How To Create Multiple Flows Of Income

The relentless rise in the cost of living, coupled with economic uncertainties, has pushed individuals to seek financial stability beyond the traditional single paycheck. Many are now exploring diverse avenues to generate income, not just as a means of accumulating wealth, but as a crucial buffer against potential economic downturns or unexpected job losses. This proactive approach to financial security is reshaping the landscape of personal finance, compelling people to become more resourceful and entrepreneurial.

At the heart of this shift lies a fundamental question: How can individuals effectively create multiple income streams in a sustainable and manageable way? This article delves into the strategies and considerations necessary to build a diversified income portfolio, drawing upon expert advice and real-world examples to provide a comprehensive guide for those seeking greater financial independence and resilience.

Understanding the Landscape of Income Streams

The concept of multiple income streams isn't new, but its accessibility and relevance have grown exponentially in the digital age. Robert Kiyosaki, author of Rich Dad Poor Dad, popularized the idea of diversifying income beyond employment, advocating for building assets that generate passive income.

According to a 2023 report by Bankrate, nearly 40% of Americans have a side hustle, highlighting the increasing prevalence of supplemental income sources. These income streams can be broadly categorized into active and passive income.

Active Income: Leveraging Skills and Time

Active income requires direct involvement and the exchange of time for money. This includes traditional employment, freelancing, consulting, and operating a small business.

Freelancing, in particular, has witnessed significant growth, fueled by platforms like Upwork and Fiverr. Individuals can offer services such as writing, graphic design, web development, and virtual assistance, setting their own rates and schedules.

Consulting provides another avenue for active income, allowing individuals with specialized knowledge to offer their expertise to businesses or individuals. This often requires building a strong reputation and network within a specific industry.

Passive Income: Building Assets That Generate Revenue

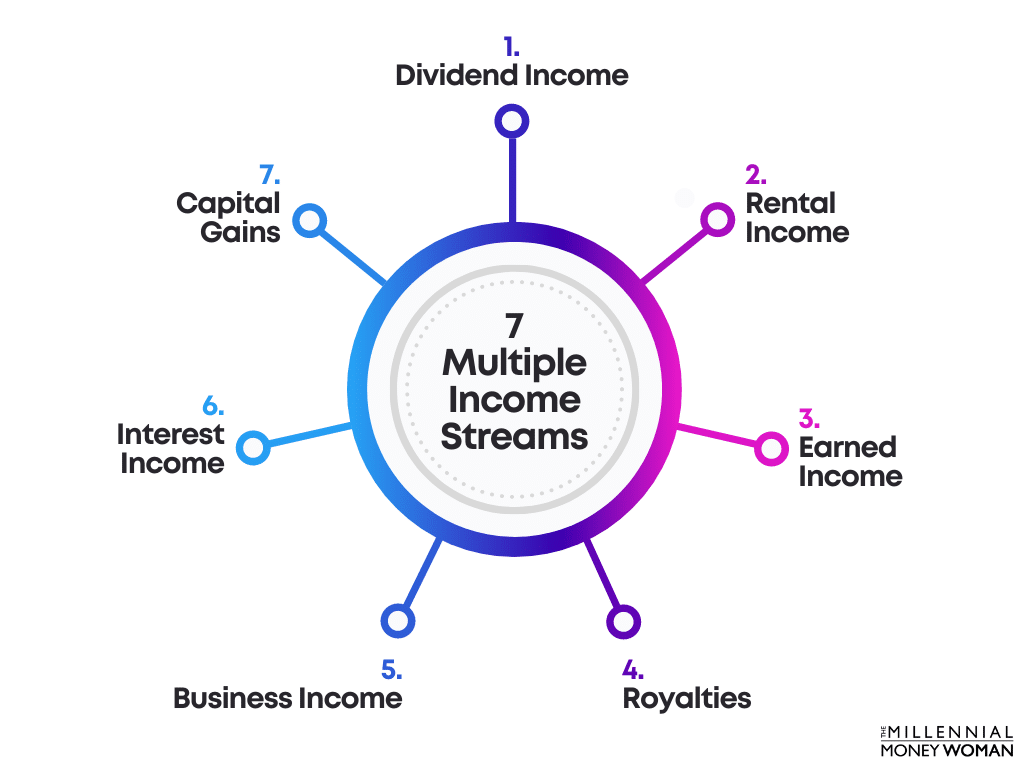

Passive income, on the other hand, generates revenue with minimal ongoing effort, although it often requires an initial investment of time, money, or both. Examples include rental properties, dividend-paying stocks, online courses, and royalties from creative works.

Rental properties remain a popular passive income source, but require significant capital investment and ongoing management. Real estate investment trusts (REITs) offer a less hands-on alternative, allowing investors to participate in the real estate market without directly owning properties.

Dividend-paying stocks provide another avenue for passive income, offering regular payouts to shareholders. Careful research and diversification are crucial to mitigating risk in the stock market.

Strategies for Building Multiple Income Streams

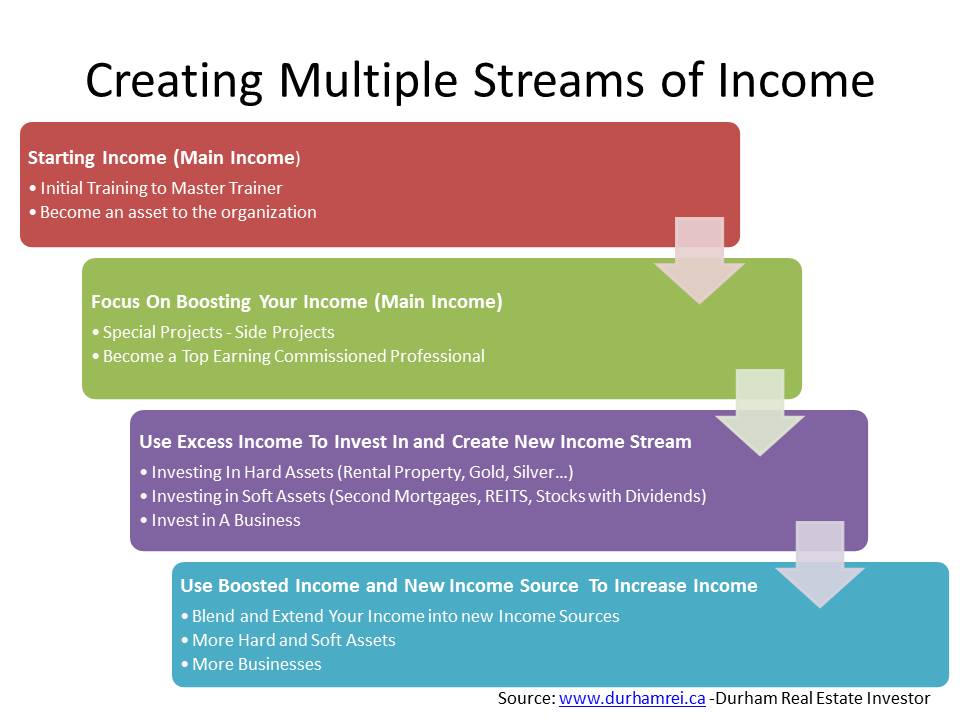

Creating multiple income streams requires a strategic and methodical approach. It's important to start with a clear understanding of your skills, resources, and financial goals.

Begin by identifying your existing skills and exploring how they can be monetized. Can you offer your skills as a freelancer? Could you create an online course to share your knowledge?

Next, assess your financial resources and determine how much capital you can invest in income-generating assets. Consider exploring different investment options and their associated risks and returns.

Potential Challenges and Mitigation Strategies

Building multiple income streams isn't without its challenges. Managing time, resources, and potential burnout are common obstacles.

Time management is crucial. Prioritize tasks, delegate where possible, and set realistic goals for each income stream. Utilizing time management tools and techniques can prove invaluable.

Avoiding burnout is also critical. Schedule regular breaks, prioritize self-care, and avoid overcommitting yourself. Remember that building multiple income streams is a marathon, not a sprint.

Another challenge can be the potential for fluctuating income from different sources. Having a solid financial plan and emergency fund can help buffer against these fluctuations.

The Future of Income Diversification

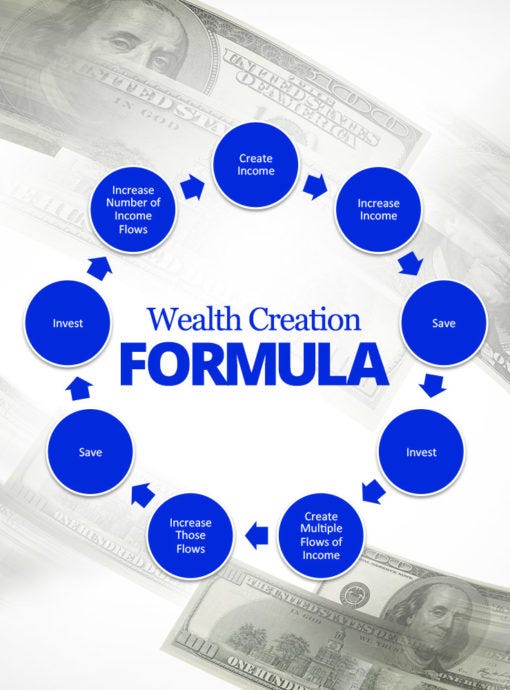

The trend toward multiple income streams is likely to continue as the gig economy expands and technology continues to democratize access to income-generating opportunities. The rise of AI and automation may also necessitate income diversification as certain jobs become obsolete.

Individuals who proactively develop multiple income streams will be better positioned to navigate the changing economic landscape and achieve greater financial security and independence.

By embracing a diverse approach to income generation, individuals can not only enhance their financial stability but also unlock new opportunities for personal and professional growth.