The Length Of A Complete Business Cycle

The rhythm of the economy ebbs and flows, expanding and contracting in a cycle familiar to economists but often mysterious to the general public. Understanding the length and characteristics of a complete business cycle – from peak to peak, or trough to trough – is crucial for businesses, investors, and policymakers alike.

This article examines the average duration of a business cycle, the factors that influence its length, and the implications for economic planning and forecasting.

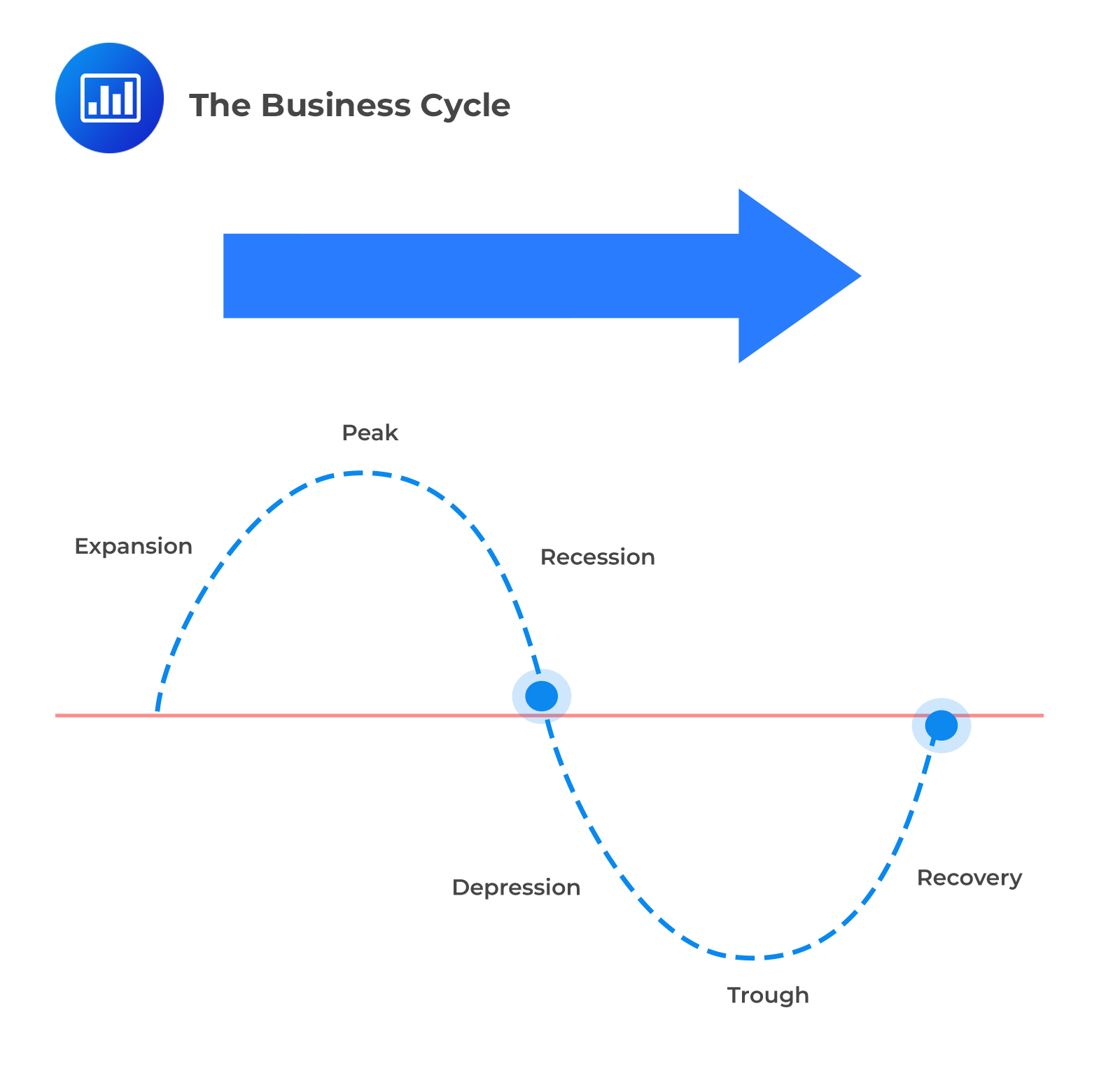

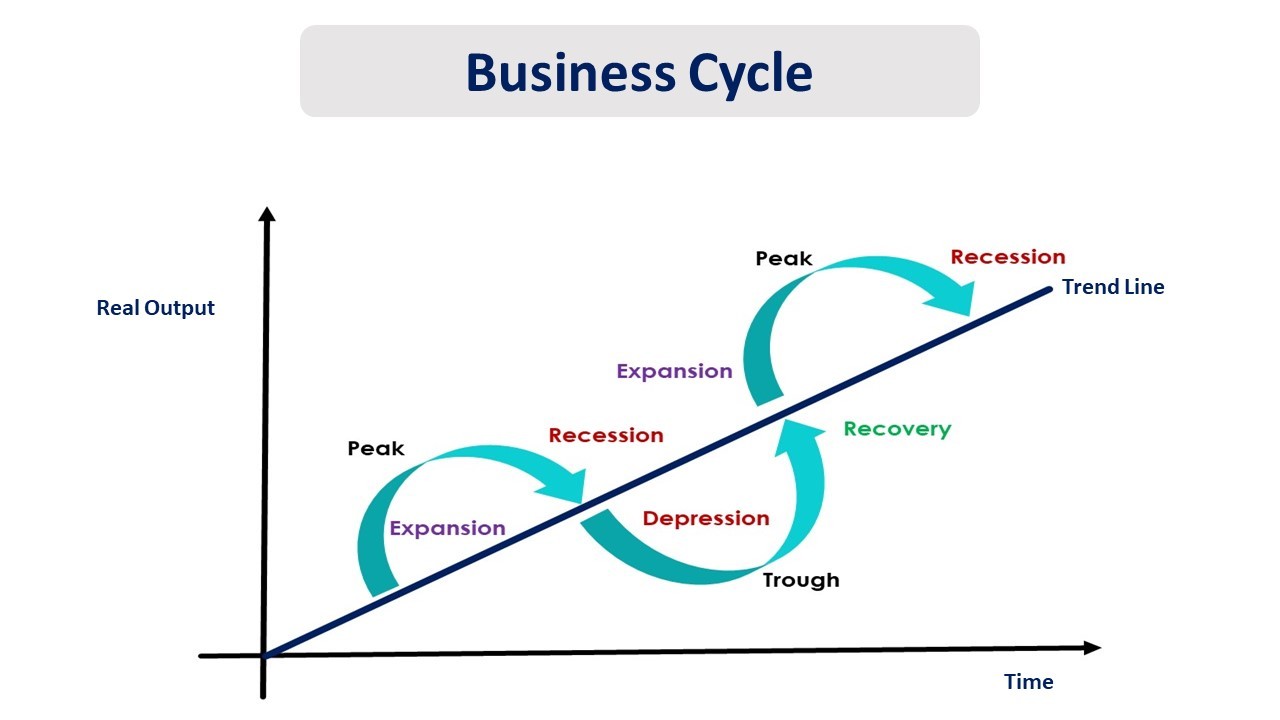

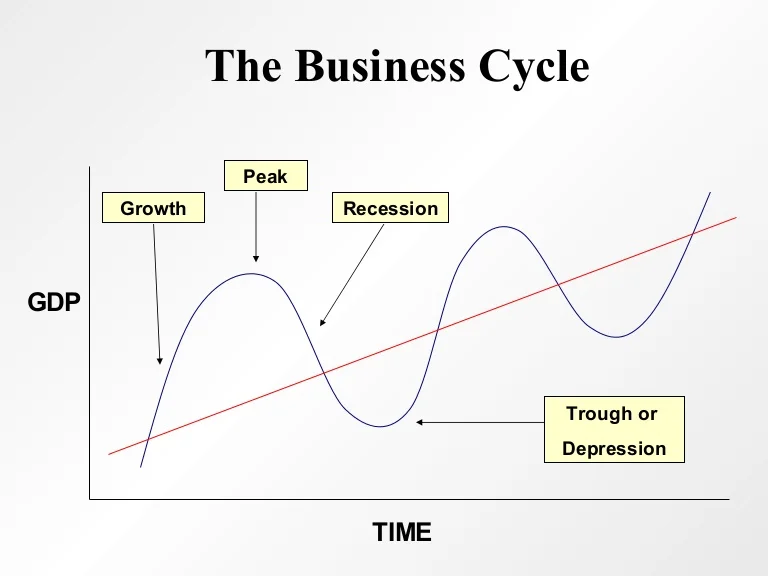

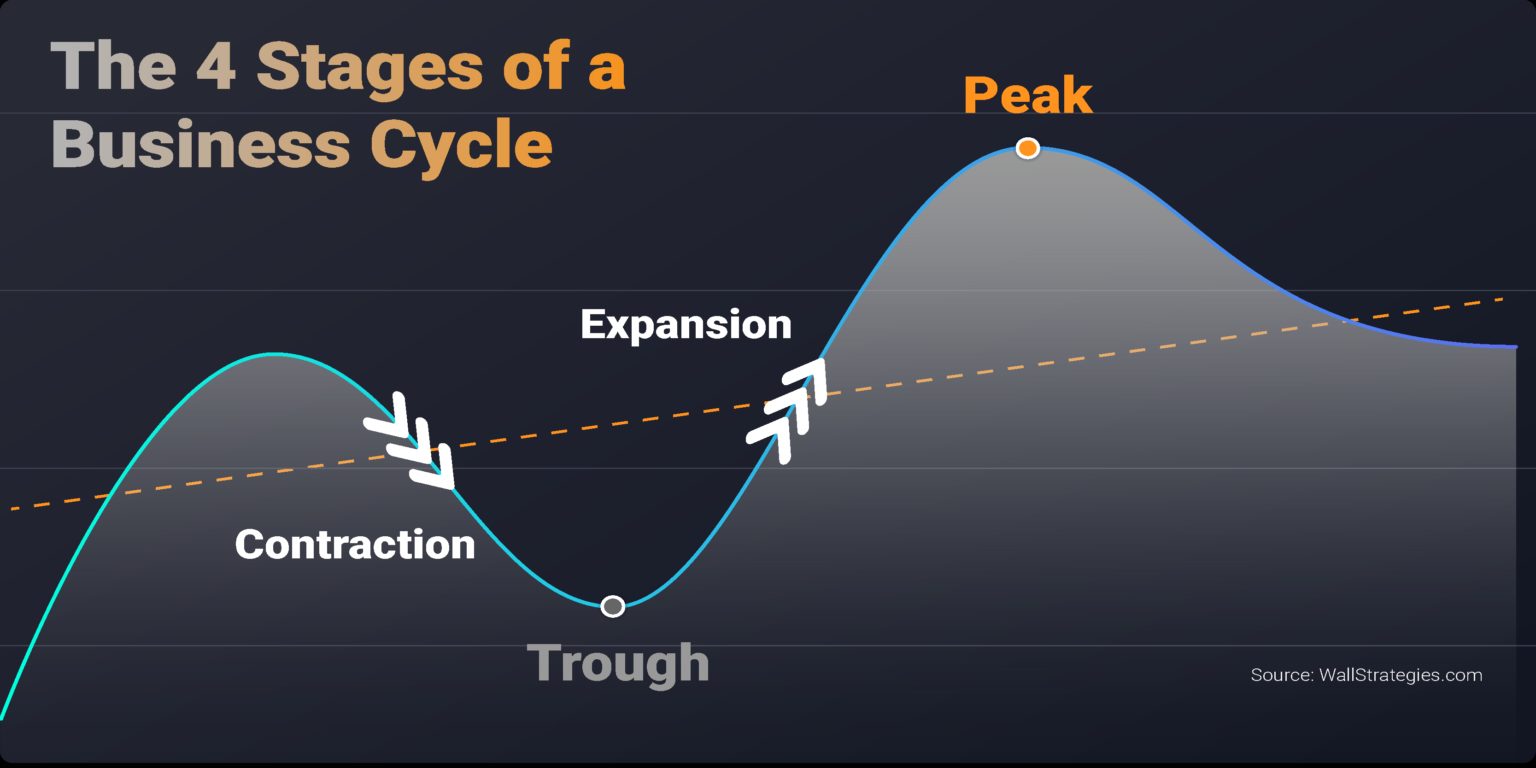

What is a Business Cycle?

A business cycle represents the fluctuations in economic activity that an economy experiences over a period of time. The National Bureau of Economic Research (NBER), the official arbiter of U.S. business cycle dates, defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

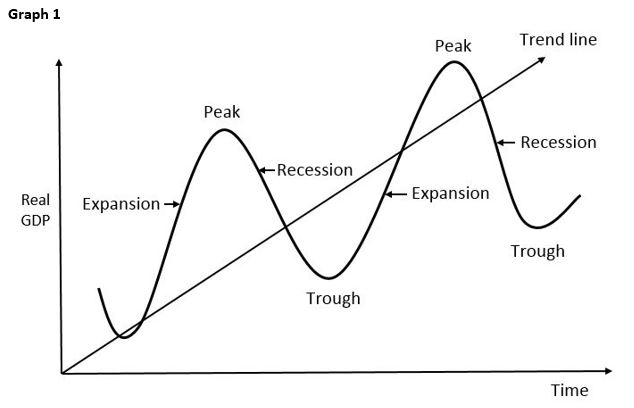

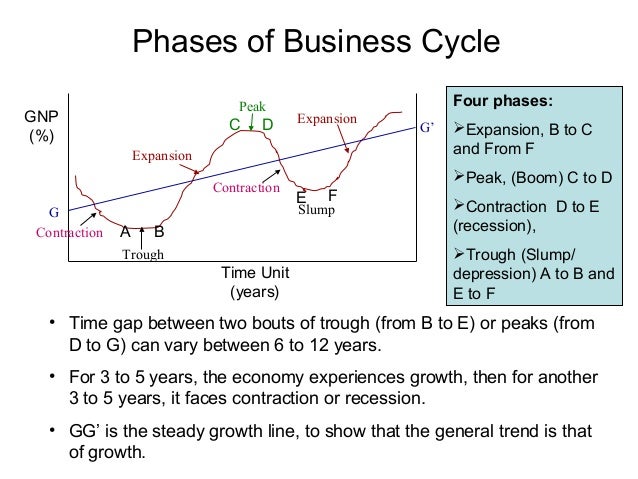

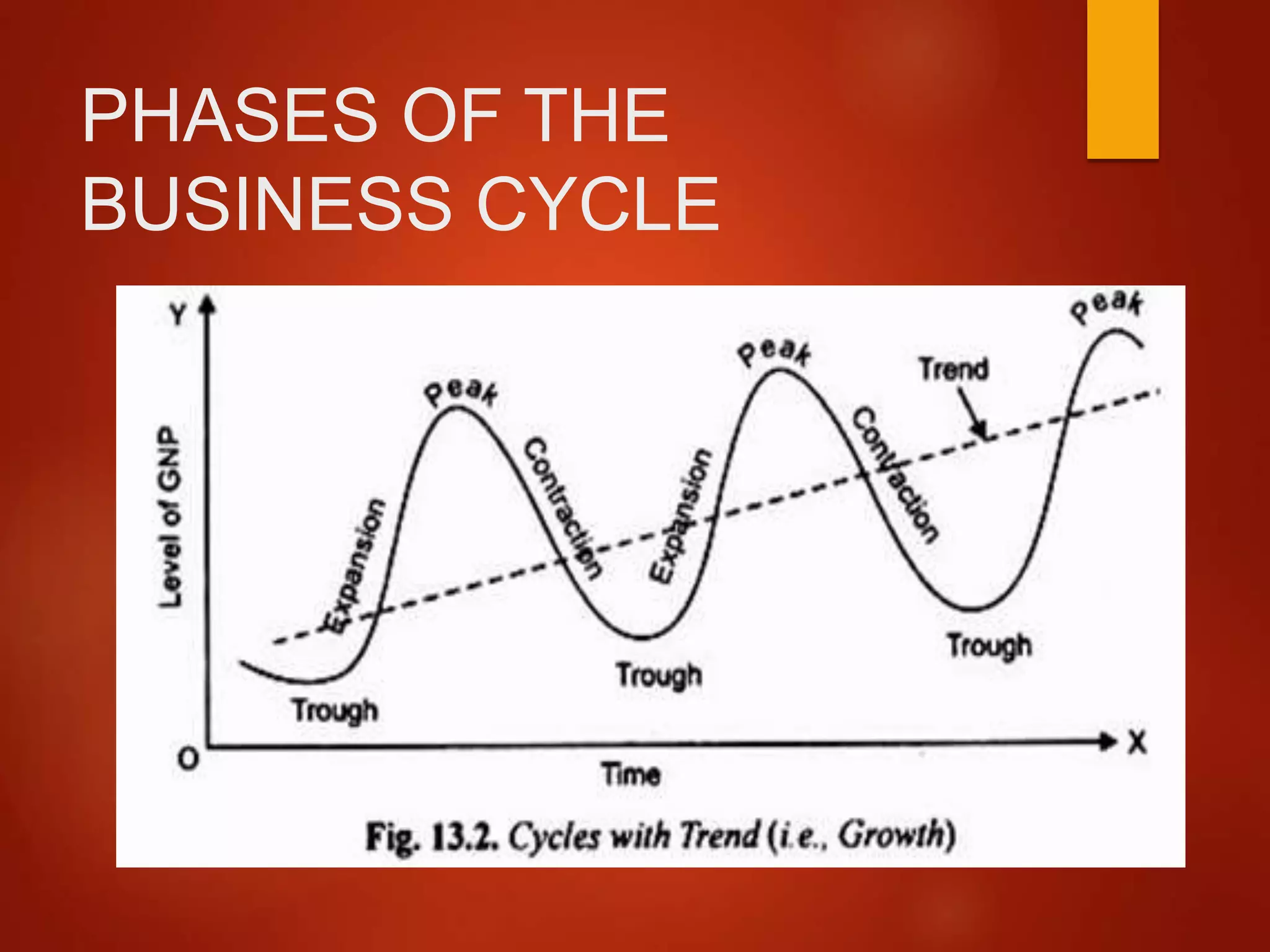

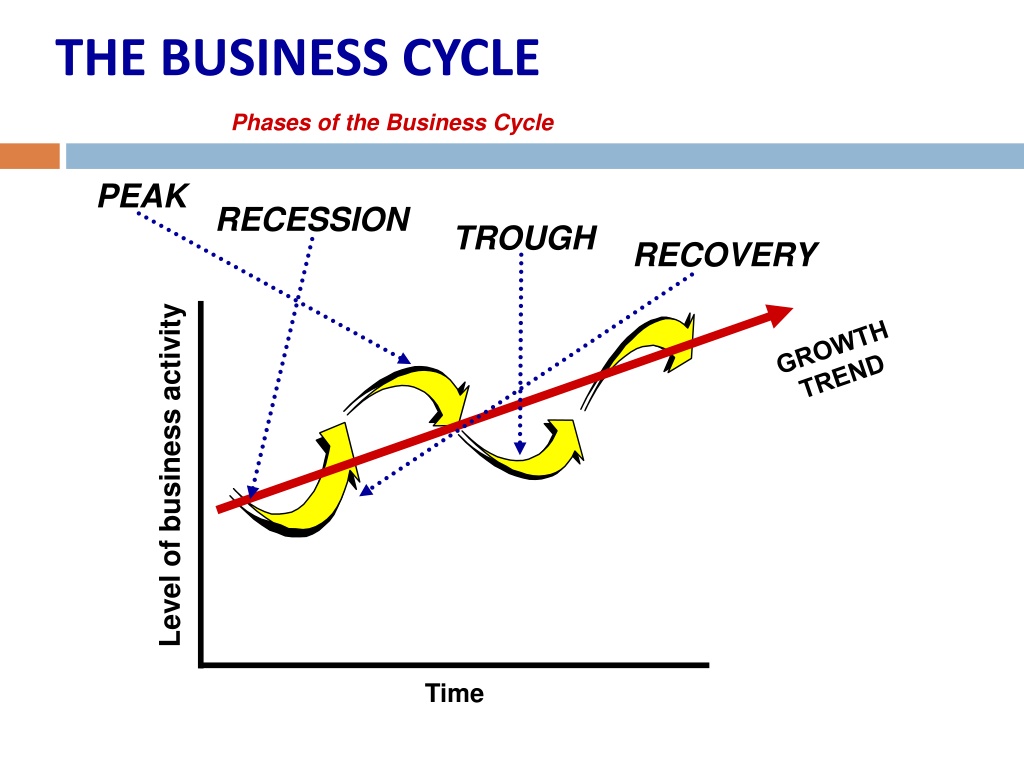

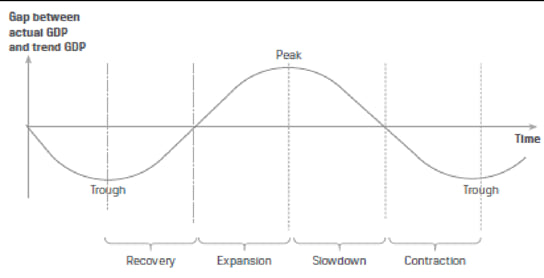

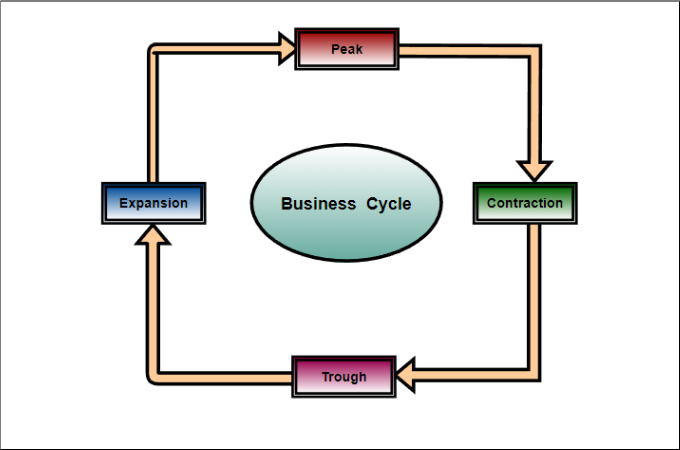

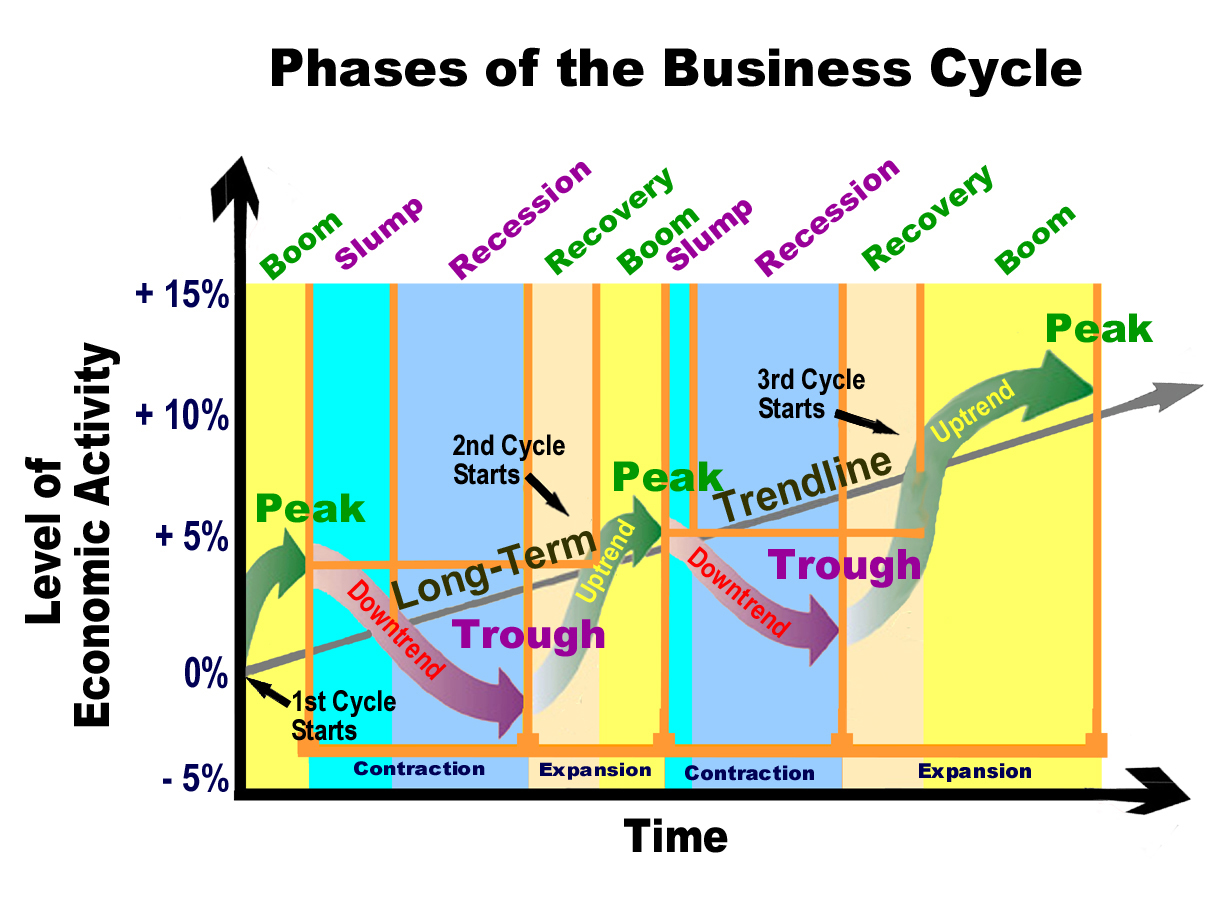

A business cycle consists of four main phases: expansion, peak, contraction (recession), and trough. Expansion is a period of growth, peak is the highest point of economic activity, contraction is a period of decline, and trough is the lowest point.

Historical Length of Business Cycles

Historically, the length of business cycles has varied considerably. According to the NBER, since 1854, the average business cycle in the United States, measured from peak to peak, has lasted approximately 56 months.

However, there's a clear trend toward longer expansions and shorter recessions in the post-World War II era. Before World War II, the average cycle was considerably shorter, punctuated by more frequent and often more severe recessions.

Post-War Trends

Post-World War II, the average expansion has lasted significantly longer than the pre-war average. This shift is attributed to factors such as improved monetary and fiscal policy, the rise of the service sector, and greater economic stability.

The expansion from 2009 to 2020, lasting 128 months, was the longest in U.S. history. This unprecedented length raised questions about whether traditional economic models were still accurately reflecting the dynamics of the modern economy.

Factors Influencing Cycle Length

Several factors can influence the length and intensity of a business cycle. These include monetary policy decisions by central banks like the Federal Reserve, fiscal policy implemented by governments, and external shocks such as pandemics or geopolitical events.

Technological innovation can also play a significant role, driving productivity growth and potentially extending expansions. Consumer confidence and business investment decisions are also crucial determinants of economic activity.

Implications for Businesses and Investors

Understanding the length of a business cycle is essential for businesses and investors. Businesses can use this knowledge to make informed decisions about hiring, investment, and inventory management.

Investors can use cyclical trends to guide their asset allocation strategies, shifting investments based on where the economy is in the cycle. For example, during expansions, investors may favor stocks, while during contractions, they may shift to bonds or other safer assets.

The Human Impact

The business cycle has a direct impact on individuals. Recessions can lead to job losses, reduced incomes, and increased financial stress. Expansions, on the other hand, can create jobs, boost wages, and improve living standards.

For example, the impact of the 2008 financial crisis was felt deeply by millions of Americans who lost their homes and jobs. While the subsequent expansion brought recovery, it also highlighted the uneven distribution of benefits, with some groups experiencing greater gains than others.

Forecasting and Future Cycles

Predicting the precise length of future business cycles remains a challenging task. Economists use a variety of models and indicators to forecast economic trends, but these forecasts are not always accurate.

The evolving global economy, characterized by rapid technological change and increasing interconnectedness, adds further complexity to forecasting efforts. New economic paradigms and unforeseen events can quickly alter the course of the cycle.

Ultimately, understanding the length and characteristics of a business cycle provides valuable insights for navigating the complexities of the economy, but it is not a crystal ball. Vigilance, adaptability, and sound risk management are essential for businesses, investors, and policymakers alike to thrive in the face of economic fluctuations.

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)