How To Dissolve A Business Partnership

Imagine two friends, fueled by shared dreams and late-night brainstorming sessions, launching a business. The initial excitement is palpable, the potential limitless. But what happens when those shared dreams diverge, when disagreements become frequent, and the foundation of the partnership begins to crack? The reality is, dissolving a business partnership is a common, albeit often painful, experience.

Navigating the dissolution of a business partnership requires careful planning, open communication, and a thorough understanding of legal and financial implications. While it can be emotionally challenging, a well-executed dissolution can protect both parties and pave the way for future success, even if it's on separate paths.

The Foundation: Partnership Agreements

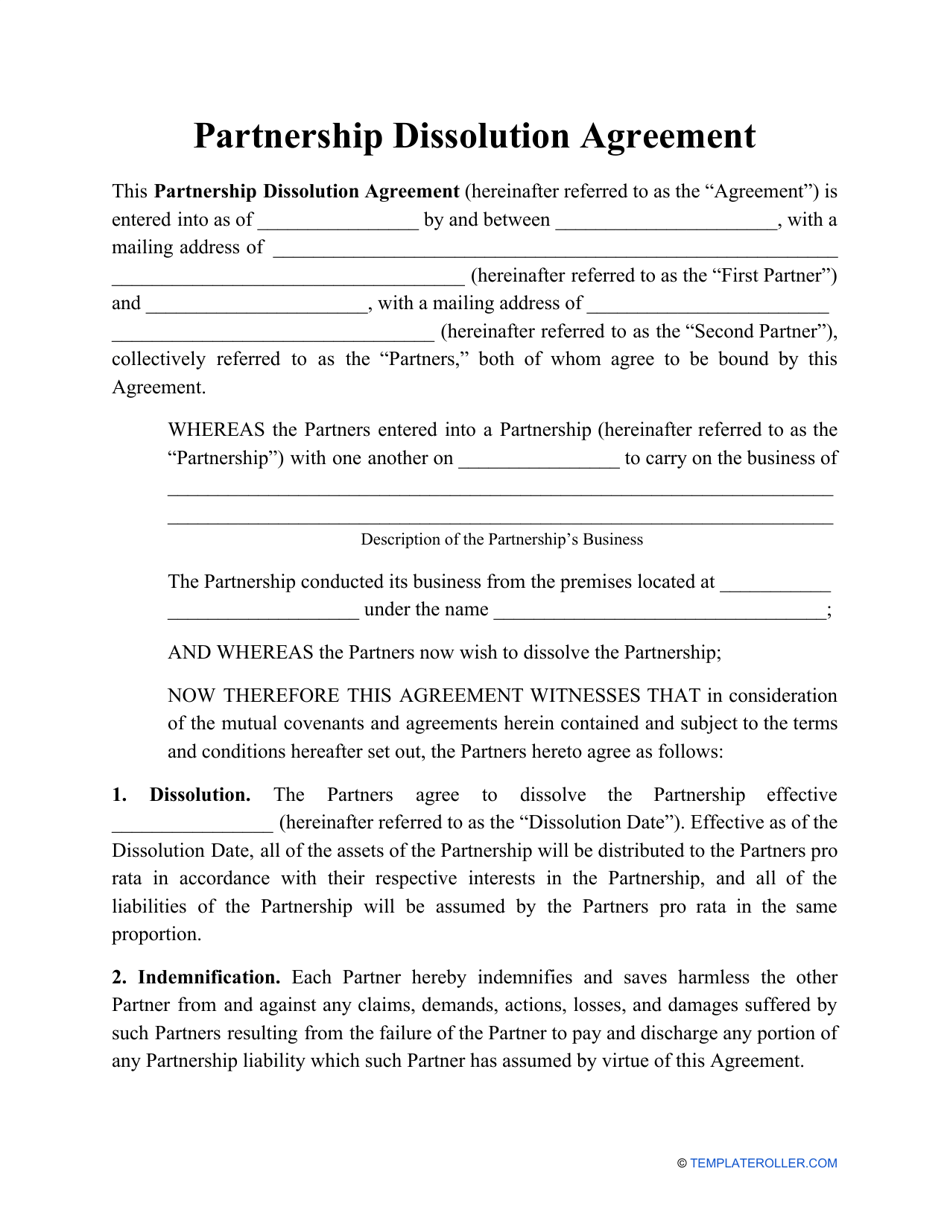

At the heart of any successful, and ultimately dissolvable, partnership lies the partnership agreement. This document, drafted ideally with legal counsel, outlines the responsibilities, contributions, profit-sharing arrangements, and perhaps most importantly, the procedures for dissolving the partnership.

Without a clear agreement, dissolving a partnership can become a complex legal battle, costing time, money, and emotional energy. A well-defined agreement anticipates potential conflicts and provides a framework for resolution.

Common Causes of Partnership Dissolution

Numerous factors can lead to the dissolution of a business partnership. Disagreements over business strategy are common, as are conflicts about financial management or differences in work ethic.

Personal circumstances, such as illness, relocation, or a change in career aspirations, can also necessitate the end of a partnership. Sometimes, the simple reality is that the initial vision no longer aligns with the partners' individual goals.

The Process: Steps to Dissolution

The first step in dissolving a business partnership is to review the partnership agreement. This will outline the specific procedures that must be followed, including notification requirements, valuation methods, and dispute resolution mechanisms.

Next, open and honest communication is crucial. Partners should discuss their reasons for wanting to dissolve the partnership and try to reach a mutually agreeable solution. Negotiation and compromise are key during this stage.

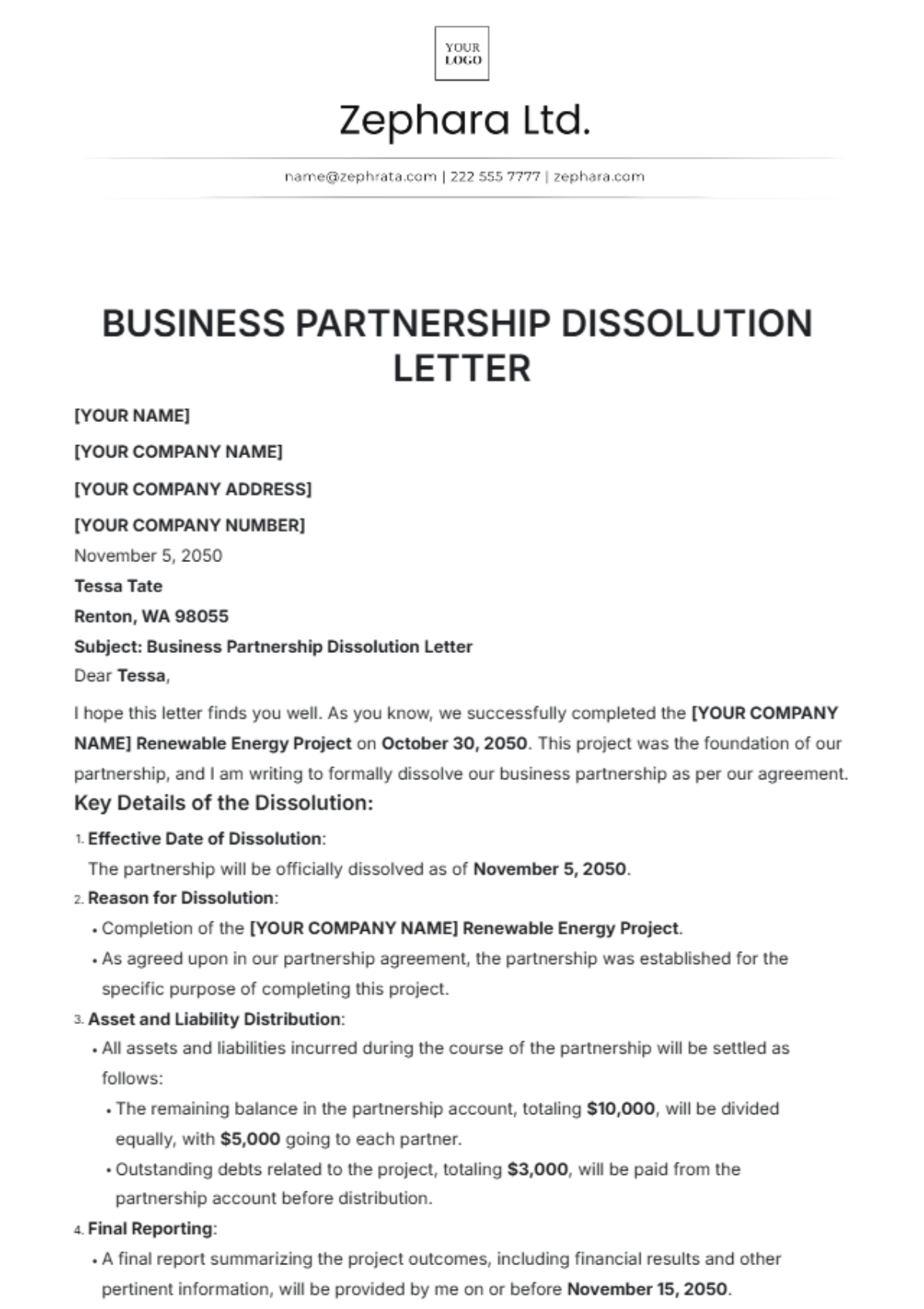

Valuation of the business assets is another critical step. This typically involves hiring a qualified appraiser to determine the fair market value of the business's tangible and intangible assets. These can include equipment, inventory, intellectual property, and goodwill.

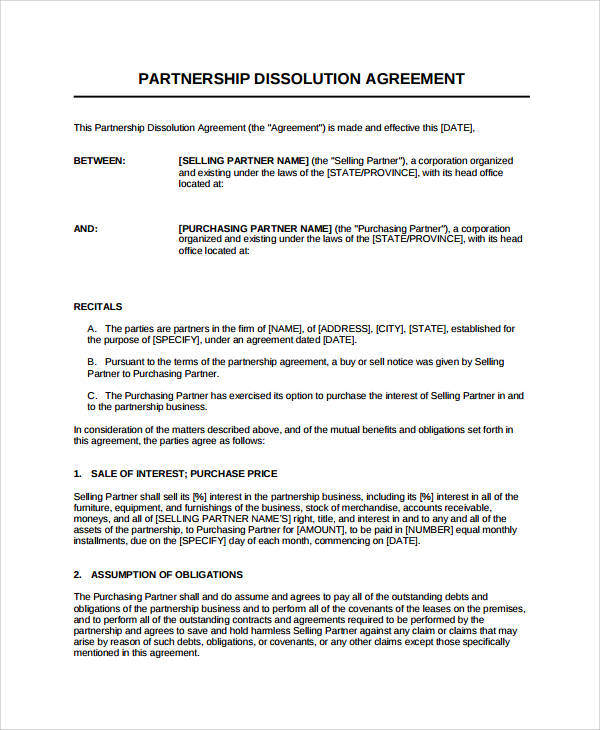

Once the assets have been valued, partners must decide how to divide them. This may involve one partner buying out the other's share of the business, or selling the entire business to a third party. It’s crucial to follow the protocol described in the partnership agreement.

Legally, formal dissolution is typically achieved by filing a Statement of Dissolution with the relevant state authorities. This notifies the public that the partnership is no longer in operation. Additionally, the partnership must settle its outstanding debts and liabilities.

Don't forget to notify all stakeholders of your dissolution. This may include clients, suppliers, and employees.

Legal and Financial Considerations

Seeking legal and financial advice is essential throughout the dissolution process. An attorney can ensure that all legal requirements are met and protect your interests. A financial advisor can help you navigate the tax implications of the dissolution.

It is critical to understand the tax consequences of the dissolution, including capital gains taxes and income taxes. Consulting with a tax professional can help you minimize your tax liability.

Consider intellectual property rights, too. Who owns what? Make sure to have it figured out legally to avoid future conflicts.

Moving Forward: New Beginnings

Dissolving a business partnership can be a difficult experience, but it doesn't have to be a failure. It can be an opportunity for both partners to pursue new ventures and achieve their individual goals.

The lessons learned from the partnership, both positive and negative, can be valuable assets in future endeavors. Reflecting on the experience can provide insights into your strengths, weaknesses, and what you look for in future collaborations.

Ultimately, the dissolution of a business partnership can be a catalyst for growth and change. It's a reminder that even when paths diverge, the bonds of friendship and mutual respect can endure.

"The best way to predict the future is to create it." - Peter Drucker