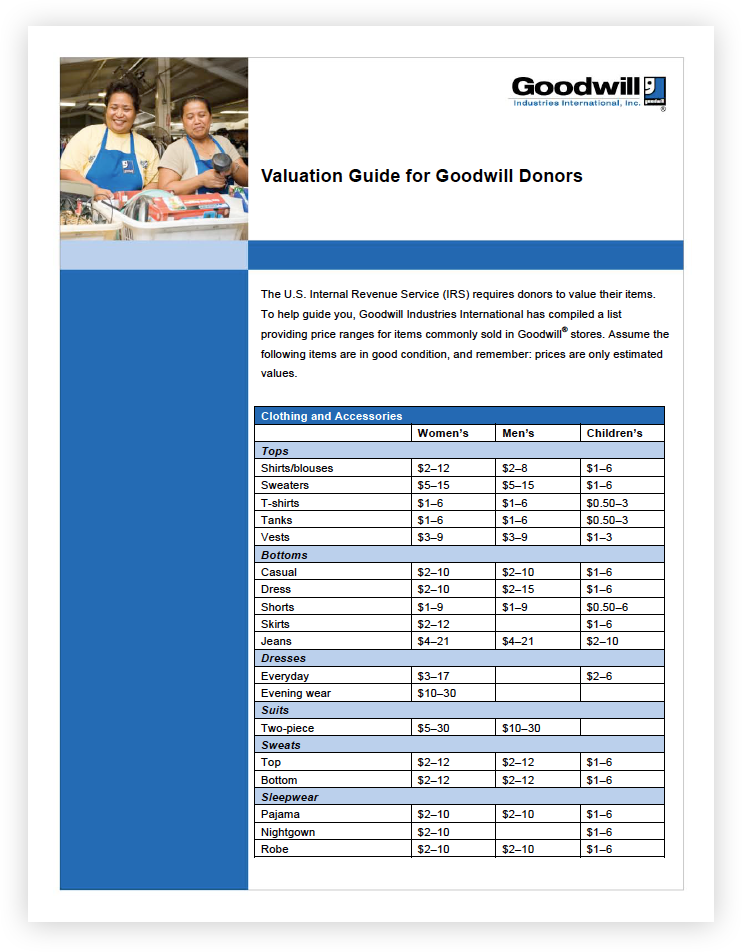

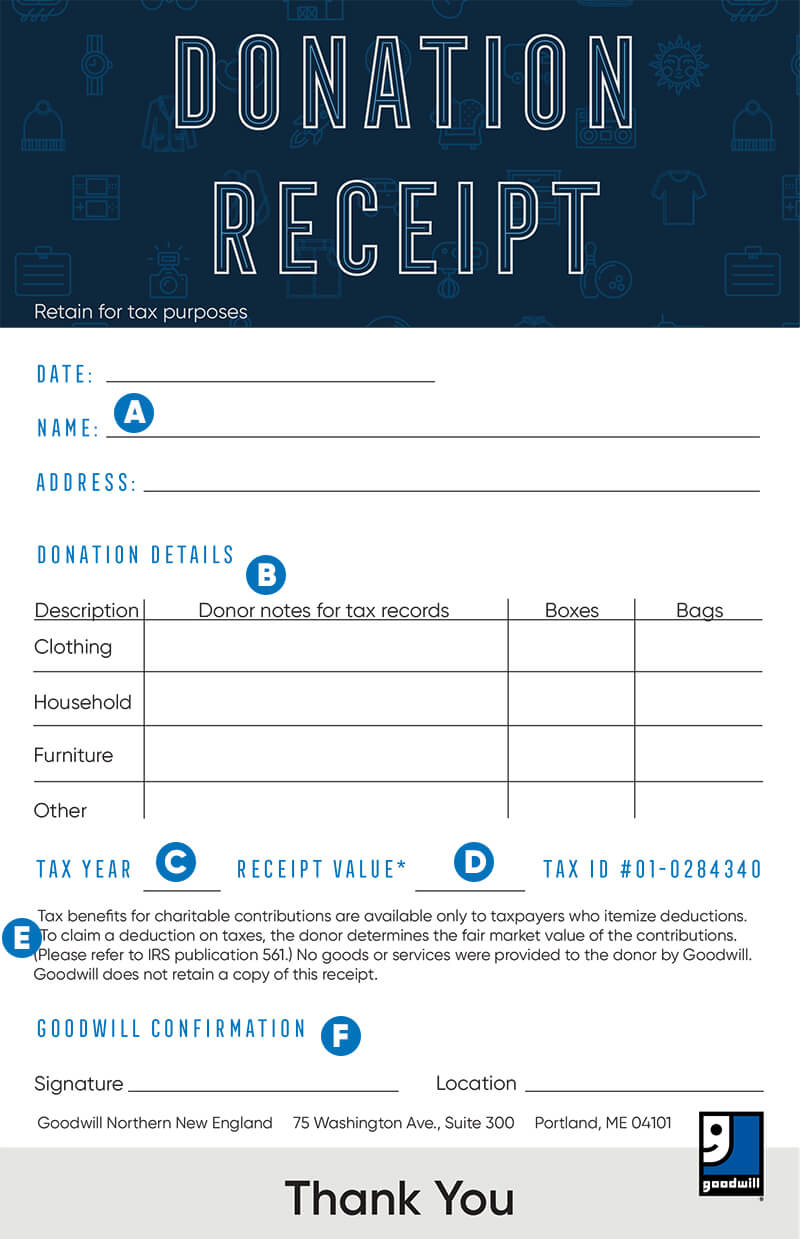

This designation allows donors to deduct contributions to Goodwill to the extent permitted by law.

However, it is always prudent to consult with a tax professional to ensure that your donation qualifies for a deduction.

Ongoing Scrutiny and Transparency

While Goodwill is generally recognized as a public charity, it is still subject to ongoing scrutiny and must maintain transparency in its operations.

Like all charitable organizations, Goodwill is required to file an annual Form 990 with the IRS, providing detailed information about its finances, programs, and governance.

This transparency allows the public to assess Goodwill's activities and ensure that it is operating in accordance with its charitable mission.

The Impact of Classification

The classification of Goodwill as a public charity has far-reaching implications.

It allows the organization to attract a broader base of donors, as contributions are generally tax-deductible to a greater extent than those made to private foundations.

This increased funding enables Goodwill to expand its programs and services, reaching more individuals and communities in need.

Maintaining Public Trust

Ultimately, Goodwill's continued success depends on maintaining public trust and confidence.

By operating transparently, adhering to ethical standards, and effectively fulfilling its charitable mission, Goodwill can solidify its position as a valuable community resource.

This trust is essential for attracting donations, recruiting volunteers, and fostering strong relationships with local communities.

Conclusion: A Community Staple

So, is Goodwill a private foundation? The answer, based on current IRS guidelines and Goodwill's operational structure, appears to be a resounding no. It stands as a testament to the power of community-based efforts and the enduring appeal of a simple idea: giving a second life to discarded items while empowering individuals to achieve their full potential. As shoppers continue to browse the aisles, filled with the promise of discovery and the satisfaction of supporting a worthy cause, Goodwill remains a vital thread in the fabric of countless communities, offering hope and opportunity, one donation at a time.