How To Create A Second Income Stream

Imagine the crisp autumn air, a steaming mug of coffee in hand, and the quiet satisfaction of knowing you’re building something solid, something beyond your regular paycheck. Maybe it's the freedom to travel, the security of a financial cushion, or simply the joy of pursuing a passion. A second income stream isn’t just about extra money; it’s about creating options.

This article explores practical and accessible ways to cultivate a second income stream, empowering you to achieve greater financial security and pursue personal fulfillment. We’ll delve into diverse avenues, from leveraging existing skills to exploring new opportunities, all while maintaining a healthy work-life balance.

Understanding Your "Why" and Assessing Your Resources

Before diving into specific strategies, it's crucial to clarify your motivation. Why do you want a second income stream? Is it to pay off debt, save for retirement, or pursue a creative hobby?

Knowing your "why" will help you stay focused and motivated when challenges arise. Next, assess your existing resources: time, skills, capital, and network.

What skills can you monetize? Do you have any hobbies that could generate income? Consider your available time commitment realistically.

Exploring Diverse Avenues for Second Income

Freelancing and Gig Economy Opportunities

The gig economy offers a plethora of opportunities to leverage your skills. Websites like Upwork, Fiverr, and Guru connect freelancers with clients needing various services.

If you’re a writer, designer, programmer, or marketer, freelancing can be a great way to earn extra income. The Bureau of Labor Statistics reports that the number of individuals participating in the gig economy continues to grow, highlighting its increasing accessibility and popularity.

Think about your strengths and how they align with the demands of the digital marketplace.

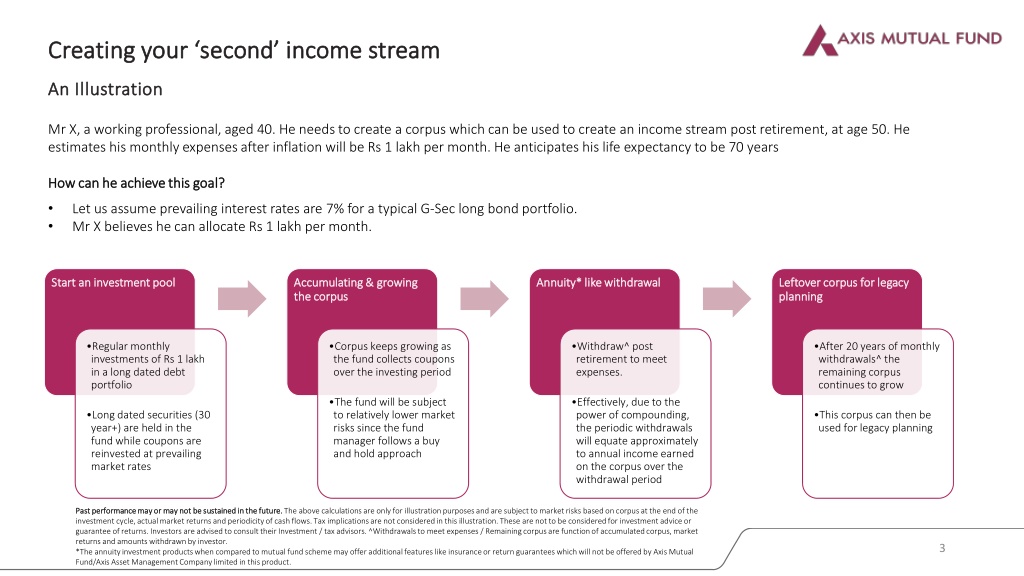

Investing in the Stock Market or Real Estate

Investing can provide a passive income stream, but it requires research and understanding of risk. Investing in stocks, bonds, or mutual funds can generate dividends and capital appreciation over time.

Real estate investing, whether through direct ownership or Real Estate Investment Trusts (REITs), offers the potential for rental income and property appreciation. Consult a financial advisor to determine the best investment strategy for your risk tolerance and financial goals.

Creating and Selling Digital Products

If you have specialized knowledge or creative skills, consider creating and selling digital products. This could include online courses, ebooks, templates, or digital art.

Platforms like Teachable, Etsy, and Creative Market make it easy to reach a global audience. Building a loyal audience and creating high-quality products are key to success in this area.

Start small, gather feedback, and iterate to refine your offerings.

Affiliate Marketing

Affiliate marketing involves partnering with businesses to promote their products or services and earning a commission on each sale generated through your unique referral link. This strategy is often used by bloggers and social media influencers.

Building a strong online presence and creating engaging content are crucial for success in affiliate marketing. Choose products and services that align with your audience's interests and that you genuinely believe in.

Starting a Side Hustle Business

Consider launching a small side hustle business that aligns with your passions and interests. This could involve anything from baking and selling homemade goods to offering pet-sitting services or crafting unique jewelry. The Small Business Administration (SBA) offers resources and guidance for aspiring entrepreneurs.

Start with a solid business plan, identify your target market, and focus on providing exceptional customer service. Word-of-mouth marketing can be a powerful tool for small businesses.

Keep in mind that building a business takes time and effort, so be patient and persistent.

Maintaining Balance and Avoiding Burnout

Adding a second income stream can be demanding, so it's essential to prioritize self-care and maintain a healthy work-life balance. Set realistic goals, schedule regular breaks, and delegate tasks when possible.

Remember that your health and well-being are paramount. Don't be afraid to say no to opportunities that overextend you.

Regularly reassess your priorities and adjust your strategies as needed to avoid burnout.

Building a second income stream is a journey, not a destination. It requires dedication, perseverance, and a willingness to learn and adapt. Embrace the challenges, celebrate the successes, and enjoy the process of creating a more financially secure and fulfilling life. By leveraging your skills, exploring diverse opportunities, and prioritizing your well-being, you can unlock your potential and build a brighter future. Start small, dream big, and never stop learning.