Stockholders' Equity Can Best Be Defined As The Rights Of

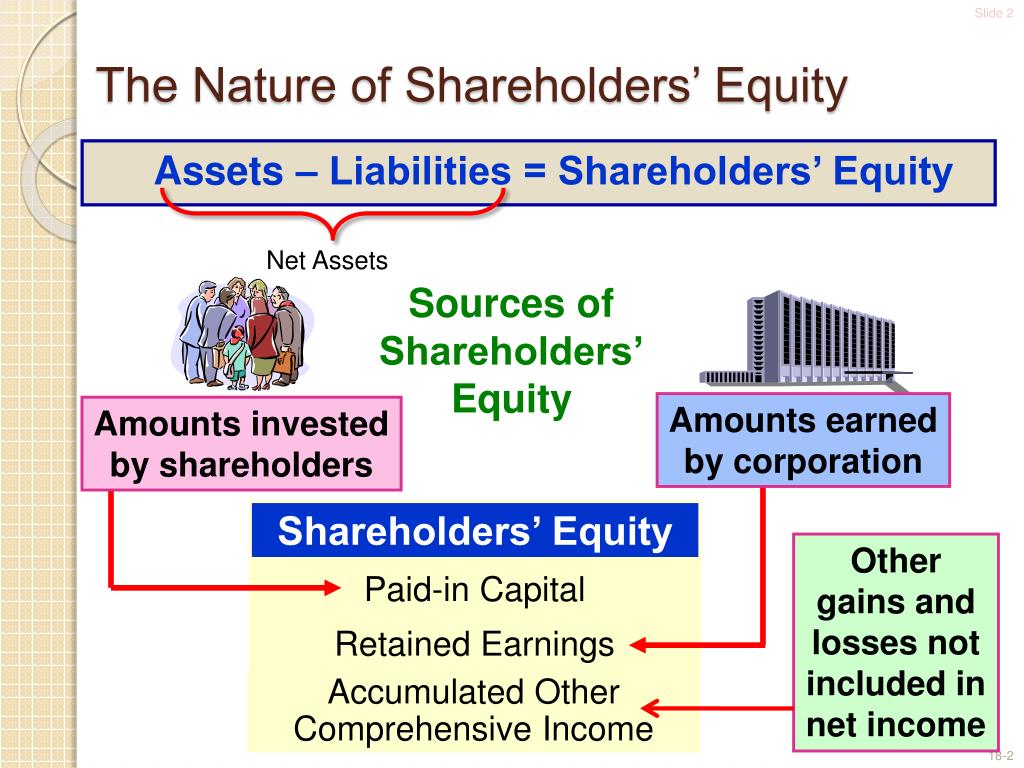

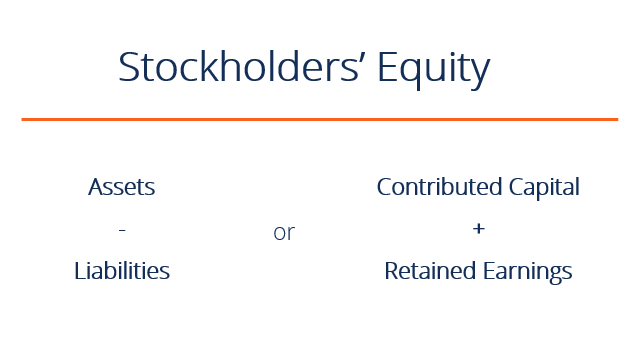

The bedrock principle of ownership in any corporation boils down to a single, potent phrase: Stockholders' Equity. Often misunderstood, it represents far more than just a number on a balance sheet. It's the ultimate claim on a company's assets, a claim held by those who have invested their capital and placed their trust in its future.

At its core, Stockholders' Equity, also known as shareholders' equity or net worth, represents the residual interest in the assets of an entity after deducting all its liabilities. This article delves into the true essence of stockholders' equity, examining its components, its implications, and its critical role in assessing a company's financial health. We will explore how understanding this crucial metric empowers investors and stakeholders alike.

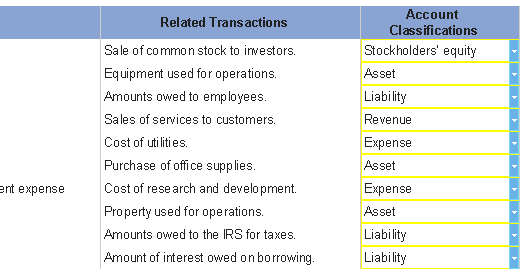

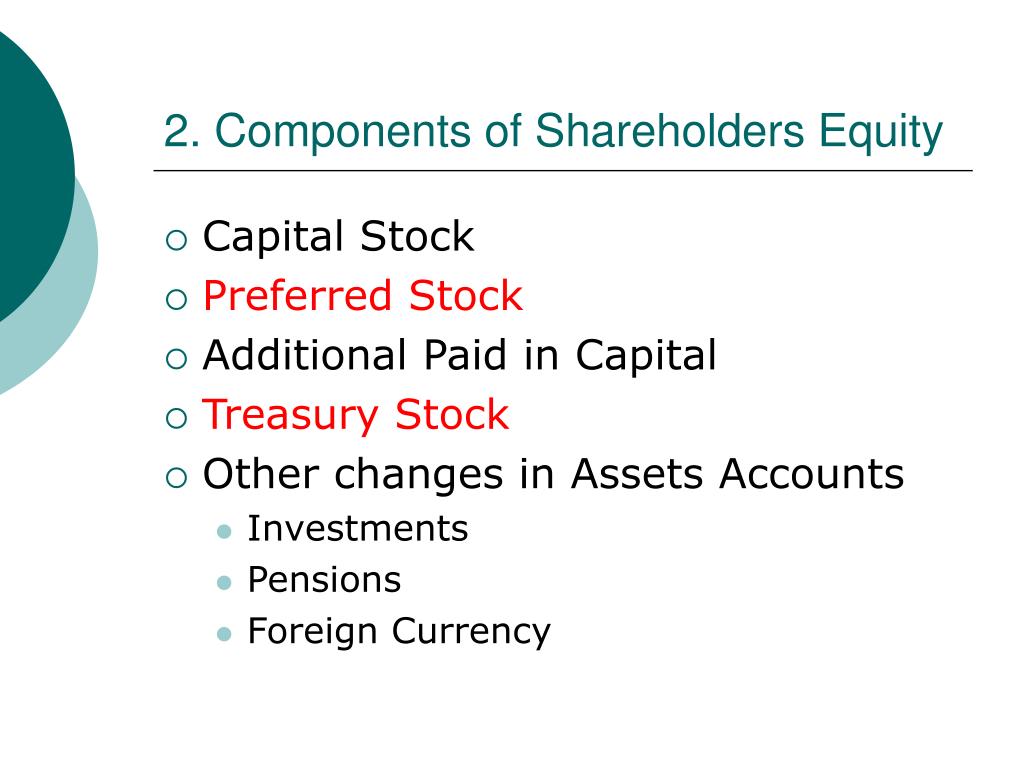

Understanding the Components of Stockholders' Equity

Stockholders' Equity isn't a monolithic figure. It's comprised of several key components, each reflecting different aspects of the investment and operational history of the company.

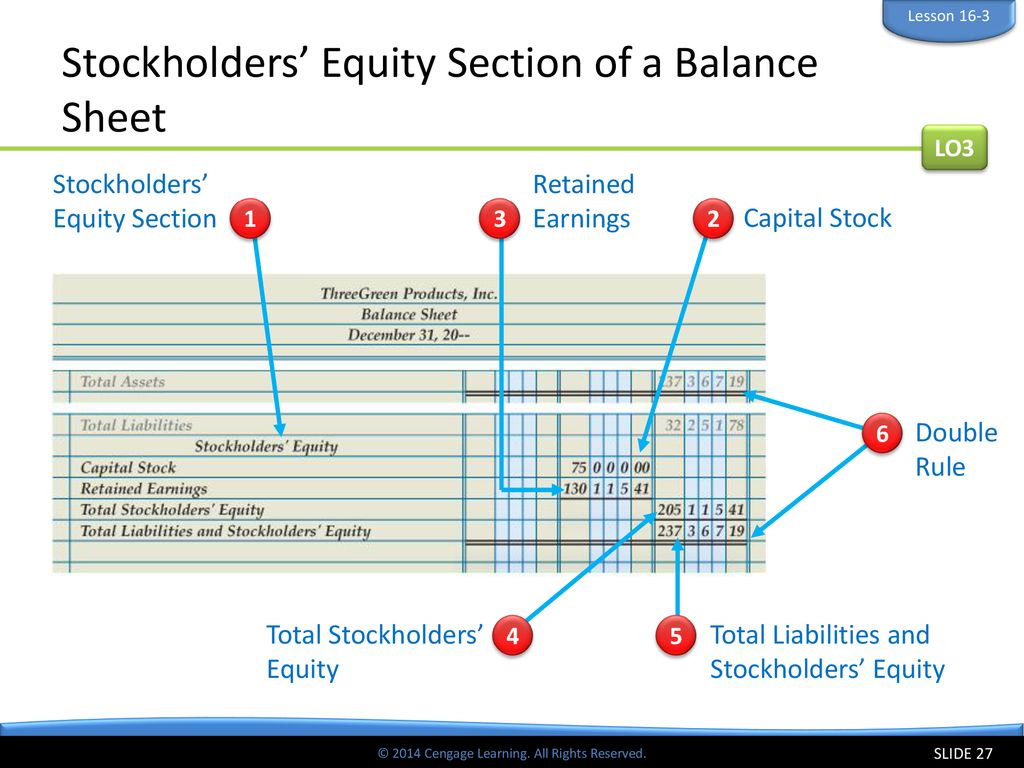

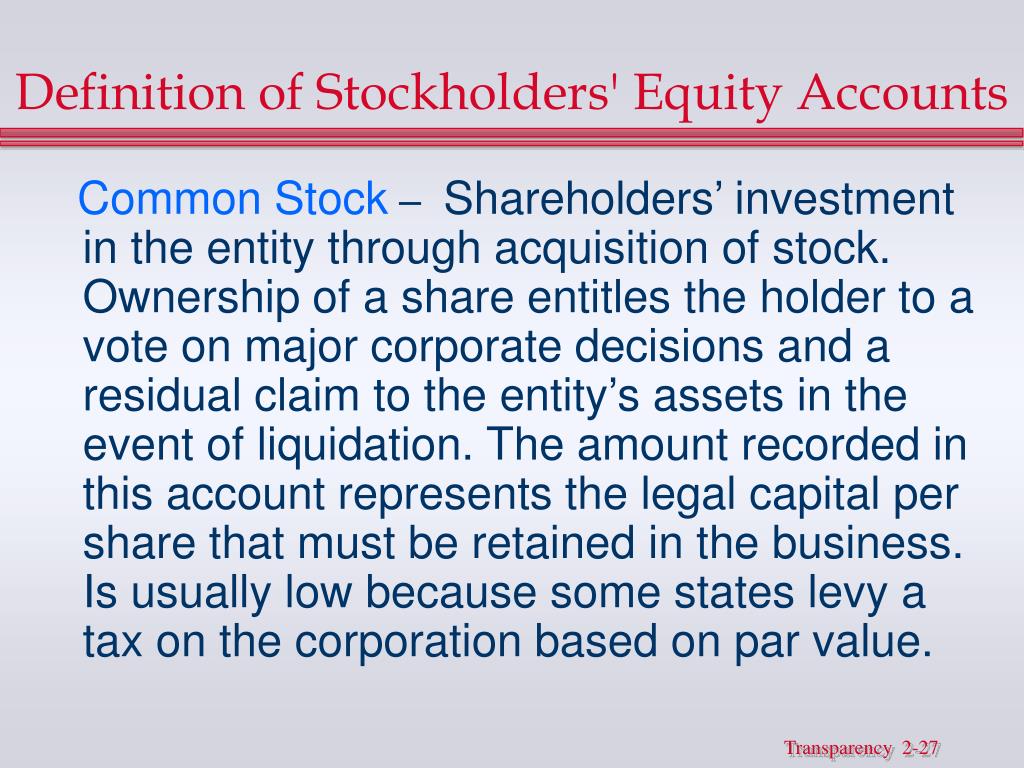

Contributed Capital

Contributed capital represents the total amount of money raised by the company through the issuance of stock. This includes both common stock and preferred stock. The par value of the stock and any additional paid-in capital are key components of contributed capital.

According to the Securities and Exchange Commission (SEC), companies must clearly disclose the different classes of stock and the rights associated with each.

Retained Earnings

Retained earnings are the accumulated profits of the company that have not been distributed to shareholders as dividends. This account represents the portion of a company’s net income that is reinvested in the business rather than paid out to owners.

A healthy retained earnings balance generally signifies a company's profitability and its ability to fund future growth initiatives. Dividends paid out to shareholders reduce the retained earnings balance.

Accumulated Other Comprehensive Income (AOCI)

AOCI includes items that are not typically included in net income, but affect stockholders' equity. This can include unrealized gains and losses on available-for-sale securities, foreign currency translation adjustments, and certain pension-related adjustments.

The Financial Accounting Standards Board (FASB) provides specific guidance on the items that should be included in AOCI. These items reflect changes in equity that are not the result of transactions with owners.

Stockholders' Equity as a Measure of Financial Health

Stockholders' Equity is a crucial indicator of a company's financial strength and stability. A positive and growing equity balance generally signifies a healthy organization.

This metric helps in assessing the company's ability to meet its long-term obligations and fund future growth. It’s a safety net for creditors, representing the cushion available should the company face financial difficulties.

Debt-to-Equity Ratio

The debt-to-equity ratio, calculated by dividing total liabilities by stockholders' equity, is a common financial ratio used to assess a company's leverage. A higher ratio indicates that the company is relying more heavily on debt to finance its operations.

According to research from corporate finance institutions, a high debt-to-equity ratio can be a red flag, potentially indicating a higher risk of financial distress. Different industries have different norms for acceptable debt-to-equity ratios.

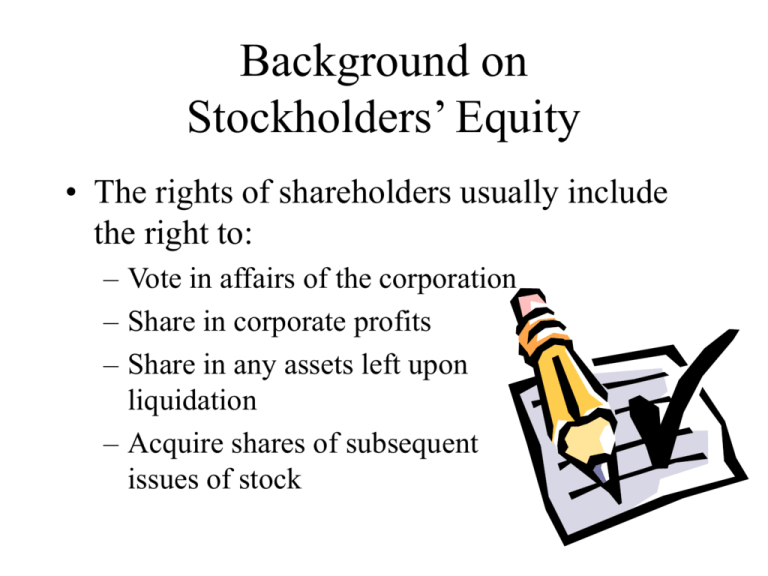

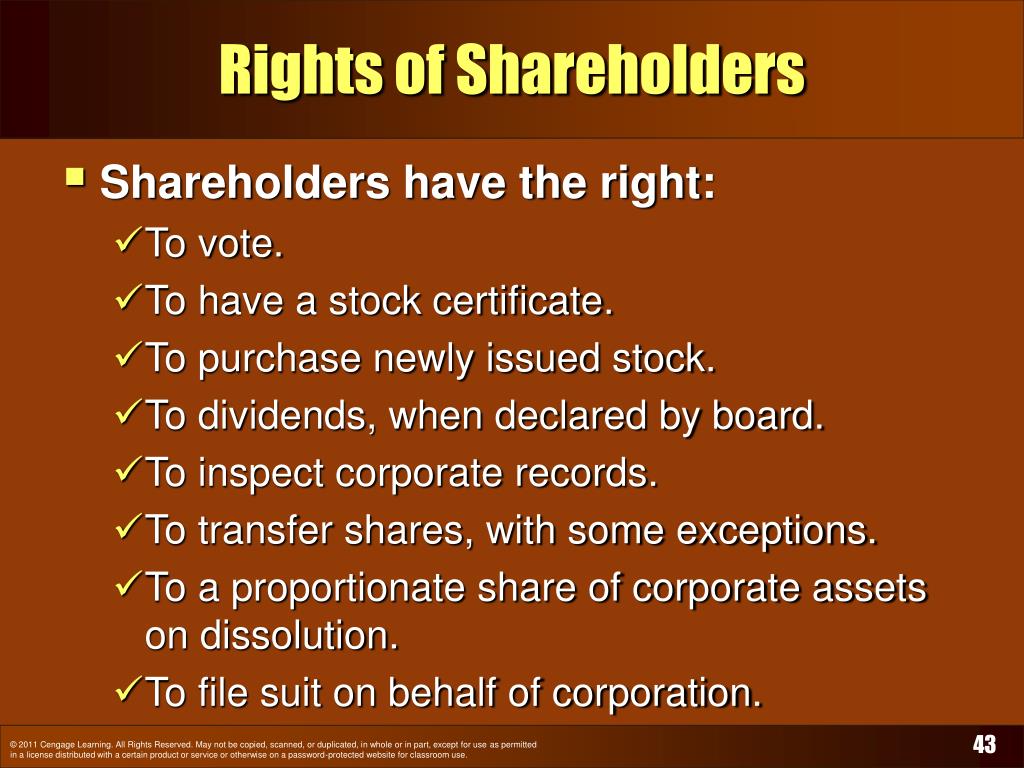

The Rights Afforded by Stockholders' Equity

Stockholders' Equity isn't just a number; it embodies a bundle of rights and privileges granted to shareholders.

These rights vary depending on the class of stock held, but generally include the right to vote on important corporate matters, to receive dividends (if declared), and to claim a share of the company's assets upon liquidation.

Voting Rights

Shareholders with voting rights have the power to elect the board of directors and to vote on major corporate decisions, such as mergers and acquisitions. This is a fundamental right that allows shareholders to influence the direction of the company.

The number of votes a shareholder has is typically proportional to the number of shares they own. Dual-class stock structures can sometimes grant certain shareholders disproportionate voting power.

Dividend Rights

While not guaranteed, shareholders have the right to receive dividends if the company declares them. Preferred stockholders often have a priority claim on dividends compared to common stockholders.

The decision to pay dividends is typically made by the board of directors, based on the company's financial performance and its investment needs. A company's dividend policy can have a significant impact on its stock price.

Liquidation Rights

In the event of a company's liquidation, stockholders have a claim on the remaining assets after all creditors have been paid. This is often referred to as the "residual claim."

Preferred stockholders generally have a higher priority claim on assets than common stockholders. The value of a shareholder's liquidation rights depends on the company's assets and liabilities at the time of liquidation.

The Future of Stockholders' Equity

As the business landscape continues to evolve, the concept of Stockholders' Equity remains a cornerstone of corporate finance. Understanding its nuances is crucial for investors, managers, and stakeholders alike.

Increased scrutiny of corporate governance and transparency will likely further emphasize the importance of a healthy and accurately reported Stockholders' Equity balance. The continued development of accounting standards will play a vital role in ensuring the reliability and comparability of this essential metric.

:max_bytes(150000):strip_icc()/Stockholdersequity_Sketch_final-5230009146b749cc85d8b57339a52dad.png)