Which Of The Following Primarily Provides Loans For Home Purchases

The dream of homeownership, a cornerstone of the American ideal, rests heavily on the availability of mortgage loans. But navigating the complex landscape of lenders can be daunting, leaving many prospective buyers wondering: Which institutions primarily fuel the engine of home purchases?

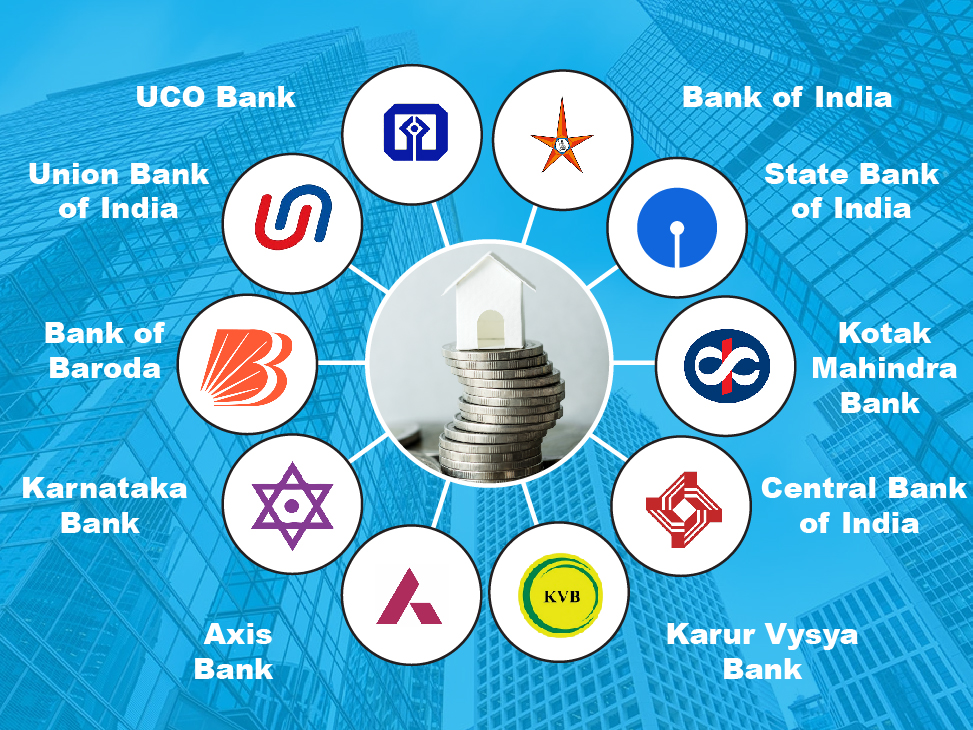

The answer isn't as straightforward as it may seem. While banks play a significant role, the mortgage market is a multi-faceted ecosystem. It includes credit unions, mortgage companies, and government-sponsored entities (GSEs). Understanding the roles of these various players is crucial for both homebuyers and those tracking the health of the housing market.

The Mortgage Market Landscape: A Detailed Overview

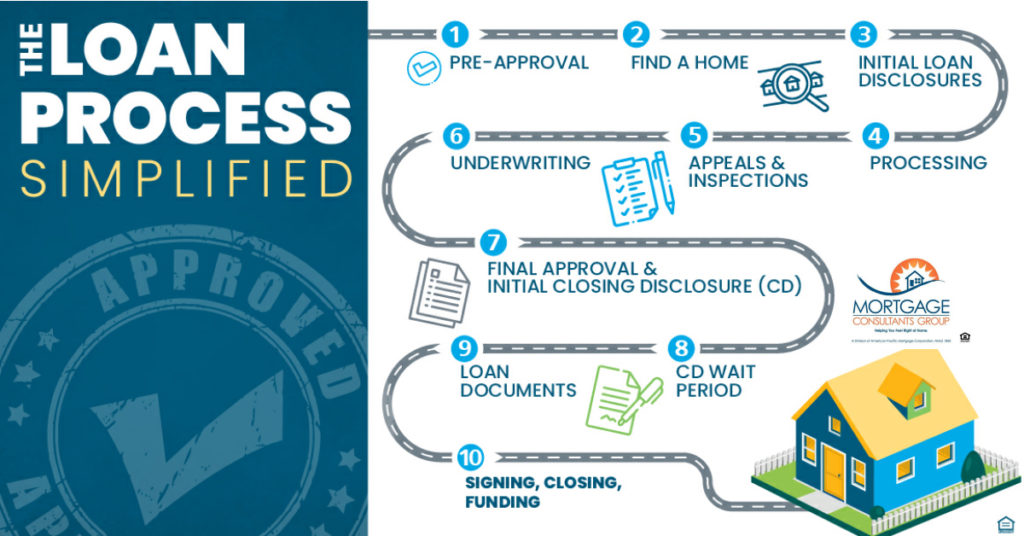

At its core, the mortgage market is about connecting borrowers with capital. Lenders provide the funds for home purchases, and borrowers repay the loan over a set period, typically with interest. The process is more complex than a simple transaction, involving various intermediaries and risk management strategies.

Federal agencies also back some loans, often targeted towards specific demographics or geographic areas.

Banks: The Traditional Mortgage Provider

For decades, banks were the dominant force in mortgage lending. Institutions like JPMorgan Chase, Wells Fargo, and Bank of America originate and service a large volume of mortgages.

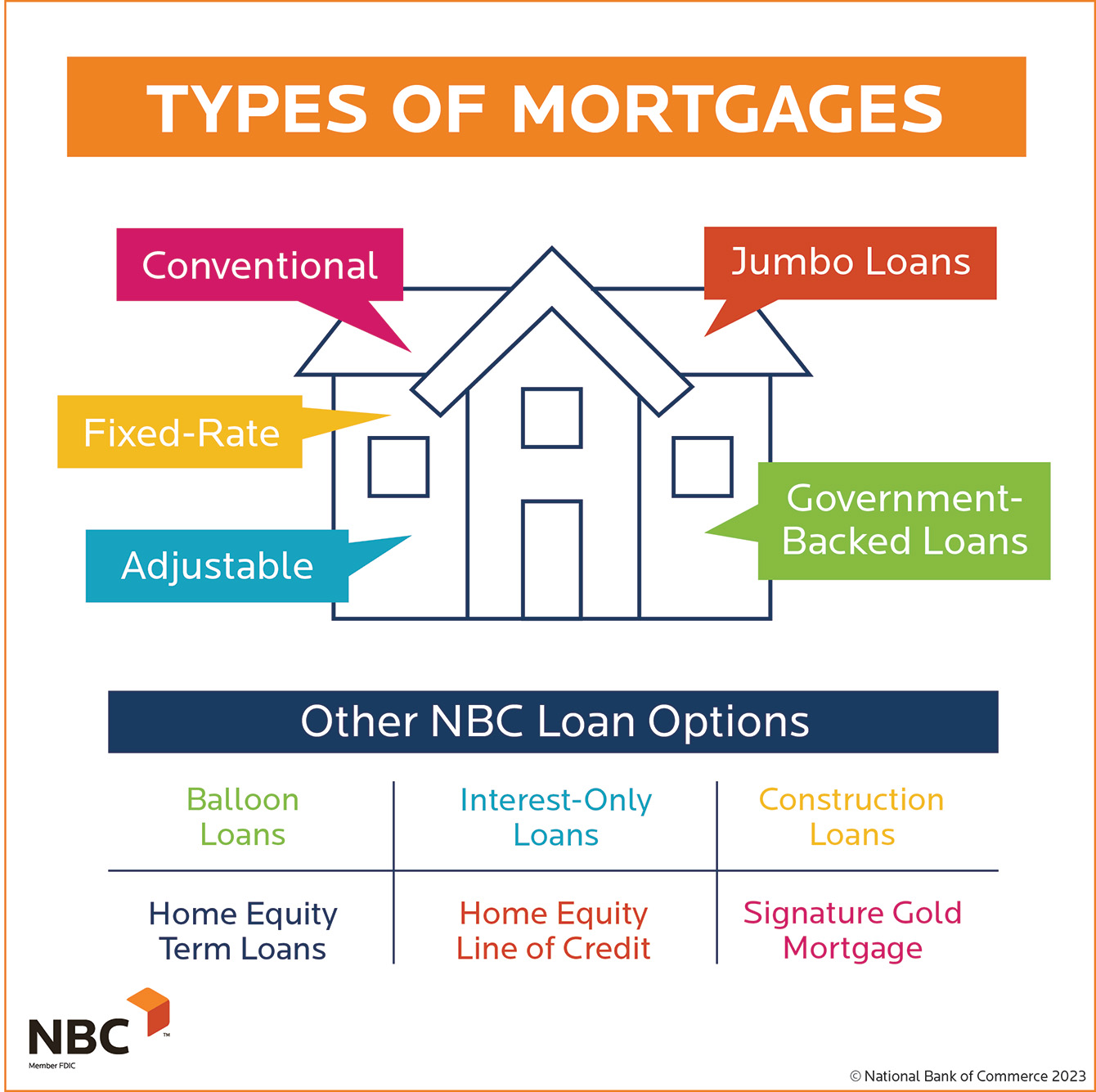

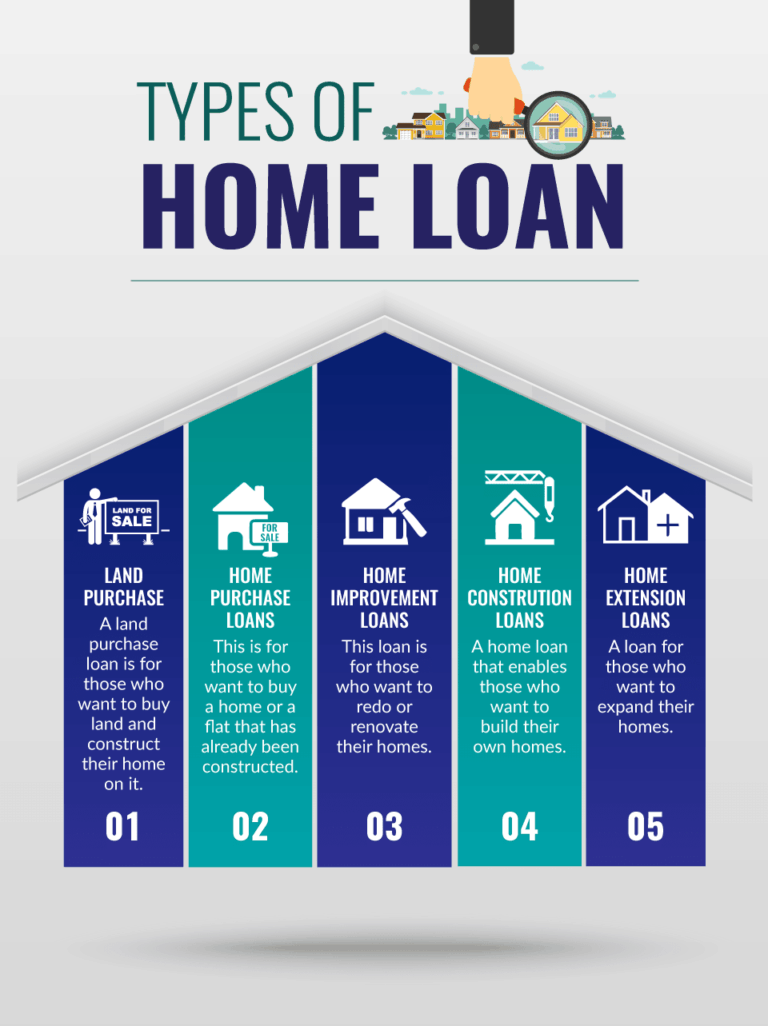

They offer a range of mortgage products, including fixed-rate, adjustable-rate, and government-backed loans like Federal Housing Administration (FHA) loans.

Banks often hold these mortgages on their balance sheets or sell them into the secondary market.

Mortgage Companies: Specializing in Home Loans

Mortgage companies, such as Rocket Mortgage and loanDepot, focus exclusively on mortgage origination and servicing. They often offer a wider variety of loan products and may have more flexible underwriting guidelines than traditional banks.

Mortgage companies generally do not hold the loans on their books. They originate the loans and then sell them to investors in the secondary market.

This specialization allows them to streamline the mortgage process and potentially offer competitive rates.

Credit Unions: Community-Focused Lending

Credit unions, non-profit financial cooperatives owned by their members, are another important player. They tend to prioritize serving their local communities and members, often offering competitive rates and personalized service.

While their overall market share is smaller than that of banks or mortgage companies, credit unions can be a valuable option. This is especially true for those seeking a more community-focused approach to lending.

They may also offer unique loan products tailored to the specific needs of their members.

Government-Sponsored Entities (GSEs): Shaping the Market

Perhaps the most influential entities in the mortgage market are the government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. These entities don't directly originate loans but purchase mortgages from lenders, package them into mortgage-backed securities (MBS), and sell them to investors.

This process provides liquidity to the mortgage market and makes homeownership more accessible. By guaranteeing these securities, they reduce the risk for investors and encourage lenders to offer lower interest rates.

Without the GSEs, the mortgage market would likely be far less liquid and interest rates significantly higher.

Data-Driven Insights: Market Share and Trends

Analyzing market share data provides a clearer picture of which institutions are the primary lenders. According to the Mortgage Bankers Association (MBA), non-bank mortgage companies have steadily increased their market share in recent years.

This trend reflects the specialization and efficiency that mortgage companies bring to the origination process.

However, banks remain a significant force, particularly for jumbo loans and loans to borrowers with complex financial situations.

The role of GSEs remains crucial, with the vast majority of mortgages being conforming loans that meet their guidelines. These conforming loans are eligible for purchase and securitization by Fannie Mae and Freddie Mac.

The Future of Mortgage Lending

The mortgage market is constantly evolving, driven by technological innovation, regulatory changes, and shifts in consumer preferences. Fintech companies are increasingly disrupting the market, offering online mortgage platforms and streamlined application processes.

These platforms often leverage data analytics and automated underwriting to provide faster and more efficient loan approvals. This potentially creates more competition and lower costs for borrowers.

Furthermore, regulatory changes, such as those related to capital requirements and risk management, can impact the lending practices of banks and other financial institutions.

Ultimately, while banks, mortgage companies, credit unions, and GSEs all play vital roles in the mortgage market, no single entity holds a monopoly. The landscape is complex and dynamic, with each type of institution catering to different segments of the market.

Prospective homebuyers should carefully research their options. By comparing rates, terms, and services, they can find the lender best suited to their individual needs and financial circumstances.

Understanding the various players involved is the first step towards achieving the dream of homeownership.