How To Determine If A Business Is Viable

The dream of entrepreneurship is a powerful lure, promising independence, innovation, and financial reward. Yet, the path to business success is littered with the remains of ventures that, despite their initial promise, failed to thrive. Before investing time, money, and energy into a new business or expanding an existing one, a rigorous assessment of its viability is paramount.

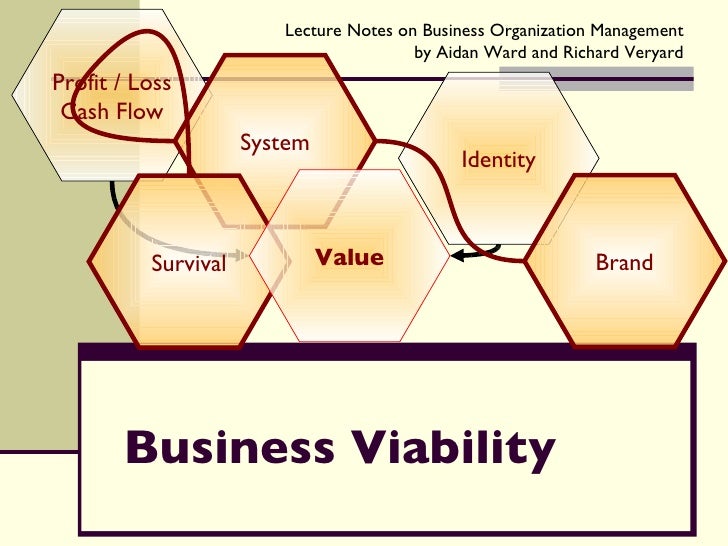

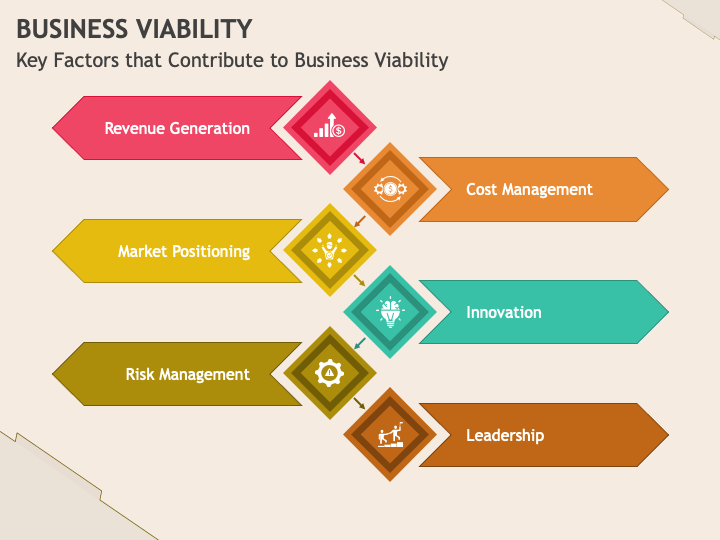

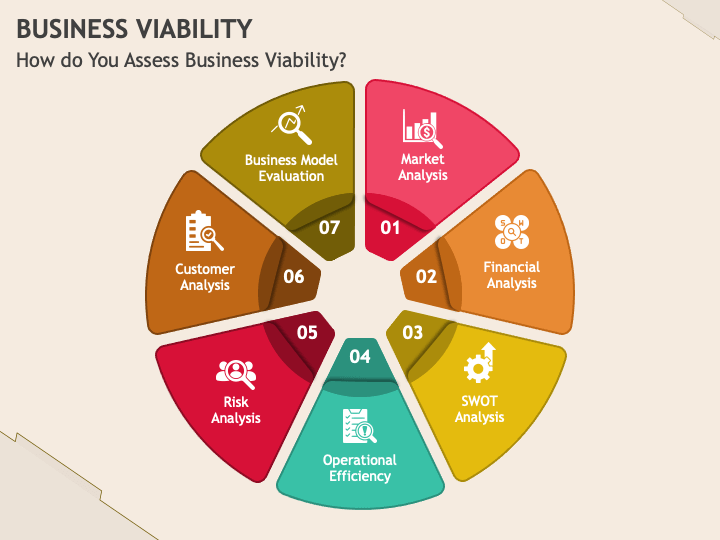

Determining if a business is viable requires a multifaceted approach. This encompasses analyzing market demand, evaluating financial projections, assessing operational capabilities, and understanding the competitive landscape. A thorough viability study acts as a crucial filter, separating potentially successful ventures from those doomed to failure, minimizing risk and maximizing the chances of long-term sustainability. This article will dissect the key components of assessing business viability, providing a framework for aspiring and established entrepreneurs alike.

Market Analysis: Gauging Demand and Opportunity

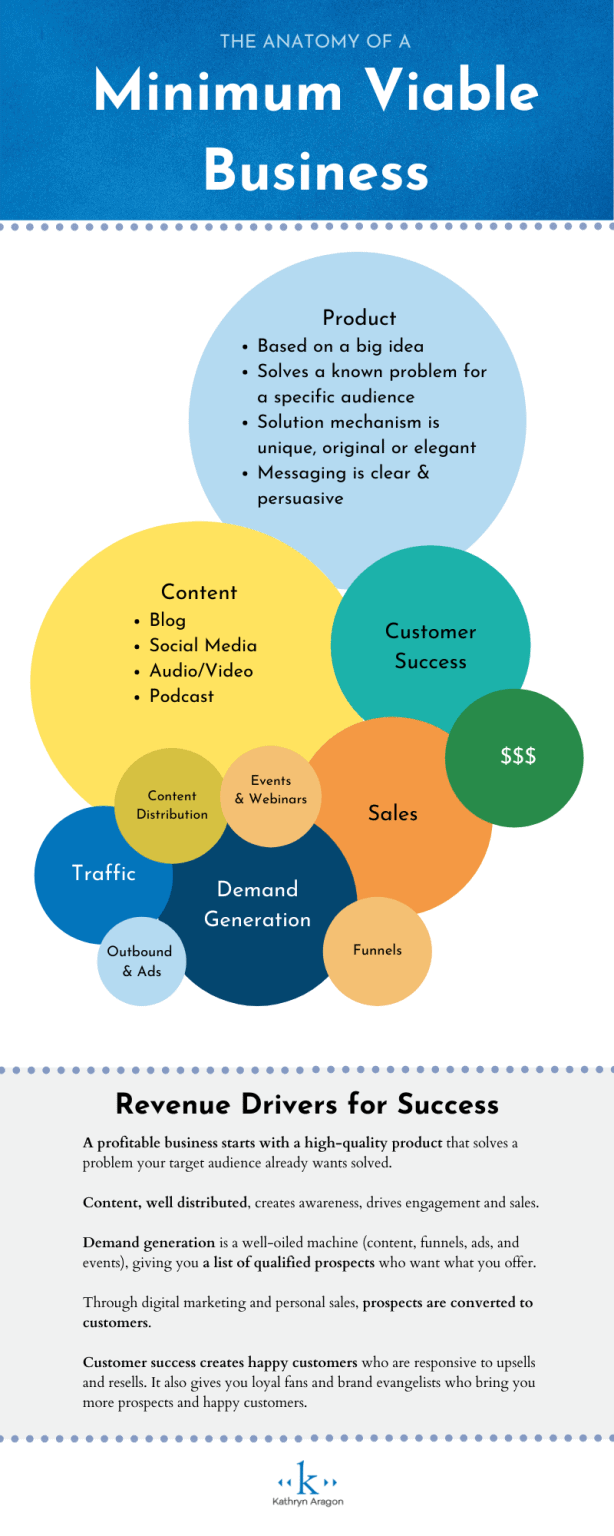

Understanding the market is the bedrock of any viability assessment. This involves identifying the target audience, assessing the size and potential of the market, and determining whether a genuine need exists for the product or service being offered.

Start with market research. This can include surveys, focus groups, and analysis of existing market data from reputable sources like the Small Business Administration (SBA) and industry-specific research firms.

Consider factors such as market trends, demographic shifts, and consumer preferences to paint a comprehensive picture of the potential customer base.

Competitive Landscape: Identifying Strengths and Weaknesses

No business operates in a vacuum. Understanding the competition is crucial to identify opportunities for differentiation and potential threats to success.

Analyze existing competitors, both direct and indirect. Identify their strengths, weaknesses, pricing strategies, and market share.

Determine how the proposed business can offer a unique value proposition, whether through innovation, superior customer service, or a more competitive pricing model.

Financial Projections: Assessing Profitability and Sustainability

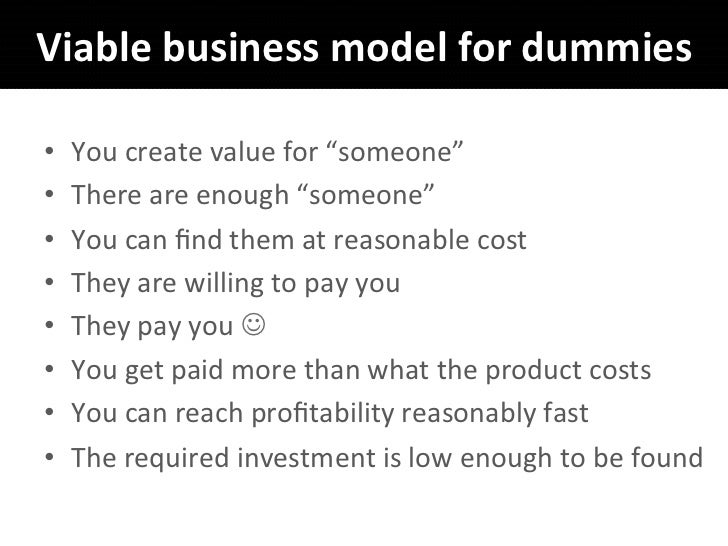

Even with a strong market and a compelling product, a business can fail if it lacks a sound financial foundation. Creating realistic financial projections is essential to determine long-term viability.

Develop a comprehensive business plan that includes projected income statements, balance sheets, and cash flow statements. These should be based on realistic assumptions about sales, expenses, and financing.

Consider factors like startup costs, operating expenses, pricing strategies, and break-even analysis to determine the potential for profitability. Seek guidance from a financial advisor if needed.

Funding and Investment: Securing Capital and Managing Risk

Access to capital is often a critical factor in determining business viability. Explore potential funding sources and assess the risks associated with different financing options.

Consider options such as bootstrapping, loans, grants, angel investors, and venture capital. Each option has its own advantages and disadvantages in terms of cost, control, and risk.

Develop a contingency plan to address potential financial challenges, such as unexpected expenses or slower-than-anticipated sales growth.

Operational Feasibility: Evaluating Resources and Execution

Beyond market and financial considerations, the operational feasibility of a business is equally important. This involves assessing the resources, infrastructure, and expertise required to effectively deliver the product or service.

Evaluate the availability of necessary resources, such as equipment, raw materials, and skilled labor. Identify any potential bottlenecks or challenges in the supply chain or production process.

Assess the management team's capabilities and experience to ensure they have the skills and expertise to execute the business plan. Consider seeking external expertise if needed.

Legal and Regulatory Compliance: Ensuring a Solid Foundation

Understanding and adhering to all relevant legal and regulatory requirements is critical for long-term viability. Failure to comply can result in fines, penalties, or even the closure of the business.

Research all applicable permits, licenses, and regulations at the federal, state, and local levels. Consult with legal professionals to ensure compliance with industry-specific laws and regulations.

Develop a plan for ongoing compliance and stay informed of any changes in the legal and regulatory landscape.

Looking Ahead: Adaptability and Continuous Improvement

Determining business viability is not a one-time exercise. The market is constantly evolving, and businesses must be adaptable to thrive in the long run. Continuous monitoring and evaluation are essential.

Regularly review financial performance, market trends, and competitive dynamics. Be prepared to adapt the business model, product offerings, or marketing strategies as needed.

Embrace a culture of innovation and continuous improvement to stay ahead of the curve and maintain a competitive edge. The most viable businesses are those that are constantly learning and adapting.