How To Check My Hdfc Personal Loan Balance

Imagine a quiet evening, settling in after a long day, and a sudden thought pops into your head: "What's the current balance on my HDFC personal loan?" No need to rummage through files or wait for banking hours. The digital age has brought convenience to our fingertips, making it easier than ever to stay on top of your finances.

This article provides a comprehensive guide on how to check your HDFC personal loan balance quickly and efficiently. We'll explore various methods, from online banking to mobile apps, ensuring you have the knowledge to manage your loan with ease.

Understanding the Importance of Knowing Your Loan Balance

Keeping track of your loan balance is crucial for effective financial planning. It allows you to monitor your progress towards repayment, calculate interest accrued, and make informed decisions about your budget.

Regularly checking your balance also helps you identify any discrepancies or unauthorized transactions promptly, safeguarding your financial interests.

Methods to Check Your HDFC Personal Loan Balance

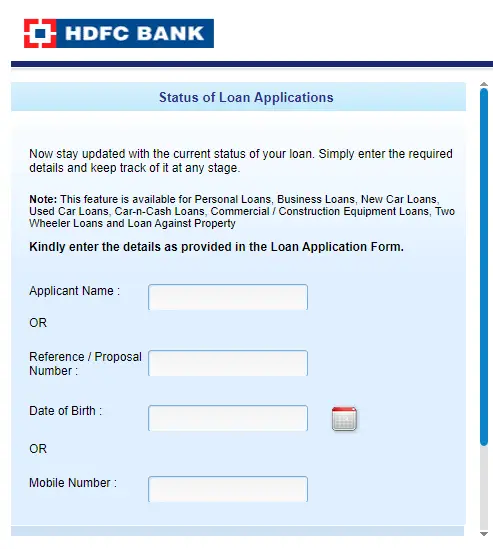

Online Banking: Your Virtual Branch

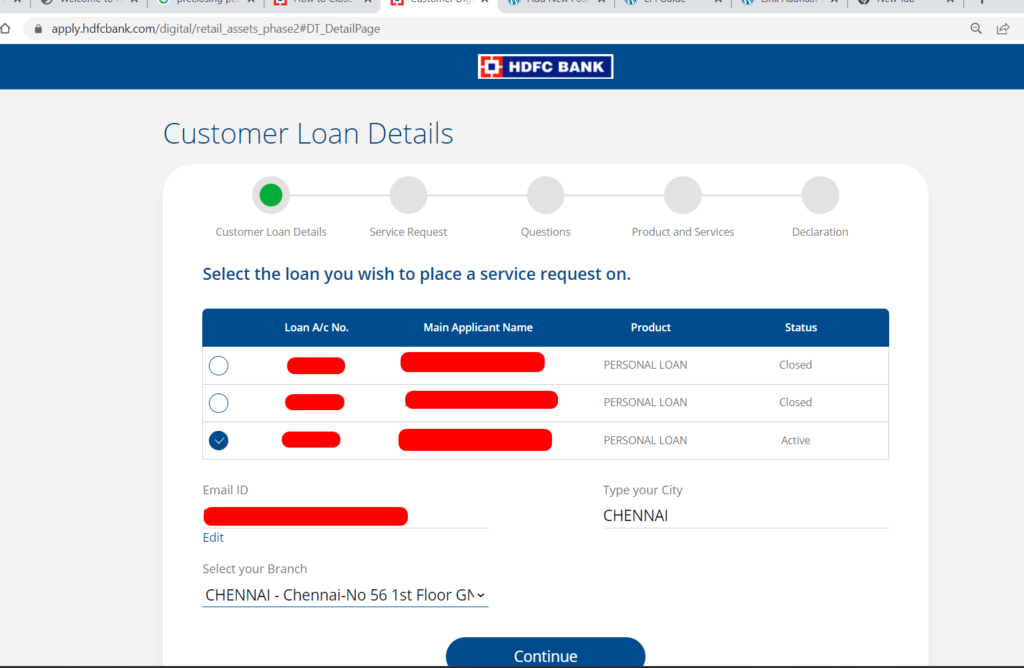

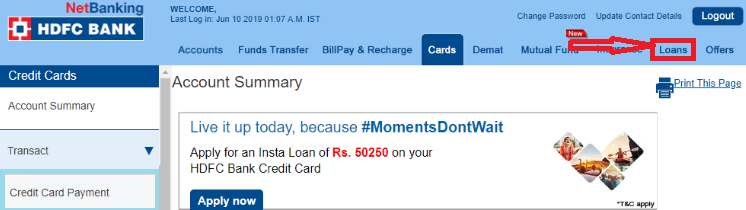

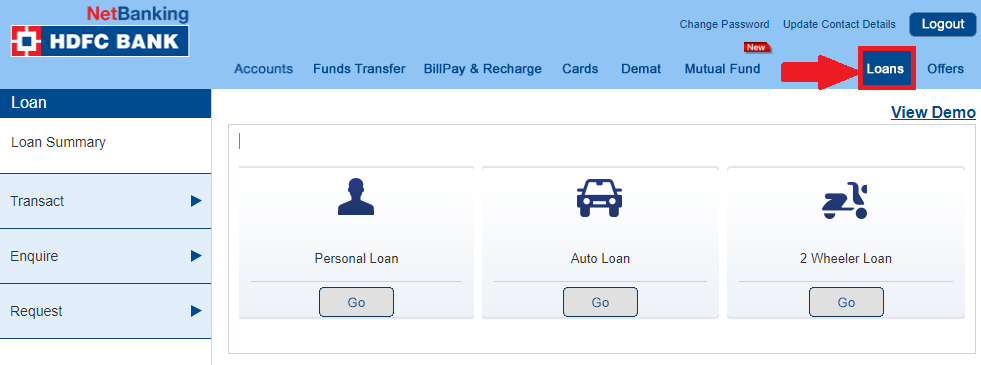

HDFC Bank's online banking portal is a powerful tool for managing your loan. Simply log in using your customer ID and password.

Navigate to the "Loans" section, and you'll find a detailed overview of your personal loan, including the outstanding balance, repayment schedule, and interest rate.

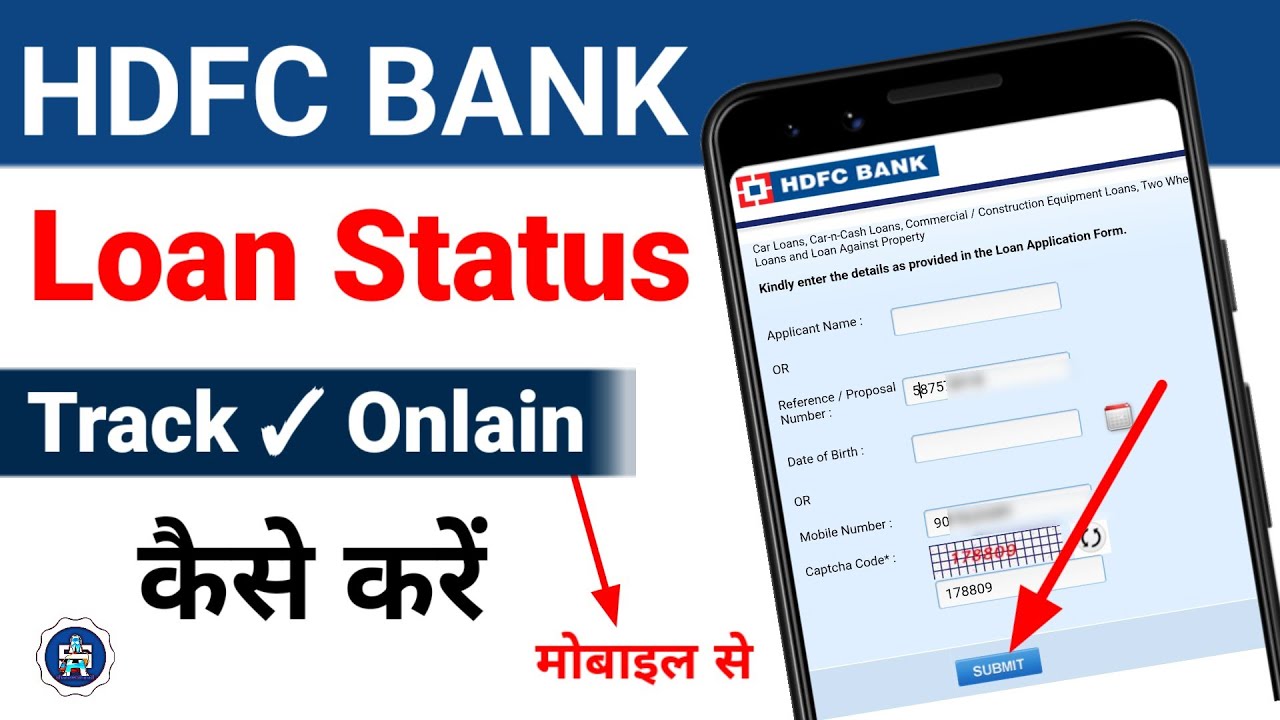

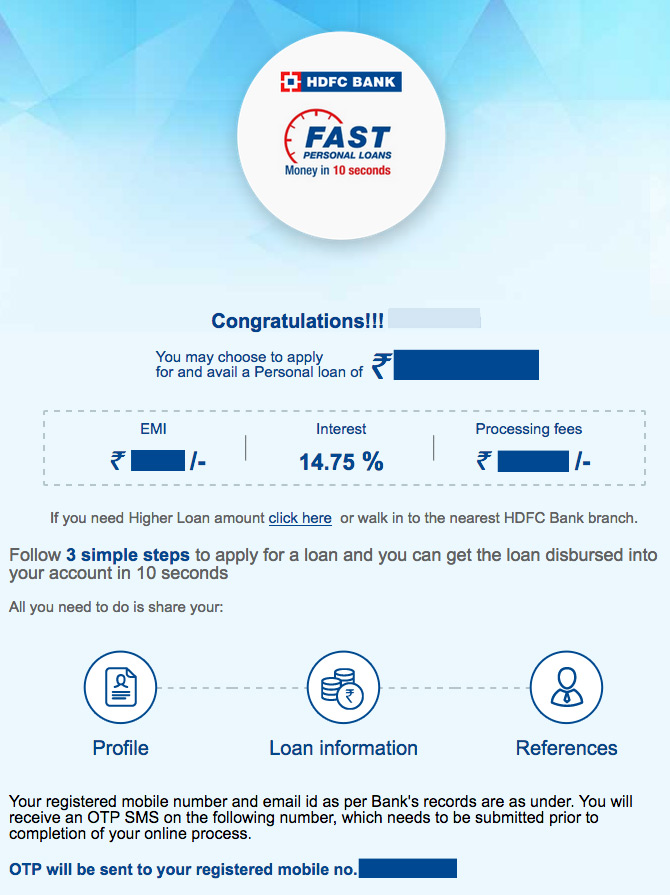

HDFC Bank Mobile App: Banking on the Go

For those who prefer banking on the go, the HDFC Bank mobile app is a perfect solution. Download the app from your device's app store and log in with your credentials.

The app offers a user-friendly interface, allowing you to quickly access your loan details and check your current balance.

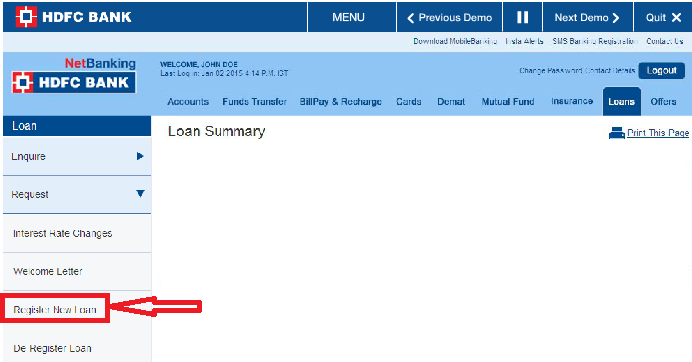

NetBanking: A Digital Dashboard

HDFC NetBanking provides an easy way to check your balance. This digital dashboard presents all your banking information in one place.

After logging in using your Customer ID and IPIN, you can access your personal loan account to see your balance, payment history, and other relevant loan information.

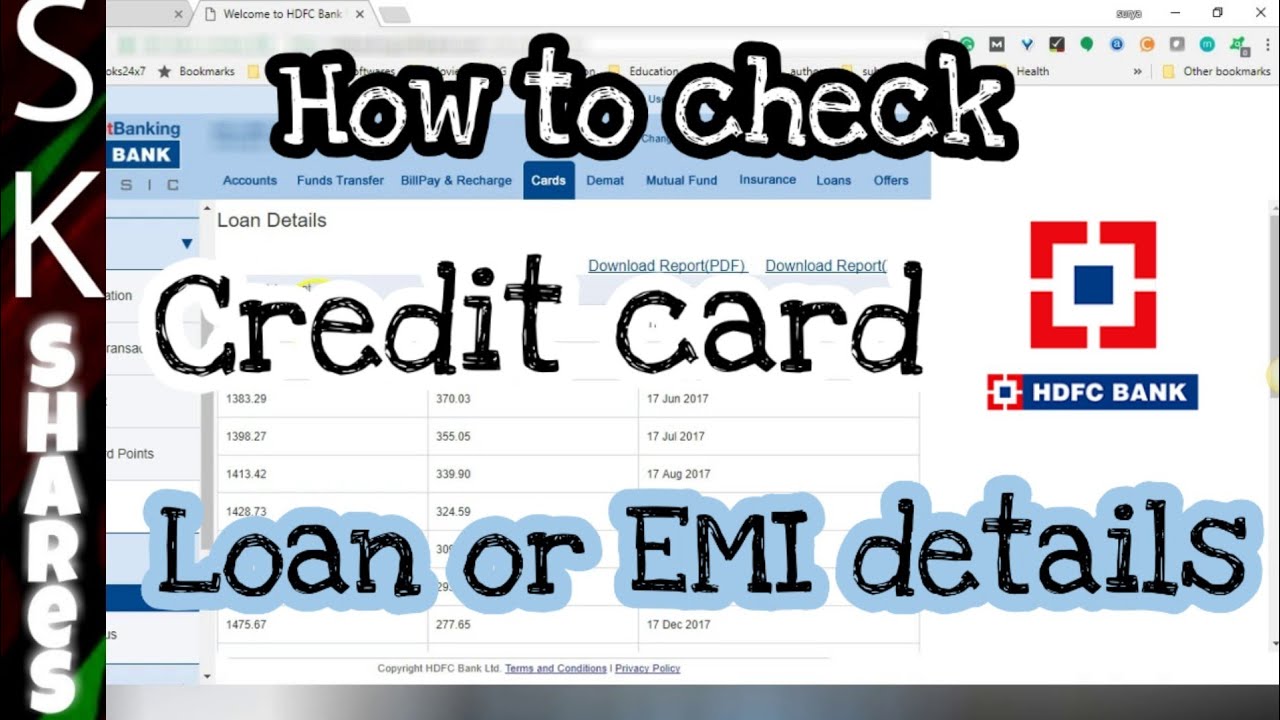

Statement Request: A Detailed Overview

You can also request a statement of your loan account through online banking or by visiting a branch. This statement provides a comprehensive view of your loan transactions, including repayments, interest charges, and the outstanding balance.

Visiting a Branch: Personal Assistance

For those who prefer a more personal touch, visiting an HDFC Bank branch is always an option. A bank representative can assist you in checking your loan balance and answer any questions you may have.

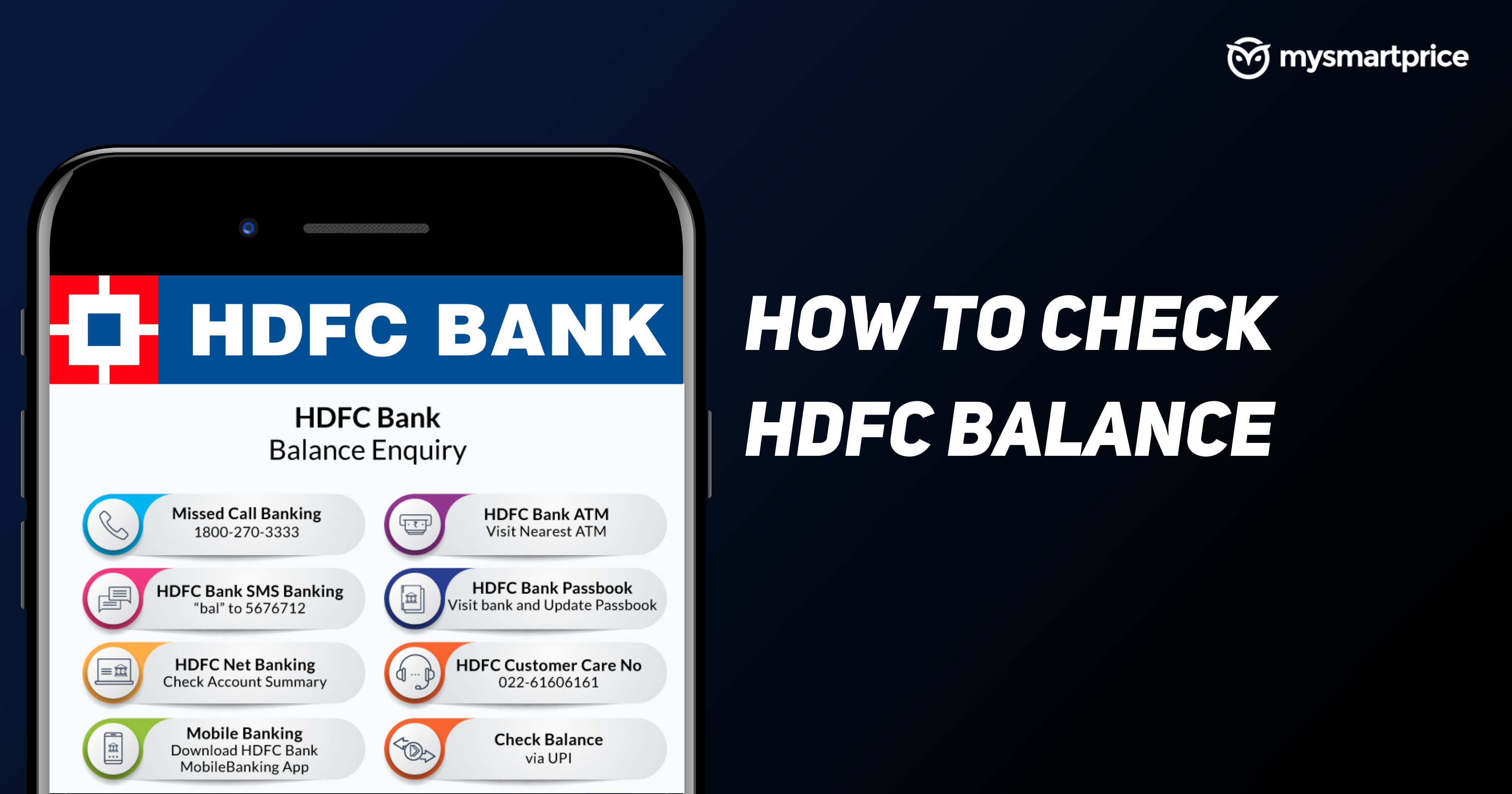

Customer Care: A Helping Hand

HDFC Bank's customer care is available to assist you with any queries regarding your loan. You can call their toll-free number or send an email to request your loan balance information.

"Empowering customers with easy access to their financial information is a priority for HDFC Bank," states a recent press release.

Tips for Managing Your HDFC Personal Loan

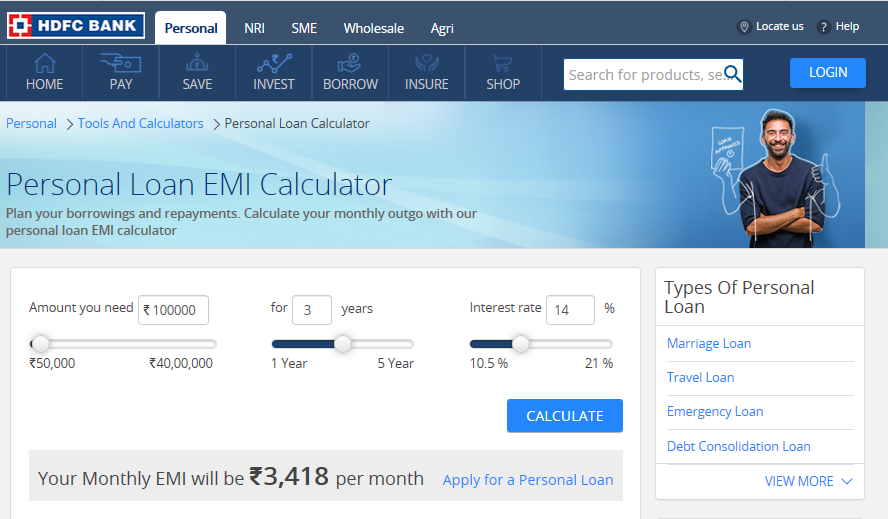

Beyond checking your balance, consider these tips for managing your HDFC personal loan effectively. Set reminders for your EMI payments to avoid late fees and maintain a good credit score.

Explore options for pre-payment if you have surplus funds to reduce your interest burden and shorten the loan tenure. Regularly review your repayment schedule to ensure it aligns with your financial goals.

Consider setting up auto-debit for your EMIs from your HDFC account. This will ensure timely payments and prevent any potential penalties.

Conclusion

In today's fast-paced world, staying informed about your finances is more important than ever. With the various methods available to check your HDFC personal loan balance, managing your loan has become a seamless and convenient experience. Embrace these tools and take control of your financial journey with confidence.