Of The Following Dividend Options Which Is Taxable

Investors face a critical decision regarding dividend payouts: understanding the tax implications of each option is paramount. Misunderstanding can lead to unexpected tax liabilities and reduced investment returns.

Dividend Taxation: A Clear and Present Danger

This article cuts through the complexity of dividend taxation. We’ll examine the taxability of various dividend options. This ensures you make informed decisions and avoid costly errors.

Understanding Dividend Types: A Taxpayer's Guide

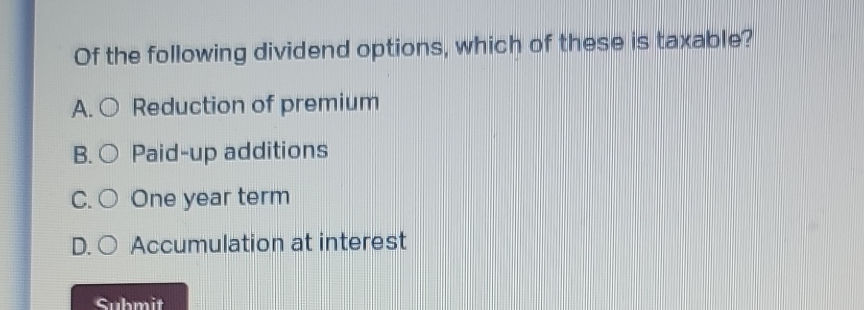

Several dividend options exist, each with its own tax implications. Let's break down the most common types and their tax status.

Cash dividends are the most straightforward. These are typically taxable in the year they are received.

Stock dividends are distributions of additional shares in the company. Generally, these are not taxable when received. However, they do affect your cost basis.

Property dividends involve receiving assets other than cash or stock. These are taxable at their fair market value.

Taxable Dividends: The Ones to Watch Out For

Certain dividend types trigger immediate tax consequences. Understanding these is crucial for tax planning.

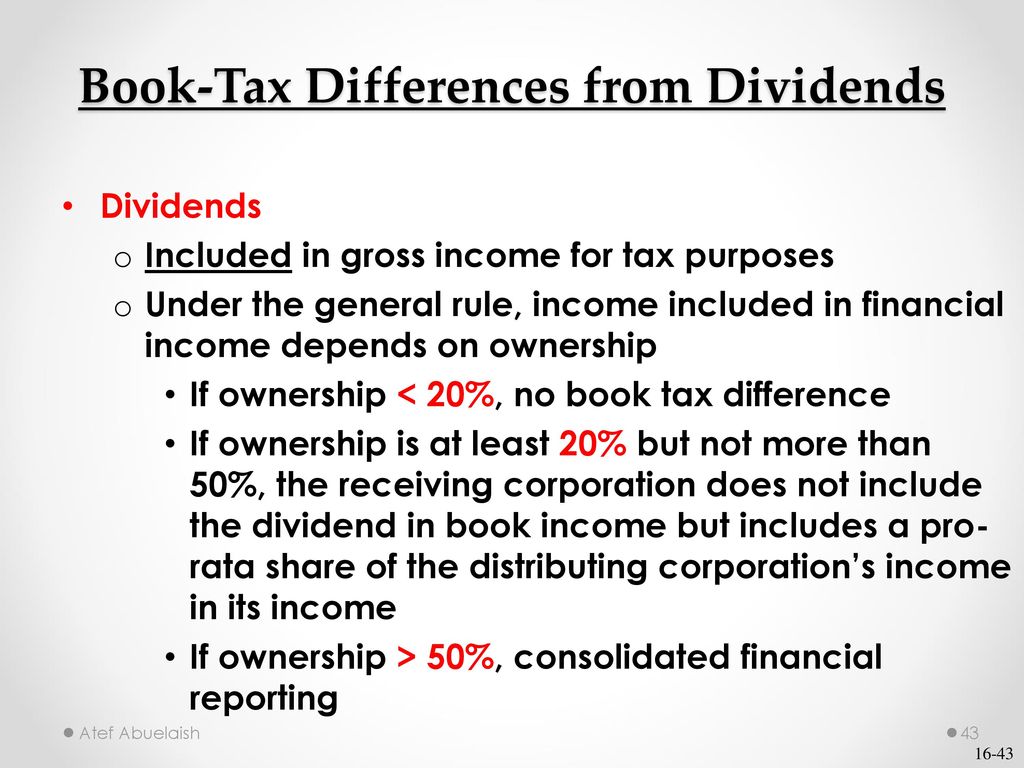

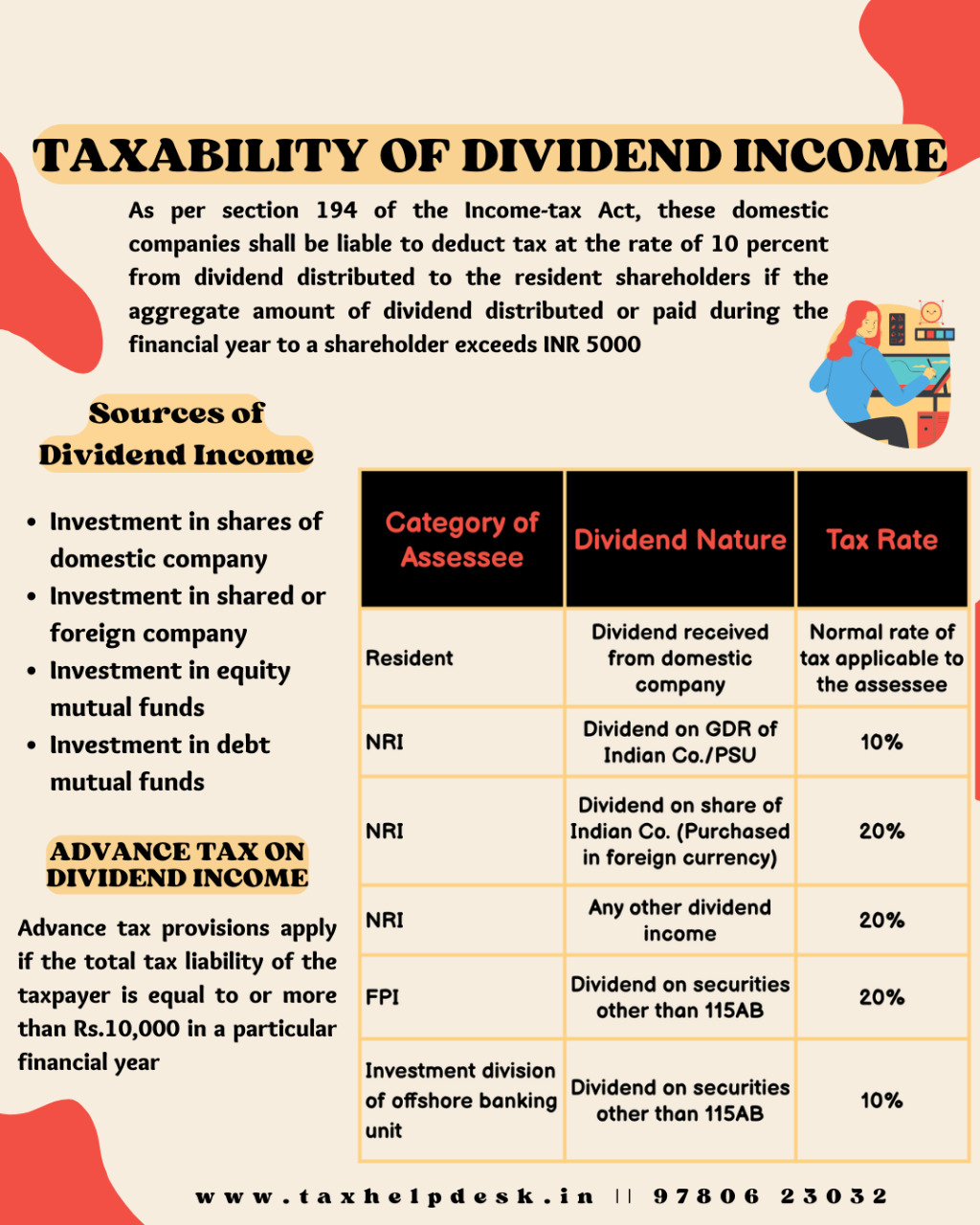

Cash dividends and property dividends are almost always taxable. The rate depends on whether they are qualified or non-qualified (ordinary) dividends.

Qualified dividends are taxed at lower capital gains rates, while non-qualified dividends are taxed at your ordinary income tax rate.

According to the IRS, to be a qualified dividend, the stock must be held for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date (IRS Publication 550).

REIT dividends are often taxed as ordinary income. Therefore, they are non-qualified and subject to higher tax rates (as per IRS guidelines).

Non-Taxable Dividends: A Temporary Reprieve

While less common, some dividends offer temporary tax relief. Stock dividends are generally not taxable upon receipt.

However, they reduce your cost basis per share. This means a higher capital gain (or lower capital loss) when you eventually sell the shares.

Return of capital distributions, while technically not dividends, can also be non-taxable. They reduce your cost basis and are only taxable when your basis reaches zero (according to IRS guidelines).

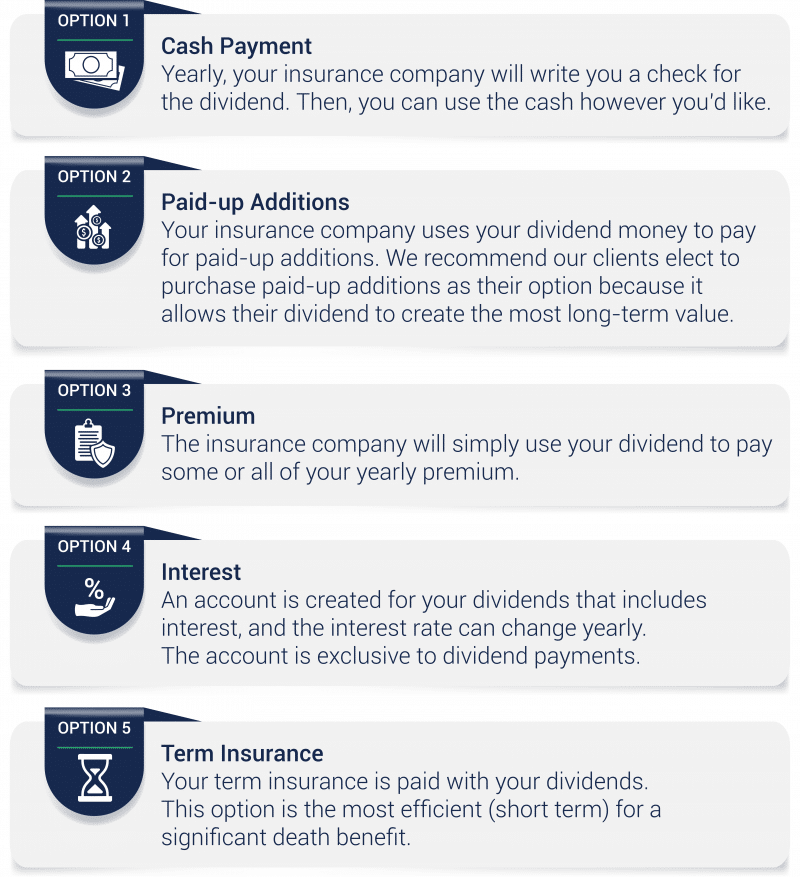

The Nuances of Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) allow you to automatically reinvest dividends to purchase more shares. While convenient, reinvested dividends are still taxable.

Whether the dividend is paid in cash and then reinvested, or directly used to purchase shares, the tax liability remains.

You will still need to track the cost basis of the newly acquired shares for accurate capital gains calculations when you eventually sell.

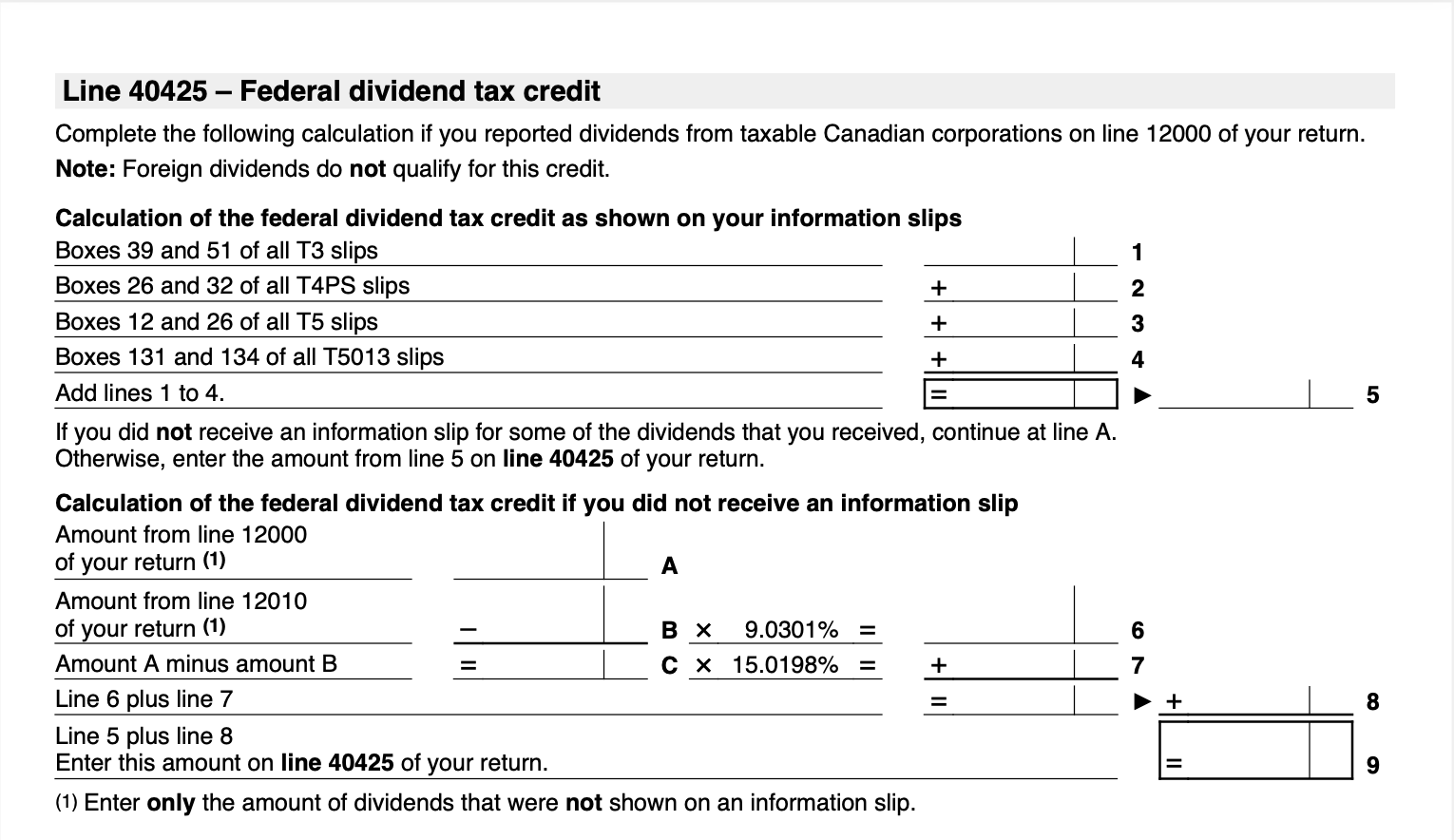

State Taxes: An Additional Layer of Complexity

Federal taxes are not the only consideration. Many states also tax dividend income.

State tax rates vary significantly. It is important to consult your state's tax regulations or a qualified tax advisor to determine your state tax liability.

Some states may offer exemptions or deductions for certain types of dividend income, so research is critical.

Who is Affected? Every Dividend Investor

This information is vital for anyone receiving dividends. It impacts individuals, trusts, and businesses alike.

Failing to understand these rules can lead to penalties and interest charges from the IRS (as highlighted in numerous IRS publications and rulings).

Accurate record-keeping and understanding the tax implications of each dividend type are essential for responsible investing.

When Does This Matter? Every Tax Season

This knowledge is crucial during tax season. However, it's also important for ongoing financial planning.

Proactive tax planning throughout the year can help minimize your tax burden and maximize your investment returns. Consult with a qualified tax professional.

The urgency to understand these details grows as tax deadlines approach, potentially impacting the entire financial year.

How to Prepare: Consult a Tax Professional

Navigating the complexities of dividend taxation can be challenging. Seeking professional guidance is often the best course of action.

A qualified tax advisor can provide personalized advice based on your specific financial situation and investment portfolio.

They can help you develop a tax-efficient investment strategy and ensure you are complying with all applicable tax laws.

Next Steps: Take Action Now

Review your dividend statements and understand the tax implications of each payout. Contact a tax professional immediately to discuss your specific situation and develop a tax-efficient investment strategy.

.jpg)