How To Change Mobile Number In Kvb Bank Account

In today's digital age, maintaining accurate contact information with your bank is paramount for secure and seamless banking experiences. A mobile number registered with your bank account is crucial for receiving transaction alerts, OTPs (One-Time Passwords), and other important updates, acting as a primary defense against unauthorized access and fraud.

This article provides a comprehensive guide on how to change your registered mobile number in a Karur Vysya Bank (KVB) account. Understanding the various methods and required documentation will empower KVB customers to keep their accounts secure and information up-to-date. We will delve into the different channels available, including online banking, ATM visits, and branch interactions, offering a step-by-step approach for each.

Methods for Changing Your Mobile Number in KVB

Online Banking

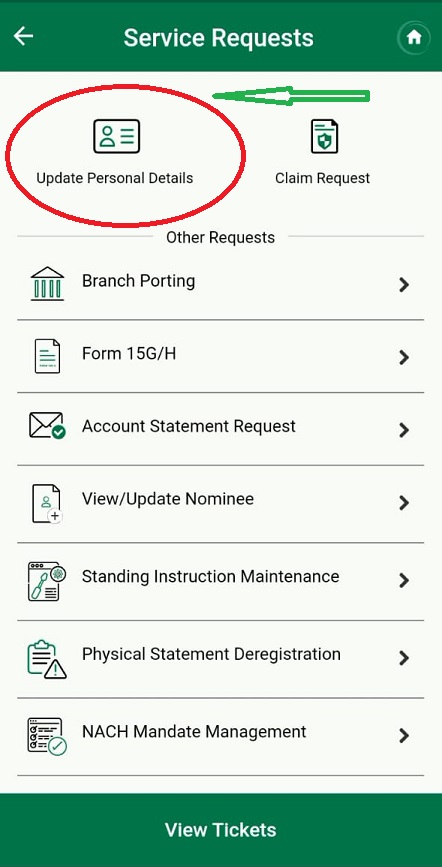

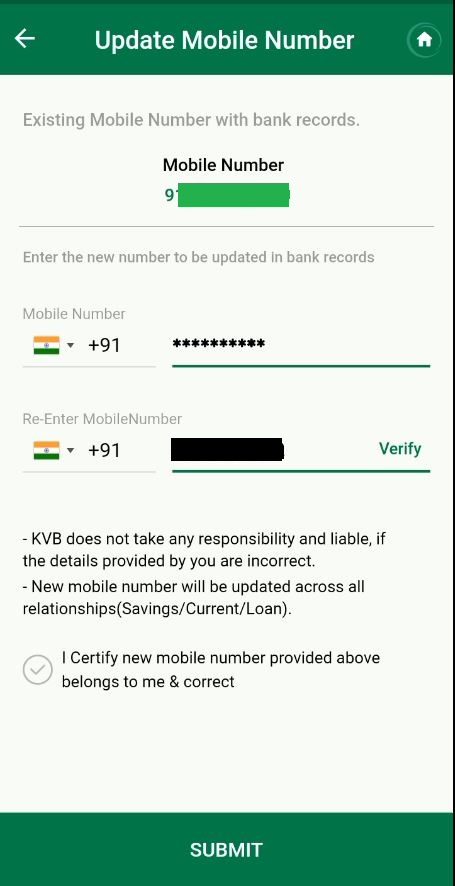

KVB provides its customers with the convenience of updating their mobile number through their online banking portal. This method is generally preferred for its speed and accessibility, allowing users to make changes from the comfort of their homes.

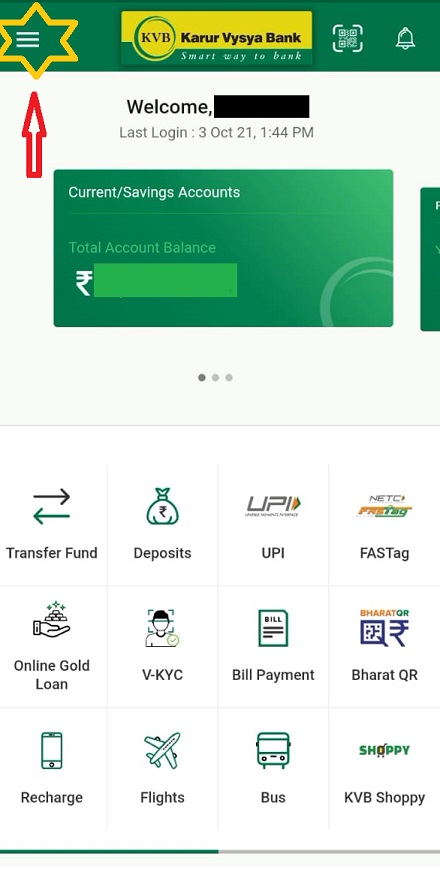

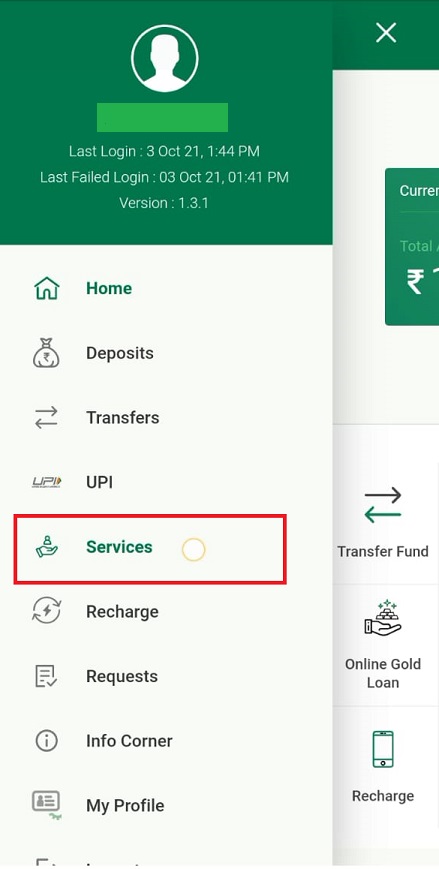

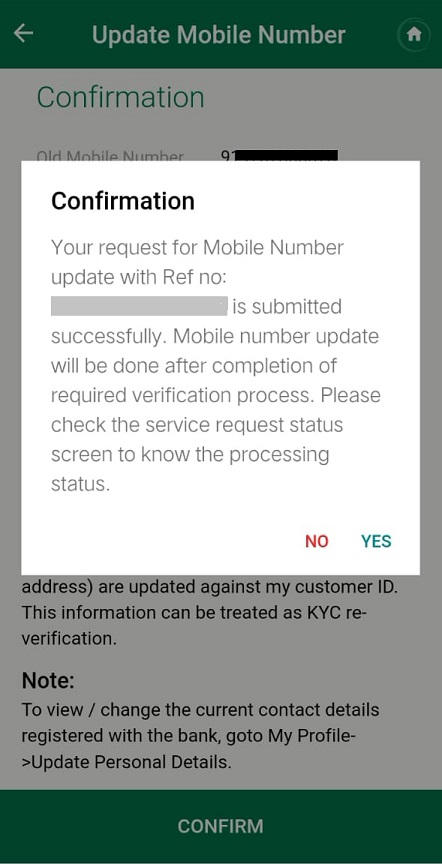

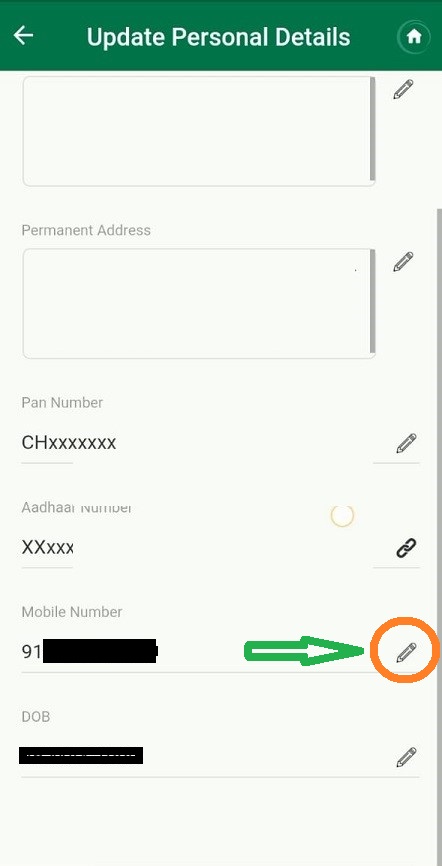

To change your mobile number online, first, log in to your KVB net banking account using your credentials. Navigate to the "Services" or "Profile" section, where you'll typically find an option to update your contact information, including your mobile number.

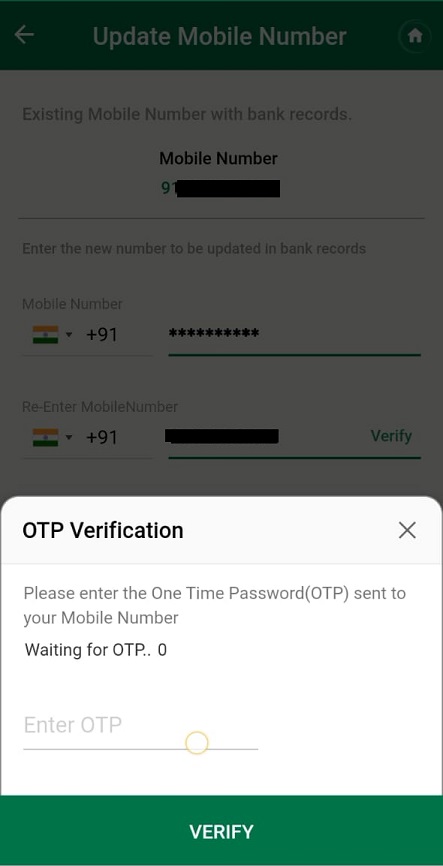

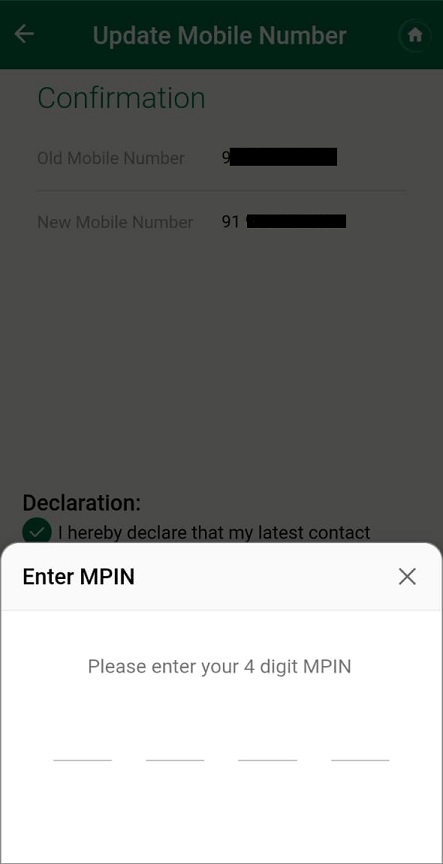

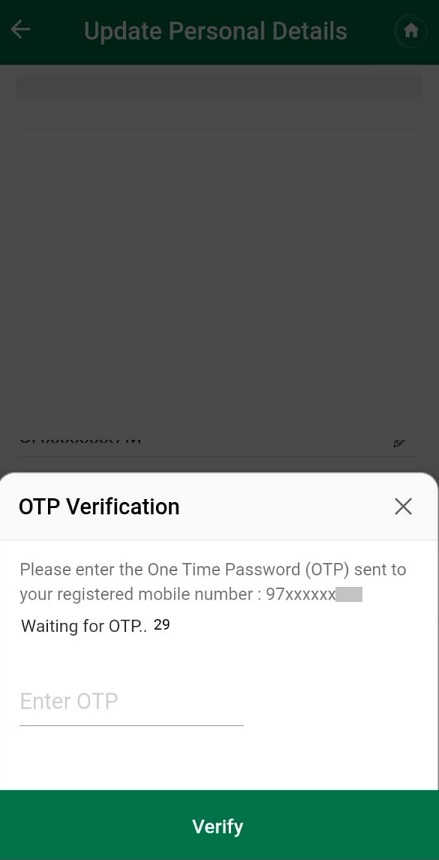

You'll likely be required to authenticate the request using an OTP sent to your existing registered mobile number or email address. Follow the on-screen instructions carefully and ensure all details are accurate before submitting the request.

Visiting a KVB ATM

Another convenient method is to visit a KVB ATM. Certain ATMs offer the facility to update your registered mobile number.

Insert your ATM card and enter your PIN. Look for the "Registration" or "Other Services" option on the ATM screen. Within this menu, you should find an option to update your mobile number.

The ATM will guide you through the process, and you may be required to enter the new mobile number twice for verification purposes. Once completed, you should receive a confirmation message.

Visiting a KVB Branch

For those who prefer a more personal touch or encounter difficulties with online or ATM methods, visiting a KVB branch is a reliable option. This method allows for direct interaction with bank staff who can assist with the update process.

Visit your nearest KVB branch and request a mobile number update form. Fill out the form accurately, providing all required details, including your account number, old mobile number (if applicable), and the new mobile number you wish to register.

Submit the completed form along with a self-attested copy of your KYC documents, such as your Aadhaar card, PAN card, or passport. A bank official will verify the information and process your request. Expect a processing time of a few business days for the update to take effect.

Required Documents and Considerations

Regardless of the chosen method, certain documents are essential for verifying your identity and ownership of the account. KYC (Know Your Customer) documents are typically required for any updates to your account information. These documents serve as proof of identity and address.

Acceptable KYC documents usually include Aadhaar card, PAN card, Voter ID, Passport, or Driving License. Ensure that the copies you provide are self-attested and legible.

Keep in mind that for online and ATM methods, the process may require your existing mobile number to be active for OTP verification. If your old mobile number is no longer in use, visiting a branch and submitting a written request with supporting documents is often the only solution.

Security Best Practices

It's crucial to remember that your registered mobile number is a gateway to your bank account. Always keep your mobile phone secure and avoid sharing your OTPs with anyone. Regularly review your transaction history for any unauthorized activity.

KVB, like other reputable banks, will never ask for your sensitive information, such as your PIN or OTP, over the phone or through email. Be wary of phishing attempts and fraudulent schemes.

Report any suspicious activity to the bank immediately. Keeping your mobile number updated and practicing safe banking habits are essential for protecting your financial security.

Conclusion

Updating your mobile number with Karur Vysya Bank is a straightforward process with multiple options to suit your convenience. Whether you choose the speed of online banking, the accessibility of an ATM, or the personal assistance of a branch visit, understanding the steps and required documentation will ensure a smooth and secure update. Prioritize keeping your contact information current with KVB to safeguard your account and enjoy uninterrupted banking services.